Introduction

A demand for blueberries has been growing significantly and at a faster rate than production. As a consequence, importation from abroad has also been increasing (Carrera, 2012). The blueberry market offers competitive advantages at a productive and commercial level for Colombia for geographical reasons, soil conditions, and for characteristics and properties of the fruits. Resources are available such as environmental conditions with optimal temperatures, soil humidity, soil types, pH, and water quality, etc. Blueberry production in Colombia is an attractive scenario for investors due to its weekly production without strong seasonality. Growing interest in blueberry production worldwide is due to its functional food properties, such as anthocyanin and antioxidant content (Maldonado et al., 2017). However, a lack of financial information in the formulation and evaluation of productive blueberry projects in Colombia reduces investor interest in decisions about establishing crops.

Industrial blueberry production began in Colombia in 2019 (Red Agrícola - Asocolblue, 2020). Various authors underline that Colombia occupies the sixth place in blueberry production among South American countries with an average of 25 ha cultivated; however, there is still not enough formal information on cultivation and on public demand (Brazelton et al., 2011; Fernández-Gutiérrez, 2014; Cortés-Rojas et al., 2016). Cundinamarca and Boyacá are the departments with the most planted areas; they equaled an estimated 550 ha in the country in 2020. The average planting is 2 ha per project (Red Agrícola - Asocolblue, 2020). The blueberry in Colombia is one of the most outstanding emerging products for 2021 (ProColombia, 2021).

An analysis of capital budgeting practices explains and supports decision-making for investors interested in blueberry agribusiness projects. There is a number of different methods for estimating the cost-effectiveness of agribusiness projects, but the most used are the net present value (NPV) and the internal rate of return (IRR) indicators in the cost analysis. The weighted average cost of capital (WACC) and the capital asset pricing model (CAPM) are indicators for risk, and the cost of capital affects corporate investment. In the present study, data were obtained and presented from blueberry growers, suppliers, and intermediates by building a 1 ha sample plot of blueberry cultivation in order to identify the opportunities for blueberry production in Colombia.

We identified the requirements for blueberry production, as well as the areas of the Colombian highlands suitable for cultivation (from 2,200 to 3,000 m a.s.l.) and the best soil characteristics (Red Agrícola - Asocolblue, 2020). As a result of this project, for the next four years the potential for foreign sales of blueberries could exceed 100 million US dollars (USD) as long as production and commercial processes are adjusted to international regulations (Asohofrucol, 2018). To achieve competitiveness and sustainability in the blueberry agricultural sector, it is essential to have reliable, timely, and pertinent information on land use and aspects such as appropriate location, extension, spatial and temporal distribution, costs of production and infrastructure, initial investment, and labor costs, etc. Therefore, it is important to develop a case study focused on project evaluation and blueberry production marketing in Colombia to identify financial viability.

Materials and methods

Literature review

A theoretical perspective in the development of this case study is both a process and a product. A process of immersion in existing and available knowledge is linked to our approach to the problem. A product (theoretical framework) is part of a larger product, i.e., the research report. However, the case study is focused on presenting estimated capital investment in a financial scenario in order to make decisions for investors interested in blueberry cultivation in Colombia.

Estimated capital investment

In financing, complex methods related to capital budgeting theories are used by the management in the decision-making process related to capital budgeting theories in order to prevent risk factors and uncertainty (Dikerson, 1963; Mao, 1970; Arnold & Hatzopoulos, 2000; Cooper et al., 2002; Byrne & Davis, 2005; Bock & Trück, 2011; Kersytè, 2011; Zhang et al., 2011; Singh et al., 2012; Kaczmarek, 2015; Kengatharan & Lanka, 2017). Some authors have defined capital budgeting as follows: "capital budgeting practices are the methods and techniques used to evaluate and select an investment project" (Verbeeten, 2006). For many reasons, small and medium business enterprises (SMEs) and investment projects that focus on agriculture crops lack financial information because of the uncertainty and risks in the industry. However, national or international investors seek the most up-to-date information relating to budgeting of the most optimal and productive locations for blueberry production. An increase in financial uncertainty is associated with the use and importance of sophisticated capital budgeting practices. Simple capital budgeting practices generally consider the time value of money, and they systematically incorporate risk. However, advanced capital budgeting practices (IRR and NPV) consider cash flows (Verbeeten, 2006). The Colombian blueberry industry has experienced significant growth in recent years with different scenarios and characteristics in continuous production throughout the year that grants a competitive advantage and a financial opportunity for national and foreign investors. Thus, capital investment methods incorporated as a financial analysis are important for investors for future growth.

Methodology

This research was carried out between October and December 2021 in a blueberry crop located in Zipaquirá, Cundinamarca, Colombia, located at 4°59'00.001"N, 73°59'26.94'' W at 2,569 m a.s.l. A 1 ha blueberry-producing plot was established as a case study as a standard measure for installation cost.

We established the initial structure of the blueberry plot, data, and information by establishing and implementing 1 ha of blueberry crop var. Emerald. The research was an exploratory study with descriptions to identify components of production costs based on data collected from 18 blueberry farms in the area. Cost data were collected using three processes: First, a blueberry farmer from the case study was identified in Zipaquirá. The farmer submitted information and data on the costs for the infrastructure of 1 ha equipped with anti-hail mesh for 7,680 plants. Second, in a diagnosis and characterization process with the Colombian Association of Blueberry Growers - ASOCOLBLUE, data were obtained from the 18 blueberry producers surveyed. Data were collected through face-to-face interviews and surveys with farmers and administrators for 2 months in 2020. Finally, national economic data for WACC and CAPM analysis were obtained from the Colombian government websites and the National Administrative Department of Statistics - DANE.

According to Ericsson et al. (2009), a case study implies the following components of production cost: 1) estimated capital investment, 2) cost of establishment, 3) cost of land, 4) NPV, IRR, and 5) investment analysis. These components were used to summarize the establishment-production costs and the potential profitability of 'Biloxi' cultivar among Colombia's blueberry crops. This methodology has become an interesting and effective tool for a business project to guarantee implementation from data collection to the determination of a corporate strategy and the corporate budget planning (Amir et al., 2016).

Assumptions

Assumptions used for the cost analysis were included in the structure for the plot, the plants, maintenance costs, and external factors focused on political and economic issues.

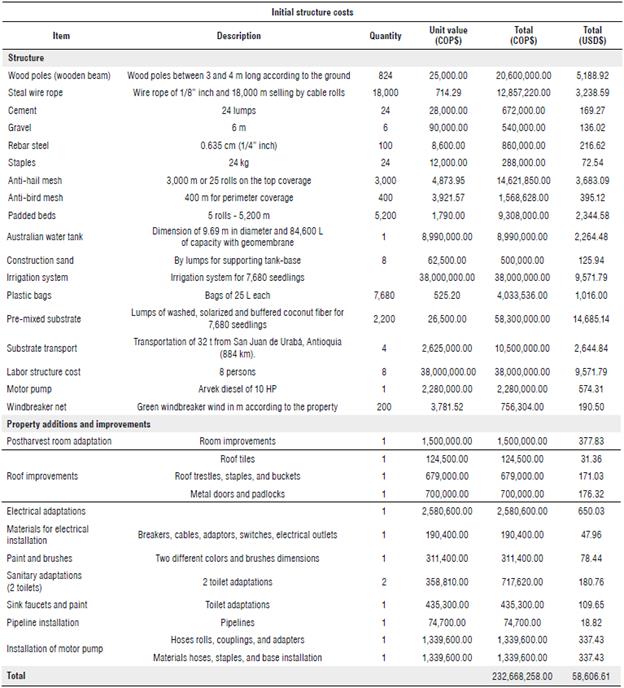

Anti-hail mesh structure

A structural model was presented according to the characteristics and minimum conditions for sustainable blueberry production such as land properties, altitude (m a.s.l.), and the Cundinamarca and Boyacá climate. Soil characteristics are optimal for blueberry cultivation in this region (Salgado et al., 2018); however, the cost analysis was organized and structured for a 1-ha blueberry planting in 25 L bags (due to the root development of the species) with fertirrigation monitoring management (Hart et al., 2006). The optimal altitude for a blueberry production in Colombia is between 2,100 and 3,000 m a.s.l. (Cleves, 2021). The structure for the plot was designed for 1 ha of flat land in the defined region, and it was distributed every 0.6 m among plants (240 plants per row) and 2.2 m between rows (32 rows) (Ojeda et al., 2016). The structure was covered with anti-hail mesh for hail protection due to the positive effects on blueberry production performance and crop yield at high altitudes (Milivojevic et al., 2017). For the productive units established in greenhouses, the covering used was polyethylene plastic with mechanical properties of high resistance to tearing and impact, thus increasing investment costs. For this case study, owners invested in the anti-hail mesh structure to reduce costs.

Plants (seedlings)

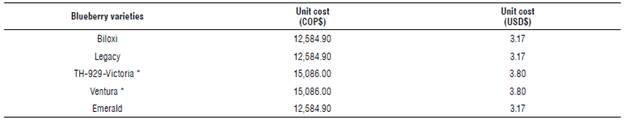

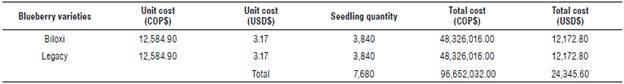

A US nursery supplier company (Fall Creek Farm & Nursery, Inc., Oregon, USA), through its representatives in Colombia, offered quotes on the plants; and 7,680 plants were established for the farm in Zipaquirá. This supply company produces blueberry seedlings of high quality as well as varieties adjusted to the climate conditions of Colombia. This commercial nursery allows the growth of many varieties of blueberries, and the varieties suitable to be cultivated in Colombia in the present case were Biloxi and Emerald (Tab. 1) (Fall Creek Farm & Nursery, 2021). Blueberry yield was approximately 500 g fruits per plant in the first year (2022), with an increase of 30% in the second year (2023) and so on (Muñoz-Vega et al., 2017). The calculation of yield per plant is shown in the NPV as well as the pruning intensity effect on average fruit weight per plant. The unit costs for 7,680 plants are presented in Table 2. The substrate used was coconut fiber + perlite. Coconut fiber is a waste product of the coconut industry that provides good aeration to plant roots and a high rewetting capacity (Michel, 2010). This byproduct of the coconut fruit has been widely used as a substitute for peat in different horticultural, floriculture and fruit growing systems (Schmilewski, 2008). We transplanted the plants in 25 L polypropylene bags (Salgado et al., 2018). Other costs about of the anti-hail mesh structure and services are presented in Table 3.

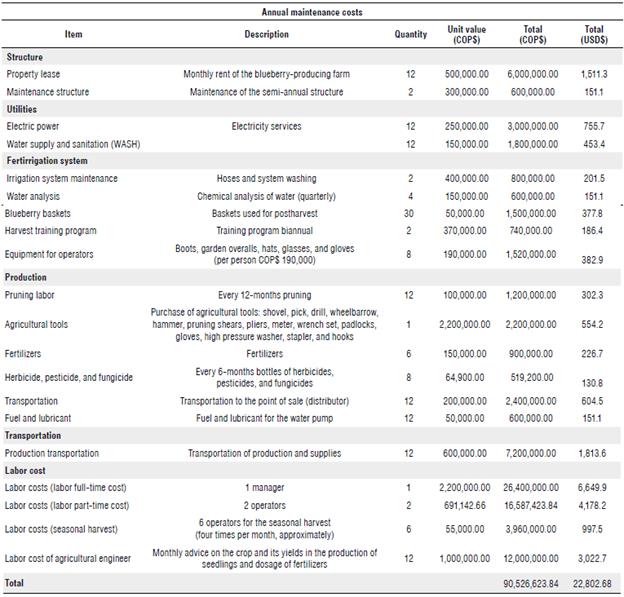

Maintenance costs

According to experts, the first harvest after being cultivated takes twelve months for the plants to reach full production, and the opportunity for the possibility of continuous production could supply domestic and North American demand (Cortés-Rojas et al., 2016). So, costs may vary according to the maintenance of the structure, the irrigation system, production cost, and costs per harvest (four harvests per month approximately). On the other hand, land is not owned, and investors require a monthly lease of the land to establish a productive farm. Monthly costs may vary according to several factors in the Cundinamarca and Boyacá region such as location, water resources, flat land, proper roads, property extension, access to the farm, and distance for getting supplies and points of sale.

Cost per harvest is focused on labor costs and training. The operator's costs should be incorporated in different ways: labor seasonal cost, labor part-time cost, and labor full-time cost. Production costs are focused on harvest, pruning, herbicide, pesticide, fungicide, tools maintenance, transportation, and gasoline for water pumps (Tab. 4).

Financial assumptions

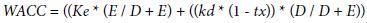

The weighted average cost of capital (WACC) is often used as the appropriate discount rate to value companies or projects and measure a company's cost to borrow money (Frank & Shen, 2016). WACC is an appropriate discount rate for valuing a company or for projecting using the discounted cash flows modality since it reflects the financial structure of the company and the cost of the resources used by it for the case study of its corporate purpose. WACC was evaluated using the formula:

where Ke is the cost of equity, E is equity, D is debt, Kd is the cost of debt (interest rate), and Tx is the tax rate. Ke is the cost of capital, i.e., a rate of profitability that investors (partners) would expect; it is known as TIO (opportunity interest rate) or expected profitability to invest in the project and not in other options. E is a proportional amount of contributions corresponding to "equity" or equity contribution generated by the partners and the absolute value; D is a proportional amount of contributions obtained by debt or credit "debt" or liabilities generated by third parties to constitute the total value of assets together with equity contributions and absolute value; Kd is a cost of credit or loans and is an interest rate of the aforementioned resources; and Tx is a current tax rate in Colombia. Parts of the assets come from resources provided by third parties and their cost. Cost is given by the current interest rates for such loans or credits (kd). Part of the assets come from the resources provided by its partners or shareholders when consolidating the company's equity. WACC is usually more subjective to determine since it is considered as the shareholder's opportunity interest rate (OIR). It reflects the rates expected to grant resources to the company instead of investing in other options. The risk of investing in the company is offset by higher profitability (Tab. 5).

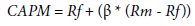

To generate a more objective determination of the cost, the capital asset pricing model (CAPM) is used to establish the relationship between the risk and expected return for assets. It is widely followed for the pricing of risky securities like equity, generating expected returns for assets given the associated risk, and calculating costs of capital (Chen, 2021). Sharpe (1964) and Lintner (1975) present the CAPM as "an equilibrium rate of returns on individual assets adjusted to levels that reflect the risk which each asset contributes to a market portfolio of all assets" (Barry, 1981). Therefore, the case study presents a comparison in the blueberry market from the farming sector between the USA and Colombia. On this case, the formula to obtain CAPM is:

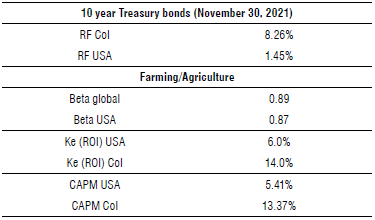

where Rf = risk free, β = Beta, and Rm = market risk (Rf is the interest rate or return of risk-free reference bonds; Beta is the level of sensitization of the model regarding movements in the market interest rate where evaluated; it is usually a value between -1 and 1. Rm is the market risk premium of the country under analysis to compensate with respect to risk-free bonds. In the case study, a parallel comparison of the CAPM model is presented for an agricultural project of two reference countries, the USA and Colombia. It is taken as a reference for the risk-free rate, the rate of government bonds of each country at 10 years as a reference par excellence to reflect the absence of risk, considering payment capacity of the nations and their risk rating. Bond rate for November 30, 2021, is taken as a reference by the cited information provider (Investing.com, 2021). In the case of a 10-year project, bonds for the stipulated date reflect an interest rate of 8.2% (Tab. 6).

For Beta, the information is published by Deamodaranon-line.com (2021). The website presents the current information for estimating the discount rate of Beta adjusted to reflect a firm's total exposure to risk rather than only the market risk component. It is a function of the market beta and the portion of the total risk that is the market risk. These Beta might provide estimated costs of equity for undiversified owners of businesses. Total Beta by industrial sector for the global case includes countries such as Colombia. Beta for the "Farming / Agriculture" sector for the global area is at the level of 0.89.

The OIR expected by the shareholders is taken as a reference, and the 14% rate is accepted as a reference according to inquiries made by investors in the sector. From the calculation of the CAPM model under these conditions, the cost of equity adjusted under these conditions amounts to 13.3 %. As previously reviewed in the case currently studied, resources from debt are not contemplated; therefore, the Ke as a source of total resources for the company is taken as the WACC.

If an agribusiness in the future considers borrowing or acquiring financing from financial entities in Colombia, it could evaluate the cost of the resources reflected in the interest rates of loans for the sector. It may be of the same level or lower that the cost of equity and that they will also be adjusted by the tax shield if deducted from its tax base. The tax base is a proportion of the resources paid for financial expenses reflected in the WACC formula (1-tx for the WACC calculation formula, the tax shield is included, as part of the interest, is a deductible element for income purposes; tx is the tax rate). If these conditions are met, it could reflect a lower WACC which will have a favorable impact on the NPV of the same, providing a higher valuation (Tab. 7).

Other assumptions

Some products and materials for blueberry production are covered by a value added tax. However, some of them are exempted due to the last tax reform on the agricultural sector (Ministerio de Agricultura y Desarrollo Rural, 2020). The general income tax rate applicable to national companies is 32% for taxable year 2020, 31% for taxable year 2021 and 30% as of taxable year 2022.

Projections were applied with the average increase of the last 5 years of consumer price index (CPI acronym in English and IPC acronym in Spanish) in Colombia (Banco de la República, 2021a). The CPI index was used for the adjustment values of the fixed and variable costs on projections.

The fruit weight (kg) at the first harvest was determined for each plant after 12-months production. Therefore, the first year will not have a harvest until 10 or 12 months after having planted the seedlings (Cleves, 2021). The first blueberry harvest on one year production of a 1 ha weighed approximately about 500 g (Jorquera-Fontena et al., 2017; Muñoz-Vega et al., 2017). Weight increases on average until each plant reached 2,000 g after 10 years are based on several factors such as cross pollination, fertilizers, pruning, and good farming practices, and climate (Muñoz-Vega et al., 2017). This results in the fruits having a higher caliber, number of seeds and fruit weight.

According to the blueberry kilogram price index, ASO-COLBLUE determined on report of May 2021 the final average price for the last 12 months (Asocolblue, 2021) and it was used to determine the sales forecast in grams.

Results and discussion

Blueberry seedlings exported from the USA have a standard price compared to the national seedlings cultivated and reproduced by the propagation method. The varieties have a different performance in the Cundiboyacense region and distributors recommend cultivating specific varieties for the climate conditions found in Colombia. Seedling prices are high; however, the blueberry plant is a perennial plant with long productivity.

Initial structural costs are around USD $58,606. Benefits for the structure are high performance in production. Greenhouses are more efficient, although they duplicate costs. Around 70% of the materials purchases for the structure in our case study came from abroad and 50% of the distributors were found in Bogotá city (close to the farm). Annual maintenance costs are focused on the structure, utilities, fert-irrigation system, costs per season harvest, production, transportation, and labor cost. The cost is around USD $22,800 at the beginning of the first year. On many of the cases, land purchases for agriculture are expensive and involve generational legal problems in Colombia. So, investors prefer a lease contract rather than the purchase of the property allowing them low maintenance costs. The cost of land lease is cheap compared to a lease contract for buildings or houses for living in cities. Labor cost is the highest cost and is proportional to the production season. In Colombia, the agricultural sector is still using an informal wage according to the activities of the farmer, and this process even reduces costs. Minimum informal wage oscillates between USD $10 and $12, according to the farm activities. The fert-irrigation system maintenance is the cheapest cost of the production year. Also, control of the different diseases for the several climate conditions represents a high price on maintenance costs; however, that is still cheap for annual maintenance costs.

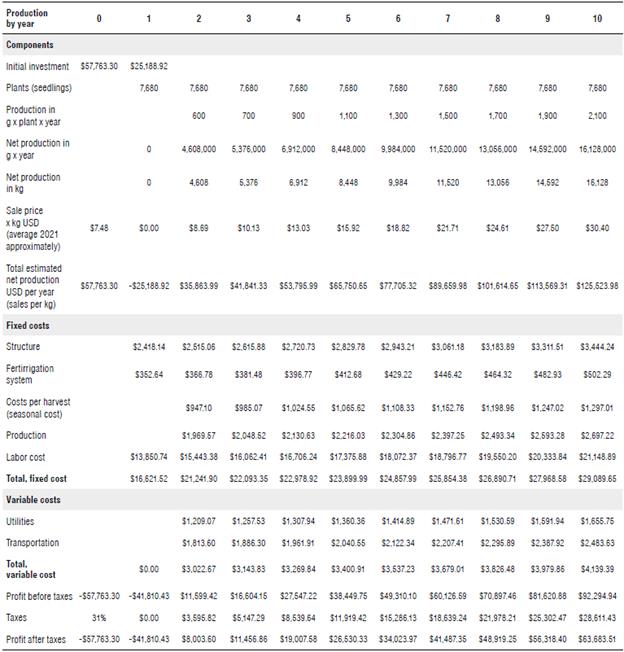

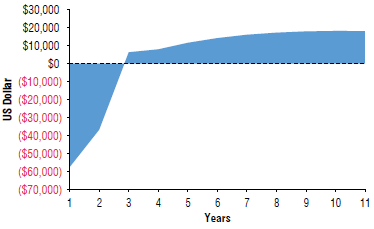

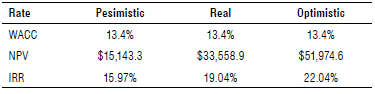

Following, NPV was adjusted according to the exchange rate: COP to USD (November 21rst, 2021). With a WACC of the 13.4%, the IRR was obtained at 19% and NPV of about USD $33,500. As a result, ROI turned positive on year 3 (Fig. 1). According to the methodology, differences between a pessimistic, real and an optimistic scenario are not particularly wide. Based on the different scenarios, the IRR is dominant and adapted from a conservative net production estimate that could be affected by climate conditions. However, some authors estimate increased production for the next 5 years.

FIGURE 1 Return of the investment (ROI). Colombian peso exchange rate on November 11th, 2021 was $1 USD = C0P$ 3,875.38 (Banco de la República, 2021b).

TABLE 1 Units cost of blueberry varieties per plant (seedling).

* Licensed to Fall Creek; royalties should apply. C0P$ corresponds to Colombian peso; USD$ corresponds to USA dollar.

TABLE 2 Costs of plants (seedlings) for 1 ha (7,680 plants) blueberry plantation establishment.

Colombian peso exchange rate on November 11lh, 2021 was$1 USD = C0P$3,875.38 (Banco de la República, 2021b). C0P$ corresponds to Colombian peso; USD$ corresponds to USA dollar.

TABLE 3 Initial structure costs for 1 ha (7,680 plants) blueberry plantation establishment.

Colombian peso exchange rate on November 11th, 2021 was $1 USD = COP$ 3,875.38 (Banco de la República, 2021b). COP$ corresponds to Colombian peso; USD$ corresponds to USA dollar.

TABLE 4, continaution. Maintenance costs for 1 ha (7,680 plants) blueberry plantation.

Colombian peso exchange rate on November 11th, 2021 was $1 USD = COP$ 3,875.38) (Banco de la República, 2021b).

TABLE 5 Weighted average cost of capital (WACC), net present value (NPV), and internal rate of return (IRR) for different scenario assumptions.

TABLE 6 Capital asset pricing model (CAPM) in the USA vs. Colombian (Col) currency. Rf, risk free; Beta, the level of the sensitization of the model regarding movements in the market interest rate where is evaluated; Ke, the cost of capital.

Conclusions

The case study provided costs and investment analysis for the decisions made by investors in the production of Colombian blueberries. Final information and analysis should be useful for foreign investors, new growers, and for current blueberry growers. For new growers, this represents an economic benchmark analysis on the average operation for a 1 ha plot. For international investors, the study estimates expenses and costs combined with the market price and estimates potential revenues and profits in this agribusiness.

The research identified an initial investment of about USD $58,000 in the first year and about USD $25,000 in the second year per 1 ha of blueberry crop in the Cundiboyacense highlands region. Consequently, blueberry production is profitable under the best conditions. However, a greenhouse infrastructure and different blueberry varieties for testing may represent better performance for future research.

The NPV underlined differences between the present value of cash inflow and the present value of cash outflow over 10 years. The IRR is still relevant and attractive in different scenarios. To guarantee a profitable scenario, plantation care during the first two years of growth is crucial when it comes to planting blueberries. It is still cheaper compared to other countries such as the USA, Perú, and Chile. Labor costs are cheaper and more attractive compared to other Latin-American countries. Profitability depends on the quality of the fruit that results from each harvest.

Intermediate suppliers affect establishment costs for different commercial reasons. Resource imports and raw materials for the initial blueberry crop affects the initial investment and rise of Colombian prices on the market. However, the weighted average cost of capital (WACC) shows an average rate where the case study is expected to pay for stakeholders to support assets. The capital asset pricing model (CAPM) shows little volatility in the initial investment. However, according to blueberry imports, market price, and marketing, the higher the CAPM, the higher the expected return.

In brief, several factors were concluded to consider the initial investment reasonable and timely in the infrastructure creating a favorable microclimate for the development of blueberries and increasing production focused on fruit quality.