Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Cuadernos de Administración

Print version ISSN 0120-3592

Cuad. Adm. vol.22 no.39 Bogotá Sep./Dec. 2009

* An earlier version of this paper was presented at the First European -Latin American -Caribbean International Management Conference "European and Latin American-Caribbean Strategic Partnerships: Un leashing the Potential" held in Monterrey, Mexico October 15-17, 2008. The article was received on 30-03-2009 and was approved for publication on 19-10-2009.

** Master's in Economics Business and Finance Internationalization from Università di Roma "Tor Vergata", Rome, Italy, 1999; Master's in Economics from Pontificia Universidad Javeriana, Bogotá, Colombia,1996; Diploma in International Relations from Academia Diplomática de San Carlos, Bogotá, Colombia, 1993; BS in Education - Major in Spanish and English from Universidad Distrital Francisco José de Caldas, Bogotá, Colombia, 1989. Associate Professor and Researcher at the Pontificia Universidad Javeriana School of Economics and Administration Sciences. Co-director of the research group CINNCO (Conocimiento, Innovación, Competitividad). E-mail: jhsierra@javeriana.edu.co.

ABSTRACT

This paper makes an assessment of the Colombian Export Promotion Program (EPP). The process and the results of such a program are considered in the light of the literature on international strategy and exporting culture in developed and developing countries. Literature findings on EPAs and EPPs around the world are complemented by information from two surveys, one applied to a set of 56 firms that took part in the EPP (2002-2004) and the other addressed at a group of consultants hired by program operators to support firms. The information obtained permits the characterization of program participants (firms, entrepreneurs/managers, operators, consultants) and a deep appraisal of the processes and methodologies implemented by the program, as well as the acknowledgement of the participants' perceptions on the expectations and the outcomes reached. Finally, some reflections are made on the accomplishments and shortfalls of the program, a number of firm and program-level proposals for improvement are advanced, and some future research avenues are suggested in order to deepen the discussion on exporting/internationalization culture and its importance for developing and developed economies.

Key words: Exporting culture, international strategy, systemic competitiveness, organizational capabilities.

RESUMEN

El artículo evalúa el Programa de Fomento a las Exportaciones (PFE) de Colombia. Su proceso y resultados se analizan a la luz de la literatura consultada sobre estrategia internacional y cultura exportadora en países desarrollados y en desarrollo. Los resultados acerca de organismos de fomento a las exportaciones y PFE alrededor del mundo se complementan con la información de dos encuestas: la primera, aplicada a un grupo de 56 empresas que tomaron parte en el PFE (2002-2004), y la segunda, llevada a cabo con un grupo de consultores contratados por los operadores del PFE para asesorar a las empresas. La información obtenida permitió caracterizar a los participantes (empresas, emprendedores/gerentes, operadores del programa, consultores) y revisar profundamente los procesos y metodologías implementados, así como reconocer las percepciones de los participantes sobre sus expectativas y logros alcanzados. Finalmente, se presentan algunas reflexiones acerca de los alcances y limitaciones del programa, se adelantan algunas propuestas de mejoramiento y se plantean algunas líneas de investigación futura, respecto de la cultura exportadora y la internacionalización y de su importancia para las economías desarrolladas y en desarrollo.

Palabras clave: cultura exportadora, estrategia internacional, competitividad sistémica, habilidades organizacionales.

RESUMO

Este artigo faz uma avaliação do Programa de Promoção de Exportações (PPE) colombianas. O processo e os resultados de um programa deste tipo são considerados à luz da literatura sobre a estratégia internacional e cultura exportadora em países desenvolvidos e em desenvolvimento. Achados da literatura sobre os APE e os PPE em todo o mundo são complementados por informações dos dois estudos, um aplicado a um conjunto de 56 empresas que participaram do PPE (2002-2004) e outro dirigido a um grupo de consultores contratados pelo programa para as empresas operadoras de apoio. A informação obtida permite a caracterização dos participantes do programa (empresas, empresários/gestores, operadores, consultores) e uma avaliação profunda dos processos e metodologias implementadas pelo programa, bem como o reconhecimento das percepções dos participantes sobre as expectativas e os resultados alcançados. Finalmente, são feitas algumas reflexões sobre as realizações e as deficiências do programa, um número de empresas e um programa de propostas de melhoria são de nível avançado, e algumas pesquisas futuras são sugeridos a fim de aprofundar a discussão sobre a exportação/internacionalização da cultura e sua importância para o desenvolvimento e as economias desenvolvidas.

Palavras chave: cultura exportadora, estratégia internacional, competitividade sistêmica, capacidades organizacionais.

Introduction

Colombian exportation of goods and services as a share of the GDP at current prices ranged from 14.5% to 21.5% in the 1994 to 2005 period and showed an average of 18.9% for the 1996-2005 decade. The trend was stable until 1998 when a rather large upsurge elevated the share, which stabilized once again from 2001 on (Figure 1).

The main export products were oil, coffee, coal, and other products such as emeralds and gold. Travel services, ICT-related services, and transportation services were the most important export services. During the period from 1994 to 2006, the net balance of the current account was rather erratic and almost always reflected a deficit. This was due to the fact that the net balance for services was always negative during that period and that the net balance for goods was negative until 1999 and then it became positive although irregular from 2000 to 2006 (Figure 2).

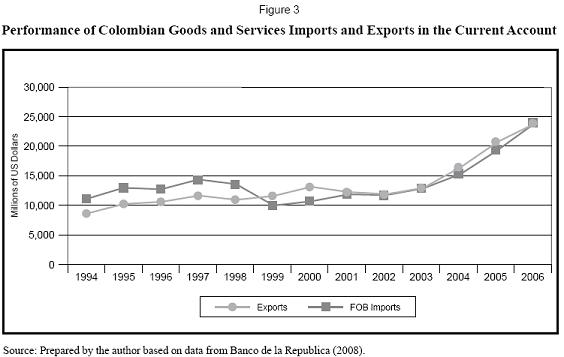

Imports and exports have followed a very similar pattern with lower export values than import values until 1998. However, there was a reversal of that relation from 1999 on, even though the values remained quite close. Notwithstanding, the net balance of transfers was always positive and increased steadily from 1998 on whereas factor-related revenues were always negative during the period (Figure 3 and Figure 4).

From 1992 to 1996, traditional goods exports prevailed even though industrial goods, included in non-traditional exports, grew at a higher rate than primary products. As of 1997, however, non-traditional exports growth exceeded traditional goods growth. It is key to mention the importance of rising oil prices in Colombian exports as of 1992, reflected in a greater growth of exports at current pricesas compared to exports measured at constant prices. Moori, Yoguel, Rodríguez, and Granados (2006) state that Colombian exports have exhibited a procyclic performance, except for the 1997-2003 period, even if there were some significant changes in export / product elasticity; they conclude that just like in other countries in the region, the specialized profile of exports reveals that Colombian export dynamics strongly depend on the evolution of international of export commodity prices and of the most important macroeconomic variables. That condition unchains the principal symptoms of the Dutch Disease whenever there is a strong increase in international prices or a liberalization of the capital account: a revaluation of the exchange rate and greater influence of the tradables affected by price rises.

In that context, SME participation in Colombian exports has always been quite modest. Brooks (2006) reports that most plants are low intensity exporters as long as "...among the 10-20% of Colombian manufacturing plants that exported during the 1980s, the average export share was roughly 20% [ratio of total export sales to total sales] ... This phenomenon existed regardless of plant size, since the larger plants also had low export shares..." (p. 161).

Ferro et al. (2007) confirm the above using figures that indicate that SMEs contributed to 11% of Colombia's total non-traditional exports whereas OECD-country SMEs contributed 30% on an average. Such factors have pushed Colombia to look for greater and better opportunities to sell its goods in international markets under more favorable conditions.These are the pressing circumstances that govern the negotiation environment for the different Free Trade Agreements with several target markets, as a part of a strategy for economic internationalization.

Also a significant effort has been made to "build an exporting culture" through Expopyme, a government program aimed at SMEs managed by Proexport, the Colombian agency for the promotion of exports.

The main objectives of this study are (i) to assess the Colombian Export Promotion Program (EPP) in terms of its main components and development of activities; (ii) to ascertain EPP achievements regarding building an exporting culture among Colombian firms; (iii) to propose a methodological approach for EPP assessment to complement the result-based approach.

This analysis is aimed at making the following main contributions: (i) a better understanding of how the program has been run; (ii) a critical analysis of the different components, based on the opinion and perception of firm advisors (consultants) and of the firm owners / managers themselves; (iii) an external assessment of the results obtained and an appraisal of the effects achieved in the light of available theoretical and empirical studies; (iv) a series of suggestions and proposals for improving the program process, results, effects, and impact.

To do so, this paper is organized in six sections. The first one discusses the concept of an exporting culture, in order to establish the focus to be used in the remaining sections. The second section reviews the literature on internationalization and on creating an exporting culture in different countries and, particularly, in Colombia. The third section makes a characterization of the Colombian Exporting Culture Program, to set the basis for the subsequent analysis. The fourth section makes a first assessment of the Colombian EPP through an in-depth examination of the agents, processes, activities, and results regarding a sample of firm projects carried out in Expopyme. The fifth section introduces the assessment exercise by explaining the methodological proposal, characterizing the various participants, and considering the opinions and perceptions of consultants and entrepreneurs / managers alike; and it appraises the methodologies and tools used. Finally, the last section reflects on the results obtained, in the light of some prior considerations on the why and where for building an exporting culture.

We feel that this paper is a legitimate endeavor for minimum four reasons: first, there is still generalized confusion on the meaning, the value, and the reach of a "culture for internationalization and exports" (Sierra, 2006, pp. 69-73); second, such "conceptual looseness" affects efforts to create, monitor, and assess programs aimed at creating or strengthening an exporting culture; and, third, the Colombian program itself has not been evaluated by an external third party, which guarantees distance-based neutrality and a more in-depth approach than reading partial or total end figures. Finally, we believe that this exercise complements cross-country analysis by delving into the study of country specificities, as recommended by Lederman, Olarreaga, and Payton (2006).

1. What is an Exporting Culture?

There is great confusion regarding the concept associated to the term "exporting culture". Consequently, its loose -not to say totally careless- use in different settings implies that the term has acquired different meanings. In contrast, building upon concepts such as organizational culture (Ouchi, 1982; Smircich, 1983; Schein, 1988; Denison, 1991; Allaire and Firsirotu, 1992; Hitt, Ireland and Hoskisson, 1999; Barney, 1986 and 1991; Cabrera and Bonache, 1999; Cabello and Valle, 2002; Méndez, 2003),Sierra (2006) deploys a conceptual framework in which firm culture, strategy, and competitiveness are closely related in such a manner that "exporting culture" -a variant of "culture for internationalization" -acquires meaning and importance. It implies a high level of complexity and complementariness among a number of aspects and variables pertaining to the organization and its milieu, whose creation/acquisition and articulated interaction aimed at formulating an export strategy ensures meeting well-defined objectives (Porter, 1990; Hamel and Heene, 1994; Esser, 1999).

Thus, "culture for internationalization" starts with the generic concept of culture (a cultivated behavior or accumulated experience that is socially transmitted or a behavior acquired through social learning), but it has to be considered from a two fold perspective: organizational factors and contextual factors (Figure 5).

Thus, as is the case of most Export Promotion Agencies (EPAs) and EPPs, initiatives meant to create an "exporting culture", especially in economies characterized by structural restrictions, should focus on mid-and longterm actions that affect some of the abovementioned sensitive issues: creating and incorporating knowledge to create differentiation in the units (firms) and in the system (the economy); creating value and reaction capability; promoting inter-firm and inter-locality alliances; creating and strengthening distinctive locality-based firm-based capabilities and competences (Basile, 2001; Roper and Love, 2002); investing in information, education and training systems, to facilitate decision-making; stimulating strategic internationalization modes other than exports.

It also becomes self-evident that initiatives to promote an "exporting culture" cannot be addressed only to firms and entrepreneurs. It must have a broader focus and include all members of the society because that is the only way to create and incorporate knowledge on a large scale into a country's industrial system processes and products. In fact, produced through differentiation based on a mix of knowledge, experience, and creativity, added value is generated in a complex system where achievements in formal education and professional training, setting strategic objectives during the decision-making process to include all of the actors' interests, appreciation of local culturalelements from an ample sociological perspective, and sustainability of a social network built on the principles of trust and solidarity all interact to create an appropriate environment.

In fact, we believe that it is the missing link in so many cases in which well-intended programs have not yielded expected results despite the efforts made and resources allotted. In order to confirm our suspicions, we will analyze the case of Colombia and attempt to shed light on the lessons learned, which might eventually allow reformulating policies, instruments, and initiatives to create an effective "exporting culture".

Currently, studies on the impact of EPAs and EPPs on national exports (changes in exports and access to new markets) and the assessment of services provided to firms are the basis for the approach usually adopted to ensure economic wellbeing. Findings in terms of success factors and failure factors are mixed in both developed and developing countries. However, EPP results cannot be compared due to country specificities, which are mostly unexplored (Lederman et al., 2006) (Table 1).

That is why we propose to evaluate the process itself as a complementary approach to the conventional glancing at the results. In the latter case, one could affirm that a higher standard can be achieved as more firms become permanent exporters (number of years of continuous exporting), intensive exporters (share of exports in total sales), and progressively internationalized (use of schemes other than exports to a greater number and variety of more complex target markets).

In the former case, the process can be seen in terms of the different stages of the export process; that means assessing the main aspects that concern the decision-maker(s) and the firm(s) during the three majo rsteps of the export process. Take, for instance, the impact of a simple dual interpretation of needs /opportunities during the awareness stage: if internationalization (exports) is not seen as a need, detecting opportunities will be merely passive (e.g.,waiting for unmotivated orders to come in); on the contrary, should exports be seen as a need driven by different types of pressure, acknowledging opportunities will become an active scouting effort that will, in turn, affect motivation, attitude, expectations, and actions. Of course, the "domino effect" will also reach the decision-making process and the steps of testing, assessment, and acceptance (e.g., exploration and selection of target markets, choice of mode of entry and mechanism to enter the markets or expand them) during the implementation stage in terms of committing resources, gathering /using information, making analyses, and setting goals.

Of course, this dual approach needs an appropriate instrumental assemblage for it to be operative in any given context. One way to do that may imply the construction of simple or composite indicators that facilitate comparing and contrasting firms or groups in the given sectors or economies and analyzing firm -institution interactions.

2. International Strategy and Exporting Culture

2.1 International Background

So far, most of the literature on internationalization has usually focused on predicting a firm's export potential or on attempting to describe/explain export behavior, especially in developed economies (e.g.,Wiedersheim-Paul, Olson and Welch, 1978; Reid, 1981; Bilkey, 1982; Cooper and Kleinschmidt, 1985; Roux, 1987; Young, Hamill, Wheeler, and Davies, 1989; Yang, Leone and Alden, 1992; Caughey and Chetty, 1994; Andersen and Rynning, 1994; Morgan and Katsikeas, 1997; Beamish, Karavis, Goerzen, and Lane, 1999; Bernard and Jensen, 1999; Moen, 1999; Bernard, Eaton, Jensen and Kortum, 2000; Javalgi,White, and Lee, 2000; Gankema, Snuif, and Zwart, 2000; Ellis and Pecotich, 2001; Baldwin and Gu, 2003; Eaton, Kortum, and Kramarz, 2004; Salomon and Shaver, 2005; Munch and Skaksen, 2006, Ilmakunnas and Nurmi, 2007). As Eaton et al. (2004) put it, nearly everything that we have after so many years can be summed up by saying that "The findings that most firms do not export while those that do sell most of what they make at home suggest substantial barriers to exporting. Theories of producer export behavior have suggested either standard "iceberg" costs, or fixed costs, as explanations." (p. 150).

Only a few studies have taken interest in studying developing country exporter SMEs (e.g., Roberts and Tybout, 1997; Clerides, Lach, and Tybout, 1998; Aulakh, Kotabe, and Teegen, 2000; Moori, Milesi, and Yoguel, 2001; Child and Rodrigues, 2005; Pietrobelli, Porta, and Moori-Koenig, 2005; Brooks, 2006; Moori et al., 2006; Ferro et al., 2007).

Furthermore, so far studies have paid little attention to what happens in companies during the so-called pre-export stages and when carrying out export activities from the decision stage to the time when the export process is consolidated (Ilmakunnas and Nurmi, 2007; Ferro et al., 2007). More specifically, as Ferro et al. affirm, "... literature has not deepened on the study of pre-export stages and the identification of potential exporters in developing countries." (2007, p. 9) (Figure 6). In fact, most studies have concentrated on separating firms that have the potential to become regular exporters from those that do not even intend to do so or that do it occasionally (broadly referred to as "non-exporters").Yet, several authors acknowledge that that"...models do a better job in classifying non-exporter firms [than exporters]" (Yang et al., 1992, no page number; Ferro et al., 2007, p. 9).

Actually, Child and Rodrigues (2005) point out that the explanations on the internationalization strategy of emerging country latecomer firms differ from the mainstream theory in that such accounts have to come to terms with the fact that developing country firms seek to find a way out of their competitive disadvantages. That is, "latecomer firms did not start from positions of strength, but rather 'from the resource-meager position of an isolated firm seeking some connection with the technological and business mainstream' (quoting Matthews, 2002)" (p. 384). That could be said to be true of all emerging country companies that want to go international1.

Moreover, those authors emphasize that the mainstream perspective on firm internationalization "focuses strongly on the firm as an actor and less on its embeddedness in its wider society. Indeed, it tends to view the subject primarily through an economic rather than a social or political lens." (p. 384).

They seal their argument by accruing evidence to sustain that developing and transition economies are typically characterized by an active governmental involvement in business, through ownership and through regulation alike. Government support can, in turn, later become a lofty hurdle because it weakens firm strategy by generating institutional dependence and alien administration approval, thus promoting "a conservative attitude or through more direct constraints (quoting Lewin, Long, and Carrol, 1999)"(p. 385).

Now, regarding the role of the institutions and government in the internationalization of emerging country firms, international business theory should make a greater effort to explain the potential importance of domestic institutional factors in developing and transition economies. Indeed, they contend that so far analysis has failed to account for the activity of governments as sponsors of internationalization and outbound FDI. More specifically, "it is likely that the interaction between the institutional legacies of developing economies and the dynamic capabilities of their corporate entrepreneurs will be crucial for understanding the internationalization strategies that the latter pursue" (Child and Rodrigues, 2005, p. 405). For instance, it is necessary to study the extent to which the pattern of firm internationalization is institutionally embedded instead of reflecting the firm leaders' strategic choice.

Finally, a few other studies focus on the impact of EPAs and EPPs on the exports of developed countries and developing economies alike (see Kedia and Jagdeep, 1986; Milner, 1990; Seringhaus and Rosson, 1990; Diamantopuolos, Schlegemilch, and Inglis, 1991; Keesing and Singer, 1991a and 1991b; Kotabe and Czincota, 1992; Gencturk and Kotabe, 2001; Hogan, Keesing, and Singer, 2001; Czinkota, 2002; Ledermanetal., 2006).

2.2 Background on Colombia

As to the case of Colombia, studies on SME internationalization are even scarcer. Eaton et al. (2007) study the dynamics of Colombian exports for the1996-2005 period by accruing firm-level data on entry/exit, target markets, and sales volumes. They conclude that "Each year, large numbers of new Colombian exporters appear in foreign markets. Most drop out by thefollowing year, but a small fraction survives and grows very rapidly. Thus, while the entering cohort in any given year makes a trivial contribution to total export sales, its contribution over a long period is significant" (pp. 23-24)2.

This may be interpreted as the existence of a period of partially successful learning for both potential buyers and exporters. Also, neighboring markets seem to be the stepping stones to reach other Latin American markets and, further ahead, even larger Organization for Economic Co-operation and Development (OECD) markets3.

Interestingly, they also find that "... Only firms in the top two quintiles face more than half a chance of staying in their quintile or higher. Only those in the top three quintiles face more than half a chance of surviving." (p. 13) Concerning the tie between firm size and entry and export longevity, only sellers in the top quintile have a higher likelihood of continuing than of exiting (taking into account that one third of the entrants start in the fifth quintile and only 4% begin in the top quintile).

Brooks (2006) attempts to find out why Colombian exporters sell only a small fraction of their products abroad; he leaves aside some stylized facts that do not allow traditional trade models to work when fed with Colombian data4. Evidence seems to support an explanation based on a two-dimensional productivity structure. In short, "low-intensity exporters are the best output producers; however, they are not able to produce at the quality level demanded by wealthy and large foreign markets." (p. 176)

Brooks concludes that there is strong evidence to support a product quality theory that proposes that "Colombian trade is inhibited well beyond the previously estimated sunk costs model of exporting." (2006, p. 177)5.

So far it seems that Colombian firm efforts to reach foreign markets are marked by two characteristics. First, they have a strong desire or need to penetrate increasingly complex markets by starting with culturally nearby ones. Second, they are not very successful at doing so, due to a number of factors (e.g., learning failures, quality failures, institutional weakness or external constraints).

Ferro et al. (2007) attempt to shed light on such phenomena by using a model to identify potential exporters among manufacturer SMEs in eight different sectors. They start with several hypothetical causal relationships between export behavior and a set of characteristics associated with the company, the decision-maker, the firm's past expansion behavior, and the firm's competitive capability. They identify five statistically significant variables that can be included in the selection models: level of sales, variation in assets, percentage of local sales, marketing staff's knowledge of foreign languages, and whether or not the company has had formal training and has participated in training and export support programs.

Some relevant issues for reflection are: (i) Following the world trend, models do a better job of identifying non exporters than single out exporters; (ii) The export potential is positively related to firm size and seems heavily influenced by the existence of a network of international firm manager contacts; yet, no conclusive relation was established between firm age and export propensity; (iii) The greater the company's international experience, the smaller the risk perceived from export activities; (iv) Participation in formal training and export support programs has a positive relation to the export potential. Nevertheless, a high number of both exporters (88.9%) and non-exporters (54.2%) had taken part in such a program; (v) Competitive capabilities related to the export potential are proxied by the development of products prior to export, having a marketing department, and training of marketing staff in marketing-related aspects and in foreign languages. Moreover, the expansion capacity seems related to the export potential if such companies have better "market expansion abilities and therefore are more prepared to assume international activities than those who concentrate their sales locally [sic]." They conclude that:

... it is more common for a medium-sized company to export than for a small company. The participation in training and export support programs has a strong positive relation to the firm's export potential. This variable not only reflects the importance of the manager's networks on acquiring information, but also the need to stimulate interaction among the firms, the universities and the institutions that promote entrepreneurial development. (Ferro et al., p. 9)

Likewise, Rodríguez (2003) states that a great number of SMEs that have used State support programs consider that at best such programs have had little impact on their improvement6. Rodríguez also confirms that over 50% of entrepreneurs think that access to foreign markets does not at all affect firm development and only 25% consider that going international is somewhat important or very important to boost the firm. The main reasons identified for unsuccessful attempts or tries were formalities and regulations, the perception that it isdifficult to access foreign markets due to lack of knowledge, costs, lack of information, and financial problems.

For active exporters, consultants, government officials, and institutions that offer firm services, the main hurdles are complex formalities, poor information and deficient marketing, and troublesome export procedures. As to what keeps firms from exporting, they pointed out difficult access to foreign markets, unavailability of human resources and specialized services, and the lack of information.

All of the above leads us to reflect on the fact that the apparently wide rangeof factors that prevent Colombian firms from effectively placing their products abroad seems to be structural in nature and has several origins, as was confirmed by Moori et al. (2006). They built an Export Performance Index (EPI) aimed at identifying "firms that have obtained particularly successful results in their internationalization process." (p. 56)7.

Successful exporters are characterized by: (i) their foreign currency balance (for every dollar imported, they exported 4.59); (ii) their main target markets (Nafta, Andean Community, other Latin American markets, EU, Central American Common Market); (iii) their economic sector (successful firms belong to the garment industry, the leather goods sector, and to the metal products sector).

Moreover, Moori et al. attempt to identify the productive, commercial, and technological practices that make SMEs successful exporters. They conclude that successful exporter SMEs are "younger" than unsuccessful exporter SMEs and that their export activity began earlier -right from the start or nearly-.

They replant the proposal made by Rodríguez (2003) that states that a firm's market consolidation takes from 5 to 15 years. Near 36% Colombian SMEs were involved in the process during the period under study. As to "learning-by-exporting", the authors find no difference between successful and unsuccessful exporters concerning the time elapsed from identifying an export opportunity to the first shipment. However, the export consolidation period -the time that it takes for exporting to become a regular business activity- does indicate a difference between successful exporters and unsuccessful exporters. Other issues may be of interest to characterize the internationalization process of both "successful and unsuccessful" Colombian SMEs as well8.

Finally, Moori et al. (2006) stated that success in exporting seems to be related to a number of firm conditions, conducts or relations9. Regarding international operations management, all successful exporters and most unsuccessful exporters said that they had minimum one person in charge of such tasks. Most of the firms said that they had an international department and some subcontracted or hired persons to share the responsibilities.Such differences seemed to have an impact since international operations personnel represented more than 10% of the contracted labor of both the successful exporters and the unsuccessful exporters.

3. Colombian Attempts at Building an "Exporting Culture"

Recent Colombian efforts to tackle the "exporting culture" topic are materialized in Proexport, the national EPA in charge of promoting non-traditional exports, international tourism, and foreign investment in Colombia. Thus, Colombian exporters can benefit from different services, such as information on trade and logistics, market intelligence, international missions, international business opportunities, export plans, and quality assurance.

Expopyme is the government EPP. It is a component of the Plan for the Development of Exports aimed at SMEs to support the placement of Colombian products in foreign markets. It provides assistance to would-be exporters from all economic sectors, especially handicraft producers. One of Expopyme's most challenging efforts has been to create a new,export-oriented mindset in national entrepreneurs, to facilitate their adaptation to an increasingly globalized economy and to new standards of competitiveness10.

In that sense, Proexport looks for ways to interact with entrepreneurs, universities, Regional Advisory Committees on Foreign Trade (CARCE), Chambers of Commerce, and the Trade Federation of Colombian SMEs (ACOPI), among others. Also the National Training Service (SENA) and Fomipyme -another SME-supporting initiative- support the program.

Expopyme aims at assisting Colombian enterprises who wish to design and implement their export plan, as a manner of driving them to take a step toward the international scene. They do so, first, by identifying the enterprise's weak points and strong points and the goods that they want to sell abroad; to better define their target markets and strategies to meet internationalization goals.

The output of the first stage of the program is the formulation of an Export Potential Diagnosis (EPD) for the enterprise, based on a simple SWOT analysis. The second stage consists of a Market Intelligence (MI) exercise, to determine the most likely export markets. The third stage has to do specifically with the Export Plan Formulation (EPF) through which priorities are established regarding investment needs and a course of action for initiating the export activity. The activities developed during those three stages are funded by Proexport and the formal training course11 offered to entrepreneurs / managers is paid by the participants and by Proexport (Table 2).

The whole process is backed by consultants that assist the enterprises, to ensure the best possible results. The consultants12 are hired by and given support by coordinators designated by institutional Program Operators13, with the consent of the enterprises, under a contract entered into directly by the coordinator and the firm.

To participate in Expopyme, firms only need tocomplete an application form, go through a screening process before a regional Selection Committee, and allow program consultants to visit their premises. According to the figures given by the program itself:

... By 1999, SMEs who participated in Expopyme exported USD 48,900,000; exports increased 37% by 2000 (USD 67,100,000). The trend persisted and, during the first quarter of 2001, some 319 firms exported USD 46,200,000.

From January to September, 2001, over 50% non-traditional exports were made by firms serviced by Proexport at a cost of COP7,486,000,000. Expopyme had reached 1,680 SMEs, out of which 1,070 had designed their export plan; 417 assessed firms sold USD 49,000,000 in 1999, and USD 46,000,000 during the first quarter of 2001.

Proexport 2002 goals included reaching 250 more SMEs, to complete their work with 1,930 industrial enterprises. (www.businesscol.com/empresarial/pymes/index.htm)

Notwithstanding, such results are subject to strong discussion because the Colombian National Planning Department and the Colombian Ministry of Trade, Industry, and Tourism have recently acknowledged (Departamento Nacional de Planeación [DNP] y Ministerio de Comercio, Industria y Turismo, 2007) that, even though agencies such as Proexport (e.g., Expopyme, Programa de Redes Empresariales) have set different programs in motion, to support firms in their attempt to gain access to foreign markets, their efforts14 have been countered by some serious shortcomings still to be resolved: "i) lack of monitoring and impact assessment systems (see also Macario et al., 2000); ii) low capacity to reach all potential beneficiaries; iii) low participation of regions to formulate, implement and finance programs; iv) low articulation." (p. 14).

Here lies the source of the present reflection. There is a series of facts that lead to reasonably questioning the final achievements of this attempt to build an "exporting culture" among Colombian SMEs. First, the only assessment of Expopyme's results and impacts has been provided by the program officials themselves. Second, the only external assessment effort has been limited to employing firm participation in the program as a variable in regression analysis, to establish whether or not it is a determinant of export participation among Colombian firms (Ferro et al., 2007). Third, there is ongoing evidence that Colombian SMEs have not improved their participation in total exports through time (Brooks, 2006; Eaton et al., 2007). Fourth, there are also long-term indications that Colombian SMEs have not been able to overcome a number of structural factors that have chronically restricted their possibilities of reaching foreign markets, particularly those in developed countries (Rodríguez, 2003; Calle and Tamayo, 2005; Pietrobelli et al., 2005; Moori et al., 2006).

Consequently, the considerations the author makes on the "exporting culture" of Colombian SMEs started with an endeavor to obtain first-hand knowledge of the program and its implementation. To do so, a series of interviews were conducted with a program operator, with the consultants associated with that operator, and with some of the firms accepted in the program.

This all must be considered in the light of thefindingsonEPAandEPPeffectivenessin specific cases around the world. The quality of assistance provided does not match user expectations (Diamantopuolos et al., 1991). There is a lack of knowledge of the export development process (Weil, 1978). Export related decisions are heavily influenced by organizational characteristics and by the firm's external environment (Ditchl et al., 1983). There was fear of government intervention and signaling firm's export strategy (Kedia and Jagdeep, 1986). Differentiated degrees of assistance are required based on the stage of internationalization (Kotabe and Czinkota, 1992). There are filtering requirements for accessing programs (Reid, 1982).

4. Methodology Used to Assess the Program

The study of country EPP specificities requires methodological approaches that fit both the context and the analysis goals. Therefore, we decided to assess the main components of the Colombian program and the activities carried out. Then, we consolidated the components by collecting primary information from the main actors involved: the operator coordinator, the hired consultants, and the firm manager / owner.

To start with, two different surveys were designed15.One was aimed at the consultants; it consisted of 23 questions related to their experience, the methodology applied, the entrepreneurs and the enterprises participating in the program, and the lessons learned that they considered valuable. The other survey was given to the firms; it was made up of 28 questions related to the company status regarding export activities before their acceptance into Expopyme, the results of their participation in the program, their perceptions on different aspects of the program, and the lessons learned that they most valued).

Six out of approximately twenty consultants working for the same Operator in Expopyme Phases I and II answered the survey. Their mean experience accrued is ten years and their mean time working for Expopyme is over two years.

For the survey on the firms, due to resource constraints, the study focused on firms located in Bogota. Out of the 85 firms that the operator had accepted, 71 were eligible to be incorporated in the study (the other 14 were no longer in the program). Out of 25 participants in the first phase of Expopyme (EP I) (2002), 22 firms were deemed "active" (still formally involved in the program). Out of 37 participants in the second phase (EP II) (2003), 26 were deemed "active". And the other 23 firms were included for follow-up after switching operators (University) (2002-2004). The end result was that 56 enterprises answered the questionnaire designed for acquiring information on the developmentof the program (Figure 7).

The surveys were personally applied to consultants and entrepreneurs / managers alike, to seek clearer, more precise, complete answers. As to the process that the consultants carried out in the firms, the operator provided all available documents related to the diagnosis (EPD), the corresponding market intelligence (MI), and the export plan formulation (EPF).

Secondary information was gathered from the program operator itself. It basically comprised firm files containing information on the process carried out in each case, starting with the selection procedure. Additionally, close contact with the operator coordinator and a brief inquiry into the background of the program enabled better acquaintance with it.

We think that this was an appropriate modality for exploring and understanding the specific traits of an EPP, necessarily custom made according to the needs of each country. We thus avoided the enormous heterogeneity found in cross-country studies (Lederman et al., 2006).

The main constraint was that it was not possible to simultaneously work with more than one program operator for reasons of confidentiality and a competitive attitude. Indeed, all of them were private universities in different cities although they worked with an official program.

4.1 A Brief Characterization of Expopyme Participants

First of all, the enterprises included in this study are all considered SMEs pursuant to the definition in Colombian law (Act 590/2000).

It is also important to point out that 17 of the firms (30.4%) had been formally incorporated less than five years before they participated in the EPP (2002 or after), which means that most of the firms were already established in local markets.

Also out of the 56 companies included in the sample, 22 of them (39.3%) had some export experience prior to their participation in Expopyme. In fact, 10 companies (40%) reported three or more years of exporting experience: 16 firms had made direct exports, 2 had made indirect exports, and 4 had used both modalities. The main export destinations were the USA and Canada (5 firms), Central America and South America (20 firms), and the European Union countries (3 firms)16.

Moreover, 10 prior exporters (40%) had appointed a person to be responsible for their export operations. However, the appointed person made export decisions in only 2 cases whereas the general manager was responsible for all decisions in 15 firms and the manager's decisions were supported by the appointed person in 5 cases.

4.2 Inventory of Success and Failure, based on a Combined View of Entrepreneurs and Consultants

4.2.1 The Consultants' Views

Consultants identified some structural impediments in the methodology (inadequate completeness, relevance, articulation), which had the direct effect of not being able to meet the goals set. Some outstanding positive factors were also identified- availability of an individual consultancy service (one consultant available per enterprise although a consultant was usually appointed to support more than one firm at a time) and the training course offered to the entrepreneurs-.There were other minor positive factors (government financial incentives to stimulate enterprise participation, direct commitment of entrepreneurs/managers, knowledge exchange among entrepreneurs, consultants, and universities),which did not suffice to counter act the identified flaws (Table 3).

This implies that there is a lot to do to build a path of learning that guarantees ever increasing returns for such a huge structural effort to make Colombian firms international players.

As a matter of fact, when asked about lessons and suggestions for the program and for the operator, the consultants mainly answered: (i) fine tuning the firm selection methodology and providing continuous feedback to improve the intervention methodology; (ii) incorporating methodological specificities according to the economic sector of the enterprise; (iii) contracting consultants with prior experience in firm internationalization processes; (iv) finding mechanisms to stimulate greater entrepreneur participation and commitment; (v) accompanying and helping entrepreneurs/managers to manage organizational change in firms; (vi) educating entrepreneurs and managers in international business and strengthening SME management skills; (vii) strengthening and broadening the program through ongoing assessment, verifying goals / results, and providing more funds.

Lastly, their suggestions reflect most of the lessons learned and needs identified: (i) allocating more resources and institutional support to consultants; (ii) improving mechanisms for selecting and exploring potential target export markets; (iii) appointing consultants by matching their knowledge / experience to the firm's specific needs; (iv) sorting candidate firms and participant firms according to given relevant criteria (activity or product, international experience, growth rate); (v) strengthening Proexport's commitment and control.

4.2.2 The Entrepreneurs' Views

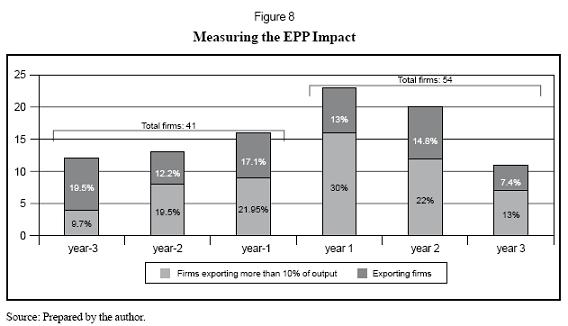

A short review of the EPP results (Table 3; Figure 8) indicates that:

• In a six-year period (from three years before the program to three years afterward), the number of exporters grew 31.7%. Nonetheless, the total number of exporters decreased 47.8% in the three years following the program.

• The average number of enterprises that sold at least 10% of their output internationally rose from 50.3% (the three years b efore) to 65.2% (the three years after). That means a 15% increase insubstantially internationalized firms (with a preference for direct exports).

• Reasons for participating mainly involved a desire to access / increase presence in foreign markets and benefit from the incentives.

• There was a clear U-turn in the previously growing trend of substantially internationalized companies as only some prior exporters maintained foreign sales-to-output ratio greater than 10%. Target market diversification did not change substantially.

• Export operations became more formal (i.e., the appointment of a person in charge and funds included in budget), but decisions were still highly centralized.

• The training course contributed some valuable new insights: the importance of exports/organizational processes/international marketing.

The entrepreneurs' perceptions of the EPP (selection, intervention, and follow-up processes, EP formulation and implementation coherence, consultants, outcome, and problems) are as follows. (i) There is plenty of room for improvement in firm selection, in the intervention process, and in export plan formulation and implementation coherence. (ii) Considerable attention should be given to the consultants' quality and performance given that expectations were not completely met and consultant turnover per firm was high. (iii) Meeting goals and final outcomes can be substantially improved. (iv) Most of theparticipantsthinkthattheprogramwould be of benefit to other enterprises even if improvement in processes, methodology and contents are needed.

Relevant suggestions from both firms and individuals confirm the issues stated above. They include the following: (i) adapt the program to more specific firm needs (e.g., services, technological products such as software); (ii) create a stronger link between training course contents and the consulting stages; (iii) take greater advantage of the firm experience; (iv) take the firm's capabilities into consideration; (v) facilitate bank-firm interaction and foster contacts with the university and government offices involved;(vi)promote firm "clusters" for easier access to foreign markets; (vii) engage "higher level" consultants; (viii) keep a log of individual processes; and (ix) enforce EP implementation.

4.3 A More In-depth View of the Selection Process and of the Intervention Methodology

Based on available information (firm records in the hands of the program operator) regarding diagnosis (EPD), market intelligence (MI), and export plan formulation (EPF), a rather clear-cut consistency analysis was made. That was complemented with the entrepreneurs'/managers' and consultants' perceptions. Additional information furnished by the operator coordinator was valuable for creating a down-to-earth assessment framework.

Initially, the entrepreneur's/manager's expectations before the firm was accepted into the program were ascertained17. Next, we attempted to elicit the objectives mutually agreed upon by the entrepreneur/manager and the program coordinator (operator) after the firm had been admitted. A fact worth mentioning is that most entrepreneurs/managers (42 out of the total 56) had relatively high expectations, although they were too general18. Surprisingly only in a few cases (8) were consensual objectives explicitly accorded and recorded in the files, even if the consultants and the operator itself assured that the objectives for each particular process were clearly defined with and known by each firm.

Secondly, the SWOT matrix resulting from the EPD for each firm was analyzed and its contents matched against the MI process output (target market sselected).Thepurpose of such comparison was twofold: to control analysis quality and process results and to verify that firm objectives, EPD results, and MI proposals were aligned.

EPD outcomes summed up in the SWOT matrix for each company exhibited highly variable quality levels ranging from ambiguous remarks or "conclusions" regarding diverse firm functions (e.g., production, marketing, and logistics) to highly precise suggestions concerning production and even technological capabilities.

The MI exercise was based on secondary information and its results were expressed in the form of a list of primary, secondary, and contingent target markets. It is important to remark that the limited number of available market studies available restrained MI possibilities; indeed, neither the SMEs nor Expopyme could afford to pay for additional market studies19. That may explain why most of the markets were chosen in the Americas and very few else where.Simultaneously,another questionarises, how specific can the available information on the firms' interests be when such firms' products range from software to leather garments to homeopathic medicine?

Furthermore, one would expect that initial objectives are revised and adjusted based on EPD and MI results. That was not done in any of the 56 cases reviewed; nor was it done in the case of the 23 companies that were in the EP implementation stage. That is a serious setback because there appears to be a merely sequential, mechanical relation throughou tthe different steps that makeup the methodology for supervising the EP formulation (EPF).

In fact, the results of the EPF seem to be as varied as those of the EPD. Some of the EPD were supported by general and sometimes ambiguous assertions (e.g., "We mean to remain and increase our market share, by making products that incorporate the features that our customers require, by discovering new national and international distribution channels, and by reaching international markets"). Other EPDs are much more precise and focused (e.g., "We will update our processes using Best Practice Standards; technological upgrading and personnel development will be the core of the firm strategy").

All in all, the quality of the process itself seems affected by a number of factors that hinder the cohesion and progression of the different phases (EPD, MI, EPF), how they relate to the associated training course (Table 2), and the likelihood of EP implementation. The main issues appear to be the screening process, the quality of the analytical outcomes (consultants, processes, and coordination), aligning the process components (Figure 9), and the interaction between the program (consultants and coordinator) and the firm.

Moreover, one of the greatest faults that impair the consistency of the whole program is that EP implementation is entirely optional in the event that the firm must fund it on its own and Expopyme can only accompany the firm. That adds to the traditional financial constraints that Colombian SMEs face, particularly when results are not guaranteed because this type of projects entails a great deal of uncertainty and risk. That situation is particularly clear in the case of firms that have been supported by two or three different consultants (46%) sometimes due to the deficient performance of the appointed consultants or due to external reasons (payment or contractual conditions, the operator's administrative reasons); it is also seen during the follow-up stage when the firms want to implement the formulated EP.

5. Final Remarks on the Program

So far, we are able to point out some major issues that have emerged from our analysis. First of all, most entrepreneurs/managers do not hesitate to recommend the program to their colleagues. However, most of them formulated a rather long list of suggestions aimed at improving the program processes (79%) and the program methodology and contents (57%).

This leads us to establish some definite points to be validated at two different levels. First, there are consistent concerns among consultants and entrepreneurs/managers alike regarding the different program stages and actions. Indeed, the criteria and actions in the selection process, the training course, the intervention phases (EPD, MI, EPF), and the eventual follow-up period deserve serious attention and review. Consultants and firm entrepreneurs/managers agree that:

• Training and intervention as well as internal intervention phases must become more coherent.

• Goals must be set upon mutual agreement between the firm and the program representatives.

• The results attained express program under-performance.

• Primary and secondary information sources are not sufficient.

• Some (EPD/MI/EPF) methodological tools are not appropriate.

• The consultants' expertise does not match the needs of all of the firms.

• Coordination problems (communications and control) between operators and Proexport are obvious.

• Low firm commitment is related to weak organizational planning and decisionmaking processes.

Secondly, some of the findings of this assessment exercise provide additional evidence to support the conclusions drawn by previous studies on Colombian exports. Actually, our data seems to confirm a number of assertions, such as:

•There is high firm turn over regarding exports. That would suggest problems along two different lines: (i) Colombian small and medium-sized companies do not consider international markets a source of firm growth and development or do not trust them to bes o and (ii) the Colombian SMEs that engage in exports have serious learning problems (only a few firms go on to access new markets through time,asis shown below).

• There is a high concentration of export firms in a few target markets, plus those markets are relatively close in geographical and cultural terms, and not very complex in terms of quality requirements; furthermore, only a few firms reach far away, complex markets after gaining experience with those that are close and demand little.

• The lack of knowledge on the role of foreign markets stems from an absence of specialized persons to properly manage the exports and to a lack of the capabilities required for building an international strategy (an outcome of bounded rationality?).

• Exports are considered secondary to local sales and little importance is attached to the role of foreign markets in the firm's development (capabilities).

• Colombian firms are low intensity, low quality exporters.

• Direct exports are the most commonmodality.

• Medium-sized enterprises do better than small enterprises, and start outs "born international" seem to do better than older firms that attempt to access new markets.

• Colombian firms have little interaction with other firms, with universities, entrepreneurial development institutions, and other agents of the institutional assembly that could benefit them.

All of the above facts pose highly relevant questions regarding the type of exporting culture models needed to work out the puzzling issues stated here in acountry such as Colombia with a small, non-complex home market characterized by low-margin, cost-based competition (even when compared to other emerging economies such as China, Brazil or Mexico). For now, the question of the interaction between institutional legacies and dynamic firm capabilities concerning internationalization strategies remains unanswered. Also, efforts to provide firms -particularly SMEs- with formal training and support programs do not seem to suffice to boost the firms' "market expansion abilities".

Actually, if the results of this assessment are placed side by side with the issues presented in Sierra (2006), it seems clear that the Colombian EPP still has a lot left to do to crea-te an organizational culture and a national culture aimed at internationalization, which grant better, more ample learning processes, to implement new practices and develop sustainable competitive advantages on the international scene.

That is connected to the need for a change in mindset where efforts towards internationalization are not thought of as costs but as strategic investment, particularly in a corporate environment where elaborate, long-term strategy is not appreciated, and especially in SMEs.

The analysis also suggests that current EPP services and incentives should be made more articulate through a stronger interaction with firms on an individual basis, but also by giving importance to the role that alliances (e.g., chain linkage, sector and inter-sector agreements, clusters) can play, to build a truly national strategy for export-based internationalization.

It also seems clear that Colombian organizations still have a full agenda when it comes to creating capabilities and developing an international strategy. Innovation and internationalization have to be incorporated into the organizational culture. Organizational learning patterns and the consequent establishment of new practices have to be studied in individual and group cases. The accumulation of international experience should be an item in building competitive advantages. The creation of international departments and the reallocation of internal resources are factors to be taken into account. Informed decision making and choosing the timing for taking action are issues to be considered when designing a strategy to go international.

All of the above implies that the role of the Colombian EPP and the role of the EPA should be reviewed and adjusted based on internal studies. The experience of other countries where policy environments and institutional structures go hand in hand with private corporate decision to boost the internationalization effort by improving the overall business climate should be taken into account.

6. Implications and Some Reflections for Future Research

We believe that this kind of study can be profitably replicated and employed in depth in different countries because the proposed analysis goes well beyond traditional EPP assessment methodologies that are mainly based on separate evaluations or measurement of awareness, usage of EPP services or results in terms of changes in national exports.

Of course, this study can and should be refined, but we think that it is worth the effort, focusing on an integral view of what creating a culture for internationalization means. Besides complementing cross-country statistical analysis, comparative studies on building exporting cultures in diverse settings can produce useful ideas on how to tackle relevant problems in new creative manners in developing economies and developed economies alike, starting with the very concept of internationalization and an exporting culture.That could be used for EPAs around the world to learn the lessons that particularly successful EPPs have to share and incorporate them, thus giving academics and practitioners new ideas and tools to examine and apply.

Take, for instance, the evidence on the achievements and short falls of the Colombian EPP and its "exporting culture model". Seen from within, it suggests very interesting avenues of theoretical and empirical research concerning the policy and practices required to strengthen the model and effectively contribute to improving national firm international competitiveness. As a matter of fact, there is room for much reflection on the individual dimens ions of exporting culture and how they are linked.

From the view point of individual firms,questions may be posed. What is the role of the capabilities for an exporting culture and how can required capabilities be created inside and outside a firm from a strategic perspective? How can firms undertake and manage learning as a cornerstone for building an exporting culture? How can the challenges of managing effective organizational changes related to going international be faced? What can contribute to better processes for formulating and implementing international strategy when firms deal with the characteristic constraints that developing economies suffer and the stressing forces of aglobalized economy?

From the standpoint of macro and meso policies and services, other queries arise as well. How can national governments motivate firms to go abroad and how can they support them on a steady basis as a part of a joint strategy, not just in an individual basis episodically and assuming the risk of random results? How can firms be convinced to move beyond culturally-close markets, particularly when that implies high levels of complexity? What role should the financial system play, particularly if internationalization is seen as an innovation process? How can "internationally born" startouts be stimulated and managed? How can a country proceed beyond exports into more complex internationalization modes if most of its firms remain traditional, small, and isolated? How can firm and intersector alliances and various sector initiatives be promoted in a context where cooperation is an alien concept? Can formal training and other initiatives alone spur the creation of proper capabilities, strategy formulation and implementation, and the development of fruitful alliance schemes for going international? How can institutions and their agents become effectively involved in the internationalization process? How can programs for inducing the creation of an exporting culture be implemented, given the fact that the concept is still loosely interpreted and inaccurate and given the natural differences among firms?

These and many other questions merit close attention and demand new ideas in order to cope with the growing challenge of an ever increasingly interdependent economy and a rapidly evolving enterprise system. As mentioned above, the challenge is not confined to emerging economies, it is to be dealt with by developed countries as well.

Footnotes

1. The authors quote a study by Boisot (2004) who argues that "...in contrast to the assumptions of conventional international business theory, 'many Chinese firms will not be moving abroad to exploit a competitive advantage that was developed in the domestic market, but to avoid a number of competitive disadvantages incurred by operating exclusively in the domestic market'." (p. 388). Such disadvantageous domestic conditions include, among others: regional protectionism in the home country, which limits the opportunities that the large domestic market offers to exploit economies of scale and creates market fragmentation; limited access to capital, which hinders adequate investment; problems with intellectual property rights, which limits access to state-of-the-art technology; the underprovision of top quality training and education, which limits the access to skilled human resources; and poor local infrastructure, which increases transport costs.

2. Calculations by those authors indicate that contributions by entrant firms (exiting firms) to the net growth (decrease) of exports average only 3.2 percent (2.3% for exiting companies) per year. In the long run, however, "gross entry contributed 47 percent of total growth... [and]... the average sales of exsiting firms were about 25 percent of the beginning of period average, implying a net contraction of exports due to gross exit of 13.9 percentage points." (p. 9).

3. Very few Colombian firms sell to the EU and it is an unlikely destination for a new entrant; also, firms selling only to the EU are less likely to add new target markets and are more likely - if they are single-market exporters- to drop out of exporting. Regarding the fact that sales growth is systematically higher in the firms in the low-sales quintiles (a major departure from Gibrat's law), Eaton et al. hypothesize that either export growth (across quintiles) is difficult due to specific problems (e.g., capacity constraints, foreign demand elasticity drops with expansion, decreased return expenditure on advertising) or that there is a learning period during which buyers try out new exporters on a limited scale and sellers learn about their partners'reliability,so that,when the exploration period is over, either the relation ends or orders surge. Now, as to the fact that single-year exporters are particularly small, the authors venture two possible explanations: (i) sunk entry costs to "test the waters"are quite modest, in fact substantially less than the cost of locking in major exporting contracts; (ii) firms undergo serially-correlated productivity or quality shocks so, under certain circumstances, some firms find exporting very profitable and persist on a large scale while others can only do it on a small scale and may experience negative shocks that drive them out of foreign markets.

4. (i) Export shares are small, particularly when sunk costs and relative market sizes are considered; (ii) The distribution of export shares is bimodal (most Colombian plants export a tiny share of their output, but there is also a small but significan tnumber of high-intensity exporters); (iii) Export intensities at an individual plant level were not modified by the economy-wide export intensity boom that occurred during the 1981-1991 period; (iv) Low-intensity exporters do not usually become high-intensity exporters through time; they rather remain low-intensity exporters whereas high-intensity exporters enter and exit the market with the same status.

5. Some interesting questions that deserve further analysis arise from some connected assertions made by that author along the lines that "high-quality producers may succeed with high unskilled labor intensities", a fact that -according to Brooks- could explain why, when compared to non-exporters, high-intensity exporters have higher added value per worker, total labor, fewer domestic sales, and lower non-production worker shares.

6. Such considerations should be placed into the context of the entrepreneurs’ perceptions on how State agencies work: the huge number of informal enterprises seems to be directly related to the elaborate, time consuming procedures required to register new firms, also the institutional lack of coordination is perceived as a high impact hurdle, and security conditions still matter in terms of costs andc onsequences (Rodríguez, 2003).

7. The EPI classification values range from 0 to 10; firms were considered "successful" if they obtained no less than six EPI points, exported minimum USD 25,000 (2003) or exhibited an export coefficient greater than or equal to 5% (2001).

8. (i) Most firms seek information on international business opportunities through Proexport programs (63%), through their own exploration trips (53%), through visits from potential buyers (33%), and through potential buyers' requests (23%). Only 13% uses Internet. (ii) Most firms developed specific actions -basically related to products/processes/services and commercialization- to access international markets. The top five ranking adaptations include modifying/improving product design (70%), scaling up production (66%), incorporating machinery and equipment (63%), training technical personnel (56%), and finding a distribution chain (51%). (iii) Price, quality, and delivery time are very important competitive attributes for both types of firms whereas market knowledge and geographic location are far more important to successful exportersthantounsuccessfulexporters.Nonetheless,only quality, market knowledge, and geographic location represent an advantage to successful exporters whereas price and delivery time represent a disadvantage. (iv) Firms say that the main barriers to internationalization efforts are the exchange rate (89%), insurmountable non-price disadvantages, bureaucratic customs red tape, and tax burdens (45%); successful exporters are also affected by delivery costs (46%) and by non-tariff barriers 38%). Other troublesome aspects have to do with the scarceness of export/production enhancement financing and with the legal and political instability (33%).

9. For instance, they determined that successful exporters in Colombia had more intense commercial relations with more banks (2.2 on an average) than unsuccessful exporters (1.7) and that about 38% of the firms had one third of their exports financed through banks. Moreover, official support mechanisms (e.g., financing, insurance, information) were hardly known or used. For instance, private banks were used more than official banks (Bancoldex), only 18% of the exporters used the Fondo Nacional de Garantías mechanism to back their loan requests, and only 6% used Segurexpo. Also, most exporters used more than one payment instrument; pre-paid orders were by far the most used instrument, followed by promissory notes, e-payments, and checks.

10. Expopyme is a joint program backed by all of the national agencies related to foreign trade: the Ministry of Trade, Industry and Tourism; the national EPA (Proexport); the Colombian Association of SMEs (Acopi), the Export Bank (Bancoldex); some industry trade unions; several universities; and the Confederation of Chambers of Commerce (Confecámaras).

11. The training course "Change-oriented Management" includes topics such as economic analysis, management strategy, human behavior and management, finance, international marketing, logistics, and negotiation, among others.

12. The consultants may be professionals in foreign trade or last-term students of foreign trade or of related undergraduate programs.

13. Initially, participant universities included Colegio de Estudios Superiores de Administración (CESA), Instituto Nacional de Alta Dirección Empresarial (INALDE), Universidad Sergio Arboleda, Universidad EAFIT, Universidad ICESI, Pontificia Universidad Javeriana de Cali, Universidad del Norte, Universidad de los Andes, and Universidad del Rosario.

14. During the 2002-2006 period, over USD 4,000,000 were spent to assist 861 SMEs and to conform 15 entrepreneurial networks (DNP y Ministerio, 2007, p. 13).

15. The questionnaire applied to the consultants and the questionnaire applied to the entrepreneurs are available upon request to the author. The surveys were applied and processed in 2005 to enterprises in Bo gota that participated in the first two phases of the Program (Expopyme I and II). Companies located in cities other than Bogota have been included in all the program phases although not all of them are or have been supported by the same operator.

16. Out of the 56 enterprises included in this study, 4 firms entered Expopyme in 2000, 8 in 2001, 22 in 2002, 21 in 2003, and only 1 in 2004.

17. There was an explicit question regarding this aspect on the application form to be completed by all potential participants.

18. Expectations were mostly expressed in vague terms, such as "improving conditions to be able to export" or "being able to sell more abroad".

19. Proexport provides free access to some contracted market studies, as a component of the agency's current activity. Also, access to additional information on markets available through Proexport was facilitated.

References

1. Allaire, Y. y Firsirotu, M. (1992). Teorías sobre la cultura organizacional. En H. Abarbanel et al., Cultura organizacional: aspectos teóricos, prácticos y metodológicos (pp. 3-37). Bogotá: Legis. [ Links ]

2. Andersen, O. and Rynning, M.-R. (1994). Prediction of export intentions: Managing with structural characteristics? Scandinavian Journal of Management, 10 (1), 17-27. [ Links ]

3. Aulakh, P. S., Kotabe, M. and Teegen, H. (2000). Export strategies and performance of firms from emerging economies: Evidence from Brazil, Chile, and Mexico. Academy of Management Journal, 43 (3), 342-361. [ Links ]

4. Baldwin, J. R. and Gu, W. (2003). Export-market participation and productivity performance in Canadian manufacturing. The Canadian Journal of Economics/Revue Canadienne d'Economique, 6 (3), 634-657. [ Links ]

5. Barney, J. B. (1986). Organizational culture: Can it be a source of sustained competitive advantage? Academy of Management Review, 11 (3), 656-665. [ Links ]

6. Firm resources and sustained competitive advantage, (1991). Journal of Management, 17, 99-120. [ Links ]

7. Basile, R. (2001). Export behaviour of Italian manufacturing firms over the nineties: The role of innovation. Research Policy, 30, 1185-1201. [ Links ]

8. Beamish, P. and Calof, J. (1989). International business education: A corporate view. Journal of International Business Studies,20(3),553-564. [ Links ]

9. Beamish, P., Karavis, L., Goerzen, A. and Lane, C. (1999). The relationship between organizational structure and export performance. Management International Review, Wiesbaden, first quarter, 37-54. [ Links ]

10. Bernard, A.B. and Jensen, J.B. (1999). Exceptional exporter performance: Cause, effect or both? Journal or International Economics, 47, 1-25. [ Links ]

11. Bernard, A. B., Eaton, J., Jensen, J. B. and Kortum, S. (2000). Plants and productivity in international trade, in NBER Working Paper 7688, Cambridge, MA. [ Links ]

12. Bilkey, W. (1982). Variables associated with export profitability. Journal of International Business Studies, 13 (2), 39-55. [ Links ]

13. Boisot,M.(2004). Notes on the internationalization of Chinese firms. Barcelona: Open University of Catalonia. [ Links ]

14. Brooks, E. (2006). Why don't firms export more?: Product quality and Colombian plants. Journal of Development Economics, 80, 160-178. [ Links ]

15. Cabello, C. y Valle, R. (2002). La cultura en la teoría de los recursos y capacidades: una aproximación empírica. Sevilla: Universidad Pablo de Olavide. [ Links ]

16. Cabrera, E. and Bonache, J. (1999). An expert HR system for aligning organizational culture and strategy. Human Resource Planning, 22 (1), 51-60. [ Links ]

17. Calle, A.M. y Tamayo, V.M. (2005). Estrategia e internacionalización en las pymes: caso Antioquia. Cuadernos de Administración, 18 (30), 137-164. [ Links ]

18. Caughey, M. and Chetty, S. (1994). Pre-export behaviour of small manufacturing firms in New Zealand. International Small Business Journal, 12 (3), 62-68. [ Links ]

19. Child, J. and Rodrigues, S. B. (2005). The internationalization of Chinese firms: A case for theoretical extension? Management and Organization Review, 1 (3), 381-410. [ Links ]

20. Clerides, S. K., Lach, S. and Tybout, J. R. (1998). Is learning by exporting important?: Micro-dynamic evidence from Colombia, Mexico, and Morocco. Quarterly Journal of Economics,113 (3), 903-947. [ Links ]

21. Cooper, R. and Kleinschmidt, E. (1985). The impact of export strategy on export sales performance. Journal of International Business Studies, 16 (1), 37-55. [ Links ]

22. Czinkota, M. (2002). National Export Promotion: A statement of issues, changes and opportunities. In M. Kotabe and P. S. Aulakh (eds.), Emerging issues in international business research (123-139). Lansdown Road: Elgar Publishing. [ Links ]

23. Denison, D. (1991). Cultura corporativa y productividad organizacional. Bogotá: Legis. [ Links ]

24. Diamantopuolos, A., Schlegemilch, B. B., and Inglis, K. (1991). Evaluation of export promotion measures: a survey of Scottish food and drink exporters. In F. H. R. Seringhaus and P. J. Rosson (eds.), Export development and promotion: The role of public organizations (pp. 189-216). Massachusetts: Kluwer Academic Publishing. [ Links ]

25. Dichtl, E., Leibold, M., Koglmayr, H.G., Muller, S. (1983). The foreign orientation of management as a central construct in export-centered decision making process. Research in Marketing, 10 (1), 7-14. [ Links ]

26. Departamento Nacional de Planeación (DNP) y Ministerio de Comercio, Industria y Turismo (2007, 13 de agosto). Política nacional para la transformación productiva y la promoción de las micro, pequeñas y medianas empresas: Un esfuerzo público-privado. Documento Conpes 3484. Bogotá. [ Links ]

27. Eaton, J., Eslava, M., Kugler, M. and Tybout, J. (2007). Export dynamics in Colombia: Firm level evidence. Borradores de Economía (446). [ Links ]

28. Eaton, J., Kortum, S. and Kramarz, F. (2004). Dissecting Trade: Firms, Industries, and Export Destinations. The American Economic Review, 94 (2), 150-154. [ Links ]

29. Ellis, P. and Pecotich, A. (2001). Social factors influencing export initiation in small and medium sized enterprises. Journal of Marketing Research, 38 (1), 119-130. [ Links ]

30. Esser, K. (ed.), (1999). Competencia global y libertad de acción nacional: nuevo desafío para las empresas, el Estado y la sociedad. Caracas: Nueva Sociedad. [ Links ]

31. Ferro, L.M., Laureiro, D., Marín, A., Ospina, M.and Pinilla, V. (2007). Factors influencing export potential of a developing country's SMEs: A study of Colombian firms. In Management Galleys 10. Bogotá: Facultad de Administración, Universidad de los Andes. [ Links ]