INTRODUCTION

In recent years, the issue of gender diversity in the workplace has gained significant attention (Fine et al, 2020). The push for greater representation of women in leadership positions and boardrooms has become a key topic of discussion across various industries (Longman & Anderson, 2016; Tamerius et al, 2010; Alli et al, 2021). The corporate world has been under particular scrutiny for its lack of gender diversity and the potential consequences this may have on business performance. However, it may be useful to investigate how other aspects of diversity, such as colour, ethnicity, and age, intersect with gender diversity in determining financial outcomes. I nvestigating the combined impact of different diversity characteristics could provide a more complete picture of the consequences on corporate financial difficulties.

Gender diversity refers to the fair representation and engagement of people of different genders in a variety of social, economic, and organisational contexts (Georgiadou & Syed, 2021). Gender disparities have traditionally characterised businesses and other societal areas, with men holding most positions of power and decision-making authority. However, there has been a rising realisation in recent years of the necessity for increased gender diversity in order to address concerns of fairness, equality, and overall organisational success (Heidelberg, 2019).

Gender diversity is important for reasons other than social justice. Diverse teams and organisations report various benefits, including increased creativity, innovation, problem-solving abilities, and decision-making processes, according to research (Ly-le, 2022; Wicker et al, 2022). A varied workforce brings together people from various backgrounds, experiences, and viewpoints, resulting in a wider range of ideas and methods. This range of perspectives has been linked to enhanced performance, flexibility, and competitiveness in dynamic and complex contexts.

While some progress has been achieved in improving gender diversity, problems and inequities remain. Women, in particular, continue to encounter barriers and biases that limit their access to leadership roles (Evans & Maley, 2021) and possibilities for career progression (O'Connell & McKinnon, 2021). Some of the recurring difficulties that require greater investigation and resolution include the gender pay gap (Meara et al, 2020), underrepresentation of women in top management and board roles (Furlotti et al, 2019), and workplace discrimination (Yu & Lee, 2021).

Academic research is critical in shedding light on the complexity of gender diversity. Scholars investigate how gender diversity affects a variety of outcomes, including organisational success, employee well-being, innovation, and social dynamics. They also investigate the mechanisms, processes, and contextual factors that determine the relationship between gender diversity and these outcomes.

One area of interest in this regard is the relationship between gender diversity and financial distress (Jia, 2019; Yousaf et al, 2021; Guizani & Abdalkrim, 2023). Financial distress, which is characterized by a company's inability to meet its financial obligations, is a serious concern for any business. Previous research has shown that gender diversity can positively impact firm performance, but its potential impact on mitigating financial distress has received less attention (Zhou, 2019, Abbas & Frihatni, 2023).

Financial distress is a phenomenon that has garnered significant attention in academic research and practical applications within the field of finance and related disciplines. It refers to a state of financial instability or vulnerability faced by individuals, organizations, or even entire economies. The implications of financial distress are far-reaching and can have substantial consequences for individuals' financial well-being, firm performance, and overall economic stability. Financial distress can manifest in various forms, such as cash flow problems (Vazov, 2019), excessive debt burdens (Valaskova et al, 2021), liquidity constraints (Osinubi, 2020), and inability to meet financial obligations (Altman et al, 2019). It is often characterized by a state of financial imbalance, where liabilities exceed assets or cash flows are insufficient to cover expenses and debt obligations. Individuals experiencing financial distress may face challenges in meeting their daily living expenses, servicing debt, or planning for their future financial needs. Similarly, organizations facing financial distress may struggle with declining revenues, profitability, or the risk of insolvency.

The study of financial distress is crucial for several reasons. Firstly, it helps us understand the factors that contribute to the occurrence and persistence of financial distress. Economic and financial shocks, mismanagement, market dynamics, industry-specific factors, and macroeconomic conditions are among the numerous factors that can precipitate financial distress. By identifying and understanding these causes, researchers and practitioners can develop effective strategies and interventions to prevent or mitigate financial distress.

Secondly, the study of financial distress contributes to our understanding of its consequences and impacts. Financial distress can have wide-ranging implications, including increased stress levels, diminished mental and physical health, strained relationships, decreased productivity, and compromised quality of life for individuals. For organizations, financial distress can lead to reduced profitability, decreased market value, layoffs, bankruptcy, and even systemic risks that can spill over into the broader economy. By comprehending the consequences of financial distress, researchers can develop frameworks and models that assist in predicting, measuring, and managing its impact on individuals, organizations, and the economy. Understanding the causes and manifestations of financial distress can inform the design and implementation of regulatory frameworks, prudential measures, and intervention strategies aimed at preventing or mitigating systemic risks and safeguarding the overall stability of the financial sector.

The purpose of this research is to examine the relationship between gender diversity and financial distress in corporate settings. This study will investigate whether a higher representation of women in leadership positions and boardrooms can help companies avoid or manage financial distress. Such incidence will be determined by analysing the financial performance of companies with different levels of gender diversity and assess whether this diversity affects their likelihood of experiencing financial distress.

Indonesia, as an archipelago with vast cultural, economic, and social diversity, offers a unique microcosm for understanding gender dynamics in different contexts. This diversity aligns with the United Nations Development Promgramme (UNDP)'s aim to address gender inequality through tailored approaches that consider varied local contexts. By examining Indonesia's multifaceted regions, the strategy can draw more nuanced insights and develop adaptable frameworks applicable to other diverse nations.

Indonesia has made significant strides in gender equality but continues to face substantial challenges. For example, while female literacy rates and women's participation in the workforce have increased, issues such as gender-based violence and limited access to higher-level political and economic roles persist. Studying Indonesia's progress and setbacks can provide valuable lessons for the strategy, highlighting successful initiatives and identifying areas that need targeted interventions. The COVID-19 pandemic had profound effects on gender equality in Indonesia, exacerbating existing disparities and creating new challenges. For instance, women in Indonesia have experienced increased domestic responsibilities and higher rates of job loss compared to men. Analyzing these impacts within Indonesia can help the UNDP tailor its pandemic response strategies to better address gender-specific issues, making the overall strategy more resilient and inclusive.

The findings of this study could have important implications for companies and policymakers alike. By shedding light on the potential benefits of gender diversity, this research could encourage companies to adopt more inclusive practices and policies, leading to better financial performance and overall business success. Additionally, it could inform policymakers on the need for more robust measures to promote gender diversity and inclusion in the corporate world.

While previous studies have investigated the impact of gender diversity on firm performance (Marinova et al, 2016; Perryman et al, 2016; Brahma et al, 2021), this research adds to the literature by examining its potential role in mitigating financial distress. By analysing the financial data of companies listed on Indonesia Stock Exchange, this paper aims to provide empirical evidence on the relationship between gender diversity and financial distress. Moreover, the study will explore potential mechanisms that may explain this relationship, such as the impact of diverse perspectives on risk management and decision-making. By filling this research gap, this study aims to provide insights that can help companies and policymakers make informed decisions on promoting gender diversity and mitigating financial distress in corporate settings.

LITERATURE REVIEW AND HYPOTHESIS

Identity Theory

The first theoretical perspective is social identity theory. Social identity theory suggests that individuals form their self-concept based on their membership in social groups, such as gender (Scheepers & Ellemers, 2019). As such, the presence of individuals with different social identities in decision-making positions can lead to the consideration of a wider range of perspectives and ideas, which in turn can improve decision-making and risk management. Therefore, this study will explore whether gender diversity in leadership positions and boardrooms can promote more effective decision-making and risk management, and whether this can mitigate financial distress.

Resource Dependence Theory

The second theoretical perspective is resource dependence theory. Resource dependence theory suggests that organizations depend on external resources, such as capital, labor, and information, to achieve their goals. As such, a diverse network of resources can help organizations overcome external challenges and achieve greater stability (Orazalin & Baydauletov, 2020). Therefore, this study will explore whether gender diversity can provide companies with a diverse network of resources and perspectives that can improve their ability to adapt to changing environments and mitigate external risks.

Institutional Theory

The third theoretical perspective is institutional theory. Institutional theory suggests that companies conform to societal norms and expectations. As such, a lack of gender diversity in leadership positions and boardrooms can reflect a failure to conform to societal expectations of diversity and inclusion (Lewellyn & Muller-Kahle, 2020), which can have negative consequences for company reputation and stakeholder relationships. Therefore, this study will explore whether gender diversity can improve company reputation and stakeholder relationships, and whether this can mitigate financial distress.

Stakeholder Theory

The fourth theoretical perspective is stakeholder theory. Stakeholder theory suggests that companies must balance the interests of multiple stakeholders, including shareholders, employees, customers, and the wider community (Jan et al, 2022). As such, a lack of gender diversity in leadership positions and boardrooms can lead to a narrow focus on shareholder interests at the expense of other stakeholders, which can have negative consequences for company performance and stability. Therefore, this study will explore whether gender diversity can promote a more balanced focus on multiple stakeholders, and whether this can mitigate financial distress.

Gender Diversity

Reviewing literature from the past five years, the discourse on gender diversity has progressively evolved. The potential benefits of gender diversity in the workplace, particularly in leadership roles, have been extensively explored (Fine et al, 2020; Greider et al, 2019) . In recent reseach, Issa (2023) argued that firms with gender-diverse boards demonstrate greater social performance and corporate reputation.

In the same year, Post and Byron revealed an interesting non-linear relationship between gender diversity on boards and financial performance (Galletta et al, 2022).

Liu & Wu (2023) emphasized that gender-diverse executive teams display enhanced strategic risk-taking, which can result in improved organizational performance. Research conducted by Nishesh et al. (2022) explored gender diversity's role in financial distress. They found that companies with more gender diversity at leadership levels faced less financial distress, aligned with findings from Safiullah et al. (2022), who reported lower insolvency rates in firms with more gender-inclusive leadership.

In 2019, research by Turban et al. presented a comprehensive view, arguing that gender diversity impacts not just financial performance but also company culture, innovation, and reputation. They found that gender diversity on boards fostered a more collaborative and innovative work environment. In 2020, a study by Romano et al. reinforced that diversity within an organization, particularly gender diversity, leads to better decision-making and governance, consequently contributing to improved financial performance and resilience. Across the studies, the consensus points towards a positive correlation between gender diversity and several facets of corporate performance. It underscores the importance of gender diversity in promoting inclusive decision-making, fostering innovation, enhancing financial performance, and reducing financial distress.

Financial Distress

Research on financial distress has evolved over the past five years, addressing causes, consequences, and mitigation strategies. In 2022, Wu et al (2022)'s study provided a comprehensive understanding of financial distress predictors using the Z-Score model. They found that key indicators such as profitability, leverage, liquidity, solvency, and activity were significant in predicting financial distress. In 2020, Dat et al. focused on the relationship between corporate governance and financial distress. Their findings suggested that robust governance mechanisms could help mitigate financial distress risk.

In 2020, studies by Kim and Heshmati highlighted the role of external ma-croeconomic factors in contributing to a company's financial distress. They argued that economic instability could increase the likelihood of financial distress. In 2021, Ararat et al.'s research linked gender diversity in corporate leadership with reduced instances of financial distress, arguing that diverse leadership can result in improved decision-making and risk assessment. In 2022, a study by Nini et al. examined the effects of financial distress on employee morale and productivity. They discovered that companies experiencing financial distress often faced a simultaneous decline in employee productivity.

The research in 2023 by Jebran & Chen reiterated the importance of effective corporate governance and leadership diversity in mitigating financial distress. They found that diversified boards tended to engage in better risk management, leading to lower incidences of financial distress. Across these studies, predictors of financial distress, corporate governance, macroeconomic factors, leadership diversity, and the impact on employees are recurrent themes. This underscores the multifaceted nature of financial distress, necessitating comprehensive strategies for prevention and management.

Hypothesis1: Increased representation of female commissioners within the company has negative significant effect to financial distress

Hypothesis 2: Increased representation of female director within the company has negative significant effect to financial distress

Hypothesis 3: Increased representation of female commissioners within the company with firm and board control variables have negative significant effect to financial distress

Hypothesis 4: The presence of a higher number of female director within the company, with firm and board control variables have negative significant effect to financial distress

METHODOLOGY

Sample selection

This paper used quantitative method which focus on how the existence of women on board would affect financial distress. This paper used firms listed in Indonesia as the research object. There are 868 firms listed on the Indonesia Stock Market as of June 2023. I exclude firms listed on the Indonesia Stock Exchange after January 1st 2022 to make sure that data from the firms can be used. The sample period is year 2019-2022, resulting 2,737 firm-year observation. Then, I exclude all firms with incomplete data which shows 1,870 firm year observation, then I also exclude 218 firm-year financial firms. Table 1 present the purposive sampling.

Table 1 Purposive Sampling

| No | Description | Total |

|---|---|---|

| 1. | Firms listed on the Indonesia Stock Exchange as of June 2023 | 868 |

| 2. | Firms listed on the Indonesia Stock Exchange after January 1st 2022 | (101) |

| 3. | Firm-year listed on the Indonesia Stock Exchange between 2018-2022 | 2,737 |

| 4. | Firms with incomplete data | (649) |

| 5. | Financial sector firms | (218) |

| Total firm-year observation | 1,870 |

Source: author's elaboration (2023).

Financial Distress

The dependent variable in this study is Financial Distress. Financial distress is measured using the ICR (Interest Coverage Ratio) (Suranta, 2023) computation using a dummy variable to identify whether a company is suffering financial troubles or not. If the company has an ICR value greater than 1.5, it is categorised as having no financial troubles; if the company has an ICR value less than 1.5, it is characterised as having financial difficulties or being in financial distress.

Women on Board Measurement

This study calculates the proportion of women on the board as well as the percentage of independent female directors over the total number of women on the board (Bennouri et al., 2018).

Control Variables

Following previous literature that mentions a relationship established between performance and governance quality (Adams et al., 2010) and the importance of control variables to the significant result, I use the size of the board proxied by the number of board members and the percentage of independent directors as control variables for governance variable, as well as firm size, leverage, and sales growth as control variables.

Table 2 contains the definition of the variables used in this paper.

Table 2 Definitions of variables.

| Variables | Abbreviation | Measurement |

|---|---|---|

| Financial Distress | FD | Dummy variable 1: ICR > 1,5 ; 0 otherwise |

| Women on Board 1 | WOB1 | Percentage of female commissioner over total commissioners in the company |

| Women on Board 2 | WOB2 | Percentage of female director over total director in the company |

| Board Size | BSize | Total number of the board of director in the company |

| Board Independence | BInd | Percentage of independent director in the company |

| Firm Size | FSize | Natural logarithm of total asset from firm i at time t |

| Leverage | Lev | Ratio of total financial debt to total assets |

| Sales growth | Growth | Percentage growth in reported sales between year t and year t-1. |

All variables are measured at the firm-year level.

Source: author's elaboration (2023).

Research model

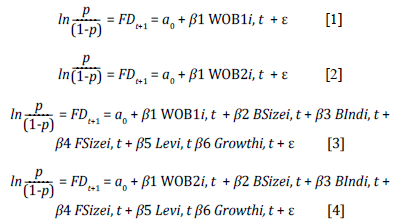

Following previous literature, this paper study the influence brought by the existence of women on board to the financial distress following this logistic regression model:

where:

• FD(t+1)i Financial distress firms at times t+1

• WOB1 is the percentage of female commissioner over total commissioners in the company.

• WOB2 is the percentage of female director over total directors in the company.

Governance variables and firm variables as control variables:

• BSize is the total board size.

• BInd is the percentage of independent director in the company.

• Leverage is total debt divided by total asset

• Growth is the percentage of sales growth from last year.

• FSize is the in the natural logarithm of total asset as control variable.

EMPIRICAL RESULTS

Table 3 Statistic Descriptive

| Variables | N | Min | Max | Mean | Std Dev |

|---|---|---|---|---|---|

| WOB1 | 1870 | 0.16 | 0.33 | 0.18 | 0.02 |

| WOB2 | 1870 | 0 | 0.30 | 0.09 | 0.01 |

| BSize | 1870 | 5 | 21 | 8.07 | 4.44 |

| BInd | 1870 | 0.09 | 0.26 | 12 | 0.02 |

| FSize | 1870 | 0.5 | 21 | 15.68 | 0.73 |

| Lev | 1870 | 0 | 754 | 1.98 | 33.8 |

| Growth | 1870 | -1 | 353 | 2.86 | 17.4 |

| ValidN(listwise) | 1870 |

Source: Authors's own elaboration (2023).

Table 3 shows statististical description of the variables employed on this paper. Variable WOB1 shown that 33 % is the maximum value of woman participating as commissioners, while the minimum percentage is 16%. This suggests that all firms included in the study have woman serving as commissioners. Variable WOB2 measured the percentage of women participating as directors, showing that some firms have no woman on their directorship. For the firms that did count with women occupying director positions, WOB2 reached a maximum value of 30 % of the total ensamble of directors with mean 0.09 or 9 % of the total directorship. This number empirically demonstrates that gender diversity is still considerably low in Indonesia.

Table 4 Frequency on Financial Distress

| Frequenct | Percent | Valid Percent | Cumulative Percent | |

|---|---|---|---|---|

| Valid 0 | 243 | 13 | 13 | 13 |

| 1 | 1627 | 87 | 87 | 100 |

| Total | 1870 | 100.0 | 100.0 |

Source: Authors's own elaboration (2023).

Regression Model Feasibility Test

Hosmer and Lemesho's Goodness of Fit Test was utilised in this investigation, along with the following provisions (Ghozali, 2013):

There is a substantial discrepancy between the model and the observed value if the statistical value = 0.05.

If the statistical value is greater than 0.05, the model can be accepted because it corresponds to the observed value.

Table 5 reveals that the significance value of Hosmer Lemesho's Goodness of Fit for this study to test the four hypothesis.

The Nagelkerke R Square test

The coefficient of determination test seeks to determine the extent of the dependent variable's variability that can be explained by the independent variables through their connection. The coefficient of determination is calculated using the Nagelkerke R Square value. The coefficient of determination (%) is given as a percentage. If the coefficient of determination is near to one, the independent variable has a complete effect on the dependent variable.

Table 6 reveals that the features of twomen on board influence financial distress by 0.7 %, 0.5 %, 2 %, 1,7 % for each model according to the hypothesis, other variables might explain more and affect more the financial distress in firms

The Hypothesis Testing

In this study, the multiple logistic regression research model was conducted as follows:

A logistic regression test was used for hypothesis testing, with the independent variable being a combination of metrics and non-metrics. A normality test was not required for the logistic regression test. The following are the criteria for evaluating the hypothesis:

If the p-value is less than 0.05, the hypothesis is accepted.

If the p-value is more than 0.05, the hypothesis is rejected.

Table 7 displays the results of the logistic regression test that was performed. One of the four independent factors studied, the number of existing audit committees, has a positive and significant impact on the financial distress of companies listed in Indonesia Stock Exchange.

Table 7 Logistic Regression Test Results

| Variable | B | Sig | Keterangan |

|---|---|---|---|

| WOB1 | -7.077 | 0.005 | Significant(-) |

| WOB2 | -7.495 | 0.001 | Significant(-) |

| WOB1, Board Characteristics, Firm Characteristics | -5.435 | 0.105 | NotSignificant(-) |

| WOB2, Board Characteristics, Firm Characteristics | -1.582 | 0.725 | NotSignificant(-) |

Source: Authors's own elaboration. (2023).

DISCUSSION

The analysis results provide compelling evidence of a significant inverse relationship between gender diversity at the corporate leadership level and financial distress. This paper found that companies with a greater representation of women in leadership positions, particularly as commisioners or members of the directorship, demonstrated enhanced financial stability and experienced fewer instances of severe financial distress and bankruptcy.

In table 7, the first model examines the relationship between women on the board, specifically as commissioners, and its effect on financial distress. The analysis reveals a negative and statistically significant impact at the 0.7 % level. This suggests that having women on the board as commissioners is associated with lower levels of financial distress. It implies that their presence may contribute to better financial management, decision-making, or governance practices that help mitigate distress situations within the company.

The second model focuses on the effect of women on the board as directors on financial distress. Similar to the first model, this analysis also finds a negative and statistically significant impact, albeit at a slightly lower level of 0.5 %. These findings suggest that having women on the board as directors is associated with reduced financial distress. Their presence may bring diverse perspectives, expertise, and skills to the decision-making process, which can positively impact financial performance and stability.

In contrast, the third and fourth models yield different results. Both models explore the relationship between women on the board and financial distress, but the effect is found not to be statistically significant at the 2 % level. This implies that the presence of women on the board, whether as commissioners or directors, does not have a discernible impact on financial distress within the analyzed context when board characteristics and firm characteristics is included.

These divergent results across the four models indicate that the relationship between women on the board and financial distress is not consistent. The significance and direction of the effect can vary depending on the specific role of women on the board, control variables that is included and other factors that may influence financial distress. Therefore, it is crucial to interpret these findings with caution and consider conducting further research to gain a comprehensive understanding of the relationship between gender diversity on boards and financial outcomes.

This study underscores the business case for gender diversity, implying that balanced leadership not only promotes inclusivity and equality but also serves as a buffer against financial distress, contributing to the overall sustainability of corporate entities.

CONCLUSIONS

In conclusion, this study sheds light on the significant role that gender variety plays in reducing the severity of financial hardship within corporate settings. The findings of the study show that there is a substantial beneficial association between gender diversity and reduced financial distress in organisations. This was discovered through an in-depth investigation.

The findings of this study have a wide range of applications and are of critical significance for business executives, government decision-makers, and society as a whole. Firstly, these results highlight the importance of increased gender diversity in the boardrooms of corporations and in executive roles. Organisations can improve their overall performance and their resistance to the effects of financial strain if they take proactive steps to encourage the participation of women and to develop a balanced representation of the sexes in their ranks.

Secondly, the research underscores the need of incorporating a wide variety of viewpoints and experiences into the decision-making process. Teams that include members of both sexes are more likely to consider a diverse variety of perspectives, which in turn leads to improved risk management techniques and improved financial outcomes. Therefore, fostering gender diversity is consistent with the principles of good corporate governance and has the potential to contribute to long-term growth that is sustainable.

Lastly, the findings of the research stress the significance of equity and gender equality in contemporary society. In addition to enhancing financial performance, addressing gender inequalities is a matter of ensuring fairness, making progress in society, and creating equitable opportunities. Organisations and societies can work towards the creation of inclusive settings where everyone has the opportunity to develop and contribute their unique abilities if they place an emphasis on gender diversity and make it a priority.

The findings of this study demonstrate that there is a favourable correlation between more gender diversity and decreased financial stress in corporate settings suppported previous study by Jia (2019). The ramifications highlight the necessity for proactive steps to achieve gender balance in organisations, recognising its potential to improve decision-making processes, promote sustainable growth, and advance societal equality. These goals are highlighted by the need for proactive measures to achieve gender balance in organisations. We can make corporate environments more resilient and inclusive by embracing gender diversity, which will, in the end, lead to better results for individuals, organisations, and society as a whole.