INTRODUCTION

The relevance of the study of economic growth is unquestionable and of great interest to multiple economic subareas and the field of business management. Since the initial studies on the Gibrat Law, multiple studies have analyzed this concept. Gibrat's Law, or the Law of Proportional Effects (LPE) (Gibrat, 1931), is one of the standard works for explaining business growth. The proportional growth rate of a firm is independent of its absolute size. Thus, it establishes independence between the growth of a company and its size.

The validity of this law has been accepted and rejected in multiple studies; therefore, it is not possible to confirm its general validity convincingly. This lack of unanimity in the results leads us to establish as the main objective of this work, the validation or otherwise of 'Gibrat's Law as a pattern of growth for the Colombian Agri-food industry.

One of the debates regarding compliance with 'Gibrat's Law is related to the dependent variable, both its definition (sales, number of workers, and total assets) and its measurement in terms of absolute or relative value. The use of a measure in absolute value favors the growth of larger companies, while the use of growth rates identifies the growth of smaller companies. Given the significant presence of smaller firms, but also being aware of the difficulty of working with small numbers in percentage terms, we include both types of measures.

However, business growth cannot be isolated from other business variables such as profitability, risk, or financial measures. The first objective is to study the growth paths via 'Gibrat's law and the differences in the results as a consequence of the dependent variable used.

The contributions of this work are as follows: (1) The consideration of the relevance of SMEs. Many studies have only included larger businesses. Given the important weight and role that SMEs have, we consider that they should be part of the study of growth patterns; (2) The relationship between growth and profitability is also a constant. Growth alone is insufficient if not accompanied by profitability. However, considering only profitability parameters is a biased measure, as economic literature reflects profitability/risk duality in the decision-making process. In this study, this concept is included as a key aspect in understanding how the decision-making process takes place. The use of the Sharpe ratio (traditionally used to classify portfolios! is a contribution that will allow us to understand the rationality of the decisionmaking process; (3) The study of growth during an economic boom is as important as understanding how companies grow in times of crisis. The contributions of this work include the identification of company profiles for both good and bad economic times. (4) The identification of the variables that explain growth is multiple, and many of these variables, although not directly related, have significant explanatory power. Therefore, as a fourth objective, variables such as age, region, profitability, and time were included to establish business growth profiles (Fiala, 2017).

According to the World Economic Forum (2017), Colombia is the fifth most competitive economy in Latin America, surpassed only by Chile, Costa Rica, Panama, and Mexico. Now, if we analyze GDP by sector of the economy, it is essential to highlight that one of the industries that contributes most to it is the food and beverage industry. This sector amounts for 14.1 % of the total GDP and its exports represent 73 % of the country's total exports (DANE, 2022).

The choice of the agri-food sector will allow us to establish similar patterns of behavior as divergent positioning in terms of production and consumption prevails in the industry sector. The agri-food sector includes the industrial production of food, and is one of the most critical industry sectors in Colombia. In 2015, the food and beverage sector accounted for 25 % of the total manufacturing industry (Confecámaras, 2022). Therefore, it seems that a strategic area of the economy is responsible for the quality and safety of food products. For these reasons, our second objective is to consider the Colombian Agrifood industry as a useful reference for growth studies in an emerging country.

The remainder of this paper is organized as follows. Section 1 includes relevant literature on growth, the duality of risk and return, and the economic cycle, as well as different aspects of conditional variables such as age, size, or region. Section 2 presents the research method, and Section 3 presents the results and discussion. Finally, Section 4 offers concluding remarks and discusses the implications of our findings.

1. THEORETICAL BACKGROUND AND HYPOTHESES

1.1 Firm growth

Over the last decades, numerous studies have tested Proportional Effects, or Gibrat's law (Gibrat, 1931). Gibrat's Law states that the growth of a company is not a continuous process. Growth is an erratic process independent of the size of the company; for example, it does not depend on its initial size in the period analyzed, nor on the past growth rate.

Despite the broad debate in the literature on this law and its degree of compliance, it is impossible to affirm that the validation or refutation of this law has a unanimous position (Distante et al., 2018). Patters of business growth remain a valid subject for study, especially considering their importance in terms of economic development.

A review of the literature on Gibrat's Law can be found in Fiala et al. (2015) and Fiala (2017), in which studies on Gibrat's Law are classifying according to their acceptance, rejection or the situation in which both are possible, depending on the sample, sector or period analyzed. One of the critical questions concerning 'Gibrat's Law is whether it complies with the industry sectors in which the study is being carried out. Most of the published studies analyze the manufacturing industry in large companies, and in countries belonging to the OECD, extending the survey to other countries with different growth trajectories adds value to this study.

Studies of Gibrat's Law in Colombia concerning the growth of cities and regions (Pérez Valbuena & Meisel Roca, 2014), and in non-financial companies, the results refute the LPE (Langebaek, 2008). However, this pattern of behavior does not consider the agri-food sector or SME firms.

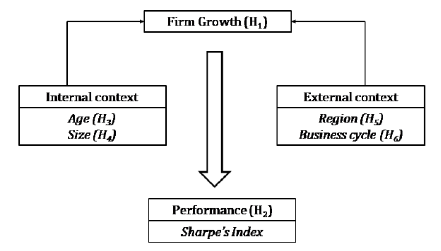

Figure 1 shows the differential aspects incorporated in our study to determine growth patterns. Thus, we formulated the following hypothesis:

H1: The probability of growth of an agri-food business is proportional and independent of its initial size. -LPE-

1.2 Risk/return trade-off: the 'Sharpe's ratio

Growth by itself is not positive if it also has a positive profitability ratio. Organizational decisions relate to the growth and performance as a question to improve competitiveness. This question is another aspect considered in the growth study particularly to validate the 'Gibrat's Law (Choi, 2010), (Coad et al., 2018). The expected sign of the profitability variable is ambiguous as the literature does not reach conclusive results (Coad et al., 2017).

One important concept is the inclusion of the profitability-risk binomial. Some studies (Coad et al., 2015) (Coad et al., 2018) have analyzed the difference between risk and uncertainty; both concepts differ in terms of the possibility of establishing an associated probability function.

Finally, it is necessary to consider the existence of companies that make deliberate decisions to not grow. Reasons such as loss of control or shareholder independence lead these companies to not be interested in business growth, although they are interested in profitability (Hermans et al., 2015) (Eberhat et al., 2017).

However, the importance of addressing this aspect should not be forgotten. Some studies (Langebaek, 2008) consider the inclusion of risk measures based on the quartiles of variation of the performance measure or the change in ROA in the industry. Other authors, such as Mundt et al. (2016), consider the importance of studying the profitability of companies, not only for their profitability but also for their volatility.

Because of the above, this study considers the measurement of the risk-return model through the inclusion of Sharpe's ratio (Sharpe, 1966). This ratio is a standard measure for the analysis of the return on investment, at equal risk. Usually, investment funds use this ratio as the selection criterion. We consider it to be an adequate measure to establish whether the return obtained by companies that grow the most is equivalent according to their level of risk, and we believe it to be one of the contributions of this study to the debate.

Vorst & Lombardi (2018) further examined the importance of the relationship between growth and profitability. Vorst and Lombardi question whether growth by itself is beneficial when other business skills such as employment, innovation, and promotion of competitiveness in markets are not present. The debate about risk measures is open, and it is more difficult without market indices (Delage & Yu, 2018). In this sense, the study of business performance and growth is a critical relationship that allows for the formulation of the following hypothesis:

H2: The growth of the agri-food industry is positively related to its risk/return binomial.

1.3 Internal context

1.3.1 The impact of firm age on firm growth

The effect of age on growth and performance is a heavily studied relationship (Coad et al., 2018). The dominant view on this relationship is that each type of business contributes to economic growth differently and that age is more than a control variable. This variable implies the need for an in-depth study of the relationships between age, growth, and performance. First, growth does not influence a firm's age per se but rather affects performance as a consequence of routinization, learning, innovation, and organizational rigidities (Calvo, 2006; Coad et al., 2016; & Ciftci et al., 2019). Second, the relationship between age and growth has a non-linear U relationship, such that a learning effect as the age of the enterprise increases (Photopoulos & Giotopoulos, 2010).

The relationships between age, size, and growth have been one of the issues analyzed in the literature. Coad et al. (2017) and Eberhat et al. (2017) suggest that younger firms have higher levels of growth and that growth decreases with age. One determinant of growth and survival is the entrepreneur's experience. Mature companies have lower growth rates than younger companies. Anyadike-Danes et al. (2015) have established age periods and their relationships with growth. The temporal evolution of companies indicates that the highest rates of growth and survival occur up to five years of age, whereas only 10 % of companies reach 15 years of age. This consideration allows us to propose the following hypotheses:

H3: The growth of the agri-food business is positively related to age.

1.3.2 The impact of firm size on firm growth

The most analyzed variable with growth is company size (Höhler & Kühl, 2016; Megaravalli & Sampagnaro, 2017; Spescha & Woerter, 2019; & Ciftci et al., 2019). The negative correlation between size and growth contradicts Gibrat's law, based on the assertion that growth follows a random distribution, and the correlation with company size does not exist (Megaravalli & Sampagnaro, 2017).

Moreover, it is necessary to consider the overrepresentation of smaller companies among the fastest-growing enterprises, which, although smaller in number, play an essential role in job creation (Daunfeldt et al., 2015), (Coad et al., 2017).

Coad et al. (2015) state that growth variables in smaller firms have limitations owing to their high volatility; thus, many studies eliminate smaller firms. This removal is a disadvantage, as it excludes a significant percentage of firms operating in the industrial sector.

Dar & AmirKhalkhali (2015) present a literature review of empirical studies that have included the study of 'Gibrat's Law, concluding that small firms grow more rapidly than their counterparts in terms of size.

H4: Growth of an agri-food business is positively related to company size.

1.4 External context

1.4.1 The impact of a 'firm's operating region on its growth

The business location is a critical aspect of regional development. Proximity to or being located in dynamic areas is a crucial aspect in understanding imitation factors in business locations.

Recently some studies have analyzed the impact of an urban or technological location on high-growth companies (Arauzo-Carod et al., 2010; Duschl et al., 2015; & Giner et al., 2017) on the basis that proximity to regions, cities, or centers with regional dynamism will positively influence the growth of companies. The labour flows between the regions are directly related to the agglomeration and the interindustry relations (Neffke et al., 2017).

One of the most relevant questions about location is the importance of geographical situation as a driver and attraction effect for the establishment of new companies, which results in an agglomeration effect. (Hervas-Oliver et al., 2018).

In the case of the Colombian industry, a study by Confecámaras (2022) reflects on the importance of geographic location, noting its impact on firm survival as well as the possibilities of specialization and geographic concentration, which allows us to formulate the following hypothesis:

H5: The growth of the food industry is positively related to the region in which it operates

1.4.2 Firm growth over the business cycle

The results regarding the acceptance of LPE varied depending on the period analyzed. Authors such as Vorst & Lombardi (2018) or the proposals obtain different results depending on the year analyzed and claimed that these differences by years are the result of the different periods of the economic cycle.

In some cases, the acceptance of Gibrat for short periods is a reality, while this law is rejected for extended periods. Under these considerations, Gibrat's Law is not a general rule but a dynamic rule valid for large and mature companies that have a minimum size. However, the exact definition of a short or long term is not clear, which affects whether the law can be confirmed. Other studies have questioned the random nature of growth measures and linked growth to its deterministic and cyclical nature. Peric & Vitezic (2016) find periods of growth from which a slowdown or stagnation occurs, without this variation, to be a loss of growth in the trajectory of the company. This study claims that every four years, there is a slowdown in a company's growth. The variation of the growth rates over time is a common situation for the companies. Periods between three and five years are considered long periods and do not consider periods of non-growth. A few companies have linear or stable growth trends over time. Another study on Colombia links the growth and business scenarios to the role of innovative entrepreneurship (Aparicio et al., 2016).

In this study, the definition of subperiods includes both aspects. On the one hand, it considers the stage of the economic cycle (crisis vs. recovery), which, together with the period of four years of consecutive growth, allows us to identify two sub-periods to analyze the growth pattern of companies.

H6: The economic cuele affects the growth of firms.

2. METHODOLOGY

2.1 Sample

The database obtained for this research, compiles the financial statements corresponding to the Colombian agri-food industry deposited with the Superintendency of Corporations SIREM database for the period 2007-2015 section C based on NACE classification data (Business Information and Reporting System, 2018). Table 1 defines all the variables.

All sizes and sales greater than zero are criteria to include companies in the database. Companies have not been excluded because of their small size, although the literature indicates that these companies will show higher growth than large firms. New firms that were able to enter the market during the period considered are not included.

Table 1: Definition of the variables

| Variable | Definition | Expected Sign |

|---|---|---|

| Dependent variable (measure absolute!relative) | ||

| Sit | Sales Firm i year t | + |

| Δ Sales it | Sales increase of the firm i between years t y t-1 (A Sales) | + |

| Independent Variables | ||

| Age | Number of years from the first year to year t | + |

| Age2 | Squared Age | + |

| Small | Dummy variable, Law 905 of 2004 (Total Assets > 501 and <5000 SMMLV) | - |

| Centre Region | Dummy variable, firms located in Bogota, Cundinamarca, Huila y Tolima. | + |

| Antioquia and Eje | Dummy variable, firms located in Antioquia, Caldas, Quindío y | _ |

| Cafetero Region | Risaralda. | |

| Sharpe | Indice de Sharpe (ROAit- Rf)./ σ ROAt | + |

| 2009-2015 | Dummy variable (year) | +/- |

Source: own elaboration.

Following the example of other studies that have considered different types of samples as a reason to explain the acceptance or rejection of Gibrat's Law (Distante et al., 2018), we include only surviving companies with financial information for the entire period considered. Therefore, it is a balanced panel made up of 418 companies, very heterogeneous in terms of periods, sizes, and seniority in the activity sector, representing 41 % of the total income of the Colombian food and beverage industry in 2015.

2.2 Dependent variable

The first issue is the growth measure and type of growth because it can determine the acceptance or rejection of 'Gibrat's Law. This study focuses on the organic growth of companies, thus avoiding the impacts that mergers and acquisitions can have on these data (Hermans et al., 2015).

The second issue concerns the variables to be used and how to measure them. Many studies have used absolute term variables such as sales, size, or total assets (Choi, 2010), while others use relative measures, such as the growth rate of total sales. The use of an absolute measure of growth at the expense of arate emphasizes the growth of large firms concerning the growth of small firms (Coad., 2017).

In this study, following the proposals of other researchers (Bottazzi et., 2019), sales volume is taken as a dependent variable and includes a lag of one period to be considered as an independent variable (Bottazzi et., 2019) propose a positive correlation between annual growth rates.

Another question of interest relates to the number of lags to be considered. In Coad et al. (2018), we revised the number of lags to obtain a serial correlation that oscillated between one and three. The use of the same variable as a dependent and lagged variable as an independent means includes information from two years (one for the calculation of growth and the other for the delay itself).

This study includes companies of all sizes, and in order not to bias the study towards big companies, we have opted for the inclusion of absolute value measurement (sales) and a relative variable (increase in sales). The conclusions related to size can be drawn based on both variables.

2.3 Independent variables

Furthermore, to test the hypotheses raised, we include as independent variables those corresponding to absolute growth measurement (sales) or growth rate of total sales lagged one year, and the variables that evaluate the combined effect of growth and size as regressors in the estimation matrix (Greene, 2008). The Price Ratio for the Colombian Industry Sector (DANE, 2022) is used to deflate all variables.

Thus, the impact of age is defined as the number of years from its incorporation date to the current fiscal year (continuous variable), and it includes the learning impact on the squared variable.

The geographical location covers companies located in the Central Region (Bogotá, Cundinamarca, Huila, and Tolima), the Antioquia Region and the coffee Region (Antioquia, Caldas, Quindfo and Risaralda) and the Rest of Regions (Oriente, Pacífico, Amazonia, and Orinoqufa). The central Region includes Bogotá, the 'country's capital, as well as Cundinamarca, Huila, and Tolima. The effect of the 'country's capital into the region is a crucial feature to explain the growth of the companies. The location was coded by a dummy variable, depending on its postal code.

Sharpe's ratio is included as a continuous variable and summarizes the profitability-risk binomial. The R¡, summarizes the risk-free rate, and we consider the Interest Rate of Certificate of Deposit (CD) for 180 and 360 days (Business Information and Reporting System, 2018).

According to Law 905 of 2004, and taking only total assets, the number of employees and companies are classified according to their size. According to the Law, companies with total assets greater than or equal to 501 legal monthly minimum wages in force (S.V1MLV), which vary each year, and less than 5,000 SMMLV are considered by the law as small businesses.

Finally, temporary effects are included and measured as dummy variables for each year included in this study.

2.4 Econometric model

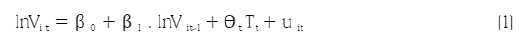

The approach in was used to verify the validity of the Gibrat's law.

Where

Vit- corresponds to the sales volume of the i-th firm in the t period

θtTt- corresponds to the time vector specified as fixed effects

The values of the ¡ parameter indicates the validity or otherwise of Gibrat's Law. This Law is valid when 1 = 1. If ß1 < 1 for larger firms, they can be expected to grow less than the small ones, while if ß1 > 1, it will be the larger firms that grow faster than the small ones.

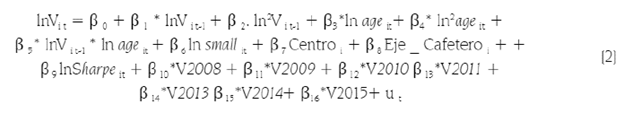

To estimate the validity of Gibrat's Law, the following model is proposed, which also permits the inclusion of some of the proposals presented in the theoretical debate.

Following Daunfeldt et al. (2015), the model estimation was carried out using the fixed effects of Panel Data (Hausman's test). Once problems of heteroscedasticity (Wald's Test) and autocorrelation (Wooldridge's Test) were corrected, the model also included an analysis of the temporal effects of the years covered (Wooldridge, 2010).

2.5 General considerations for the estimation of the results

The following criteria complied with the results of the analysis: First, the statistical significance for all the tests was p-value>0.1, indicating the lower statistical significance 0.05 and 0.01 with asterisks and represented in the table.

Second, concerning the estimation coefficients, the results of a series of tests used in the estimation procedure are included as a table note. For example, when testing panel data models for fixed and random effects, the 1978 Hausman Test was used to choose between the two models (Greene, 2008). The p-values that appear in the row "Hausman" are less than 0.01, which allows us indicating that the use of fixed effects is more appropriate than random effects. We tested heteroscedasticity to estimate the existence of dependence on skewing in the error terms.

The result is the use of the Wald Test (Calvo, 2006; Evans,1987), which rejects the homogeneity of the variances and has forced their correction. Finally, autocorrelation was tested using the Wooldridge test and presented positive correlation values (Wooldridge, 2010).

The existence of these two situations led to the correction of heteroscedasticity and autocorrelation through the Prais-Winsten estimation, as required in Stata. These results are presented in the following section and allow us to explain the appropriateness of the panel data methodology.

Finally, to identify whether the inclusion of years affects the estimation of growth, an analysis of the time effects was conducted. The rejection of this hypothesis confirms the appropriateness of the individual inclusion of years as an illustrative pattern of the dependent variable.

3. RESULTS AND DISCUSSION

The discussion includes five parts, detailing the estimation and interpretation of parameters related to the functional form of the proposed model. The first part contains general remarks on the descriptive statistics. Second, what are the results and consequences of the type of dependent variable used and what is the most appropriate to measure firm growth? Third, rationality decisions are studied considering the binomial risk/return measured by the Sharpe Index. Fourth, the impact of the context variables is analyzed, and the final part evaluates the effect of the economic cycle on the sector in the period 2008-2015.

3.1 Descriptive statistics

Table 2 summarizes the descriptive statistics for the variables considered in this study. The data represent the original variables. It is necessary to consider the work with these data; they have been normalized based on the OECD criterion (OECD, 2008), in addition to winsorization or truncated means for continuous variables because of the high asymmetry index (Keselman et al., 2000).

Table 2 Descriptive statistics

| N | Min | Max | Mean | Standard Deviation | Freq | |

|---|---|---|---|---|---|---|

| Sales (mill. $ Colombian Pesos) | 3,702 | 0 | 1.45Ó | 57.37 | 129.62 | |

| Δ Sales | 3,344 | -1 | 30 | 0.08 | 0.81 | |

| Age | 3,762 | 9 | 111 | 24.75 | 13.72 | |

| SME | 3,762 | 0 | 1 | 242 | ||

| R1 Centro | 3,762 | 0 | 1 | 198 | ||

| R2 Antioquia & Eje Cafetero | 3,762 | 0 | 1 | 76 | ||

| SHARPE | 3,762 | -6 | 6 | -0.03 | 1.06 |

Source: own elaboration.

Regarding the dependent variable, the data show that the differences in terms of sales volume are significant; the database removes those companies that do not meet the sales volume greater than zero. On the other hand, an increase in sales presents both positive and negative values in the period analyzed.

As for the independent variables, those corresponding to organizational features indicate that the companies have a minimum age of 9 years. Hence, the debate on the growth of these companies links to their survival over the full period considered. In terms of size, 176 are large, 166 medium, and 76 small, meaning that SMEs represent 58 % of the total.

As for the External Context, it is essential to point out the significance of the geographical location, with 198 companies located in the Central Region, 76 companies in the Antioquia and Eje-Cafetero Region, and 144 in the rest of Colombia.

Finally, about 'Sharpe's ratio, the relationship between profitability and risk has both positive and negative values, the latter derived from those companies with negative profitability rates in the period considered. Accordingly, it is worth pointing out that a higher figure for this ratio indicates a better risk/return ratio, a basic binomial in the analysis of business economic performance measures.

Table 3 presents the correlation table, which shows the existence of correlations between some of the variables of the study, which reinforces the theoretical hypotheses raised in previous sections: First, there is a positive relationship between sales and age, and second, the negative sign between turnover and business size, as well as the significant presence of small companies in both regions. In terms of location, the correlation between the Central Region and coffee regions is negative, which helps explain different growth patterns based on a territorial model.

Table 3 Pearson correlation coefficients

| Sales | Δ Sales | Age | SME | R1 Centro | R2 Antioquia Eje Cafetero | SHARPE | |

|---|---|---|---|---|---|---|---|

| Sales | 1 | ||||||

| A Sales | 0.006 | 1 | |||||

| Age | 0.218** | -0.018 | 1 | ||||

| SME | -0.472** | 0.014 | -0.179** | 1 | |||

| R1 Centro | -0.024 | 0.029 | 0.004 | 0.063** | 1 | ||

| R2 Antioquia Eje Cafetero | -0.051** | -0.011 | -0.070** | " 0.052" | -0.589** | 1 | |

| SHARPE | 0.030 | 0.031 | -.049** | 0.078** | 0.014 | 0.021 | 1 |

*,**,*** significance at 10 %, S % and

Source: own elaboration.

The positive correlation between the Sharpe ratio and size is worth noting as it indicates that small companies are not making decisions that harm their profitability. In addition, the negative relationship between the Sharpe ratio and age points to a broader divergence between mature companies and profitability/risk ratios.

3.2 Consequences of use of an absolute or relative variable to measure firm growth

Table 4 presents the results regarding the hypotheses put forward. As for Gibrat's law, there are divergences in its acceptance or rejection, depending on the dependent variable considered. Thus, the Law is rejected (HJ in terms of growth measured using the variable (sales); that is, not all companies have the same growth opportunities regardless of their initial value. However, 'Gibrat's Law is not rejected if the variable used is the growth rate of total sales.

Table 4: Growth paths for the Colombian Agri-food firms - Panel Data Model-

| Dependent variable (Sales) | Dependent variable (Δ Sales) | |||||

|---|---|---|---|---|---|---|

| Full period 2008-2015 | Crisis 2008-2011 | Recovery 2012-2015 | Full period 2008-2015 | Crisis 2008-2011 | Recovery 2012-2015 | |

| Constant (α) | 5.474 *** | 4.876 *** | 5.140 *** | -3.049 *** | -0.885 *** | -3.244 *** |

| ln (sales or Δ sales) ¡ (t-1) | 0.460 *** | 0.566 *** | 0.425 *** | -0.021 | 0.034 | -0.072 |

| (ln sales or Δ sales ¡ (t-1))^2 | 0.014 *** | 0.010 *** | 0.016 *** | -0.026 | -0.025 | -0.020 |

| ln age it | 0.345 ** | -0.522 *** | 0.010 | -0.199 ** | -0.302 *** | -0.113 |

| (ln age tt) ^2 | 0.015 | 0.153 | 0.001 | 0.029 ** | 0.044 ** | 0.022 |

| ln sales ¡ (t-1) * ln age it | 0.014 ** | 0.024 *** | -0.001 | -0.008 | -0.018 | 0.008 |

| Small it | -0.162 *** | -0.185 *** | -0.121 *** | -0.041 *** | -0.071 *** | -0.014 |

| Centro Region | 0.014 | -0.006 | 0.040 ** | 0.019 | 0.001 | 0.037 *** |

| Antioquia & Eje Cafetero Region | 0.024 * | 0.030 * | 0.079 *** | -0.040 *** | 0.007 | 0.067 *** |

| ln Sharpe it | 0.116 *** | 0.070 *** | 0.160 *** | 0.196 *** | 0.163 *** | 0.230 *** |

| Year 2008 | -0.031 | |||||

| Year 2009 | -0.030 | -0.034 ** | 2.683 *** | 0.776 *** | ||

| Year 2010 | -0.063 *** | -0.061 *** | 1.841 *** | -0.124 | ||

| Year 2011 | 0.067 *** | 0.045 ** | 1.966 *** | |||

| Year 2013 | 0.026 | 0.038 * | 2.566 *** | 2.524 *** | ||

| Year 2014 | 0.004 | 0.006 | 1.254 *** | 1.263 *** | ||

| Year 2015 | -0.038 *** | -0.040 ** | 1.277 *** | 1.263 *** | ||

| R2 adjusted | 0.970 | 0.974 | 0.974 | 0.864 | 0.449 | 0.905 |

| Test Hausman | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Test Wooldridge | 0.000 | 0.000 | 0.000 | 0.000 | 0.610 | 0.000 |

| Temporal effects | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

. *** significance at 10 %, 5 % and \% Source: own elaboration.

NOTE: Balanced Panel Data, n = 418.

The consequences of this statement for both types of variables are two-fold. On the one hand, the volatility of sales in such a turbulent period can affect the extent of growth opportunities. Also, the growth of smaller companies acts as a driver for the growth trend (ß1 <1), one of the aspects formulated in the theoretical proposals.

We considered the significant weight of smaller companies have in the Colombian agri-food sector. This is an important reason to include these companies in the analysis, and hence, the relevance of using growth rates that allow their values to be included in the study to explain economic growth.

The squared dependent variable is only significant for absolute measures of growth with a positive sign and reflects the impact that large companies have in the explanation of growth. Therefore, contradictory results are generated for the acceptance or not of our Hypothesis 1, depending on the dependent variable considered.

3.3 Sharpe Ratio: risk/return

The performance of companies is one of the most significant results in the study of growth. The growth or profitability choice is a decisive issue since these are two variables whose relationship will explain and guarantee the competitiveness and survival of companies. The Sharpe ratio indicates the profitability of companies with equal risk positions.

The results shown in Table 4 indicate a significant and positive value of 'Sharpe's ratio, which allows us to state that the companies that are growing are also doing so with excellent performance results for the same risk positions in the sector. These figures indicate that growth decisions with good profitability indicators for the same level of risk allow a good business situation to survive in the long term. This result is a crucial finding given the strong presence of the agri-food sector in the development of Colombia (46) and allows us to accept our Hypothesis 2.

3.4 Explanatory internal and context variables

The results of the context variables analyzed are listed below. First, the significance of age variable is worth noting. When the explanatory variable is sales, it has a positive sign, which allows us to state that larger companies have high sales growth. This data contrasts with the values expected in the theoretical hypotheses (H3) and suggests that the oldest companies are those that continue to grow.

However, when considering the growth rate of total sales, the sign is negative, which is consistent with the theoretical hypothesis and better reflects the effect that small companies have on growth.

The age squared is only significant for growth rates and, as expected, the sign is positive. Therefore, age firm has a U-shaped effect on the growth of the Colombian agri-food industry, which explains the learning effect. The results also contradict Hypothesis 3, depending on the dependent variable considered.

In terms of size (H4), the significance is relevant regardless of the growth measure used, and the sign is negative, which conforms to the theoretical hypotheses that the smaller the size, the higher the growth values. The relevance of this result is crucial in the case of agri-food companies whose minimum age is nine years and which, although still small, have the highest growth rates.

Firm size is the variable with the most robust results concerning the theoretical hypotheses set out since it is significantly representative and with a negative sign for all the analyses carried out, which indicates the importance of size in the explanation of economic growth and allows us to validate Hypothesis 3.

In terms of geographical location (H5), opposite to what might appear from a theoretical point of view, there is no clear advantage for the industries located in the Central Region over other regions when it comes to explaining growth. Location is an essential piece of data because it reveals that growth opportunities are not related to the capital city and that, in general, it is in Antioquia and the Coffee Region, where higher rates of business growth are concentrated. These data are more evident for Antioquia and the Coffee Region, in which the size of the companies is smaller than that in other regions. This firm size has allowed them to grow better in times of crises. In times of recovery, growth has increased in all regions.

3.5 Economic Cycle

The results referring to the economic cycle break the period down into two phases or stages. The first is a crisis period (2008-2011), followed by a recovery period (2013-2015), taking 2012 as the starting point for recovery and excluding 2012 from the estimate.

In terms of compliance with Gibrat's Law, the results are inconclusive (H6). On the one hand, if the criterion is the measure-dependent variable, we can reject it for both the crisis and recovery periods. However, when considering growth rates, such as the increase in sales, it is possible to accept the existence of growth opportunities independent of the initial value. These results reinforce the critical weight that smaller companies have in explaining business growth as well as the reason for the effect of business learning through the squared variable.

When considering the age of companies in the different phases of the economic cycle, this is a relevant variable in the crisis period but not when it comes to explaining growth in the recovery period. These results allow us to state that in times of economic expansion/recovery, age is not a relevant variable.

In terms of size, SMEs are the ones that explain growth both in periods of crisis and in recovery. In addition, in terms of the growth rate and recovery period, this variable is not relevant.

The use of the variable increase in sales, is another aspect that reinforces the previous statement on the degree to which the economic cycle may explain business growth in terms of organizational variables.

In terms of regions, the positive relationship between the Antioquia and Coffee regions stands out as an explanation for growth, the period of economic recovery being the moment in which the Central Region has a positive significance in its interpretation.

An important question is related to the lack of significance for the Central Region during the crisis period, i.e., it was not the region driving economic growth in this period, showing coefficient estimates lower than those corresponding to the Antioquia and Coffee regions at the time of economic recovery.

Finally, there are no differences in economic cycle sub-periods in the decisions related to profitability-risk binomial. These results can explain the reasons for national issues such as the formalization of the peace agreements, which has allowed a particularly convulsed economic cycle to overcome and which has corresponded to the global crisis of 2008.

Overall, it is clear that the economic cycle has unevenly affected business growth, growth opportunities are favorable for smaller or younger companies, and geographical location influences growth only in the recovery period.

The importance of the positive sign of the Sharpe ratio in both periods is worth highlighting, as it allows us to state that the companies that grow are doing so under appropriate risk-return conditions.

4. CONCLUSIONS

The main findings that we can extract from this study yield essential results for the study of the economic growth of the Colombian food and beverage industry. Growth is one of the relevant variables in the study of economics and acts as a driver for industrial development. However, we cannot find unique patterns of growth for the industry over long periods, so it is necessary to establish sub-periods that can help explain companies' organic growth policies. The studies about the business cycle are critical to identifying the 'firm's behavior and logical decisions, especially during the economic crisis (Bartz & Winkler, 2016; Rivera & Ruiz, 2011). These statements are relevant to the Colombian food and beverage industry, and we find similarities between its growth patterns and most theoretical hypotheses formulated in the literature. Regarding the appropriateness of using absolute or relative growth measures, the use of growth rates of total sales better reflects the impact of the growth of smaller firms. Therefore, one will be more appropriate than the other variables, depending on the composition of the sector to be analyzed. Two reasons can explain the non-acceptance of Gibrat's Law for all analyses carried out: the first is the inclusion of smaller companies, whose small numbers may describe the high degree of asymmetry of growth, and second, because of the importance that the economic crisis of 2008 had on the economic growth trend. The positive results of Sharpe's rate are an essential piece of data, which makes us think that the evolution of the growth and profitability of the Colombian food and beverage industry will be sustainable over time.