INTRODUCTION

Financial institutions play a pivotal role in ensuring financial stability and economic growth through financial mobilization activities across the entire economy (Masood & Ashraf, 2012). Banks are among the key financial institutions that act as economic intermediaries by channeling funds from surplus to deficit areas. This role is particularly significant in developing economies (Ayadi et al., 2008). A robust and profitable banking system has the potential to enhance financial stability and economic growth as it equips the economy to better withstand adverse shocks and external pressures (Athanasoglou et al., 2008).

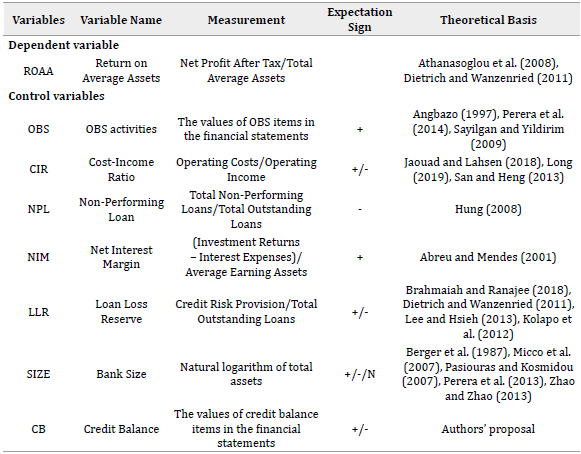

Conversely, the insolvency of the banking system can lead to economic crises (Fang et al., 2014; Fu et al., 2014). Furthermore, profitability is considered a prerequisite for the efficiency and productivity of the banking system (Chen & Liao, 2011). The profitability of banking operations not only affects their ability to provide essential financial services but also plays a significant role in sustaining and fostering overall economic development. Therefore, researching the factors influencing commercial banks' profitability is paramount for the development and stability of the entire economy. In this paper, we focus on examining the influence of seven pivotal factors on the profitability of commercial banks, including Bank Size (SIZE), Net Interest Margin (NIM), Non-Performing Loan ratio (NPL), Loan Loss Reserves (LLR), Cost-to-Income Ratio (CIR), Off-Balance Sheet activities (OBS), and Credit Balance (CB), on the Return on Average Assets (ROAA) of banks.

NIM is a critical indicator of a bank's ability to generate profits from its core operations, specifically fund mobilization and lending. NPL and LLR signify the level of risk in a bank's lending activities and its capability to manage NPL. CIR measures the bank's efficient cost management, while OBS relates to off-balance sheet activities and financial risk exposure. Our objective in this paper is to analyze in detail the impact of these factors on the ROAA of commercial banks. We will utilize data and statistical methods to investigate the relationship between these factors and banks' financial performance. Gaining a deeper understanding of the effects of SIZE, NIM, NPL, LLR, CIR, OBS, and CB on ROAA will help banks and relevant stakeholders gain better insights into the challenges and opportunities within the banking and financial sector.

Literature review

Mitchell and Onvural (1996), using the Stochastic Frontier Analysis (SFA) model for U.S. commercial banks with total assets exceeding $100 million during the 1986-1990 period, found that larger banks tend to be more cost-effective than smaller ones. Altunbas et al. (2001) employed both Data Envelopment Analysis (DFA) and SFA methods. They discovered that in Germany between 1989 and 1996, banks with similar ownership structures, larger in scale, exhibited cost efficiency compared to smaller banks. Shehzad et al. (2013), using dynamic panel data models with data from over 15,000 banks in 148 countries between 1998 and 2010, observed a positive relationship between scale and business efficiency for banks in OECD countries.

However, other studies, such as De Haan and Poghosyan (2012) with U.S. bank samples, found an inverse relationship between SIZE and profitability volatility, indicating that larger banks tend to have more stable business efficiency. Albertazzi and Gambacorta (2009) previously suggested that excessive business efficiency fluctuations could destabilize shareholder equity. Le et al. (2017) examined factors influencing the profitability of Vietnamese banks during 2007-2013, revealing a counteractive effect between scale and profit generation, suggesting that increasing scale did not enhance financial efficiency for larger banks. The contrasting results regarding scale's impact on financial efficiency suggest that smaller banks may operate more efficiently due to economic benefits within their scale range.

In contrast, studies by Dang et al. (2019) and My (2020) demonstrated a positive relationship between SIZE and financial performance, indicating that Vietnamese banks achieve economies of scale. Moreover, Tran et al. (2020) found evidence of a non-linear relationship between SIZE and profit generation, suggesting that SIZE improves profitability until an optimal threshold, after which profit generation declines. Chi and Nguyen (2021) used Bayesian methods and data from 31 Vietnamese banks and discovered an inverse relationship between total assets and financial efficiency for Vietnamese banks from 2007 to 2017. Almajali et al. (2012) argued that various measures of financial performance exist. Cohen et al. (1997) gauged accounting profitability using the Return on Assets (ROA), indicating that market analysts widely use ROA to measure financial efficiency because it assesses the effectiveness of assets in generating income. ROA is a primary ratio for evaluating a bank's profitability because it is not distorted by high equity levels, whereas Return on Equity (ROE) downplays financial leverage risks; in other words, ROE does not address debts (Abate & Mesfin, 2019). Jaouad and Lahsen (2018) researched bank operational efficiency based on ROA, ROE (dependent variables), and various sets of explanatory variables, including bank-specific determinants, management of the bank, and macroeconomic determinants. Ashraf and Butt (2016) selected ROA as the dependent variable, with independent variables including capital adequacy ratio, operational efficiency, NIM, NPL, and the credit-to-deposit ratio. Vü (2014) presented a theoretical research model based on Wooldridge's (2010) model, with the dependent variable being ROA. Hanh (2021) utilized ROA to measure the profit-generating capacity of banks. The results indicate that the scale of capital and loans has a significant and positive impact on bank profitability, while the scale of assets, deposits, liquidity risk, and NPL have significant and adverse effects on bank profitability. Athanasoglou et al. (2006) studied the business efficiency of Southeast European commercial banks from 1998 to 2002. The research used independent variables: capital/total assets, credit risk reserves/loans, labor productivity, management expenses, SIZE, ownership structure, and inflation rate. The results indicated that labor productivity positively affected business efficiency, credit risk adversely impacted efficiency, management expenses negatively influenced ROA, SIZE did not affect ROA, ownership structure affected business efficiency, and inflation positively influenced the efficiency of Southeast European commercial banks.

Furthermore, other studies, such as Gupta and Mahakud (2020), conducted research on 64 Indian commercial banks over 19 years (from 1998 to 2016). They found that capital adequacy, revenue diversification, employee productivity, and GDP growth rate positively affected ROA and ROE, while SIZE, NPL, non-interest income, interest expenses, and inflation negatively impacted ROA and ROE. Another study by Berger (1995) suggested a relationship between capital and bank income. SIZE, scale, inflation, and GDP growth rate positively influence the interest rate, while excess credit growth and substandard loans negatively affect the bank's interest rate (Alper & Anbar, 2011). A bank's operations' efficiency is influenced by internal and external factors, including intrinsic factors such as SIZE (measured by the natural logarithm of total assets) and the NIM coefficient (Khrawish, 2011). Schiniotakis (2012) conducted research on factors influencing the profitability of banks (ROA) in Greece, showing that the number of employees per branch, the equity-to-loan ratio, and the loan-to-deposit ratio had a positive impact on ROA, while SIZE and the NPL had a negative impact. Adelopo et al. (2018) analyzed data from 123 West African commercial banks. They found that independent variables related to the banking sector, such as SIZE, capital, credit risk, management expenses, liquidity, and macroeconomic variables, had an impact on the financial efficiency of banks. According to Pervan et al. (2015), research conducted in Croatia indicated that credit risk and inflation had a negative impact on ROA, while SIZE had a positive impact. Avery and Berger (1991) conducted an empirical study and found that OBS items have a mild impact on the increase in profitability rates. Angbazo (1997) and Calmes and Theoret (2010) also identified the positive impact of OBS items on net interest income to offset the increased potential risks from OBS activities. Kashian and Tao (2014) agreed with the aforementioned studies, stating that OBS items, including loan commitments, can help increase profitability reasonably. In general, OBS items significantly generate income for the bank rather than directly contributing to the bank's risk (Aktan et al., 2013).

METHODOLOGY

To examine the impact of factors on the profitability of listed commercial banks in Vietnam, we employ a research model as follows: To measure profitability, the authors use the ROAA ratio. This indicator reflects the level of income generation from assets as well as the asset management capability of bank managers (Dietrich & Wanzenried, 2011). Because assets are reported at a single point in time on the financial statement, the author takes the average figures of this indicator. ROAA is a financial metric used to assess the performance of an organization's or business's assets. ROAA measures the ability of an organization or business to generate profit from its average assets over a specific period. ROAA indicates the efficiency of managing and utilizing assets to generate profit for the organization or business.

Profitability ratios reflect the operational efficiency and financial strength of commercial banks. Commonly used profitability ratios in previous studies include ROA, ROE, and NIM. ROA is considered a critical measure when assessing the profit generation of commercial banks (Athanasoglou et al., 2008), while ROE can provide misleading information because it is influenced by financial leverage. Other profitability ratios, such as NIM and adjusted risk-based profitability ratios, are also mentioned.

OBS activities can be categorized into four distinct types: traditional intermediary services, commitments, guarantees, and transactions. Vietnam is following the Basel II standards and classifying off-balance-sheet activities into four groups: Group 1 includes guarantee activities or other potential liabilities, Group 2 comprises commitments, Group 3 consists of market-related transactions, and Group 4 includes services such as advisory, management, or assurance functions, specifically, commitment to guarantee loans, commitment in L/C transactions, commitment in foreign exchange transactions, other commitments, and other guarantees.

CIR is calculated by dividing operating costs by operating income. Jaouad and Lahsen (2018) draw conclusions about the counterproductive impact of this ratio on operational efficiency, whereas Long (2019) and San and Heng (2013) have contrary findings.

In Vietnam, as per the regulations of the State Bank of Vietnam, NPL is defined as loans categorized under substandard, doubtful, and loss categories. NPLs are classified based on both quantitative and qualitative criteria. According to Hung (2008), NPL has a counterproductive impact on banks' operational efficiency, while for Karakaya and Ayaydin (2014), banks with high NPLs will make provisions as required, and provisioning costs will reduce profitability, thus adversely affecting the bank's business efficiency.

NIM is the difference between the income and expenditure of the bank interest divided by the total value of bank assets (Tarus et al., 2012). Increased competition drives banks to improve efficiency through lower net interest margins (Angori et al., 2019). Wide net interest margins make it difficult for banks to expand their functions as financial intermediary institutions because low deposit rates reduce the motivation to save and vice versa, with high loan rates being a heavy burden for companies in investing (Claessens & Ayhan Kose, 2017). Information related to the bank's NIM ratio is also part of the investment decision-making signal (Fathony et al., 2020). As a result, banks should be able to perform an intermediary function at the lowest possible cost to boost overall economic growth. According to Whalen (1988), the ratio of bad debt provisions to total average income-generating assets positively relates to risk, but it lacks statistical significance. On the other hand, with Halling and Hayden (2006), the ratio of risk cost to expected operating income is positively related to risk but lacks significance due to variations during the recovery process.

In 2001, Abreu and Mendes investigated the relationship between the bank's net interest margin and profitability in the European banking sector. They found that well-capitalized commercial banks were more efficient and enjoyed better profitability.

LLR is a set-aside fund created to cover potential losses that are yet to be determined during the loan classification process. This fund includes general credit loss reserves and specific reserves allocated when loan quality deteriorates. A higher LLR indicates deteriorating credit quality and a reduced ability to recover loans, thereby increasing a bank's costs and decreasing profits. Conversely, a low LLR may reflect improving loan quality or the possibility that reserves have not been set aside adequately per regulations.

The LLR ratio exhibits a positive correlation with ROA. A higher LLR indicates a bank's capacity to cover potential losses resulting from non-repayment risks, emphasizing its preparedness to offset potential loan losses (Kolapo et al., 2012). In contrast, research conducted by Brahmaiah and Ranajee (2018), Dietrich and Wanzenried (2011), and Lee and Hsieh (2013) suggests an inverse relationship between the LLR variable and the profitability of commercial banks, implying that a lower ratio of credit risk provisions corresponds to higher bank profits.

SIZE impacts profitability in two ways. It can enhance profitability through diversification of products, risk dispersion, and capitalizing on economies of scale. However, excessive growth in SIZE can lead to increased operational costs, such as office expenses and management expenditures (Dietrich & Wanzenried, 2011). Similarly, studies by Perera et al. (2013) and Zhao and Zhao (2013) have concluded that SIZE tends to be positively associated with bank profitability. Large banks are often less exposed to risks, can offer a broader range of loan products, and benefit from economies of scale, resulting in significantly reduced cost of capital and higher profits (Perera et al., 2013).

On the contrary, Athanasoglou et al. (2006) have found that the impact of SIZE on profitability is negligible, arguing that small banks often proliferate, even at the expense of profitability. Besides, newly established banks usually prioritize market share expansion over immediate profitability, so these banks may not generate profits in the first few years after establishment (Athanasoglou et al., 2006). Consequently, many other researchers have also suggested no significant relationship between SIZE and profitability (Micco et al., 2007).

According to the authors, CB impacts a bank's ROAA. CB represents loans provided by the bank to customers. The income derived from these loans, including interest, fees, and related costs, significantly contributes to the bank's total income. An increase in credit balance, thus raising income from these loans, may lead to higher ROAA. However, it is crucial to note that along with an increase in the credit balance comes credit risk. If there are many loans with the potential for late or non-payment, the bank needs to set aside reserves to handle these loans. LLR can affect the bank's net profit and reduce ROAA. To provide loans, banks require funding, and the cost of this funding may include interest paid on deposits and other sources of financing.

If the cost of funding rises due to a larger credit balance, ROAA may be adversely affected. The bank's ability to assess, manage, and mitigate credit risk is pivotal. If the bank fails to manage credit risk effectively, the credit balance could become a burden, negatively affecting ROAA by creating LLR and asset losses. Therefore, the authors have introduced variables into their research model (Table 1).

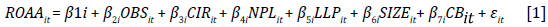

Based on the research methodology described above, the authors propose the following regression models:

Research data

This study conducts quantitative analysis using the STATA software based on aggregated data from 2013 to the end of 2022 extracted from the financial reports of the ten largest listed Vietnam joint-stock commercial banks. According to the financial reports of listed banks, the ten banks with the largest asset sizes are listed in the Appendix. The authors aggregate based on loan commitment guarantees, L/C commitments, and other guarantees presented in the financial reports of the joint-stock commercial banks.

To evaluate the impact of OBS activities, CIR, NPL, NIM, LLR, SIZE, and CB on the ROAA of joint-stock commercial banks, the authors employ the Fixed Effects Model (FEM) and Random Effects Model (REM) using panel data consisting of 100 observations from the ten listed Vietnam joint-stock commercial banks over ten years (from 2013 to 2022). The independent variables are OBS, CIR, NPL, NIM, LLR, SIZE, and CB, and the dependent variable is ROAA. Subsequently, the Hausman test is conducted to choose between the FEM and REM models, and the results suggest that the REM model is more appropriate. Therefore, the REM model is chosen to run the official data. Then, to test for model deficiencies, the authors perform the Breusch and PLM tests for random variance errors. If Prob > chibar2 = 1.0000 > significance level 5 %, a = 0.05, then the hypothesis is accepted, and it is concluded that the model does not experience the phenomenon of random variance errors changing. Lastly, the authors employ the GLS model to correct deficiencies and present the results.

RESULTS

The study was conducted using panel data through (FEM and REM. The research sample comprises 100 observations, with an average ROAA of banks at 7.17 %. Among them, the bank with the highest ROAA is 27.48 %, and the lowest is 0.3 %. The minimum overall solvency is 0.2656, while the maximum is 90.99 (Table 2).

Table2. Descriptiv e Statistics

| Variable | Mean | SD | Min | Max | Cv | |

|---|---|---|---|---|---|---|

| ROAA | 100 | 1.2803 | 0.801844 | 0.03 | 3.8 | 0.626294 |

| OBS | 100 | 1.63E+08 | 1.72E+08 | 1977763 | 9.33E+08 | 1.057762 |

| CIR | 100 | 47.3174 | 12.38538 | 22.71 | 86.96 | 0.261751 |

| NIM | 100 | 3.6893 | 1.553352 | 0.55 | 8.77 | 0.421042 |

| NPL | 100 | 0.018954 | 0.012154 | 0.004667 | 0.069121 | 0.641225 |

| LLR | 100 | 1.028979 | 0.70054 | 0.027787 | 4.205153 | 0.680811 |

| SIZE | 100 | 19.87774 | 0.756592 | 18.27249 | 21.47493 | 0.038062 |

| CB | 100 | 0.380686 | 0.333923 | 0.041993 | 1.522229 | 0.877159 |

Source: Authors' elaboration.

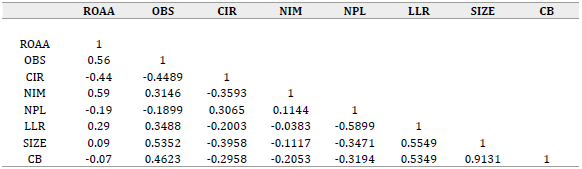

Based on the correlation among variables (Table 3), it is evident that NIM positively impacts ROAA. The relatively low correlation coefficients among independent variables indicate no signs of multicollinearity among the variables in the model. The variance inflation factors for the independent variables in the average model are 3.25, suggesting that multicollinearity is not too severe (Table 4).

Table 4 Variance Inflation Factor (VIF)

| Variable | VIF | 1/VIF |

|---|---|---|

| SIZE | 7.26 | 0.137684 |

| CB | 6.55 | 0.152585 |

| LLR | 2.09 | 0.478065 |

| OBS | 1.8 | 0.556273 |

| NPL | 1.75 | 0.571745 |

| CIR | 1.69 | 0.590421 |

| NIM | 1.6 | 0.624161 |

| Mean VIF | 3.25 |

Source: Authors' elaboration.

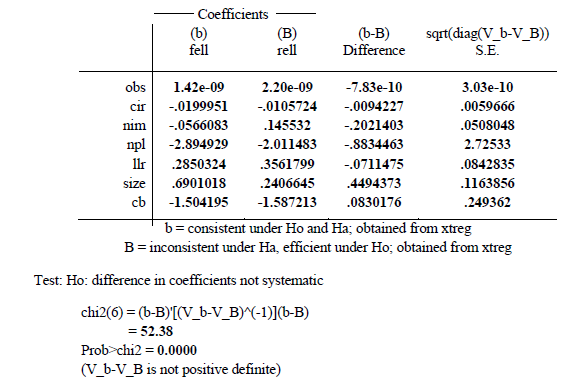

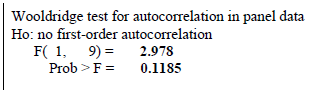

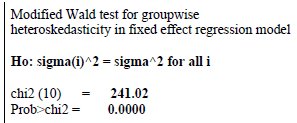

Initially, the research team estimated the FEM (Model 1), REM (Model 2), and Pooled OLS. They used the Hausman test to choose between the FEM and REM. The estimation results indicated that the FEM is more appropriate than the REM (Figures 1 - 3).

The Modified Wald and Wooldridge tests were used to check for model FEM's heteroskedasticity, and the estimation results indicated that this model exhibited changing random error variance. To address the issue of changing random error variance in the FEM model, the research team employed the Generalized Least Squares (GLS) method to remedy it, resulting in the outcomes presented in Model 3 (Table 5).

Table 5 Regression Results

| (1) | (2) | (3) | |

|---|---|---|---|

| ROAA | ROAA | ROAA | |

| OBS | 1.42e-09*** | 2.20e-09*** | 1.82e-09*** |

| (4.83e-10) | (3.77e-10) | (3.20e-10) | |

| CIR | -0.0200** | -0.0106** | -0.00667 |

| (0.00784) | (0.00509) | (0.00406) | |

| NIM | -0.0566 | 0.146*** | 0.213*** |

| (0.0643) | (0.0394) | (0.0307) | |

| NPL | -2.895 | -2.011 | -1.014 |

| (5.923) | (5.258) | (3.858) | |

| LLR | 0.285** | 0.356*** | 0.330*** |

| (0.131) | (0.0998) | (0.0659) | |

| SIZE | 0.690*** | 0.241 | 0.245** |

| (0.208) | (0.172) | (0.119) | |

| CB | -1.504*** | -1.587*** | -1.331*** |

| (0.447) | (0.370) | (0.261) | |

| Constant | -11.18*** | -3.622 | -4.227* |

| (4.072) | (3.352) | (2.361) | |

| Observations | 100 | 100 | 100 |

Note. Standard errors in parentheses. * p < 0.10, ** p < 0.05, *** p < 0.01

Source: Authors' elaboration.

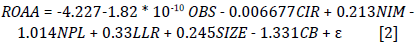

The results indicate that OBS, NIM, and SIZE positively impact ROAA, while CB negatively impacts ROAA at a 5 % significance level. Therefore, the regression model is as follows:

DISCUSSION AND CONCLUSIONS

The model results show that OBS, NIM, and SIZE have a positive impact, while CB harms ROAA. This finding aligns with studies by Abreu and Mendes (2001), Angbazo (1997), Perera et al. (2013), Perera et al. (2014), Sayilgan and Yildirim (2009), and Zhao and Zhao (2013) but contrasts with the conclusions about the impact of SIZE on ROAA by Berger et al. (1987), Micco et al. (2007), and Pasiouras and Kosmidou (2007). The mechanisms behind these effects can be explained as follows:

OBS involves a bank's financial activities, such as credit guarantees, collateral, trade finance, and derivative financial services. These activities can generate profit opportunities and contribute to the bank's revenue. However, they also come with credit and market risks. If risk management is ineffective, OBS activities can result in asset losses and reduce the bank's profitability.

NIM measures the profit obtained from the bank's interest rate structure. It is calculated by subtracting the interest earned from lending and bonds from the interest paid on deposits and other funding sources. A high NIM indicates that the bank derives significant profits from its interest rate structure. However, NIM also depends on the scale of the bank's assets, as a larger scale can lead to better performance.

SIZE measures the total assets that the bank owns or manages. A larger size can create opportunities for diversification of activities, better negotiation of transaction terms with clients, and reduced lending risk. However, larger sizes also have higher risk management requirements and capital needs.

CB has an adverse impact on ROAA. When credit lending increases, the bank faces a higher level of credit risk. If customers can not repay their debts on time, the bank incurs losses from asset write-offs. This may cause decreased profitability and increased risk, reducing ROAA. Moreover, credit lending often includes both fixed and variable-interest-rate loans. If market interest rates rise, the market value of variable-rate loans (e.g., bonds) may decrease, reducing the value of bank assets and profitability. This can also lower the ROAA.

CIR, NPL, and LLR do not directly impact ROAA. CIR measures cost efficiency in managing the bank's expenses relative to income. A lower CIR indicates that the bank manages costs effectively but does not directly impact ROAA. Similarly, NPL is the ratio of non-performing loans to total outstanding loans, indicating a high credit risk. However, it does not directly affect ROAA. LLR represents the amount set aside by the bank to deal with credit risk but does not directly impact ROAA. The impact of these variables on ROAA depends on various factors and how credit risk is managed.

In conclusion, OBS, NIM, and SIZE positively impact ROAA, while CB has a negative impact. Understanding these relationships is crucial for banks to efficiently manage their finance and ensure long-term sustainability and growth. This study provides a deeper insight into the impacts of these factors and can help banks make strategic decisions accordingly.