INTRODUCTION

Throughout the world, countries have undertaken different processes in order to implement International Financial Reporting Standards (IFRS) in the accounting of companies. This has generated different effects during the transition from local to international accounting standards, effects that can be explained by the cultural factors of each country (Clapp, 1967; Mueller, 1968; Choi, 1973), the size of companies (Stent, Bradbury, & Hooks, 2010) or the conditions of the stock market of each nation (Perera & Baudoun, 2007; Othman & Kossentini, 2016).

With respect to the direct effects on financial statements, some studies involving market variables, such as those conducted by Mazars (2005); Alemany i Costa (2007); Armstrong, Barth, Jagolinzer, & Riedl (2010); Horton & Serafeim (2010); and Othman & Kossentini (2016) reach different conclusions regarding the use of accounting information for decision-making by investors and the positive effects that arose in some of those cases. With respect to the use of financial indicators calculated from the accounting information of different companies to determine the changes that occurred before and after IFRS, there are the works of Callao, Ferrer, Jarne & Lainez (2009); Lantto & Sahlström (2009); Stent, Bradbury, & Hooks (2010); Mısırlıoğlu, Jon, & Osman, (2013); Lueg, Pawel & Burkett (2014); Espinosa, Maquieira, Diaz & Abarca (2015); and Simmer de Lima, Sampaio Franco de Lima & Gotti (2018), who by using statistical methods such as Student t-test or Wilcoxon ranks, also attained dissimilar results, suggesting that there is no consensus on the effects of implementing IFRS.

In the case of Colombia, the convergence indicated by Act 1314 of 2009 was considered in order to take as a basis, the best accounting practices at the international level, going from an accounting based on Decree 2649 of 1993, of generally accepted accounting principles COLGAAP (by its acronym in Spanish), to the Colombian financial reporting standards NCIF (by its acronym in Spanish). These are supported by the International Financial Reporting Standards (IFRS) as laid out by the International Accounting Standards Board (IASB).

One of the core objectives of Act 1314 of 2009 was to improve productivity, competitiveness and the development of business activity, as well as to ensure that accounting reports offered understandable and homogeneous bases for information users, in particular, domestic and foreign investors, thereby improving the quality and transparency of financial information.

With reference to the foregoing, the objective of this paper is to examine the effects of adopting IFRSs by comparing data from periods prior to and subsequent thereto. For this purpose, a sample of 52 companies listed on the BVC was used, whose accounting reports, published on their websites for 2014 before IFRS and 2014 after IFRS were used, a period regarded as a one of transition for companies in Group 1, who by Decrees 2784 of 2012 and 3024 of 2013 had to adopt the new standards; and the year 2015, which according to the same decrees, should be the period in which the first financial statements, prepared based on the new technical regulatory framework, had to be submitted.

Based on the financial statements by the companies in the sample, the OPM, ROE and ROIC were calculated for 2014 with and without IFRS, and with these financial indicators, a difference of means was estimated.

Due to the fact that only 32 of the total of 52 companies had engaged in stock market activities at the end of 2014 and 2015, and assuming that the nature of their data was comparable, share price variations for these two years were obtained. Thus, with the variables leverage, revenue, operating income, and profit or loss for the year, the effects were analyzed that this set of data had on the stock market value using the difference in differences method.

Lastly, and seeking to contribute to the studies on the impact of implementing IFRS, particularly for Colombia through the use of quantitative methods, this paper is divided into four sections: the first, presents several previous studies through a literature review; the second, lays out the methodology; the third, sets forth the results obtained; and the fourth and final one presents the conclusions.

LITERATURE REVIEW

Applying IFRS has a direct impact on the quality and credibility of financial information, therefore, using high-quality (Mhedhbi & Zeghal, 2016) accounting standards favors economic growth, strengthens markets, and increases foreign investment and trade, (Rueda, 2010) and improves the overall economy of the nation (Zaidi & Paz, 2015; Mhedhbi & Zeghal, 2016).

Therefore, companies end up generating more reliable financial reports under IFRS, and decision-making by stakeholders improves (Halbouni, 2005).

For Begoña (2014), international standards aim to ensure transparency, and offer a system that makes financial statements comparable at an international level, with which the capital market operates more efficiently and improves the transparency of transactions. This leads to more diaphanous accountability and more transparent financial information, because (Zaman & Rahaman, 2005) IFRSs are more complete and specific than local accounting standards, which raises the level of investor confidence (El-Sayed, 2016).

IFRSs eliminates the obstacles faced by those who consolidate, audit and prepare the financial accounts of multi and transnational companies, that is, they offer more benefits in terms of measurement than disclosure (Mısırlıoğlu, Jon, & Osman, 2013), which translates into more-easily comparable financial information used by investors, financial analysts and credit agencies that seek to “evaluate and compare the performance and perspectives of companies from different countries” (Halbouni, 2005, p. 75).

In general, the literature has identified that the implementation of IFRS generates reactions in the market and in financial indicators.

In a first line of arguments fall the reactions in the market, for the use of IFRSs affects the price of shares traded on the stock exchange; this is how Alemany i Costa (2007) observed the influence of published accounting information in the capital market taking into account basic variables such as net result and net equity value, examining their ability to influence and explain market prices. Between 1986 and 2003, data from Spanish companies was used, econometrically relating the accounting variables and the information obtained from the market to conclude that investors take into account other types of information, which they consider important for making investments. Furthermore, the accounting data loses relevance for shaping the price of securities in the Spanish capital market.

Faced with the adoption of IFRSs in Europe, Armstrong, Barth, Jagolinzer & Riedl (2010) analyzing the adoption and the gross return per share (percentage change in the price), found that market expectations regarding the benefits of convergence to IFRSs were positive, as it brought improvements in the quality of information, and decreased information asymmetries.

In this sense, Mazars (2005) in a qualitative study for 12 European countries, when looking at 556 companies listed with high market capitalizations, found that 63% of the companies perceived that the new accounting standards facilitated comparing financial statements, and that this had a positive effect on the communication of results.

For their part, Horton & Serafeim (2010) observed the market’s reaction to the announcement of preparing the Financial Statements under IFRS, taking into account the daily abnormal returns (DAR) in a window of 11 days (5 days before and 5 days after the announcement, considering the day of the announcement as day zero). For 297 London Stock Exchange (LSE) FTSE350 firms the results showed that those that experienced a negative IFRS adjustment in their results had a negative zero-day DAR.

The study by Othman & Kossentini (2016) explored how the adoption of IFRS had effects on emerging market exchanges (ESMs). Using a dynamic panel model with data for 50 emerging economies over the period 2001 to 2007, these authors found that a high level of adoption of IFRS positively affects the development of capital markets, and that a partial adoption of IFRS could not only be inappropriate and irrelevant, but detrimental to the development of ESMs. Indeed, as Perera & Baudoun (2007) state, IFRS cannot function satisfactorily in emerging economies that do not have well-established capital markets.

Hence, the pre-eminence of IFRS in developing countries has been questioned because these nations do not necessarily have a properly organized capital market, or it does not exist (Zeghal & Mhedhbi, 2006), or its degree of participation in the world economy is low. In addition to the above, the size of companies also has an influence, with the impact of adoption being smaller for small business (Stent, Bradbury, & Hooks, 2010).

In the same way, as research has been performed on the effects of the implementing IFRS in the securities market, similar analyses arise that show the performance of different financial indicators when companies implement IFRS. Thus, Espinosa, Maquieira, Diaz & Abarca (2015), in a study of a Chilean case, identified that the adoption of IFRS generated a change in the financial indicators of performance, liquidity and investment, except for those referring to leverage and the price/ earnings ratio of the share, finding significant differences in the accounts, with the exception of inventories and current assets. They also discovered that in the face of the announcement of the adoption of IFRS, the share price did not change.

In the United Kingdom, the study by Lueg, Pawel & Burkett (2014) determined the effect of the transition to IFRS on financial indicators. Their findings show that during the transition to IFRS, the median profitability indexes had a substantial increase as follows: operating margin increased by 10.8%; return on capital by 27%; and return on invested capital by 14.4%. Similarly, they found that these changed, but not drastically, the current ratio increased by 4.2%, and the price/earnings ratio by 2.9%.

For their part, Stent, Bradbury, & Hooks (2010) when analyzing the impact that the adoption of IFRS had on assets, liabilities, equity, income/earnings and expenses/losses of 161 companies listed on the New Zealand Stock Exchange (NZX), found that these variables changed in 87% of cases. Liabilities are the most affected with an increase of 75%, followed by equity, with a decrease of 57%. With respect to financial indicators, the return on equity, assets, leverage and return on income medians increased. This is a situation that has implications for valuation and credit decision making.

Callao, Ferrer, Jarne & Lainez (2009) quantitatively compared the impact of adopting IFRS for 242 companies from 11 European Union countries in 2004 and 2005. From the calculation of financial indicators: (based on operating income and ordinary income), they determined the relative impact through the percentage of change, which was transformed into an ordinal variable, in order to apply an ANOVA analysis and make comparisons between pairs of countries, finding that, compared to ROA and ROE, there was a strong negative impact in Denmark; a less positive and almost negative in France compared to Finland; and a greater negative impact on operating income and ROA (based on operating income) in Spain. In most countries, they found that operating income, ROA and ROE showed positive results.

For Brazil, Simmer de Lima, Sampaio Franco de Lima & Gotti (2018) in a study on the effects of IFRS adoption in the credit market, with an approximate sample of 6,500 credit ratings and 137,000 loan contracts, and including as independent variables ROA, leverage and interest coverage, as accounting risk indicators, determined what happened in pre- and post-adoption periods of IFRS. The results show, that in the analysis of credit ratings given by financial institutions, ROA affected the ratings before the adoption of IFRS, and suggests that it improved credit ratings after adoption. In addition, the three indicators studied showed that accounting information became relevant to financial institutions after the adoption of IFRS. With respect to the ratings assigned by risk assessment agencies, the indicators of leverage and interest coverage were sensitive prior to the adoption of IFRS; the post ROA and post leverage were equally explanatory, suggesting that credit ratings improved after the adoption of IFRS.

The work of Lantto & Sahlström (2009), researched the economic consequences of adopting IFRS in 91 companies listed on the Helsinki stock exchange, using the average values of seven financial indicators: OPM, ROE, ROIC, leverage, ownership ratio, and current ratio. They found that only the current ratio and the acid test ratio and taking as a market indicator the price/earnings ratio, only the current ratio calculated under Finnish Accounting Standards (FAS) and IFRS was unaffected, while there were differences in the other indicators as they moved from FAS to IFRS. Also, the profitability indicators OPM, ROE and ROIC increased by between 9 and 19% when switching from one accounting standard to the other.

In Turkey, the impact of adopting the New Financial Reporting Standards (NFRS) on financial indicators was marginal, with the exception of the percentage of current assets to total assets and long-term debt to equity, which did show a small increase after switching accounting standards (Mısırlıoğlu, Jon, & Osman, 2013).

Finally, Mazars (2005) concluded that the perceived impact, in terms of increasing or decreasing net worth and net income, was quite variable and did not show a trend. In turn, this study found that the financial impact that IFRS had on net equity and net income does not seem to be marked by the company’s country of origin or by economic sector; contrary to the findings by Perera & Baudoun (2007) and Stent, Bradbury & Hooks (2010), for whom the country and the sector to which the companies belonged was decisive at the time of implementing IFRS.

METHODOLOGY

Two sources were used to perform the empirical analysis, the first is the EMIS database, and the second is the reports of the companies listed on the BVC. The first sample of 52 companies divided into different sectors for 2014 includes the reports for that year in both local standards and IFRS. The second sample consists of 32 companies from different sectors listed in the BVC for the years 2014 and 2015, that is, the periods in which companies still submitted their reports in local standards, and in which all companies were required to submit them under international standards.

However, for the purpose of analyzing both samples, a difference of means is carried out firstly to compare the changes in 2014 between the means of the data submitted under local standards and in international norm

However, for the purpose of analyzing both samples, a difference of means is carried out firstly to compare the changes in 2014 between the means of the data submitted under local standards and in international norm

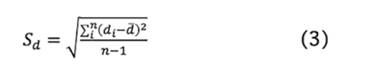

The estimated t-test is as follows:

Where

This method is used with the sample of 52 companies to identify whether the variables of profitability: operating profit margin (OPM: operating profit over income), profitability on invested capital (ROE: net profit over equity) and operating return on assets (ROIC: operating profit over total assets) differ in their mean values when the change in accounting methodology occurred.

The second part of the methodology includes a difference in differences (DD) analysis that serves to identify the effects of a treatment (the implementation of IFRS) on a population.

Usually, applying this technique requires a control group, which serves as a comparison and thus tries to find its counterfactual, i.e., the expected effect on the population as if it had never been intervened. Given that in Colombia from 2015 onwards IFRS became obligatory, it is not possible to make this comparison, and this is a problem faced by other authors such as Confetti-Gatsios, Da-Silva, Augusto-Ambrozini, Assaf-Neto & Guasti-Lima (2016), Menezes-da Silva & Ciampaglia-Nardi (2014) and Li (2010), who used the same methodology to determine the effects of international standards on the social capital of companies for the Brazilian and European cases. In these documents, they analyzed the effects of IFRS based on companies that had already adopted them or had made an early adoption, as opposed to those that did not or had a late adoption.

The approach will be similar herein, the base of companies to be compared corresponds to the second sample of 32 companies, as in both cases the variables of interest will be the level of leverage, calculated as the ratio between liabilities and assets, ordinary income, operating income, and the profit or loss for the year, because the idea is to determine the effects of these variables on the stock market value at the end of the year.

In addition to the variables of interest and the dependent variable (stock market value), the natural logarithm of the assets is also regarded as a control variable. Other financial reasons were considered for the estimation process; however, these were not included because they were not significant for determining the share price, or failing that, because they did not add additional information to that already contemplated in the variables chosen.

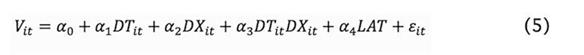

The model without including the control variable is:

And including the control variable, the model is expressed as:

Where:

: is a dichotomous variable that assumes the value of 1 when the year is 2015 and 0 when it is 2014;

: is a dichotomous variable that assumes the value of 1 when the year is 2015 and 0 when it is 2014;

: Represents a dichotomous variable of each of the variables of interest and was constructed differently for each one. According to Wooldridge (2006), the model must be defined by a control group, which in this case takes the value of 0 (and corresponds to the group of companies that were presenting high levels of indebtedness or negative yields), and a treatment group, which takes the value of 1. Now, the value for the leverage level when the companies exceeded 0.8 is 0, and 1 in the opposite case; for the operating income, the profit or loss for the year, the control group corresponded to the companies that had negative results in 2014; and finally in the control group that takes the value of 0 in the ordinary income variable, fell those companies that reported income below the average of the 32 observations.

: Represents a dichotomous variable of each of the variables of interest and was constructed differently for each one. According to Wooldridge (2006), the model must be defined by a control group, which in this case takes the value of 0 (and corresponds to the group of companies that were presenting high levels of indebtedness or negative yields), and a treatment group, which takes the value of 1. Now, the value for the leverage level when the companies exceeded 0.8 is 0, and 1 in the opposite case; for the operating income, the profit or loss for the year, the control group corresponded to the companies that had negative results in 2014; and finally in the control group that takes the value of 0 in the ordinary income variable, fell those companies that reported income below the average of the 32 observations.

corresponds to the natural logarithm of the total assets

corresponds to the natural logarithm of the total assets

Both equations give way to eight models, two for each variable of interest, since it is not possible to consider all variables together because there are linear relationship issues between them. On the other hand, in each model, the most relevant effects are those that can be captured by the coefficient that measures the interaction of 2015, when the financial statements under IFRS had already been submitted, with the treatment group. This ratio compares the effects of IFRS between companies that already showed signs of weakness and those that were financially better off.

Some considerations regarding the nature of the data is that it would be much more favorable to obtain estimates from a larger number of companies listed on the BVC, as the sample is still small enough to infer results on the universe of listed companies; however, only this group of companies contains complete accounting data and their shares are traded. Although some additional companies are listed, their shares are not traded or were no longer bought and sold before the enforced entry into IFRS.

Regarding the methodology, it is necessary to note some disadvantages exposed by authors such as Abadie (2005) and Bertrand, Duflo & Mullainathan (2004), who point out the existence of high standard errors, autocorrelation issues and heteroscedasticity. In order to mitigate all these issues, different solutions were proposed, the first of which was including a control variable with the purpose of reducing the standard errors that were too high. As for autocorrelation, only the years of the switch were used, which means that the effect of the treatment before and after implementation was analyzed; finally, the estimates were calculated through robust errors.

RESULTS AND DISCUSSION

Table 1 shows the variance difference test for both data samples (with and without IFRS) in the year 2014. Statisticians reject the constant variance hypothesis for the three financial ratios; therefore, the dispersion of data is substantially greater when local standards were used compared to IFRS.

Now that we know that the variances are different from each other, we estimate a difference of means with different variances (Table 2).

The test performed on the financial ratios’ means sheds light on the non-existence of significant differences among their means. This means that, for the sample of 52 companies, IFRS did not substantially change the average of the OPM, ROE and ROIC.

In line with this finding, Munteanu, Brad, Ciobanu & Dobre, (2014) found that when changing from Romanian Accounting Standards (RAS) to IFRS, in Romania no significant differences were observed between the mean and median of the liquidity indicator and the ROE. Moreover, Mısırlıoğlu, Jon, & Osman, (2013) in the case of Turkey, found no differences in means and medians in the indicators of total assets coverage by own capital and liquidity, calculated before and after IFRS.

On the contrary, studies such as Espinosa, Maquieira, Diaz & Abarca’s (2015) found, in the case of Chile, that the medians did suffer differences for the ratios OPM, ROE and ROA. Likewise, for the United Kingdom, Lueg, Punda, & Burkert (2014), in their work on the transition from UK GAAP to IFRS, it was concluded that financial indicators were substantially affected, especially in the median of ROE and ROA. This is consistent with Jones & Finley’s (2011) finding that the ROE and ROA’s means decreased during the transition from pre-IFRS to post-IFRS.

The work developed by Warwick, Bradbury, & Hooks (2010) combined findings, obtaining that the impacts of implementing IFRS, both in early and late adopters, showed that the ROE experienced changes when adopting the new accounting standard, while the ROA, the leverage and the rotation of assets, did not suffer such changes.

Continuing with the findings, Table 3 shows the estimates of the eight models that analyze the effects that IFRS accounting had on the valuation of companies in terms of their listing on the BVC.

From Table 3, the first result to be analyzed is the significance of the interactions between the variables of interest and the year in which the change occurred. There is no significance over the coefficient observed in any of the eight models, so taking as a control group those companies with lower financial returns, the change to IFRS did not put the companies in either an advantage or disadvantage with better returns in terms of their market value.

Furthermore, beyond the significance of the coefficients, it is necessary to revise their sign. In the first and second models, the sign of the interaction “Leverage*Year” shows a positive sign when the natural logarithm variable of the assets was not included and a negative sign when it was. It is difficult to make inferences about this result because it does not maintain consistency as one would expect.

Table 3 Estimation of Difference in Differences

*p<0.05

**p<0.01

***p<0.001

Source: Authors’ Own Elaboration.

second interaction, which corresponds to models 3 and 4, indicates that the operating income for the companies with the best prospects in 2014 was lower with the new standards by 0.177 points without the control variable, and by 0.354 points including the variable. In other words, the stock market value in 2015 fell on average between 17.7% and 35.4% for companies with a positive operating profit in 2014.

The interaction between the profit or loss for year and the year did not show significant changes either, and its sign was the same as the previous interaction. This translates into a loss of capitalization for companies with better accounting prospects at the end of 2014, from 6.8% (excluding the control variable) to 23% (including the control variable) for 2015 with the new rules.

The latest interaction also indicates a negative sign, so companies with higher-than-sample income saw a decrease in share price in the order of 22.3% to 27.9% once IFRS became effective in 2015, compared to the immediately preceding year.

These results can be contrasted with the literature on the subject, where Li (2010) found that the mandatory implementation of IFRS lowered the cost of capital by an average of 47 basis points; however, this effect is more powerful in countries with stronger legal structures5. Similarly, Gatsios, da Silva, Ambrozini, Assaf, & Lima (2016), found that the institutional structure is indeed important, but that this transmission at the cost of capital was slower in the case of Brazil.

Both results highlight a significant transmission of costs, or loss of returns to investors, results opposed to what was found in the estimates hereof, because although the stock market value was lower, this seems to be explained by factors inherent in the stock market and stock prices, and not so much by the change to IFRS, a result consistent with what Alemany i Costa (2007) found for the Spanish market. It should be noted that both operating and year-end net income, along with the level of assets, were significant factors in the change in the share price in both years regardless of the standard used.

Using this same technique, Florou & Pope (2012) sought to determine whether the demand for shares was modified once the IFRS were established on a mandatory basis and concluded that, indeed, for some institutional investors from different parts of the world, this modification allowed them to access better quality financial data, the same as Mhedhbi & Zeghal (2016) and Armstrong argue. Barth, Jagolinzer, & Riedl (2010) also identified that this effect was more concentrated among those investors who were looking for better data to make their investment decisions on the stock market in countries with greater incentives to report their financial information under IFRS, and in which the differences between local and international standards would have been more evident.

In addition, DeFond, Hung, Li & Li (2014) by using a DD estimator to determine whether the mandatory change to IFRS affected the bankruptcy risk of companies in 27 countries that made the use of IFRS unavoidable for the year 2005, were able to determine that the effect was positive, because changes in the accounting structure reduced the probability of bankruptcy, mainly in companies in sectors other than the financial sector and in countries where local standards were not entirely reliable.

Finally, Hail & Leuz (n.d); Daske, Hail, Leuz & Verdi (2008) and Franzen & Weißenberger (2018), when studying the European case since 2005, found evidence that the cost of capital decreases, while at the same time the liquidity and value of shares increases. However, this is possible on the basis of strong institutions that establish appropriate control and appropriate laws, which means that countries with best transparency practices also benefit most from the shift to IFRS.

CONCLUSIONS

In the case of Colombia, stock market valuation and financial ratios were not affected by the implementation of IFRS. Although there was a change in the average values of the variables analyzed, this variation remained within the same probability distribution, yielding statistically non-significant results.

In the specific case of the financial ratios ROE, OPM and ROIC, their variances differed with the change to IFRS, but the mean of these financial indicators for the companies in the sample remained the same, ruling out the possibility that the companies have actually undergone a substantial change in profitability.

For the second case, the results are more telling, because, despite the limitations of the sample, the estimates were different from what has been found in the specialized literature, with the exception of Spain. The lack of significance of the coefficients pointed out that IFRS did not have effects in the short term on the valuation that investors give to the price of shares. Even the gap between the companies with the best financial perspectives according to their indicators narrowed slightly with respect to companies that were not reporting profits.

Regarding the latter, this type of finding may change if long-term effects are analyzed, since taking into account only two years (2014 and 2015) makes it difficult to reach more precise conclusions about this relationship. But as the years after implementation accumulate, the effect of this switching can be better captured with methodologies such as the Chow test and panel data.

Future research for Colombia could consider financial indicators such as return on assets (ROA), EBIT over total assets, the acid test (QR) (current assets minus inventories divided by current liabilities), the current ratio (CR) (current assets over current liabilities), debt to shareholders’ equity (LEV) (capital liabilities), and investment on fixed assets (IFA) (fixed assets over total assets). For market variables, the price-to-Utility ratio (PER) and the quotient between the market value of the assets and the book value (ML) could be used.

Finally, in future analyses, it would be valuable to include institutions, which, as was seen, are a decisive factor (a recurring topic in other research) to explain the adoption and effects of accounting standards, and even to determine changes in the stock market value of companies beyond accounting information.