Introduction

In various interpersonal relationships, formal agreements, often represented as contracts, are established among the involved parties, giving rise to the agency theory (Jensen & Meckling, 1976). Agency dynamics involve the division of powers between the principal (or owner) and the agent (or company manager) (Apriliyanti et al., 2023). The principal exercises their formal rights over the company, including control and appropriation of residual profits. To ensure the effective management of the company, the owner may appoint a board of directors. This leads to the separation between ownership and control of the company, ultimately resulting in greater information asymmetry (Raimo et al., 2020).

Informational asymmetry creates opportunities for managers to make decisions aimed at maximizing their own interests, ultimately giving rise to agency conflicts (Bebchuk & Fried, 2005). To mitigate these conflicts, principals can provide incentives to managers and bear monitoring costs to prevent unexpected activities by agents. In certain situations, owners may offer compensation to managers as a safeguard against detrimental actions or as a form of reward if such actions are avoided (Jensen & Meckling, 1976). These costs incurred by the company to minimize conflicts are regarded as agency costs.

Agency costs are considered by the principal (owner) to mitigate the opportunism of agents (managers), with a view to aligning the interests of both parties. Various measures in corporate governance serve as examples of agency costs, such as the executive remuneration system, provided to encourage the agent to act in accordance with the interests of the principal (Huu Nguyen et al., 2020).

Corporate governance aims to monitor operations and resolve agency conflicts, involving both administrators and shareholders in this process (Gerged et al., 2023). Thus, the application of governance principles, such as transparency, accountability, justice, and compliance, becomes essential for the development of financial markets (Farah et al., 2021). Demirel et al. (2022) argue that corporate governance is one of the ways in which shareholders seek to guarantee returns and protect their rights regarding their investments. Consequently, corporate governance methods play a pivotal role in mitigating agent opportunism.

Considering the goals and benefits of corporate governance, it is relevant to highlight a crucial aspect within this system, which is the quality of accounting information. According to Alsmady (2023), the quality of financial information plays a crucial role in reducing these conflicts, as high-quality accounting information has the power to significantly diminish information asymmetry.

The quality of accounting information is defined as the usefulness of reported profits in financial statements (Dunham & Grandstaff, 2022), with high-quality reports providing a more solid and reliable decision-making foundation. Several elements constitute the quality of accounting in-formation, as described by Dechow et al. (2010), including earnings persistence, earnings management and smoothing, information relevance, and accounting conservatism.

Research on conservatism in accounting involves two approaches: conditional and unconditional. Conditional conservatism recognizes losses more readily than gains (Basu, 1997). On the other hand, unconditional conservatism selects lower values for assets and revenues and higher values for liabilities and expenses, reflecting an asymmetric response to uncertainty (Ball & Shivakumar, 2005).

Although both conditional and unconditional conservatism result in undervaluation of net assets, unconditional conservatism may give rise to some agency problems if investment decisions are made based on profit effects (Le et al., 2023). Additionally, conditional conservatism represents a significant attribute of financial reporting, signifying the timelier recognition of losses than gains. Consequently, it imposes a higher verification standard for financial statements, which can mitigate incremental agency problems (Hrazdil et al., 2023). Therefore, the choice was made to employ conditional conservatism due to its importance in mitigating agency problems.

Conservatism in accounting information is a controversial topic in academia, with two theoretical perspectives arguing for or against this attribute for organizations (Mora & Walker, 2015). Therefore, accounting conservatism can be evaluated from two distinct perspectives regarding the quality of accounting information.

Some argue that conservatism enhances the quality of reported information because managers seek to accurately represent the financial position of the company (Ahmed et al., 2013). However, Wang (2013) believes that conservatism contradicts the principle of neutrality in accounting information, leading to greater information asymmetry and negatively affecting the quality of reported earnings, which can harm organizations.

Vale and Nakao (2017) suggest that conservatism creates conditions that lower the quality of earnings, while Daryaei et al. (2022) assert that executives can opportunistically use conditional conservatism to secure higher compensation. Therefore, the perspective of conservatism can indeed have a negative impact on the quality of accounting information.

As mentioned, high-quality accounting information is a crucial tool for mitigating internal conflicts within organizations. Furthermore, agency costs aim to reduce these conflicts, making the electric power industry a suitable area for investigation. Therefore, the aim of this research is to examine the relationship between agency costs and conditional conservatism in Brazilian companies in the electric power industry listed on B3. This study seeks to understand the impact of various agency cost proxies on the quality of information, as measured by conditional conservatism. The significance of this study lies in its contribution to the advancement of Brazilian literature on the subject by providing consistent results.

Hence, it is evident that the relationship between corporate governance and measures of earnings quality has already been studied. However, in the Brazilian literature, there is a gap concerning research that focuses on the relationship between agency costs and conservatism, especially in the electric power industry. Additionally, a more detailed analysis of corporate governance attributes is needed since most research uses a variable that segments companies based on their levels of corporate governance on the stock exchange.

Most previous studies focus solely on evaluating earnings quality in relation to corporate governance in companies without considering measures of quality. These studies demonstrate that companies at different levels of governance exhibit superior information quality. In contrast, this study examines agency costs in electric power companies using an earnings quality measure (conditional conservatism) and 24 agency cost measures, representing a significant advancement compared to previous research.

Thus, this study has the potential to benefit regulatory authorities by allowing them to observe whether the practices adopted by companies indeed generate quality reports. Furthermore, it can assist various market agents in Brazil in making resource allocation-related decisions, providing insights into the factors that influence the quality of reports.

Electric power industry and hypothesis development

Various sectors, both public and private, face challenges of informational asymmetry, conflicts, and agency costs. A notable example is the electric power sector, predominantly funded by private capital, where shareholders’ interest in the profitability of their investments is significant. Hence, policies should be established to align the interests of the parties involved in these companies (Malanski, 2022).

The electric power sector is fundamental in society as it provides energy for essential national activities, sustaining the country’s infrastructure (Ferreira et al., 2021). Oversight is crucial for improving the living conditions of the population. According to Necoechea-Porras et al. (2021), the electric power sector is tightly regulated and relies on public policies related to prices, margins, investments, and returns.

The substantial capital infusion into the electric power industry underscores its pivotal role in the capital market, drawing continuous scrutiny from stakeholders. International studies, including research from India, furnish compelling evidence regarding the impact of corporate governance on the financial and operational performance of companies engaged in public utility services (Srivastava & Kathuria, 2020). Within the Brazilian context, existing research suggests that corporate governance practices exert a notable influence on the profitability of electric companies (Malanski, 2022).

Examining the relationship between agency costs and accounting conservatism in the Brazilian electric power industry is justified given the complexity and far-reaching implications of this sector on society. Moreover, the scarcity of studies addressing this relationship in the context of public utility companies emphasizes the importance of gaining a deeper understanding of these interactions. Such insight has the potential to catalyze the development of public policies and best practices within this industry, ultimately benefiting society.

In the current landscape, both the quality of accounting information and the costs associated with agency and corporate governance are recurring themes in international studies. Works like Alsmady (2023) scrutinize the impact of corporate governance or its individual attributes on specific measures related to earnings quality. In the realm of the electricity industry, prior studies offer evidence on how governance practices contribute to improved company performance (Couto & Rangel, 2023).

The study by Alves (2023) yields results consistent with the Agency Theory, suggesting that certain agency costs can influence the quality of accounting information in compa nies. Specifically, the attributes related to the board of directors, both in terms of quantity and composition, can influence the quality of companies’ earnings (Alves, 2023). On the other hand, the study by Rezaee and Safarzadeh (2023) states that robust corporate governance mechanisms can lead to higher quality financial reporting, particularly in the context of an emerging economy. Finally, the research carried out by Souza et al. (2023) highlights several effects of agency costs on earnings quality, covering positive and negative impacts. Consequently, agency costs are considered tools capable of mitigating agency conflicts and reducing informational asymmetries in Brazilian financial institutions (Souza et al., 2023). Based on these studies, the following overarching research hypothesis was formulated:

H1: There is a significant relationship between agency costs and the quality of accounting information (conditional conservatism) in Brazilian companies in the electricity power industry.

Methodology

Sample and data collection

To analyse the relationship between agency costs and the quality of accounting information in electric power companies in Brazil, we selected publicly traded companies listed on the B3 in this sector, using data from 2012 to 2020. Information from 2021 and 2022 was not considered due to the various problems that companies faced because of the covid-19 pandemic. For example, Brazilian inflation reached approximately 11% in 2021, whereas before the pandemic it was between 3% and 4%.

As shown on Table 1, out of the initial 45 companies in the electric power sector included in the sample, 24 were excluded due to the lack of necessary data for the statistical models in this study. Therefore, we used 21 companies with data spanning a nine-year period, totalling 189 observations.

Data regarding accounting conservatism was obtained from the Economática platform, while information on corporate governance measures was collected manually from the reference forms provided by the “Central de Sistemas” on the website of the Brazilian Securities and Exchange Commission (CVM).

Quality model: Conditional conservatism

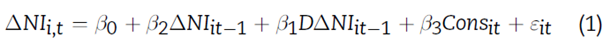

One of the key models for assessing conditional conservatism is Model 1, developed by Ball and Shivakumar (2005).

It is based on the idea that conservatism arises from temporal variations in earnings and losses related to future cash flows. Model 1 is employed in the study to classify whether companies adopt conservative, neutral, or optimistic approaches in their accounting decisions.

To investigate the impact of agency costs on information quality, Model 1 serves as a starting point. There are 24 agency cost attributes, and each of them is incorporated into the model in two distinct ways: one is introduced as an independent variable to control the effect of agency cost on the variation in current earnings (the dependent variable), while the other is included as an interactive variable with conservatism to assess whether the agency cost attribute influences the level of conservatism, neutrality, or optimism of companies.

Due to the large number of attributes, we chose to conduct separate models in order to avoid significant issues of collinearity, meaning that each model addresses a single agency cost attribute. Therefore, in total, we have 25 models, where Model 1 focuses on conservatism, while Model 2 is the general model that relates agency costs to conservatism.

Where:

ΔNIi t , = Change in net income of company i from year t-1 to year t.

ΔNIi t , −1 = Change in net income of company i from year t-2 to year t-1.

ΔNIit_,−1 = Dummy variable indicating the presence of an adverse change in accounting net income of company i from year t-2 to year t-1, taking a value of 1 if _NIit−1 < 0 and 0 otherwise.

Con = Variable representing conditional conservatism of the company through the following interaction: DΔNIit−1 * DNIit_−1

ACVi t , = Agency cost variables.

ei t , = Regression model error term.

To analyse the relationship between agency costs and conditional conservatism, we applied a panel regression model, considering the characteristics of variables over time and across different cross-sections. The fixed effects approach was adopted in all regressions, following the recommendation of Gujarati and Porter (2011) to control for individual and time-specific idiosyncrasies, minimising bias and improving model accuracy.

To check the robustness of the models, we conducted tests to assess the assumptions of normality (chi-squared test), homoscedasticity (White test), and collinearity (variance inflation factor). We used the statistical software Gretl to perform these analyses. Outliers were identified and treated using the “winsorization” technique. In the context of this study, the maximum acceptable level of significance was set at 0.1.

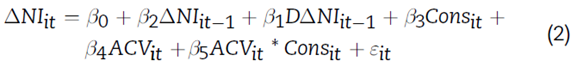

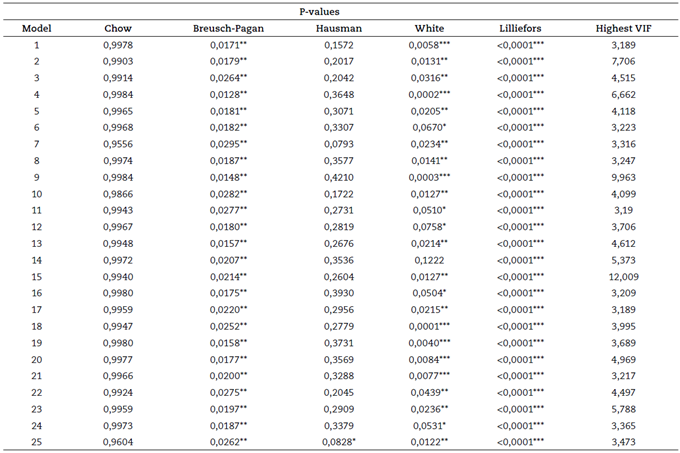

Agency cost variables

Several attributes related to monitoring and contract measures were considered, as detailed on Table 2.

Results

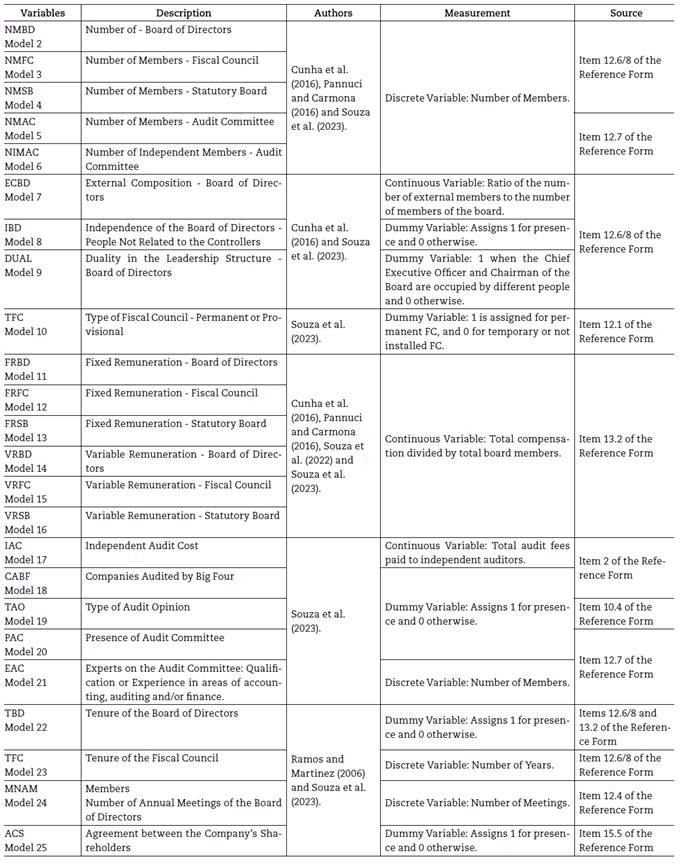

Regression validation tests and panel diagnostic

For models 1 to 24, the significant p-values in the Breusch-Pagan tests indicate that there is variance in the individual residuals, and the non-significant p-values in the Hausman tests reinforce that the individual residuals are not correlated with the regressors. These results reinforce that random effect estimation is the most consistent for models 1 to 24. For model 25, the significant p-value in the Hausman test highlights a significant correlation between the residuals and the regressors, which impairs the estimation. due to random errors. Therefore, model 25 was estimated using fixed effects, which allows correlations between regressors within a certain limit.

Regarding the assumptions, Table 3 reveals that, based on the Lilliefors test p-value, all models had residuals with a non-normal distribution. However, it is important to note that, as explained by Gujarati and Porter (2011), datasets with more than 30 observations tend to approach normality due to the central limit theorem. Therefore, the normality assumption can be considered satisfied for the regressions in this study.

Table 3 Regression validation tests and panel diagnostic

Notes: *, ** and *** statistical significance at the 10%, 5% and 1% levels, respectively.

Source: Research results.

The p-values of the White test indicate that only Model 14 has homoscedastic residuals, while all other models have heteroscedastic residuals. As a solution, regressions with heteroscedastic residuals were adjusted using White’s robust standard errors to control for this heteroscedasticity.

Regarding collinearity, only Model 15 had a slightly higher variance inflation factor (VIF) than the recommended limit of 10 put forth by Gujarati and Porter (2011). However, it is essential to note that a VIF of 12 does not seem to indicate a substantial collinearity problem. Moreover, as explained by Gujarati and Porter (2011), high R² values in combination with few significant coefficients in the t-test are indicative of collinearity issues. In the case of Model 15, the R² is 13.86% with 5 significant coefficients out of 6 in total, suggesting that collinearity is not a significant concern.

Results and discussion of regression models

Model 1 reveals the results of the base conservatism model put forth by Ball and Shivakumar (2005). In contrast to previous studies, the negative and significant sign of the _NIit−1 variable and the lack of significance of the Consit variable suggest that companies are adopting an optimistic stance, anticipating gains and being neutral regarding losses, rather than being conservative or neutral. It is important to note that this optimism was identified in all 25 models, with some indicating that companies are deferring losses (with a positive coefficient), further intensifying the optimistic outlook. The presence of optimism in all models strengthens the robustness and accuracy of these results.

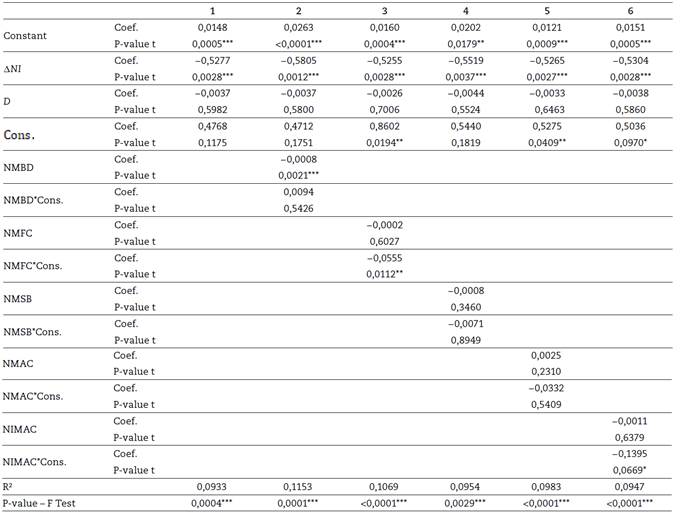

The detection of optimism has implications for the analysis of agency cost variables. Information quality is assessed based on neutrality, meaning that for an agency cost to contribute to an improvement in information quality, it must reduce optimism. This requires that the coefficients of the interactive variable between agency cost and the Consit variable be negative and significant. Table 4 provides the results for the base model and models related to the ‘members’ attribute.

Table 4 Statistical results - base model and members

Notes: *, ** and *** statistical significance at the 10%, 5% and 1% levels, respectively.

Source: Research results.

According to Table 4, Models 3 and 6 are highlighted due to the statistical significance obtained. Model 3 indicates a negative relationship between the size of the supervisory board and optimism, while Model 6 reveals a negative relationship between the number of independent members on the audit committee and optimism. Table 5 presents the result related to the “composition” attribute.

Table 5 Statistical results - composition

Notes: *, ** and *** statistical significance at the 10%, 5% and 1% levels, respectively.

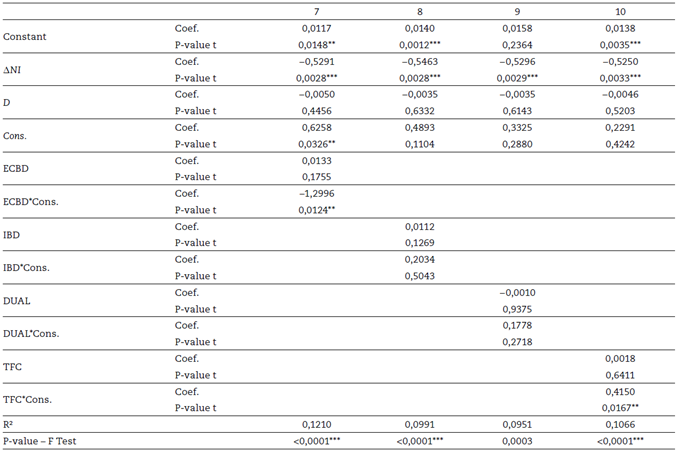

Source: Research results.

As seen on Table 5, two composition characteristics are related to optimism (Models 7 and 10). The presence of external members on the board of directors shows a negative association with optimism, while the permanent nature of the supervisory board has a positive relationship with optimism. Table 6 presents the results related to the “remuneration” attribute.

Table 6 Statistical results - remuneration

Notes: *, ** and *** statistical significance at the 10%, 5% and 1% levels, respectively.

Source: Research results.

Regarding remuneration, Models 14, 15, and 16 indicate a negative relationship between variable remuneration for the board of directors, supervisory board, and statutory management board, and optimism. In other words, the higher the variable remuneration, the lower the optimism of accounting information. Regarding fixed remuneration, only the remuneration of the board of directors has a negative and significative relationship with optimism (Model 11). Table 7 provides the results for the “audit” attribute.

Table 7 Statistical results - audit

Notes: *, ** and *** statistical significance at the 10%, 5% and 1% levels, respectively.

Source: Research results.

Among the five audit variables, only the qualified audit opinion (Model 19) shows a positive relationship with optimism. This result was expected, as qualified opinions in the audit report indicate that companies may have adopted accounting practices that differ from the standards, i.e., more aggressive accounting choices, which were noted by audit firms. The results for the last attribute “tenure and others” are provided on Table 8.

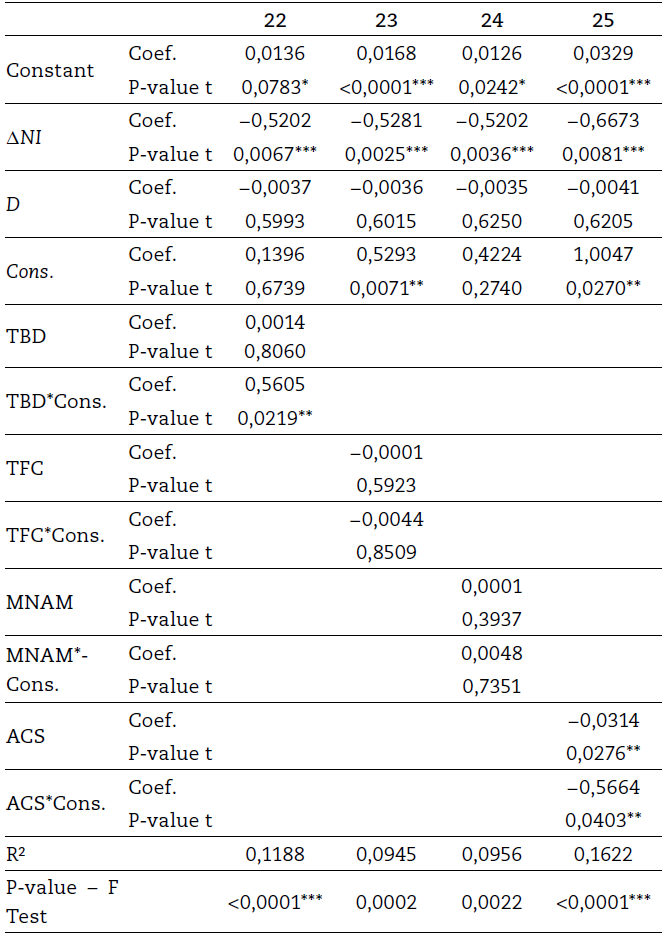

Table 8 Statistical results - tenure and others

Notes: *, ** and *** statistical significance at the 10%, 5% and 1% levels, respectively.

Source: Research results.

The results from Table 8 indicate that the tenure of the board of directors is positively related to optimism (Model 22), while the presence of shareholder agreements is negatively related to it (Model 25).

Finally, it is observed that out of the 24 analysed attributes, 11 were significant (45.83% of the total). Among these significant variables, only the Number of Independent Members on the Audit Committee (NIMAC) exhibited a statistical significance of 10%, while the others were statistically significant at levels of 5% or 1%, which enhances the reliability of the results.

Discussion

As for the results related to the “members” attribute, it is observed that there is a negative relationship between the size of the supervisory board and optimism, as well as a negative relationship between the number of independent members and optimism. The results presented indicate that the composition of some committees and councils plays a significant role in achieving the neutrality of accounting information. This finding suggests that a larger number of members, especially independent members, on the super visory board can lead to more robust discussions regarding the recognition of various factors that could impact a company’s assets. These deliberations have the potential to influence ultimate decisions, aiming to attain neutrality in financial reporting ( Aburisheh et al., 2022).

The findings related to the “composition” attribute indicate a negative relationship between external members of the board of directors and optimism, whereas the permanent nature of the supervisory board exhibits a positive relationship with optimism. These results imply that a higher proportion of external members on the board may reduce optimism but contribute to better information quality, as outlined by Ajinkya et al. (2005) and Azouzi (2019).

On the other hand, companies with a permanent supervisory board may demonstrate a more comprehensive understanding of the market and the work environment, potentially leading to increased optimism. This phenomenon suggests an ongoing learning process for board members over time. In contrast, in a provisional council, members may struggle to convey their learning effectively due to the less consolidated structure, and the ever-changing characteristics of the board can result in behavioral changes and new learning processes, mitigating the endogenous effect. The positive relationship between a permanent supervisory board and optimism contradicts the findings of Carvalhal-da-Silva and Leal (2005), who identified that the presence of a permanent board contributes to an increase in conditional conservatism. This discrepancy in results may be attributed to the specific characteristics of the electric power industry.

Results related to the “remuneration” attribute provide evidence that variable remuneration, whether for the board of directors, supervisory board, or statutory management board, and fixed remuneration of the board of directors, have a negative relationship with optimism. These findings align with the study by Daryaei et al. (2022), suggesting that remuneration is associated with higher executive conservatism. This finding is also consistent with Jensen and Meckling’s (1976) theory of contractual costs, asserting that aligning the interests of principals and agents can be achieved through remuneration that satisfies the agents. Therefore, the results suggest that variable remuneration can incentivize management quality and, consequently, improve the quality of financial reporting, as discussed by Souza et al. (2022), who emphasize that variable remuneration can align with profit quality, leading to a reduction of opportunistic management actions.

Findings related to the “audit” attribute show that only the variable related to the auditor’s opinion with qualifications has a positive relationship with optimism. These results support the study by Guimarães et al. (2022), suggesting that the Brazilian market reacts negatively to companies with auditor’s opinions with qualifications, which is linked to poor quality financial statements.

Lastly, results from the “tenure and other” attribute indicate a positive relationship between the tenure of the board of directors and optimism, while the presence of shareholder agreements is negatively related to optimism. In the case of a permanent supervisory board, longer tenures may allow for more learning (endogenous effect), potentially leading to optimistic actions by managers. This suggests the possibility of shorter tenures to promote rotation and avoid excessive institutionalization of processes. Regarding shareholder agreements, the presence of such agreements between majority and minority shareholders can align interests between the parties to an agency contract, supporting the study by Huu Nguyen et al. (2020), which suggests that such mechanisms can encourage the agent to act in accordance with the principal’s objectives.

Conclusions

Agency conflicts are inherent in information asymmetry in institutional environments. In this context, this research aimed to investigate the relationship between agency costs and conditional conservatism in publicly traded companies in the electric power sector in Brazil.

The initial results revealed that, instead of adopting a conservative approach, companies in the electric power sector tend to anticipate gains, demonstrating optimism rather than conservatism. Thus, the analysis of agency costs focused on reducing optimism and improving the quality of information.

The analysed attributes were grouped into five categories: members, composition, remuneration, audit, and term. The findings suggest that a larger number of members on the fiscal board and the presence of independent members on the audit committee contribute to reducing optimism. Regarding governance composition, having a greater number of external members on the board of directors and the absence of a permanent fiscal board are associated with lower optimism.

Fixed compensation of the board of directors, and variable compensation for the executive boards, fiscal board, and statutory board was identified as a factor that reduces optimism. On the other hand, the presence of qualified audit opinions is associated with higher optimism. Regarding the term attribute, a longer term on the board of directors and the absence of shareholder agreements contribute to higher optimism. Finally, all presented results had their assumptions verified, and robust methods were applied, reinforcing the validity of the findings.

This study is particularly relevant as it focuses on an important economic sector in Brazil. It demonstrates that the efforts of key actors contribute to the neutrality of accounting information and highlight the potential of agency costs in aligning the interests of agents with those of principals, resulting in higher quality information for the capital market.

Investors, regulators, and members of organisations can benefit from the study’s findings, using these conclusions to enhance investment decisions, oversight, and governance practices. It is important to note that the research has limitations, as it relies on data from a specific sector. Therefore, its results apply exclusively to the electric power sector. Future research may expand the analysis to other sectors and explore other models of information quality. 1 2 3