1. Introduction

The valuation of a technological or invention patent is a sensible exercise that requires considering aspects of Intellectual Property Management (IPM), in order to establish the legal status and incorporate elements of reputational risk and lack of protection of these rights or intangible assets. Good sense, coherence and technical knowledge are necessary in order not to lose sight of: what the purpose of the valuation is, why is the valuation being done in a certain way, and for what and for whom is the valuation being done.

According to Viloria, Nevado and López [1], technological or invention patents are usually classified as intangible assets that play a crucial role in a company's market opportunities and are very important when carrying out commercial transactions. The value of an invention patent is defined as the present value of the future economic benefits derived from ownership [2,3]. These benefits may be received in a single payment or may extend over time. For this reason, it is important to foresee what the future will be like in a context of time, geographies, owners and potential uses, and to answer questions such as: how much are they worth and what is the best alternative to exploit these intellectual property rights?

This article proposes a methodology for the Evaluation of Conditions and Potential of Technology (EVCPT) and raises some technical guidelines for valuing alternatives or transfer scenarios in accordance with the theoretical foundations of Intellectual Property Management (IPM) and R&D and the theory of Patent Valuation [4].

Subsequently, we proposed and applied a scoring methodology according to business conditions and those of the patent holders in order to determine a Risk Factor (RF) that would then be incorporated into the cost of capital, also called discount rate when valuing the transfer alternatives. For this valuation exercise, we consider two transfer scenarios or alternatives: i) the internal production and distribution by the company itself, which is the one initially preferred by the patent holders, and ii) the licensing alternative. Finally, the results are discussed in the light of the literature on Intellectual Property Management and R&D and patent valuation, presenting some technical guidelines to be taken into account.

2. Literature review

2.1 Technology Management (IPM) and of Intellectual Property

Intellectual property is composed of different rights such as copyrights, related rights, distinctive signs, such as trademarks, geographical indications, and new creations, such as patents, utility models, industrial designs and trade secrets among others; we will delve into patents. The World Intellectual Property Organization WIPO defines patents as:

An exclusive right granted on an invention. In general terms, a patent entitles its holder to decide whether the invention may be used by third parties and, if so, in what form. In exchange for this right, in the published patent document, the patent holder makes the technical information relating to the invention available to the public [5].

Not all innovations, technology transfers occurring in an economy, organizational changes or changes in know-how could be patentable. Moreover, a large part of what is patented never becomes an innovation, which represents a major limitation. Nevertheless, patents are an effective tool for protecting the intellectual material behind an innovation.

Intellectual property rights are similar to any other property right: they allow the creator, or the holder of a patent, trademark, or copyright, to enjoy the benefits derived from his/her work or the investment made in connection with a creation. These rights are enshrined in Article 27 of the Universal Declaration of Human Rights, which establishes the right to benefit from the protection of the moral and material interests resulting from the authorship of scientific, literary or artistic productions [6].

Industrial property is divided into two main branches: distinctive signs, consisting of trademarks, slogans and trade names, geographical indications and appellations of origin, and new creations, consisting of invention patents, utility model patents, industrial designs, layout designs and integrated circuits, and trade secrets [7]. The invention patent is a title granted by the State to an inventor that allows him, for a limited time, to prevent an unauthorized third party from using or exploiting his invention in that territory. To enjoy this power, the inventor must compensate the State with the disclosure of his invention. This bilaterality, which grants faculties and defines obligations, seeks to strike a balance between the interest of the patent holder and the public interest [8-10].

Territoriality is one of the basic principles in patent matters and has, at least, the following fundamental implications: (i) each State is autonomous in defining the national legislation and practice governing the stages of a patent granting procedure in its jurisdiction; (ii) in accordance with national regulatory systems, a rightful owner must file individual applications in each of the countries of interest in which he seeks protection for his invention and go through the national process in accordance with the procedures established by each country; iii) the scope of protection granted by a national patent office is only for the territory (specific country) where protection was requested and recognized and; iv) the same invention processed in different territories may therefore achieve a different result in terms of its legal protection in each of them, even though the patentability requirements evaluated are the same, according to the sovereign analysis carried out in each jurisdiction [11].

To internationalize patent law, WIPO has designed and implemented the PCT System. In order to facilitate the initiation of patent protection applications in a large number of territories, the Patent Cooperation Treaty (PCT) was established. This treaty establishes a simplified procedure for the filing of patent applications in a large number of countries (those that are members of the treaty). It should be noted that the use of the treaty does not imply obtaining an international patent [12].

2.2 Value properties of technology patents and due diligence in the monetary valuation process

The determination of the monetary value of a patent is influenced by a large number of technological, legal and market attributes that add value. Undoubtedly, a patented technology does not have the same value in the knowledge market as one that does not enjoy exclusion rights. The former can play without competitors or with limited competitors; the latter, on the other hand, cannot generate barriers to entry or imitation.

Regarding the technical-legal strength of the patent, it is essential to identify its differentiation due to the scope of its claims, the frequency of oppositions or legal restrictions during its prosecution or after its granting; its value proposition, degree of development and maturity, as well as its level of preparation and differentiation compared to other patented or non-patented technologies.

It is also important to consider its validity or useful life, the geographical areas where it is protected, its citations, the number of commercialization contracts or the returns received as a result of compensation for infringement or unfair competition lawsuits. Of no less importance are market aspects, such as existing technologies or substitute products, competing patents, their commercial viability and entry barriers.

In commercialization, the holder of the patrimonial rights decides to bring the patent to the market in order to obtain a profit or economic return considering and weighing risks. Examples of intellectual property commercialization methods are: assignment (sale), licensing (exclusive or not and/or lucrative or not), or creation of new business units or new businesses (spin-off/start-up).

It is important to note that the nature of patent value, like any value recognition process, is based on dimensions of conditions and potential of the patent invention and both intrinsic and extrinsic value properties.

The intrinsic value properties indicate that value is represented by all the data appearing in the patent document under the forms of patent renewal data, granted patent, patent families (backward and forward) citations, claims, oppositions, among others. The extrinsic value of patents is derived from their ability to develop their market potential, expressed in terms of geographic scope, technological change, filing strategies, duration, novelty, and inventive step [13,14].

In the valuation process it is necessary to clearly identify the object to be valued in the context of the specific exercise. The valuator must clarify whether the value is determined on the invention, the patent rights or both.

Sometimes the term patent is used to describe the economic use of the patented invention; that is, to describe the use of the invention and the patent rights. At other times, to describe some singular rights attached to a patent, i.e., on a single claim or on the totality of the rights associated with the patent [15].

According to the invention patent valuation literature, income approach methods are generally applicable to intangible assets or licenses that produce any measure of operating income. It is universally recognized that cash flow is a common measure of income used in valuation analyses of patented technologies [4,15,16]. It is also important to note that the consistency of valuation exercises depends on facts, data, and systematization of critical information on potential benefits.

3. Study case

The company, "TELEMaT.CO", was created in 2004 to meet the needs of continuous improvement of energy distribution networks. Its value promise is to contribute to improve efficiency and energy savings through environmentally friendly solutions. The patented "TransMinor" device is used by network operators for realtime information management and supervision, automatic and remote control.

The potential markets are Colombia, mainly in the central-western region and the Caribbean region. Subsequently, the plan is to reach Central and South America. The company's current installed capacity to manufacture the device is 800 units per month.

The initial business model is framed around the value proposition, customers, customer relationships, revenue sources, channels, key activities, key resources and partners, and cost structure. The most relevant aspects of the business model are initial focus on network operators and high market potential; however, it is necessary to characterize competitors and substitutes able to compete.

The market validation was carried out with 6 distribution companies, from which it is highlighted that: the device solves needs and difficulties presented by low voltage transformers; its price is close and competitive regarding the traditional transformer; 90 % of the interviewees showed interest in doing field tests and validation of performance in real time, since new technologies are currently being tested to improve the service of network operators [17].

The "TransMinor" device is in a growing sector with a market opportunity, according to the rise of smart devices and trends such as Smart Grids. The key criteria considered by the owners in deciding how to transfer the device are shown in the Fig. 1.

Source: Prepared by the authors based upon

Figure 1 Multicriteria evaluation model of alternatives or types of transfer of the "TransMinor" device.

The owners considered five (5) key criteria for the decision on the form of technology transfer: i) business autonomy; ii) control of the production process; iii) financial resources; iv) other resources and; v) level of commercial relationship.

Initially, five (5) technology transfer scenarios were considered: i) strategic alliances or shared risk; ii) internal production and direct distribution; iii) creation of a spin-off or start-up; iv) outsourcing of production and; v) licensing of the invention patent.

In-house production is the alternative preferred by the patent holders, a decision based on the intention to position the device in the sector, while maintaining control over production and entrepreneurial autonomy. However, the possibility arises, in the medium term, either in two or three years, to review other transfer alternatives, such as licensing, in order to elucidate an alternative business model that can generate a greater degree of market reach for the product [17].

4. Methodology

We propose a Technology Condition and Potential Assessment of Technology (TPCTA) methodology based on expert-based scoring and with referents of competitive and technological intelligence. The analytical framework is illustrated below with four (4) key dimensions and corresponding attributes in the Fig. 2.

Source: prepared by the authors.

Figure 2 Analytical framework underpinning the proposed methodology for the Assessment of Conditions and Potential of Technology (EVCPT).

We evaluate the conditions and potential of the invention patent through expert analysis, the expectations of technology patent owners and potential users or customers. Our proposed Evaluation of Conditions and Potential of the Technology (EVCPT) is a novel approach to calculate royalties based on the potential and key value drivers of the technology.

In the alternative of in-house production and own distribution by "TELEMaT.CO", we use the income method based on Discounted Free Cash Flow (DCF) and evaluate the manufacture of the "TransMinor" device as an Independent Business Unit (IBU) in terms of its Net Present Value (NPV), i.e., the value, at a specified date, of future cash inflows minus all cash outflows - including investment cost - using an appropriate discount rate [18]. It should be noted, however, that the valuation variables of this UNI, such as the weighted average cost of capital (ck), are calculated on the capital structure at the date of the company, "TELEMaT.CO".

The income approach is probably the best alternative for valuing an early-stage technology, but care is required to obtain a reasonable answer. A high discount rate accounts for the possibility of in-house production and in-house distribution scenarios with possible failures or adjustments in operations efficiency, timeliness, and delivery [4].

On the other hand, in the case of valuation of the licensing scenario or alternative in the national territory, we use the royalty calculation approach based on the competitive dynamics of the electricity sector. The most common form of perceiving licensing royalties is a current royalty. With current royalties, payments are made to patent holders as the licensed intellectual property is used [19,20].

Technologically complex products, such as the "TransMinor" device, provide a wide variety of functions; this includes, for example, the ability to store and reproduce information, have remote access and control to its various functionalities.

5. Data analysis

The technological, legal and financial factors related to the market potential of the technology, its evaluation horizon and exploitation expectations, allow laying the foundations for the valuation. Thus, a situational diagnosis of the conditions and potential of The Technology was made by applying an evaluation questionnaire with 5 impact dimensions: i) technological impact, ii) market potential, iii) technology and innovation strategy, iv) legal due diligence and patent status, and v) readiness for scale production.

The Table 1 shows the definition of the dimensions proposed to evaluate the conditions and potential of a technological or invention patent.

Table 1 Description of the dimensions for the Evaluation of Conditions and Potential

Source: Prepared by the authors.

The rating scale adopted for the evaluation of the different dimensions mentioned above is described as follows in the Table 2.

Table 2 Rating scale for the Evaluation of Conditions and Potential of Technology

| Range | Technology risk level |

|---|---|

| Between 0 and 0.99 | Superlative risk |

| Between 1 and 1.99, | High risk |

| Between 2 and 2.99 | Medium-high risk |

| Between 3 and 3.99 | Moderate risk |

| Between 4 and 5 | Prudential risk |

Source: Prepared by the authors.

The determination of this risk scale for the evaluation of the different dimensions of conditions and potential of the "TransMinor" device is translated into a score based on the concept of experts and their evaluation of objective conditions.

For the monetary valuation of the invention patent, under the two proposed scenarios, that of internal production and own distribution versus licensing with and without exclusivity, the conventional method of Discounted Free Cash Flow (DCF) was adopted. In order to obtain the value of the transfer alternatives, the eq. (1), estimates the net present value NPV as a function of free cash flow, under each of the two transfer scenarios considered CFi.

Where I 0 is the initial cash outflow in the R&D and prototyping phase, i.e., the pre-operational investments in the development of the "TransMinor" device; FCi are the cash flows over time generated by each of the transfer alternatives; and ck is the discount rate. In economics and intellectual property valuation, it is expected from capital theory and investments appraisal that investors will promote R&D-based projects aimed at obtaining patentable inventions if they can expect future returns that are at least as high as those of alternative investment choices under similar levels of risk [4,18].

To adequately compensate investors for the risks associated with their capital investments in intellectual property, it is necessary to determine a risk-adjusted return on capital [4,18]. These concepts are based on the logic that there are different costs for both debt and equity provided by the firm's partners or shareholders [4,18,20].

The appropriate discount rate for cash flow is called the Weighted Average Cost of Capital (ck) and for its calculation it is necessary to weight the equity capital and the amount of debt and multiply them by the cost of each of them [16,20]. We consider the discount rate ck as the company's weighted average cost of capital, according to the eq. (2).

Where:

ck: Discount rate or Weighted Average Cost of Capital

Kp: Percentage cost of equity.

Kd: Percentage cost of debt.

Wp: Participation of equity.

Wd: Participation of debt.

t: Corporate income tax rate.

The firm's capital structure consists of the ratio of its debt to the value or amount of its equity. The cost of debt (Kd) reflects the cost or interest rate a firm incurs to access loans [21]. The tax rate (t) reflects the effective tax rate of a company operating in a given country. The cost of equity (Kp) is defined as the minimum return that an investor will require to buy shares in the company. [21]. To calculate the cost of equity we use the capital asset pricing model (CAPM) [21].

The investor's opportunity interest rate Kp was calculated based on the eqs. (3) and (4), considering the Colombian risk premium Rc equal to 1.84 % [22] and that Fr equal to 1.9 % is the risk factor calculated with our scoring methodology according to opportunity and intrinsic potential of the invention, shown below in Table 4.

The company's risk with respect to the market ßl was calculated equal to 2.18, from an unlevered beta ßd of the electrical equipment sector equal to 1.13 [23]. In addition, we considered a debt weight of 58.42 %, an equity weight of 41.58 %, and an income tax of 34 %.

Finally, the horizon or explicit valuation period of the two transfer alternatives is 5 years. Perpetual cash flows are not considered since the patent has a lifespan of 15 years. Thus, a continuity period of 10 years is considered in addition to the explicit horizon or valuation period for the company and the patent holders to continue receiving cash flows, considering the eq. (5).

Where:

VCα: The bounded continuity value of the cash flows of each transfer alternative.

CF n + 1 : Cash Flow for year 6.

ck: Discount rate or cost of capital

g: Drop in demand between 2024 and 2033 due to natural slowdown in transformer replacement, technology cycle and patent expiration

n: Additional years to the horizon or explicit evaluation period according to the expiration date or useful life of the patent of invention.

6. Results

6.1 Evaluation of conditions and potential of the technology

The Table 3 presents the evaluation of conditions and potential of The Technology.

Table 3 Results of the Evaluation of Conditions and Potential of the Technology

Source: Prepared by the authors.

The patented technology is previously analyzed as an intangible that is part of a set of assets of the company "TELEMaT.CO", which is fully functional and ready to use but is currently waiting to generate income. From this revenue it is expected to obtain a fair market value figure for this patented technology with high impact in the electricity sector, both in urban and rural areas [24]. The results of the evaluation are graphically summarized in the Fig. 3.

Source: Prepared by the authors.

Figure 3 Radar with Technology Potential and Condition Assessment score (EVCPT) "TransMinor" device.

The results of the questionnaire application show a technically strong technology, with a good market potential, in line with the organic growth of the company and the installed capacity to produce the "TransMinor". However, it is considered necessary to strengthen aspects of coverage and expansion of legal protection and organizational capabilities, efficiency and quality of development and management of people for the enlistment and production at scale.

6.2 Risk factor

We propose to complement the evaluation of conditions and potential of the technology with a rating score that results in a risk factor. This risk factor was then taken to the monetary valuation as additional in the discount rate. The results of the risk premium scoring exercise are presented in the Table 4.

Table 4 Rating by factor for determining the risk premium according to opportunity and intrinsic potential of the invention

Source: Prepared by the authors.

With this risk factor by score and according to the opportunity and intrinsic potential for invention and consideration of resources and capabilities of the company, we obtained the following results (Table 5) through our proposed calculation of the weighted average cost of capital (WACC).

6.3 Monetary value of the alternatives for transferring the invention patent

The highest scoring alternatives preferred by the company and supporting its business model for transfer were evaluated. The first alternative is internal production and own distribution, which guarantees business autonomy according to the patent holders' vision. The second alternative is licensing in the national territory that would allow a greater presence in the market through the "TransMinor" device.

For the licensing alternative, the percentage of royalties was determined, according to public information on transactions and patent licensing contracts in the electrical, electronic and telecommunications equipment sector, which to date was 4 %. It should be noted that 4 types of "TransMinor" devices are offered: urban single-phase meter, rural single-phase meter, three-phase meter and light meter.

The conditions of the initial year with internal production and own distribution indicate that the light meter is not commercialized and the others would have a 50 % share for the urban single-phase meter, 25 % for the rural single-phase meter and the remaining 50 % for the three-phase meter, the following year the licensing of the light device would enter, occupying 57 % of the volume of units produced by third parties under the licensing alternative and according to market studies, the potential and advantages of the technology for the energy distribution companies.

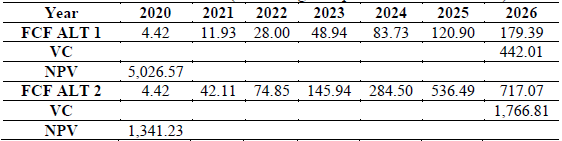

The growth in demand for internal production and own distribution is expected to double in the first two years, to stabilize in the following four years, and then begin to decline by 15 % until the patent life is over. The projections of free cash flow, continuity value limited to the useful life of the patent (15 years), as well as the net present value of each alternative are shown in the Table 6.

Table 6 Cash flow for each alternative (Dollar figures per thousands devices)

Source: Prepared by the authors.

These alternatives are not mutually exclusive; on the contrary, they are complementary. Therefore, the company started in 2020 with internal production and its own distribution. From the year 2021 it would have both internal production and own distribution simultaneously with licensing in a specific national region increasing its cash flow by 2.53 times the first year, then stabilizing for the following 3 years at an average of 2.02 times decreasing by 0.87 for the following years according to the exhaustion of the patent's lifespan and the decrease in the equipment replacement rate. Another important fact is that the granting of licenses for the year 2021 represents for "TELEMaT.CO" an additional income of USD 36.45 per device.

7. Discussion

The technological impact, the legal status of the patent and the market potential, are indispensable issues for both the valuator and the owners and decision makers on possible scenarios of transfer of technological inventions [16].

Most of the existing valuation methods do not reflect the unique characteristics of the technology. Hence the importance of considering in the valuation the attributes and extended features of the invention that consider remote access, storage, transmission and security of information [15]. Key value drivers include the innovativeness or differentiation of the technology from existing technology and the predominance of technology with similar technology, the exclusivity or measure of patent binding force of certain technology compared to the same type of technology, and the impact of such technology on the development or advancement of future technology [25]. The market for patent transactions is difficult to quantify because most of these transactions are kept secret. Patent rights are mainly transferred in private bilateral transactions [26].

Technology transfer has become increasingly important in the last two decades; therefore, valuation under commercialization or transfer alternatives are key in the negotiation [26,27]. Companies face significant financial burdens for R&D, prototyping and scaling-up of their technologies, so they may decide to sell or enter into licensing agreements with established companies in exchange for an upfront or recurring payment as a means of financing and to leverage their growth [28,29]. Firms that lack post-innovation resources and capabilities to sell their own products (manufacturing, distribution, and marketing capabilities) are more likely to opt for licensing [29,30].

Research on the dynamics of innovation and patents indicates that corporate culture may translate into some managerial myopia, inertia, risk aversion and managerial incompetence in driving the sale or licensing, strategic alliances, or structured management processes [29,31,32]. In fact, it is observed that fear of strengthening a company's competitors is a very important reason for not selling or licensing the patent [31,33,34].

8. Conclusion

Patent valuations are commonly performed for transactional purposes, as well as for notational purposes, the latter referring to the need to provide reasonable information to estimate business figures in commercialization scenarios. Therefore, evaluating the conditions and potential of the patented technology is a relevant exercise to contextualize the legal, market, strategic and business situation, and the level of maturity of the technology; as well as to weigh such variables and determine the risk premium according to the opportunity and the intrinsic potential of the invention.

In invention patent valuations for transactional or transfer purposes, owners appeal to the opinion of expert valuers to negotiate, structure and close the commercial transactions of the invention. Therefore, the technical valuation exercise is expected to establish a fair royalty rate (or other transfer price) associated with a license or other time-limited transfer for an invention or for a particular package of intangibles or intellectual property assets; or to establish contributions or other ownership rights in the event that one or more business partners contribute intangible assets in the formation of a new business venture, among other matters.

This means that in order to estimate the reasonable value of the price of the patent or royalty, the appraiser considers a valuation strategy that responds to the opportunity of the transaction; that is, in this case, the opportunity to license, either with or without exclusivity, territorially or extraterritorially, or all the technology or some of its claimed components. This valuation strategy must be supported by information on the condition and potential of the patent in order to bring the parties closer to a reasonable negotiation figure.

The valuation of the "TransMinor" device shows that there is a 2.7 times increase in added value for the company, in the second alternative corresponding to licensing to energy distributors in the national territory, compared to the alternative of only producing internally and doing its own distribution. The fear of the device being homologated and favoring competitors, although an important reason for not licensing the patent and maintaining control over production and business autonomy, should not prevent the incorporation of new transfer alternatives in the company's business model. Therefore, we conclude that, in a valuation of an invention patent, one must consider the purpose, i.e., why are we valuing the asset; the description, i.e., what the asset is; the premise, i.e., how the asset will be used; and the recipients or licensees, i.e., who is the intended purchaser of the asset. These fundamental questions frame the context of the valuation and define the focus, depth, comprehensiveness, and overall parameters of the valuation

Determining the value of an invention patent involves the evaluation of qualitative and quantitative factors. There is no completely infallible method to determine the value of a project, since it is impossible to know with certainty the future values of the premises used, as well as to anticipate all the events that may impact the technology. Patent valuation requires organizations to examine critical opportunity factors and risks to determine their value in the commercialization process. Technological, legal, and financial factors related to the market potential of the technology, its evaluation horizon and exploitation expectations form the basis of the valuation. The methodology implemented in this case evaluates the characteristics and risk factors of the technology and combines the analysis of critical factors and scenarios with competitive intelligence references and expert concepts, in accordance with the company's strategy and policies. Improved valuation models for early stage patented technologies and for companies that consolidate their market position in a given economic sector, as in this case, the electricity sector, can help attract capital and facilitate the formation of strategies for their commercialization, thus strengthening the incentives for innovation.