Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.24 no.53 Bogotá July/Sept. 2014

https://doi.org/10.15446/innovar.v24n53.43793

http://dx.doi.org/10.15446/innovar.v24n53.43793

The role of intellectual capital and entrepreneurial characteristics as innovation drivers

El papel del capital intelectual y de las características del emprendedor como motores de la innovación

Le rôle du capital intellectuel et des caractéristiques des entrepreneurs comme moteur de l'innovation

O papel do capital intelectual e características empreendedoras como motores da inovação

Nadia Ugalde-BindaI; Francisco Balbastre-BenaventII; M. Teresa Canet-GinerIII; Naiara Escribá-CardaIIII,1

I Associate Professor. University of Costa Rica (UCR). Costa Rica. E-mail: nubaf@hotmail.com

II Associate Professor. University of Valencia. Valencia (Spain). E-mail: Francisco.balbastre@uv.es

III Associate Professor. University of Valencia. Valencia (Spain). E-mail: teresa.canet@uv.es

IIII Research Fellow. University of Valencia. Valencia (Spain). E-mail: naiara.escriba@uv.es.

Correspondencia: Department of Business Administration Juan José Renau Piqueras. University of Valencia. Avda. Tarongers, s/n, 46022, Valencia (Spain).

Citación: Ugalde-Blinda, N., Balbastre-Benavent, F., Canet-Giner, T. & Escribá-Carda, N. (2014). The Role of intellectual Capital and entrepreneurial Characteristics as innovation drivers. Innovar, 24(53), 41-60.

Clasificación JEL: l26, M12, M00.

Recibido: Junio 2013; aprobado: Noviembre 2013.

Abstract:

Innovation and entrepreneurship are essential organizational strategies to find a way out of the world crisis affecting today's firms. Thus, the study of how organizational factors, like intellectual capital or entrepreneur characteristics, affects the success of an innovative entrepreneurial project is of utmost importance in helping current organizations find a solution to this problem. Intellectual capital involves investment in human, structural and relational capital. Consequently, our research goal centres on analyzing the influence of intellectual capital as well as the personal characteristics of entrepreneurs on the innovation results. This phenomenon remains unexplored in the case of micro and small firms. Our paper focuses on a particular context where small firms represent a key role in the industry: the case of Costa Rica. We used both quantitative and qualitative methodologies in order to develop the analysis. Our first results show a positive and significant relationship between structural and relational capital and innovation results; also, we can observe a positive relationship between a general measure of intellectual capital and innovation results. The case study illustrates how human capital and, specifically, the characteristics of the entrepreneur have an important influence on firm results. Our work contributes to show the relevance of intellectual capital on innovation success, and results encourage practitioners to invest in structural and relational capital and also improve the degree of planning of activities to obtain better results in the long term.

Keywords: intellectual Capital, entrepreneurship, innovation, Human Capital, structural Capital, Relational Capital.

Resumen:

La innovación y la iniciativa empresarial son estrategias organizacionales esenciales para encontrar una salida a la crisis mundial que afecta a las empresas de hoy en día. Por lo tanto, el estudio de cómo los factores organizacionales como el capital intelectual o las características de los empresarios afectan el éxito de un proyecto empresarial innovador, es de gran importancia para ayudar a las organizaciones actuales a encontrar una solución a este problema. El capital intelectual implica una inversión en capital humano, estructural y relacional. Por consiguiente, nuestro objetivo investigativo se centra en analizar la influencia del capital intelectual así como las características personales de los empresarios sobre los resultados de la innovación. Este fenómeno todavía no se ha explorado en el caso de microempresas y empresas pequeñas. Nuestro artículo se enfoca en un contexto particular en el que las empresas pequeñas tienen un papel clave en la industria: el caso de Costa Rica. Usamos metodología cualitativa y cuantitativa para desarrollar el análisis. Nuestros primeros resultados muestran una relación positiva y significativa entre el capital estructural y relacional y los resultados de la innovación; así mismo, se puede observar una relación positiva entre una medida general del capital intelectual y los resultados de la innovación. El estudio de caso ilustra cómo el capital humano, y específicamente las características del empresario, tienen un impacto importante sobre los resultados de la empresa. Nuestro trabajo contribuye a mostrar la relevancia del capital intelectual en el éxito de las innovaciones, y los resultados incentivan a los profesionales a invertir en capital estructural y relacional, y también a mejorar el grado de planeación de las actividades para obtener mejores resultados a largo plazo.

Palabras clave: Capital intelectual, iniciativa empresarial, innovación, capital humano, capital estructural, capital relacional.

Résumé:

L'innovation et l'initiative entrepreneuriale sont des stratégies organisationnelles essentielles pour trouver une issue à la crise mondiale qui affecte les entreprises d'aujourd'hui. Par conséquent, l'étude de la manière dont les facteurs organisationnels comme le capital intellectuel ou les caractéristiques des entrepreneurs affectent le succès d'un projet entrepreneurial innovant est d'une grande importance pour aider les organisations actuelles à trouver une solution à ce problème. Le capital intellectuel implique un investissement en capital humain, structurel et relationnel. Par conséquent, notre objectif de recherche est centré sur l'analyse de l'influence du capital intellectuel ainsi que sur les caractéristiques personnelles des entrepreneurs sur les résultats de l'innovation. Ce phénomène n'a pas encore fait l'objet d'études dans les micro et petites entreprises. Notre article est centré sur un contexte particulier dans lequel les petites entreprises jouent un rôle clé dans l'industrie: le cas du Costa Rica. Nous utilisons une méthodologie qualitative et quantitative pour notre analyse. Nos premiers résultats montrent une relation positive et significative entre le capital structurel et relationnel et les résultats de l'innovation; de même, on observe une relation positive entre une mesure générale du capital intellectuel et les résultats de l'innovation. L'étude de cas illustre comment le capital humain, et en particulier les caractéristiques de l'entrepreneur, joue un rôle dans les résultats de l'entreprise. Notre travail contribue à montrer l'importance du capital intellectuel dans le succès des innovations, et les résultats incitent les professionnels à investir en capital structurel et relationnel, ainsi qu'à améliorer le niveau de planification des activités pour obtenir de meilleurs résultats à long terme.

Mots-clés: Capital intellectuel; initiative entrepreneuriale; innovation; capital humain; capital structurel; capital relationnel.

Resumo:

A inovação e a iniciativa empresarial são estratégias organizacionais essenciais para encontrar uma saída à crise mundial que atinge as empresas de hoje. Portanto, o estudo de como os fatores organizacionais, como o capital intelectual ou as características dos empresários, afetam o sucesso de um projeto empresarial inovador é de grande importância para ajudar as organizações atuais a encontrarem uma solução a este problema. O capital intelectual implica um investimento em capital humano, estrutural e relacional. Em consequência, o nosso objetivo de pesquisa se centra em analisar a influência do capital intelectual bem como as características pessoais dos empresários sobre os resultados da inovação. Este fenômeno ainda não foi explorado no caso de microempresas e pequenas empresas. O nosso artigo se centra em um contexto particular no qual as pequenas empresas têm um papel chave na indústria: é o caso da Costa Rica. Usamos metodologia qualitativa e quantitativa para desenvolver a análise. Os nossos primeiros resultados mostram uma relação positiva e significativa entre o capital estrutural e relacional e os resultados da inovação; igualmente, pode-se observar uma relação positiva entre uma medida geral do capital intelectual e os resultados da inovação. O estudo de caso ilustra como o capital humano, e especificamente as características do empresário, tem um impacto importante sobre os resultados da empresa. O nosso trabalho contribui para mostrar a relevância do capital intelectual no sucesso das inovações, e os resultados incentivam os profissionais a investirem em capital estrutural e relacional, e também para melhorar o grau de planejamento das atividades para obter melhores resultados a longo prazo.

Palavras-chave: capital intelectual, iniciativa empresarial, inovação, capital humano, capital estrutural, capital relacional.

Introduction

Innovation and entrepreneurship are essential organizational strategies to help find a way out of the world financial crisis affecting today's firms. Thus, the study of the organizational factors underlying these strategies is of utmost importance to help current organizations find a solution to this problem.

In turn, the topic of intellectual capital and its components is becoming particularly relevant in the latest management literature. According to specialist literature (Tayles, Pike & Sofian, 2007; Wann-Yih, Man-Ling & Chih-Wei, 2008), intellectual capital is the basis for the generation of sustainable competitive advantages, and this relationship has been broadly studied in the case of medium and large-sized organizations. Therefore, an analysis of the components of intellectual capital as organizational enablers of innovation promises to be an interesting research field to explore in greater depth, as some works have already revealed (Aramburu & Sáenz, 2011; Santos-Rodrigues, Figueroa & Fernandez, 2010; Subramaniam & Youndt, 2005; Youndt, Subramaniam & Shnell, 2004).

Entrepreneurship has also acquired a relevant role in recent years. Traditionally, research on entrepreneurship has focused on the creation of new businesses and the analysis of the factors underlying this phenomenon. However, the field of entrepreneurship has broadened its boundaries and has added other interesting topics such as the analysis of how the opportunities for the creation of future products and services are discovered, assessed and exploited (Welbourne & Pardo-del-Val, 2009). Within this context, the role played by entrepreneurs and the study of their personal characteristics (attitudes, knowledge, competences, etc.) may become important factors to explain the above.

Bearing in mind these considerations, our research goal centres on analyzing the influence of intellectual capital as well as the personal characteristics of entrepreneurs on organizational innovation results. This phenomenon has already been analyzed in the case of medium and largesized organizations, as mentioned before. Nevertheless, this ground remains unexplored in the case of micro and small firms and its study becomes primary in the case of newly developing countries such as Costa Rica. Our analysis confirms the existence of a positive and significant relationship between structural and relational capital and innovation results. The case study developed in order to undertake an in-depth analysis of human capital confirms that sharing values, empowerment and collaboration are related to a firm's innovation results. Similarly, fluid flows of communication between the entrepreneurs and their workers have an important influence on innovation.

With this purpose, our work has been divided into three different sections. Firstly, we have developed a literature review of the main topics under research: entrepreneurship and the flexibility of small firms to adapt present context and to innovate; intellectual capital, based on three constructs: human, relational and structural capital; and the influence of intellectual capital and entrepreneur characteristics on the success and good results of the innovation projects developed by micro and small firms. When we refer to the success of the innovation project we mean that the new processes and products developed will permit the firm to compete in the markets and to obtain good results. As a consequence, we formulated four hypotheses. Secondly, we present the methodology used for the analysis (quantitative and qualitative) and the main results obtained. Third, we expose the main conclusions of the work, limitations and future research lines.

Entrepreneurship and the role of MSMES in the present crisis

Entrepreneurship facilitates innovation, creates wealth, assumes risk and is conducted by an individual capable of combining resources without fear of failure (Crane & Crane, 2007). All entrepreneurs start their businesses with the intention of succeeding, but great market uncertainty means that few projects manage to continue past their first year of life.

The current economic crisis is generating company layoffs, which, in turn, leads individuals to start up their own businesses. Moreover, this very crisis makes individuals, and especially young people, see entrepreneurship as an interesting tool for the development of their projects and for generating their own employment. Therefore, we can say that an economic crisis drives both opportunity and necessity entrepreneurship, to use the terminology of Block and Wagner (2010).

In this sense, Larroulet and Couyoumdjian (2009) argue that the nature of an entrepreneurial project (by necessity or opportunity) explains, in part, why some nations, although intensive in entrepreneurship projects, fail to achieve the economic development of others, which are less active. This is because opportunity entrepreneurs often exploit real market advantages and generate profits, as described by the theory of Schumpeter (1942) (creative destruction). However, necessity entrepreneurs move to these activities as a result of the lack of other opportunities (a frequent process in times of crisis) and their projects do not necessarily takes advantage of a profitable and viable market opportunity. Similarly, literature agrees on the fact that crisis is much more related to necessity entrepreneurship (Quian, Haynes & Riggle, 2010; Okamuro, Van Stel & Verheul, 2010; Reynolds, Camp, Bygrave, Autio & Hay, 2001). Gem research has also shown that the economic contribution of opportunity entrepreneurs is generally higher than the economic impact generated by necessity entrepreneurs (Roland, Kelley, Kew, Herrington & Vorderwülbecke, 2013, p. 28).

In Latin American countries, only 63% of entrepreneurs are motivated by opportunity compared to 80% in more developed countries (Larroulet & Couyoumdjian, 2009), which may explain the difference in the productivity of entrepreneurial activities. Less optimistic are the data offered by Roland et al. (2013, p. 28) in the Gem global report. The authors point out that "in 2012 entrepreneurs in the EU were an average of 2.7 times more likely to be an improvement-driven opportunity entrepreneur than a necessity-driven one". The same report affirms that the ratio was around 2 to 1 in Latin America, with the exception of Ecuador.

These ventures are conducted through micro, small and medium-sized enterprises. The importance of micro, small and medium-sized enterprises (MSMES from now on) in the world economy is unquestionable, and their flexibility and simplicity makes it easier for them to introduce incremental innovations in products or services (Suarez & martin, 2008). These companies employ a large part of the population, supplying markets other large companies do not reach and offering more personalized products. However, these firms are highly vulnerable to the environment, since their low capitalization makes them disappear when faced with sudden changes in demand or the appearance of new competitors. MSMES have serious difficulties in surviving their first year of operation as a result of factors such as their inexperience in the business area, strong competition and the fragility of their financial structures (Pena, 2002). Companies are usually highly dependent on a few customers, have few human resources and a low amount of capital and, as a consequence, their resources must be used in an efficient manner in order for them to survive.

In some countries, about 95% of companies are SMES. However, mortality rates are high with up to 50% of firms not reaching their third year of life (Barba & Martinez, 2009). In 2008, for example, nearly 600,000 small U.S. companies closed down (Holmes, 2010). On the positive side, the organic structure of SMES allows them to adapt easily to turbulent and heterogeneous environments compared with large corporations which are less flexible and react more slowly to changing market conditions (Landström, 2008). A small company, managed correctly, can increase a firm's opportunities, for example in terms of personalized customer service, or due to the fluid communication flows that make it easier to consider employee initiatives.

Initially, it was believed that the process of transforming knowledge into innovation was more common in large firms, yet more recent studies show that SMES are also able to carry out this process, and are sometimes more efficient in doing so (Sanchez, 2007). This process of generating and transforming knowledge implies the possession of intellectual capital.

Intellectual capital

Intellectual capital has been defined as an intangible resource and generates strategic value for the organization (Díez, Ochoa, Prieto & Santidrian, 2010; Martín de Castro & García, 2003; Ordoñez, 2004; Skandia, 1995; Steward, 1997). Its key elements are human capital, structural capital and relational capital although authors have used different names to define a similar classification.

Edvinsson and Malone wrote a book about the indicators that resulted from research conducted in Skandia, a Swedish insurance and financial services company. They included two types of intellectual capital in its annual report: human and structural. In this book, they referred to other companies that adopted this system such as Hughes aircraft, the imperial Bank of Commerce in Canada and DOW Chemical, among others (Edvinsson & Malone, 1999).

Pena (2002) proposes a relationship between intellectual capital and the survival of start-ups. The author finds a direct relationship between human capital (experience in business, education and motivation) and positive company results. In terms of organizational capital elements (the ability to adapt to change and the implementation of correct strategies), the author indicates that this concept is associated with the growth and survival of the business. Finally, the author states that the development of productive business networks and access to critical economic agents facilitate the success of an entrepreneurial project.

Zerenler, Hasiloglu and Sezgin (2008) conclude that the distinctive competences of a company may be the result of intellectual capital, as this generates better innovative skills. In their study of more than 90 companies in the automotive industry in turkey, the authors found that innovation has a positive relationship with human, structural and relational capital (customer capital), with the latter being the most relevant component.

According to Shang, lin and Wu (2009), it is widely accepted that the accumulated knowledge of customers, suppliers, relationships, processes, etc. Is directly linked to the success of an organization. This knowledge forms part of a company's intellectual capital that must be exploited and explored by the organization to improve their decisionmaking processes, and to constantly improve and innovate.

The study by Nie (2009) shows that most of the 20 companies analyzed went through three traditional stages of growth: from manufacturers and retailers to technology developers. During the first stage, companies obtained knowledge about markets, products, sales, and elements of good governance whilst building distribution channels and accumulating capital. The firms then entered the production phase, gained experience in it, and achieved economies of scale that reduced their vulnerability. Finally, the firms acquired the financial capacity to invest in research and development and establish their own products and brands. Thus, some companies create value through intangible assets, knowledge or intellectual capital. The research of Joia and Malheiros (2010), after studying the Brazilian manufacturing industry from 1996 to 2005, links strategic alliances to the development of the associated firms' intellectual capital. They found evidence that cooperation agreements for innovation provide the greatest increase in intellectual capital, especially when they are carried out in parallel with other strategic alliances.

Miller (1999) developed a model of intellectual capital introducing integrity and intelligence as core competences, as shown below (see Figure 1):

Each of the classifications of intellectual capital requires different forms of investment (Subramaniam & Youndt, 2005):

- Human capital (individual) requires investment in hiring, training, and retention of employees.

- Structural capital (structures, processes and systems) requires the establishment of work routines and procedures to retain knowledge, and

- Relational capital (networks and relationships) requires the development of standards to facilitate interaction, relationships and collaboration.

This research uses this classification together with other elements mentioned in the work by Sánchez (2012) whose classification of intellectual capital includes business capital (relations arising from transactions with customers, suppliers and distribution channels) and social capital (relationships with other social actors) within relational capital. Organizational capital (culture, values, corporate learning, etc.) and technological capital (technological developments, access to sources of information, research products, databases, patents, software developed or adapted, and infrastructure) are incorporated into structural capital, as shown in Figure 2.

The influence of intellectual capital on the success of entrepreneurial innovation projects

Intellectual capital is not a subjective measure of a company's value. By contrast, it involves investment in human capital, research and development, corporate culture, information systems and production processes. As affirmed by Lima and Carmona (2011), it is now the core of the knowledge economy and greatly exceeds the tangible value of a company.

Edvinsson and Malone (1999) claim that corporate value does not come directly from any of the three elements of intellectual capital but from the interaction between them. They also say that if a company is weak in any one of these factors, it does not have the potential to convert its intellectual capital into corporate value. Therefore, it is important for today's businesses to understand the value of their intangible assets and intellectual capital variables.

The different components of intellectual capital (human, structural and relational) are key to the success of a business project, and can be critical in the case of msme businesses and entrepreneurship projects.

- Human capital: for both large, small and mediumsized companies, human resources are key to achieving objectives. Entrepreneurial capacity, education, industry experience, experience in business management, and professional counselling in the event that they do not have the appropriate experience for attracting and retaining quality staff are vital for MSMES. Having multiple partners and devoting sufficient time to the business has also proved important. Sternberg and Lubart (1999) define entrepreneurship as a form of creativity which can be Labelled as business or entrepreneurial creativity because new businesses are often original and useful. Sternberg (1999) defines creativity as the "ability to produce work that is both novel (i.e., original, unexpected) and appropriate (i.e. useful, adaptive concerning task constraints)". Desrochers (2001) argues that creative people from varied backgrounds come together to generate new and novel combinations of existing technology and knowledge to create innovation, and as a result new firms. Furthermore, Lee, Florida and Gates (2002) show that creativity, diversity and human capital have positive and significant relationships with regional innovation measured as per capita patent production.

- Structural capital: as mentioned in the previous section, corporate structure and a business model adjusted to market conditions are key factors in achieving the strategic goals of a firm. It is also very important to have a suitable planning process and procedures for managing knowledge in a flexible environment alongside an appropriate organizational climate. Technical procedures, the level of technology, practices, Mea-Sures, and the promotion of innovation supported by a stable financial structure can foster the motivation of human resources and their alignment with business objectives. To have a clear and structured business plan may turn into a clear predictor of the success of the project (Fernández, Revuelto & Simón, 2012). Small firms dedicated to technological innovations should also receive support from governmental institutions in order to achieve an adequate financial structure.

In this regard, and in connection with both modalities of intellectual capital, Lima & Carmona (2011) in their research with 22 young Brazilian entrepreneurs from the ICT industry point to four creators of intangible value in business: human capital, knowledge management, structural capital and organizational environment, which are depicted below (Figure 3).

- Relational capital: the sale and marketing of products and services is vital in small businesses, as they are at a clear disadvantage precisely because of their size and reduced ability to influence, whilst large firms are constantly launching advertising campaigns, taking advantage of their low costs based on their economies of scale. It is therefore essential that the entrepreneur is linked to support networks, research and collaboration. This communication with external institutions pro-vides knowledge about the industry and the market, products with appropriate life cycles, and competition (Bench Marking) that enable an appropriate selection of the target market on which their efforts and resources can be focused.

On the subject of relational capital in SMES, Yaghoubi and Ahmadi (2010) found in a study on 143 Thai companies with SME characteristics, customers and markets that the way they do business, seek cooperation and financial resources, and the external environment have a positive effect in achieving their goals.

Entrepreneurial Human Capital

Different authors have analyzed entrepreneurial human capital (as a separate concept from a firm's human capital) because of its important influence on management and company results. They explain entrepreneurial human capital based on variables such as age, academic training and professional experience (Gimmon & Levie, 2009; Goetz & Shrestha, 2009; Pena, 2002).

In more specific terms, Gimmon and Levie (2009) identified twelve factors for entrepreneurial human capital associated with the success of their firms, such as academic degrees, age, education, business orientation and personality, ethnicity, culture, the team supporting the entrepreneur, gender, experience in business and in the industry, and learning ability, among others. These variables explained over 70% of business performance in the 29 firms analyzed.

Sánchez's study (2012) determined that 80% of managers in SMES have university degrees and over eight years' business experience. Education and previous experience in business are closely linked to the survival and growth of enterprises as well as company characteristics, with a focus on differentiation, quality and size (Pena, 2002). Other entrepreneurial human capital variables linked business success to the knowledge of legislation and new trends, the existence of extensive international networks, analytical and communicative skills, and the ability to link all kinds of resources for internationalization, among others.

Thus, based on the arguments set out above, we can formulated the following hypotheses:

Hypothesis 1: An entrepreneurial project's success is related to the human capital of the company.

Hypothesis 2: An entrepreneurial project's success is related to the structural capital of the company.

Hypothesis 3: An entrepreneurial project's success is related to the relational capital of the company.

Hypothesis 4: The success of the introduction of technological innovation is related to the entrepreneur's human capital variables.

Research Methodology

Our study has required the application of a mixed methodology, as it was mentioned before in the introductory section. First, we carried out a quantitative study and, later on, we applied a qualitative case study in order to perform and in-depth analysis of a contradictory result obtained in the quantitative analysis.

Quantitative Methodology

With respect to the first methodology we employed, the quantitative study was conducted by the national Committee for Research, science and technology (NACORST, - CONICIT in Spanish) which provides funding (through grants) for innovation projects in Costa Rica. This entity was chosen precisely because it develops explicit policies to support SMES with a focus on technological and management innovations. In addition, it provides support for small firms so they can participate in fairs and conventions on these topics, its databases are up to date and it offers reliable information which is difficult to find in other institutions in the country (such as bank or ministry databases).

NACORST (CONICIT, 2010) was created in 1972, through law 5048, as an autonomous institution responsible for Channelling and managing financial resources in the field of research in Costa Rica. It has been managing internal resources and loans to strengthen local capabilities in science and technology management for 35 years.

Law 8262 made funds available which are designed to enable small and medium-sized enterprises to incorporate science, technology and innovation into their production activities. These funds are administered by NACORST and applications are Channelled into the development of:

- Technological development projects

- Projects patents

- Technology transfer projects

- Projects for the development of human potential

- Technology service projects

The funds do not finance machinery, equipment, buildings or market research. The deadlines for the implementation of projects must not exceed 24 months. To have access to the funds, the firm must comply with the requirements of law 8262, which include2:

All SMEs that want to benefit from this law must comply with at least two of the following requirements:

- Payment of social security contributions.

- Compliance with tax obligations.

- Compliance with labour rules.

The NACORST Project Selection Process

To assess projects, NACORST civil servants conduct an investigation of the client company that requests the service and of the research institution (or supplier) that is going to carry out the project.

The study of the applicant's project covers aspects such as:

- Self-assessment of the company (10%): technological capacity of the companies involved.

- Opinion of the assessor (10%)

- Evaluation of the company as indicated on the form (80%): this explores the firm's potential in terms of production, implementation and/or marketing of the proposed development project and the relevance of the requirements, an analysis of the impact of the project on the productivity and competitiveness of the firms involved and on the country's economy, And the administrative capacity of the applicant to carry out the project.

The analysis of the research institution must consider six different areas:

- Quality (30%): reviews the proposed objectives, the quality of the proposal (in terms of objectives and methodology), the precise definition of the activities and the rationality of the schedule and sequence of activities.

- Capacity (20%): reviews the infrastructure, equipment and materials demanded by the firm, the track record of the research unit, and the composition and experience of the staff involved in the project.

- Opportunity (10%): refers to aspects such as duration, lead times and place of the bid.

- Conditions offered by the research unit (10%).

- opinion of the assessor (10%)

- Price (20%): economic rationality of the offer. Financing is non-refundable and can reach a maximum of 80% of the cost of the activity or project, depending on the assessment results obtained. The rest must be provided by the company.

Sample Selection

The total population of projects considered for analysis and included in the NACORST database was 143. Running or unfinished projects were discarded as were those whose aim was to attend trade fairs, seminars and conferences. Finally, we obtained 22 completed projects, and 38 projects which had not been executed for different reasons. We successfully contacted 10 of the 22 entrepreneurs who had completed their projects and 21 of the 38 entrepreneurs who had failed to complete the process.

Measurement of Variables and Methods of Analysis

As a result of the different works on intellectual capital and entrepreneurship we compiled a 6-point scale questionnaire in order to obtain the relevant information. The questionnaire analyzed the following constructs:

- Company's human capital: as explained above, human capital is the basis of change, new knowledge and innovation. We measured human capital using two scales: the first one, which had seven items, measured staff turnover, creativity, training and development, staff qualifications, development of new ideas, collaboration and knowledge flows. The second scale (eight items) measured human capital abilities (experience, knowledge, intelligence, commitment, talent, etc.). These items are based on the works of Edvinsson and Malone (1999) and Ordóñez de Pablos (2004).

- Company's relational capital: the concept was evaluated using a scale made up of eleven items, analyzing the existence of norms that facilitate collaboration, customer suggestions, customer loyalty to the firm, strategic alliances, bargaining power, etc. The scale was adapted from Ordóñez de Pablos (2004) and Subramaniam and Youndt (2005).

- Company's structural capital: organizational capital is the platform that supports the structure of knowledge and can coordinate the execution of tasks within a company (Delgado, Martín de Castro & Navas, 2011a; Delgado, Martín de Castro, Navas & Cruz, 2011b). The construct is formed by seven items measuring innovation protection, adaptability and flexibility of production processes, access to information, processes supporting innovation, routines for knowledge retention, etc. Questions were based on the works of Edvinsson and Malone (1999) and Bontis, Crossan and Hulland (2002).

- Entrepreneurial human capital: given the nature of MSMES, the preponderance of the owner in decision making, corporate culture and focus on innovation is remarkable and this fact allows us to study the entrepreneur's human capital separately. This was evaluated using three items: age, education and professional experience based on Goetz and Shrestha (2009), Gimmon and Levie (2009) and Pena (2002).

- Innovation results and success: this construct was assessed using a scale made up of three items that measured the degree to which the firm had developed innovations in products and processes, and the degree to which innovation results were successful.

The different constructs analyzed are based on the ones used by literature on intellectual capital (Edvinsson & Malone, 1999; Ordóñez de Pablos, 2004; Subramaniam & Youndt, 2005) and have been reviewed in the theoretical framework of the paper. In order to respond to the formulated hypotheses, we used descriptive and correlation analyses.

Qualitative Methodology

Concerning the qualitative methodology we have applied to our research, we have selected the case study as the research strategy to be followed. This strategy is recommendable when the researcher has to analyze how or why a phenomenon takes place, in its real context and from a dynamic perspective (Swanborn, 2010; yin, 1994), and be-come extremely useful when the phenomenon is very complex, dynamic or intangible and difficult-to-be-observed elements are implied.

The decision about the number of cases to be studied is affected by the research goals or the degree of depth in the analysis of each case (yin, 1994). In any case, the decision about the number of cases to be studied implies a trade-off (cases studied vs. Depth of analysis of each case) turning this decision into a matter of discretion. As a result of these reflections and bearing in mind that our intention with the qualitative study is to deepen in a particular result obtained in the quantitative analysis, we explored one single only case.

With respect to the selection criteria, these have to be based on the research goals and the concepts and theories supporting the research. Also, stake (1995) and Swanborn (2010) establish, as basic criteria, the maximization of learning the researcher is able to obtain as a result of the study, and the ease to access the information. Thus, in our study, we opted for looking for one organization: a) recognized by a national institution (Costa Rican Chamber of industry, NACORST, etc.), as this fact is an indicator that the firm has been well managed and achieved good results; b) easy to access; c) and with sustained and good results in its innovation activity. As a result of these criteria, Turrones de Costa Rica Doré has been the company chosen to carry out the qualitative study.

The information was gathered employing several methods. We developed semi-structured interviews and consulted organizational documents (webpage, annual reports, company's policies, etc.). Concretely, we developed three interviews:

The first two were oriented to obtain information about organizational characteristics (culture, structure, climate, etc.) and the entrepreneur's personal characteristics, and they were carried out between January and June, 2011. The third one took place in February 2012, and focused on issues relative to their innovation activity. All the interviews were recorded and transcribed to facilitate their analysis, and were undertaken with the owners/managers of the firm.

In order to analyze the information, we generated an initial code book based on our literature review. During the analysis, we employed matrices, conceptual maps and causal networks (Miles & Huberman, 1994) in order to represent the information analyzed, and facilitate the search for patterns and interpret the results obtained.

Some tactics were employed to guarantee the quality of the qualitative study. We have created a protocol to guide the case study, created a code book to increase the reliability of the study, triangulated the information gathered, and Sent the transcription as well as the final draft of the report of the case to the informants to be reviewed.

Results of the study

Quantitative analysis

As explained in the methodology section, we obtained 31 responses from MSMES, all of which were located in Costa Rica. All the interviewees were the legal representatives of their companies and they are their current managers.

Company characteristics

The sample included 9 micro firms, 17 small and 5 medium-sized firms. The 31 companies were geographically distributed as follows (table 1).

The geographical distribution was consistent with the First national Report on SMES (2008), where San José is the province with the largest number of companies (34.6%) and Limon has the least (10.1%). As we can observe, over 75% of the companies in the sample were located in San José (capital) or Cartago. Previous studies have already shown the same trend, that is, big cities concentrate the majority of firms (Al-Mahrouq, 2010).

The sector distribution (table 2) showed differences from the First national Report on SMEs (2008) in which over half of the MSMES were engaged in services (51%). This is mainly because the selected sample consisted of companies that want to innovate in the production of goods or services, and are therefore mainly industrial or agro-industrial firms. In any case, the study by Al-Mahrouq (2010) shows similar results in developing countries.

Entrepreneur characteristics

Based on an analysis of the sample, we can observe that 80% of the owners were male, and aged between 26 and 40 (45%), and between 41 and 60 (42%). Seventy-seven percent of cases had completed college or postgraduate education. This is perhaps explained because the selected population was reported by NACORST, an organization that gives support to firms in Costa Rica mainly through different agreements with universities.

Only 10% of employers had less than 10 years' experience and most (55%) had more than 20 years' professional experience. The results about entrepreneurs' experience are consistent with the study of Orser and Dyke (2009) in which 50.7% of respondents had over 20 years' experience.

In contrast with previous data, if the same factor is analyzed only for the 15 projects that were carried out with NACORST funds or otherwise, the age of entrepreneurs reached similar ratios: 80% were between 26 and 60 years of age. Consequently, age does not appear to be an important success factor.

The education variable also yielded similar results with respect to the total sample (73% had completed an undergraduate or postgraduate degree). In terms of gender, the results were also similar to those obtained in the general sample: 80% of projects were implemented by men, and only 20% by women. In this case, professional experience does seem to be an important factor because only 7% had between 4 and 10 years' experience, 33% between 11-20 years' experience, and 60% had over 20 years of professional experience.

The success factors most frequently mentioned by respondents were the commitment to quality and hard work, followed by the ability to adapt to change, business experience and motivation. They also mentioned perseverance (table 3).

The lack of importance assigned to market research and planning, which corresponds to the lowest investment in these areas, is surprising.

Company's Human Capital

Human capital was assessed using a scale that measured staff turnover, employee creativity, investment in human development, employee qualifications, proactive attitude to developing new ideas, and orientation to cooperation and learning.

The variable which is least related to this group is the one that refers to a company's investment in human development (CH4C). This is probably because SMES are able to assign fewer resources to this area. However, even with the inclusion of this indicator, Cronbach's alpha value was still above 0.71 (see tables 4 and 5).

The human capital capability was measured using a scale which analyzes the professional ability, experience, knowledge, judgment, intelligence, commitment, talent and motivation of the human resources that work in the firm (see table 7).

As shown in table 6, Cronbach's Alpha in this construct was above 0.91.

Company's Relational Capital

The company's relationship with its environment (customers, competitors and other organizations) was measured through questions such as brand loyalty, brand awareness, improved supply of products or services by customers, customer satisfaction and loyalty to the company (see table 9). The entrepreneur was also asked to indicate whether the company developed standards to facilitate interaction and cooperation, had strategic partners, efficient distribution channels, strong cooperation agreements and/or joint ventures. Cronbach's Alpha for this construct was above 0.78 (see table 8).

The question that could be removed to increase the Alpha is CR8f (cooperation with government, universities, suppliers, other producers, etc.), which would have put the indicator up to 0.806. However, a reliability index of 0.78 is considered acceptable.

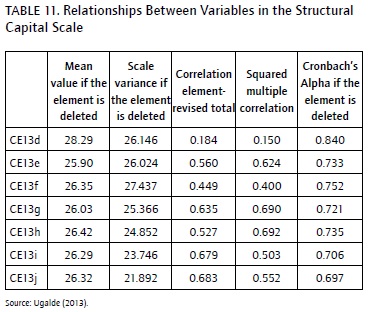

Company's Structural Capital

This was measured through questions such as the degree of innovation protection, the adaptability of production processes to the changing environment, the support of production processes, access to information, support for innovation and the degree to which work routines and processes for knowledge retention were established (see table 11).

The only value that would be worth removing to increase Cronbach's Apha is CE13D (protection of innovation through patents and Licences). However, even with the inclusion of this indicator, Cronbach's Alpha remained above 0.77 (see table 10). In Costa Rica there are not many registered patents or licences. This is because they prefer to use confidentiality as a form of protection and because the registration process is awkward for businesses.

Relationships Between Relational, Structural and Human Capital

Each construct was measured using a six-point scale (6 = totally agree; 1 = totally disagree) and mean values were used for the analysis. More specifically, human capital was measured as the mean value of the two human capital scales, whilst intellectual capital was calculated as the mean value of the scales considered (human capital, relational capital and structural capital). The interviewed entrepreneurs were asked other open questions, and their answers were used to qualitatively clarify different aspects of the results.

The analyzed projects were divided into those which were "approved" or "not approved" by the managing institution (NACORST/ CONICIT). Some of these "not approved" projects continued in the market with their entrepreneur idea obtaining funds through alternative ways. The degree of innovation success has been measured by a 3-point scale both for the approved and not approved projects (as mentioned in the methodology section).

The results obtained from the correlation analysis between the intellectual capital indicators and the approved projects are presented in table 12.

As noted, the projects with the highest indicators in the different forms of intellectual capital managed to obtain funds to develop their innovation projects. Since the grants are only for technological innovations, we can say that there is a relationship between this type of innovation and the companies' intellectual capital.

Another construct tries to evaluate the success in innovation by asking about the number of new products and processes per year, and the result of these innovations. In order to answer the different hypotheses, we developed a correlation analysis between this construct (innovation success) and the constructs of intellectual capital. The results are shown in table 13.

Significant correlations can be observed for intellectual capital and structural capital with innovation success. However, no significant correlations were obtained for relational capital and human capital when measured separately. These results differ from those reported by Santos-Rodrigues et al. (2010) and Zerenler et al. (2008) which predicted a relationship between human capital and innovation. This also contrasts with the observations of Subramaniam and Youndt (2005) who negatively related human capital to radical innovations, and positively linked relational capital to radical innovations. Other authors such as Huang and Li (2009) have also argued that increased social interaction affects knowledge management positively, and that this fact adds value to the innovation development process. These results are similar to those found by Suárez and martin (2008).

Therefore, the results support our general hypothesis that innovation results are related to intellectual capital. They also support (0.449*) H3, which relates structural capital to innovation results. Hypotheses H1 and H2 are not supported by our results.

However, when splitting the sample between approved and non-approved projects (see table 14), intellectual capital also evidenced a positive and significant relationship with intellectual capital and innovation success (0.557). A significant relationship was also observed between relational capital and innovation success (0.649*). The correlation of structural capital with innovation approached a significance of 10% but was not really a positive result. Perhaps the relationship was not significant due to the low number of surveys that were handled (although the correlation was quite high as it was above 50%).

The mean difference test for the split sample shows that for the approved projects the mean differences are significant at 10% for intellectual and structural capital and at 5% for relational capital (see Tables 15 and 16).

As a result, we can say that after splitting the sample based on the result of the project and the mean differences, the correlation analysis shows the relevance of the relational capital variable and supports hypothesis 2 (H2).

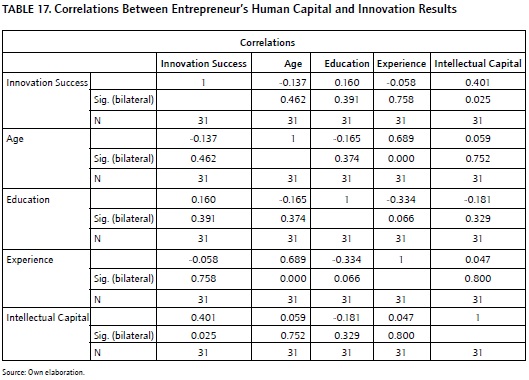

An entrepreneur's human capital is usually measured using variables such as age, education and years of experience, as shown in the previous works of Goetz and Shrestha (2009), Gimmon and Levie (2009) and Pena (2002) which evidence positive correlations with business success. However, in this study our results do not show any significant correlation with innovation success or project approval (see table 17). This leads us to reject hypothesis H4 as no relationship between the variables of an entrepreneur's intellectual capital (such as age, education or years of experience) and success in technological innovations was observed. Perhaps the successful introduction of innovations has greater relation to psychological characteristics found in entrepreneurs (positive attitude, setting clear goals, commitment to quality and customer satisfaction). Other variables that can also measure an entrepreneur's human capital, such as its relationship with other market players (business associations, competitors, major customers and suppliers) may exert more influence on how to exploit and make an innovation opportunity profitable.

The lack of consistent results between human capital and innovation success could be explained by the small size of the population and the sample. In this case, we should have needed to receive data from most of the surveyed companies to obtain statistically significant results. But perhaps, other reasons, different from population and sample size, could also explain this contradictory result. As shown above in the theoretical framework, the specialist literature considered a positive correlation between human capital and innovation results (Mavridis & Kyrmizoglou, 2005; Santos-Rodrigues et al., 2010). Hence, we have opted for developing a case study in order to shed light on this issue.

Case Study Results

Turrones de Costa Rica Doré(TCRD)

TCRD is a factory of nougats and candies created 25 years ago. Today, the firm employs 16 individuals and has a good name in the national market. It is managed by two of its founders and is structured in three important areas, namely, manufacturing, sales and administration.

Basically, the main customers of the firm are big super Market chains and some independent dealers. Also, TCRD sells its products to smaller customers, and is currently setting up businesses with international customers in Spain and middle America. The differentiation of its products is based on continuous innovation. As a result, the firm has few direct competitors, and some of them are big companies such as Café Britt, Nestlé, or Legado. Also, TCRD has been awarded and acknowledged for the quality of its products and the growth of its exports.

Entrepreneurs' Characteristics at TCRD

As mentioned above, TCRD is managed by two owners, both with degrees in business administration, both 50 years old, with over 37 years of professional experience, and in permanent training.

These two managers are brothers and have complementary abilities and knowledge to lead the firm. One of them provides the ability to solve conflicts and establish the strategic direction for the firm, communicating it with a clear leadership style. The other focuses more on the operational dynamics of TCRD, defining jobs, and motivating and coordinating the employees.

Also, these entrepreneurs are members of important national associations in order to increase their knowledge about markets as well as establish formal relationships with other businessmen to improve corporate image.

Intellectual Capital at TCRD

From an internal perspective, the short separation between managerial and control functions make decision-making become a fast process at TCRD. However, the firm has to face up to some obstacles such as the lack of specialized personnel, a short budget, or the lack of guarantees to access the credit.

Concerning the human capital, TCRD looks for employees with a high degree of human quality. Most of operational employees are not qualified, but they are recruited and selected to work coherently with organizational values. They are well-mannered, collaborative people, with a great desire to continually excel, and who share the spirit of the firm's owners. Some of the employees have been working for TCRD for over 25 years, and have always adapted to the changes faced by the firm. As the size of the firm is small, decisions are made rapidly; however, there is an excess of centralization and some problems may arise when decisions have to be made and no manager-owner is present. This problem is being solved by increasingly empowering employees, and this process is being deployed gradually as organizational size becomes greater.

With regard to the relational capital, the capability to develop cooperation networks with customers, suppliers or support institutions, becomes of utmost importance at TCRD, as these networks help the firm to carry out research activities and enter foreign markets. As an example, governmental support provides funds for innovation, application of technology, employees' training and education as well as consultancy. Other institutions collaborate so that TCRD managers create links with international fairs and learn how to export their products. Also, strategic alliances with higher education institutions become primary for TCRD, basically in the design of new products where the know-how of the firm becomes insufficient. In addition, the firm receives feed-back from customers (national and international), suppliers, contacts generated in fairs, and support institutions, and receives information about fundamental topics such as changes in the industry.

With respect to the structural capital, organizational culture makes it clear what type of behavior is not accepted in the firm. Employees have been asked about the values that keep a very healthy organizational climate. Values such as laboriousness, fellowship and honesty were agreed upon by all the employees at TCRD and are respected on all the hierarchical levels.

Their good corporate image is generating a high level of product acceptance, though the firm is not investing much money in publicity. They prefer to be known by word of mouth. Also, TCRD has a short budget for commercialization activities, and this fact becomes an important disadvantage compared to big companies. So, their commercialization strategy is focused on the point of sale, accompanied by some advertisements in press or on billboards.

Concerning their production system, TCRD has documented procedures in this area. The firm was working for two years on achieving the Iso 22000 standard certification. Though they were not certified, the process allowed the firm to acquire a great experience in formalization and documentation of working processes. Consequently, today, they have highly standardized working methods. Also, the firm has made significant efforts to broaden production facilities and guarantee the acquisition of high quality raw materials, as the latter becomes fundamental to create good designs for their products.

Intellectual capital, entrepreneurs' characteristics and innovation results at TCRD

TCRD employees are creative collaborators who are highly implied with the firm and with a great desire to excel. Some innovation challenges are established by managers; however, some initiatives proposed by employees are transformed into innovation. The positive attitude of employees towards the firm makes them more committed with organizational goals; as a result, employees tend to propose improvement ideas which, sometimes, become new products or processes. Also, the fluid communication between managers and employees facilitates this process, as their small organizational size allows the employees to transmit ideas easily and quickly. However, the transformation of improvement ideas into innovation is slow as the firm does not have any technical staff. In this respect, as stated above, the collaboration with universities and other research institutions becomes of utmost importance for TCRD.

Open communication with customers and suppliers together with the relationship with universities has provided TCRD with new ideas to manufacture innovative and differentiated products. The continuous adaptation to changes in market needs and their capability to manufacture high quality products have increased their customers' trust.

Also, organizational flexibility is fundamental in achieving this goal. Given the firm's small and Sensitive structure, it can react easily and quickly. Also, when organizational climate is respectful and pleasant, changes tend to be accepted better. Corporate image also contributes to innovation. A good corporate image at national level facilitates the launching of new products, and customers will accept this innovation assuming that the new product will have the same level of quality as traditional ones.

Links to higher education institutions and other support institutions have become primary for innovation processes at TCRD. In this respect, the school of Food technology of the Costa Rica University has been of invaluable help to formulate new product designs. Also, institutions such as Procomer and Cadexco have contributed to support TCRD in the insertion of international markets. And the NACORST/CONICIT has funded the attendance to national and international fairs in order to observe market trends as well as the development of innovation projects.

Concerning entrepreneur characteristics and their relationship to innovation, the case has revealed that the motivation of entrepreneurs and their orientation to innovation minimizes the obstacles for innovation to take place and expedites decision-making. Their business experience, together with their knowledge about markets, creates the necessary synergy for customer-oriented innovation projects arise. Understanding customer needs and expectations together with short- and long-term planning of the structural changes needed to design and manufacture products that meet those needs and expectations are personal abilities of entrepreneurs that contribute significantly to innovation.

To sum up, entrepreneurs' knowledge about markets and their motivation to innovate allows the firm to generate ideas about potential profitable products. Short and Longterm planning helps firms to develop feasibility studies about those ideas, and alliances with the academia and professionals in the area of nutrition and food technology allow them to design products that meet potential customers' needs. The relationship to support institutions facilitates that TCRD is able to obtain funds to carry out product tests. In this process, continually consulting with customers, salesmen and production managers is fundamental in order to improve the original proposals. Once the product is on the market, it is monitored at each point of sale, and usually these innovations give positive results such as a better corporate image, an increase in sales and exports, a greater customer satisfaction, and a better market positioning.

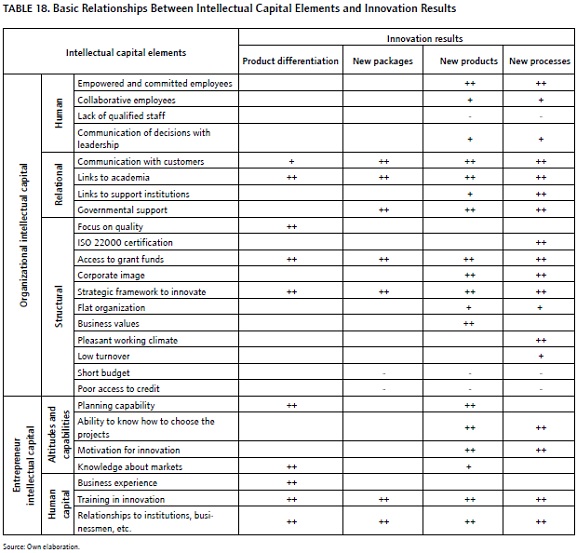

Table 18 summarizes the basic relationships between intellectual capital elements and innovation results for TCRD. To represent the intensity of each relationship between variables, we have employed the following scale: (++) represents the existence of a strong positive relationship between variables; (+) represents the existence of a medium-level positive relationship between variables; (-) represents the existence of a medium-level negative relationship between variables; and (--) represents the existence of a strong negative relationship between variables.

Conclusions

The results of our theoretical and empirical analysis have allowed us to draw some conclusions. In terms of the theoretical framework, we have analyzed the value of entrepreneurial projects in a crisis environment in which entrepreneurs try to innovate through new ideas that create new business opportunities. Small firms and new entrepreneurial projects are flexible enough to adapt to the changes of the environment because they facilitate communication flows, knowledge generation, and teamwork, which, in turn, foster innovation (Sanchez, 2007). We also analyzed the concept of intellectual capital, and its three components: human, relational and structural capital (Subramaniam & Youndt, 2005).

As a result of the literature review, we argue that intellectual capital together with the individual characteristics of a particular entrepreneur have a positive influence on the success of the entrepreneurial project. In particular, human capital and the creativity of individuals that make up the firm's human capital have a clear influence on the innovation results and company success (lee, Florida & Gates, 2002). Lima and Carmona (2011) pointed to human capital and structural capital as important factors that increase business value, whilst different authors such as Yaghoubi and Ahmadi (2010) have shown the relevance of relational capital in the achievement of a company's goals, particularly in small firms.

In order to analyze these arguments in depth, we carried out an empirical analysis. Our quantitative data produced varying results. Our descriptive work showed that the success factors most frequently considered by respondents were the commitment to quality and hard work, followed by flexibility and business experience. The lack of importance assigned to the market research and planning variables was surprising. It is true that entrepreneurs have less access to financial resources and so they cannot invest large amounts of resources in planning. However, these results have more to do with their way of doing things, I.E. with their mentality or mindset. Entrepreneurs value experience but do not value specific training in business tools and techniques as much (Gorman, Hanlon & King, 1997). An analysis of the influence of having a specific degree on the importance given to managerial tools may be of interest for future research.

In terms of our sample, the correlation analysis showed a significant relationship between innovation results and intellectual capital. In addition, intellectual capital indicators showed higher values in approved projects. This result is linked to the work of Zerenler et al. (2008), which shows that intellectual capital represented a competitive advantage for innovation.

Similarly, we found a positive relationship between structural capital and innovation success. This may be because in MSMES, which have more flexible structures and flatter organizations, it is easier to create an environment that is conducive to innovation. This proposal is in line with Aramburu and Saenz (2011), who argue that structural capital, based on organizational design, is a source of ideas. Suárez and martin (2008) relate organizational capital positively to service quality and innovation; and Subramaniam and Youndt (2005) point out the influence of organizational capital on incremental innovation capability. Also, we obtained some positive results for relational capital when splitting the sample. However, the reduced size of the sample may have reduced the level of significance of our results.

We were unable to find any significant relationship with human capital, unlike the results of studies by Santos-Rodrigues et al. (2010) and Mavridis and Kyrmizoglou (2005). However, the results obtained for the case studied using a qualitative methodology are in line with the specialist literature. Particularly, the analysis of TCRD has revealed that empowered, committed, and collaborative employees, as well as the communication of decisions with leadership have a positive impact on innovation results for the firm studied, and this effect is stronger for the variable 'empowered and committed employees'. Likewise, the lack of qualified staff in the analyzed firm has a negative effect on innovation results, concretely on the development of new products and new processes.

Although we tried to measure an entrepreneur's human capital in the quantitative study, our variables (education, age and experience) did not yield any significant results. Nevertheless, our qualitative study showed that some elements of entrepreneurs' human capital such as their business experience, their training in innovation, and their relationships with institutions (higher education and other support institutions) clearly contribute to achieve better innovation results for the case of TCRD. This effect on innovation is equally strong for the three variables; but unlike 'Business experience', 'Training in innovation' and 'Relationships to institutions, businessmen, etc.' show a positive relationship with all the results of innovation (product differentiation, new packages, new products and new processes).

We must outline that the main implications derived from our analysis have a practical dimension, as entrepreneurs should encourage the different dimensions of intellectual capital in order to innovate. Structural capital, and particularly the degree of innovation protection, the adaptability of production processes to the changing environment or the degree to which work routines and processes for knowledge retention are established, seem to turn into key tools for the development of innovations that permit the firm to compete in the market. Similarly, employees' empowerment and value sharing are two key factors for innovation success. The study reveals the need for training as one key factor that must be encouraged, mainly in small firms.

The main academic contribution of the paper is related to the fact that the present work has focused the analysis on small firms in a developing country, and there are few works that concentrate on those types of firms. Our results may become relevant as small firms configure the larger part of the industrial sector in Costa Rica.

In any case, the size of the sample is an important factor to explain the lack of results in the quantitative analysis. Also, our work has the limitations inherent to a cross-sectional study, both for the quantitative and the qualitative analysis. In addition, we have qualitatively studied just one case and have just interviewed the managers/owners of the firm. In this respect, future research should consider interviewing different individuals from different organizational hierarchical levels (not only the managers of the firm). In so doing, the triangulation would be more accurate.

Also, further work should include a broader number of indicators that can measure an entrepreneur's human capital.

In addition, a greater sample is needed to increase the statistical significance of our quantitative results. It could also be interesting to incorporate big firms in the sample, in order to see if there are differences depending on the size.

Notes

1Beneficiary of the program "Grants for research development oriented to Phd students, subprogram talent attraction" from VlC-Campus, University of Valencia.

2http://www.pyme.go.cr/svs/herramientas/documento.Aspx?id=204.

References

Al-Mahrouq, M. (2010). Success factors of small and medium-sized enterprises (SMES): the case of Jordan. Anadolu University Journal of Social Sciences, 10(1), 1-16. [ Links ]

Aramburu, N., & Sáenz, J. (2011). Structural capital, innovation capability, and size effect: an empirical study. Journal of Management & Organization, 17(3), 307-325. [ Links ]

Barba, V., & Martínez M. (2009). A longitudinal study to assess the most influential entrepreneurial features on a new firm's growth. Journal of Small Business and Entrepreneurship, 22(3), 253/266. [ Links ]

Block, J. H., & Wagner, M. (2010). Necessity and opportunity entrepreneurs in Germany: Characteristics and earnings differentials. Schmalenbach Business Review, 62(2), 154-174. [ Links ]

Bontis N., Crossan M., & Hulland J. (2002). Managing an organizational learning system by aligning stocks and flows. Journal of Management Studies, 39(4), 437-469. [ Links ]

CONICIT (2010). http://www.conicit.go.cr/servicios/incentivos/financieros/fondos_adm/propyme/index.html. Retreived October 2010. [ Links ]

Crane, F., & Crane, E. (2007). Dispositional optimism and entrepreneurial success. Psychologist-Manager Journal, 10(1), 13-25. [ Links ]

Delgado V.M., Martín de Castro, G., & Navas L.J. (2011a). Organizaional knowledge assets and innovation capability: evidence from Spanish manufacturing firms. Journal of Intellectual Capital, 12(1), 5-19. [ Links ]

Delgado V.M., Martín de Castro, G., & Navas L.J & Cruz G.J. (2011b). Capital social, capital relacional e innovación tecnológica. Una aplicación al sector manufacturero español de alta y media-alta tecnología. Cuadernos de Economía y Dirección de la Empresa. España, 14(4), 207-221. [ Links ]

Desrochers P. (2001). Local diversity, human creativity, and technological innovation, Growth and Change, 32, 369-394. [ Links ]

Diez, J.M., Ochoa, M.L., Prieto, M.B., & Santidrian, A. (2010). Intellectual capital and value creation in spanish firms. Journal of Intellectual of Capital, 11(3), 348-367. [ Links ]

Edvinsson, L., & Malone, M.S. (1999). El capital intelectual: cómo identificar y calcular el valor inexplorado de los recursos intangibles de su empresa. Bogotá: Editorial Norma. [ Links ]

Fernández, R., Revuelto, L., & Simón, V. (2012). The business plan as a project: an evaluation of its predictive capability for business success. The Service Industries Journal, 32(15), 2399-2420. [ Links ]

First National Report on SMS's (2008). Observatorio de MIPymes. Hacia el estado de las MIPymes: Primer Diagnóstico Nacional de MIPymes. Serie observatorio de MIPymes. San José, Costa Rica. [ Links ]

Gimmon, E., & Levie, J. (2009). Instrumental value theory and the human capital of entrepreneurs. Journal of Economic Issues, 43(3), 715-732. [ Links ]

Goetz, S., & Shrestha, S. (2009). Explaining self-employment success and failure: Wal-mart versus starbucks, or schumpeter versus putnam. Social Science Quarterly. 90(1), 22-38. [ Links ]

Gorman, G., Hanlon, D., & King, W. (1997). Some research perspectives on entrepreneurship education, enterprise education and education for small business management: a ten-year literature review. International Small Business Journal, 15(3), 56-77. [ Links ]

Holmes, T. (2010). Letting Go. Black enterprise: http://www.blackenterprise.com/small-business/letting-go-2/5/. [ Links ]

Huang, J.W., & Li, Y.H. (2009). The mediating effect of knowledge management on social interaction and innovation performance. International Journal of Manpower, 30(3), 285-301. [ Links ]

Joia, L., & Malheiros, R. (2010). Evidências empíricas da influência de alianças estratégicas no capital intelectual de empresas. BASE- Revista de Administração e Contabilidade da Unisinos, 7(2), 162-177. [ Links ]

Landström, H. (2008). Entrepreneurship research: a missing link in our understanding of the knowledge economy. Journal of Intellectual Capital, 9(2), 301-322. [ Links ]

Larroulet, C., & Couyoumdjian, J. (2009). Entrepreneurship and Growth. Independent Review, 14(1), 81-100. [ Links ]

Lee S., Florida R., & Gates, G. (2002). Innovation, human capital, and creativity: software industry center. Working Paper. Carnegie Mellon University, Pittsburgh. [ Links ]

Lima, A., & Carmona, C. (2011). Determinantes da formação do capital intelectual nas empresas produtoras de tecnologia da informação e comunicação. Revista de Administração Mackenzie, 12(1), 112-138. [ Links ]

Martín de Castro, G., & García, F. (2003). Hacia una visión integradora del capital intelectual de las organizaciones. Concepto y componentes. Boletín Económico de ICE, 2756, 7-16. [ Links ]

Mavridis, D., & Kyrmizoglou, P. (2005). Intellectual capital performance drivers in the greek banking sector. Management Research News, 28(5), 43-63. [ Links ]

Miles, M. B., & Huberman, A. M. (1994). Qualitative data analysis: an expanded sourcebook of new methods. Thousand Oaks C. A.: Sage. [ Links ]

Miller, W. (1999). Building the ultimate resource. Management Review, 88(1), 42-45. [ Links ]

Nie, W. (2009). Decoding the secrets of success of Chinese private companies. Perspectives for managers, 172, 1-5. [ Links ]

Okamuro, H., van Stel, A., & Verheul, I. (2010). Understanding the drivers of an entrepreneurial economy: lessons from Japan and the netherlands. CCes Discussion Paper Series 36. Centre for Research on Contemporary economic systems, september, 1-44. [ Links ]

Ordóñez de Pablos, P. (2004). Las cuentas de capital intelectual como complemento del informe anual. Economía Industrial, 357, 63-74. [ Links ]

Orser, B. & Dyke, L. (2009). The influence of gender and occupational role on entrepreneurs' and corporate managers' success criteria. Journal of Small Business and Entrepreneurship, 22(3), 275-301. [ Links ]

Pena, I. (2002). Intellectual capital and business start-up success. Journal of Intellectual Capital, 3(2), 180-198. [ Links ]

Qian, H., Haynes, K. E., & Riggle, J. D. (2010). Incubation push or business pull? investigating the geography of U.S. business incubators. Economic Development Quarterly, 25(1), 79-90. [ Links ]

Reynolds, P.D., Camp, S.M., Bygrave, W.D., Autio, E., & Hay, M. (2001). Global Entrepreneurship Monitor 2001 Summary Report. Retrieved november 10th, 2011, from http://www.gemconsortium.org/about.aspx?page=pub_gem_global_reports. [ Links ]

Roland, S., Kelley, D., Kew, J., Herrington, M., & Vorderwülbecke. A. (2013). Global Entrepreneurship Monitor 2012 Global Report. Retreived 9th of November, 2013 http://www.gemconsortium.org/docs/download/2645. [ Links ]

Sánchez, M. Paloma. (2007). Tribuna de Debate. Revista de Investigación en Gestión de la Innovación y Tecnología. I+D y Competitividad, 40, enero-febrero. Retreived October 2010. http://www.madrimasd.org/revista/revista40/tribuna/tribuna2.asp. [ Links ]

Sánchez, G. J. (2012). Capital intelectual factor clave para la competitividad: caso Pymes manufactureras de Guadalajara, México. Buenos Aires, Argentina: Asamblea General de ALAFEC. [ Links ]

Santos-Rodrigues, Figueroa, H.P., & Fernandez, C. (2010). The influence of human capital on the innovativeness of firms. The International Business & Economics Research Journal, (9), 53-64. [ Links ]

Schumpeter, J. A. (1942). Capitalism, Socialism and Democracy. New York: Harper and Brothers. [ Links ]

Shang, S., Lin S., & Wu, Y. (2009). Service innovation through dynamic knowledge management. Industrial Management & Data Systems, 109(3), 322-337. [ Links ]

Skandia (1995). Supplement to Skandia's 1994 annual report. Skandia, Stockholm. [ Links ]

Stake, R. E. (1995). The art of case study research. Sage: Thousand Oaks (C. A. [ Links ]).

Sternberg, J. S., & Lubart, T. I. (1999). The concept of creativity: Prospects and paradigms. In R. J. Sternberg (ed.) Handbook of creativity. Cambridge University Press: New York. [ Links ]

Sternberg, R. J. (1999). Handbook of creativity. Cambridge University Press: New York. [ Links ]

Steward, T. A. (1997): La nueva riqueza de las organizaciones: el capital intelectual, Barcelona: Granica. [ Links ]

Suárez T. & Martín M. (2008). Impacto de los capitales humano y organizacional en las estrategias de la PYME. Cuadernos de Administración, 21(35), 229-248. [ Links ]

Subramaniam, M., & Youndt, M. (2005). The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal, 48(3), 450-463. [ Links ]

Swanborn, P. (2010). Case study research. What, why and how? Sage: London. [ Links ]

Tayles, M., Pike, R. H., & Sofian, S. (2007). Intellectual capital, management accounting practices and corporate performance: Perceptions of managers. Accounting, Auditing & Accountability Journal, 20(4), 522-548. [ Links ]

Ugalde, N. (2013). Capital intelectual, características del emprendedor e innovación. El caso de las Mipymes costarricenses. Valencia: Universitat de Valencia. [ Links ]

Wann-Yih, W., Manling, C., & Chih-Wei, C. (2008). Promoting innovation through the accumulation of intellectual capital, social capital, and entrepreneurial orientation. R&D Management, 38(3), 265-277. [ Links ]

Welbourne, T., & Pardo-del-Val, M. (2009). Relational capital: strategic advantage for small and medium-size enterprises (SMES) through negotiation and collaboration. Group Decision and Negotiation, 18(5), 483-497. [ Links ]

Yaghoubi, N., & Ahmadi, F. (2010). Factors affecting the women entrepreneurship in industrial section. European Journal of Social Science, 17(1), 88-95. [ Links ]