The concept of economic and financial literacy (EFL), understood as the ability to understand the social economic model systematically, to involve and apply basic economic concepts and interpret events and economic policies which are not always explicit (Denegri & Delval, 2002). It also refers to the ability to make informed economic judgments and effective personal, family, and professional decisions (Cohen & Candace, 2011; Rogers, 2014). Based on this perspective, it includes the development of an individual's ability to act in the economic and financial world in relation to their experience, knowledge, and abilities. Additionally, the concept refers to a social subject that places individuals in more favourable or unfavourable positions regarding their development (Bay, Catasús, & Johed, 2014).

For this reason, it is key for today's societies to evaluate EFL levels to explore ways they can be improved (Huston, 2010). Moreover, it is also an attractive resource for researchers in the field of economic socialization (Gunter & Furnham, 1998), particularly for adolescents as many attitudes and consumption habits are established between the ages of ten and 15 that will continue into adulthood (Denegri & Delval, 2002; Ozgen, 2003).

For children and adolescents, measuring economic and financial literacy is particularly important (Gempp, et al., 2006) because their developmental characteristics actively construct explanations about the economic world that are anchored to the cognitive resources available and based on their developmental level (Delval, Enesco, & Navarro, 1994; Denegri, Delval, Ripoll, Palavecinos, & Keller, 1998). Therefore, the focus of evaluating EFL in children and adolescents cannot be on the content or management of specific information but rather on economic reasoning, i.e., the explanations and cognitive maps that the child uses to represent the economic world (Denegri, 1995).

In the case of Chile, the results of the Programme for International Student Assessment (PISA) 2015 show students' low performances. Also, the highest concentrations are found in the low performance levels, and the socioeconomic gap is clear since students with more economic resources have, on average, better scores than the most vulnerable young people (Agencia de Calidad de la Educación, 2017).

Chile has had experience in this area from 2004 when the Test of Economic Literacy in Children (TEL-C) (Cortés, Quezada, & Sepúlveda, 2004; Gempp, et al., 2006) was created and validated for children and adolescents between the ages of ten and 14, which was based on the Psychogene-sis of Economic Thinking model proposed by Denegri (1995) and validated qualitatively in several subsequent investigations (Amar, Llanos, Abello, & Denegri, 2003; Bonifacio de Araujo, 2009; Denegri & Delval, 2002; Denegri, et al., 1998).

This theoretical model considers Piaget bases and describes the development of economic thinking through progressive levels of increasing complexity that express a progression in the ability to understand situations and solve problems associated with the representation of the economic world. This model posits the existence of three developmental levels of economic thinking: (a) Level I (5 to 9 years old), further divided into: sublevel Ia (Extraeconomic Thinking) and sub-level Ib (Primitive Economic Thinking); (b) Level II (> 10 years old, adolescents, and even some adults): Subordinate Economic Thinking, and (c) Level III (older adolescents and adults): Independent Economic Thinking (Denegri, 1995; 1998). The TEL-C, therefore, has a graduated response format that is coherent with this theoretical background, which provides two ways of correcting the responses: one with three points that maintains sublevel Ia and level III but groups sublevel Ib with level II, a solution that presented better psychometric behaviour (Gempp, et al., 2006), and another with four points in which each alternative corresponds to one of the four levels and sublevels of the economic reasoning model.

Despite this advance, there is no similar instrument that can be used with adolescents over the age of 14 and that fully covers this developmental stage. The EFLT-S was, thus, based on the TEL-C and also from the Organization for Economic Cooperation and Development's guidelines (OECD) (2012), which explains that financial literacy among young people should include: competencies in managing money to deal with bank accounts and credit/debit cards, how to plan and manage personal finances, understanding saving mechanisms, indebtedness and taxes, anticipating risk and evaluating rewards, and more specific aspects relating to consumer's rights and responsibilities.

Previous studies show that differences in financial literacy levels, are related to socioeconomic status (the higher the status, the greater the literacy), educational level (the higher the education level, the greater the literacy), sex (men score better on EFL evaluations), and age (adults have better literacy than young people and seniors) (Domínguez, 2015; Hastings, Madrian, & Skimmyhorn, 2013; Webley & Nyhus, 2013).

On a psychological level, low financial competency is associated with other economic behaviours including debt accumulation, high-cost loans (Lusardi & Tufano, 2015), poor mortgage choice, and delinquent mortgages (Gerardi, Goette, & Meier, 2010; Moore, 2003). On the other hand, materialism correlates with impulse buying and indebtedness (Troisi, Christopher, & Marek, 2006), and, in the case of adolescents, it is associated with consumer susceptibility to interpersonal influence (Cárdenas, 2017; Kretschmer & Pike, 2010).

This background emphasizes the need to move forward to assess economic and financial literacy levels in adolescents because they are facing more and more complex financial products and services and a market that has identified them as a segment to address their aggressive marketing strategies (Marshall, 2014; OECD, 2012). Considering these challenges, reliable and valid measurements must be developed to determine their levels of economic literacy and financial education strategies must be proposed based on the results. For this reason, the objectives of this study were: (1) to adapt linguistically and developmentally, (2) to determine the best way to correct the items, (3) to determine the factor structure, (4) to determine the internal consistency, and 85) to correlate the total test scores with theoretically compatible variables.

Method

Participants

The autors used a two-stage sampling: the first was non-probabilistic and purposive, and a list of urban, co-ed high schools was compiled. In the second stage, we used a probability sample with a 5% error rate and a 95% confidence level. It was organized in a 3x2x2 design and considered the following control variables: type of school (municipal, subsidized, and private), geographic zone identified by commune (centre and south of the country), and sex (male and female). Eight hundred and eleven secondary students from nine schools in Santiago (48.6%) and Temuco (51.4%) participated. Fifty-two-point-five percent were female, with an average age of 15.05 (SD = 0.858), and 47.5% were male, with a mean age of 14.92 (SD = 0.961). Table 1 summarizes the characteristics according to the participants' age, sex, and socioeconomic level. It can be seen that the highest frequencies are for the ages between 13 and 15 and for the middle socioeconomic strata.

Instruments

We used a questionnaire to ascertain personal variables such as sex and age, socio-family variables including Family Socioeconomic Level (obtained from the education level and occupational category of the primary household wage earner) and socio-educational variables including the School Vulnerability Index (classification and hierarchical structuring of schools according to the percentage of students considered vulnerable based on their socioeconomic condition). Information from both these categories was used for the analyses. Additionally, we applied three instruments:

Economic and Financial Literacy Test for Secondary students (EFLT-S)

The EFLT-S contained 27 items in its original design. The response options intentionally include four quality levels: the respondent chooses an option which is scored between one and four and is in line with the four sublevels of the economic thinking model (Denegri, 1998). The following is an example: 9. We have to pay taxes every month, why?, and the possible responses are shown in decreasing order: (a) Because we must contribute to financing works and services provided by the State (4-point response); (d) Because they are discounted from paychecks every month (3-point response); (c) Because we must pay them through electricity and water bills (2-point response); and (b) Because it is mandatory (1-point response). The total scores are obtained by adding the points from the items: the higher the score, the higher the respondent's level of economic and financial reasoning.

Measure of Consumer Susceptibility to Interpersonal Influence.

The instrument was originally developed by Bearden, Netemeyer, and Teel (1989) and adapted in a reduced version for adolescents by Zhang (2001). This is composed of 8 items and uses a Likert scale from 1 to 6 that measures susceptibility to peers' normative influence, which can be translated into approval, image imposed by the group, and a sense of belonging achieved by consuming certain products or services. The following is an example: 4. In order to maintain a good relationship with my friends, I often buy the same products or brands as they do. In this measurement, the scale presented adequate internal consistency: McDonald's Omega = 0.923 CI 95% [0.899 0.940] and Ordinal Alpha = 0.923 CI 95°% [0.899 0.940].

Youth Materialism Scale

This scale for adolescents was designed by Goldberg, Gorn, Peracchio, and Bamossy (2003), and the ten items on the Likert scale (from one to six) reflect different materialist values. One question on the instrument is: 2. I would be happier if I had more money to buy more things for myself. In the present measurement, the instrument presented adequate internal consistency: McDonald's Omega = 0.923CI 95% [0.899 0.940] and Ordinal Alpha = 0.923 CI 95% [0.899 0.940].

Procedure

After receiving authorization from the school authorities, the instruments were applied in schools in the respective classrooms. The application was collective, anonymous, and participation was voluntary. Informed consent was given to the parents to sign if they authorized their child's participation in the study; once this document was received, students were then asked to indicate their intention to participate by signing another informed consent.

Analytic Strategy

Prior to performing the analyses, we explored the database and considered the 27 items on the test. Also, the following decisions were made: (a) forty subjects with two or more pieces of missing data were eliminated (> 5%): a total of 811 cases; (b) the missing data for those students was attributed to the need for an observation to be omitted using the expectation-maximization method (Dempster, Laird, & Rubin 1977); (c) a sample of 200 cases was selected at random to perform the exploratory factor analysis; d) the remaining 611 cases were kept in a separate database to perform the Confirmatory Factor Analysis (CFA).

In CFA, as an estimator, we used the Means and Variance Adjusted Unweighted Least Squares (ULSMV) method on a polychoric matrix. The fit of the model data was assessed using Root Mean Square Error of Approximation (RMSEA), the Comparative Fit Index (CFI), and the Tucker-Lewis Index (TLI). Acceptable levels for optimum fit were CFI and TLI > .95, and RMSEA < .05. Acceptable levels for reasonable fit were CFI and TLI > .90, and RMSEA < .08 (Hu & Bentler, 1999; Kline, 2005; Marsh, Hau, & Wen, 2004). We also used Schwarz's Bayesian Information Criterion (BIC) to compare the models (a lower value indicates better fit).

We analyzed the data using the FACTOR program for the exploratory factor analysis, Stata to compare the parsimonious fit indices of the models, Mplus for the confirmatory factor analysis, and IBM SPSS Statistics for the rest of the descriptive and inferential analyses.

Results

Adaptation

We conducted the adaptation of the EFLT-S in the following stage: 1) identification of the relevant items of the TEL-C (Gempp, et al., 2006), 2) language adjustments in the selected items for the adolescent population, and 3) incorporation of new areas of financial literacy that the OECD suggests (OECD, 2014).

Once the items were reviewed and adapted, we evaluated the validity of the test content using three expert judges involved in the following academic and research fields: Financial Education, Economics, and Economic Psychology (Escobar-Pérez & Cuervo-Martínez, 2008). As a result, the overall agreement percentage of theoretical coherence was 82.72%, and the Free-marginal Kappa was 0.77 95% CI [0.62, 0.92], which showed substantial agreement (Landis & Koch, 1977). Twenty-seven items were obtained, validated in terms of content; modifications were mainly made to the vocabulary, and two new items were incorporated.

Determining the form of correction

We tested confirmatory factor models with three and four-point corrections in order to find the most parsimonious model (fewer items) with the best fit. Table 2 contains the summary of the comparisons between models; the one with 21 items that had the 4-point correction was the best, We, therefore, recommend this solution. This option was chosen to have a lower Akaike information criterion than the others, which is recommended when choosing a model.

Factor structure

First of all, work was undertaken with a random sample of two-hundred cases to perform an exploratory factor analysis in the FACTOR programme (Lorenzo-Seva & Ferrando, 2006) using polychoric correlation matrices since the test items are measured at ordinal level. In addition, we used parallel analysis (Timmerman & Lorenzo-Seva, 2011) and robust unweighted least squares.

The sample adequacy measurements permitted factorization, KMO = 0.773 (acceptable), and there was a significant result for Bartlett's tests of sphericity (x2 = 1113, df = 351, p < .001). The analysis yielded a unifactorial solution for the 27 items, which explained 26.592% of the total variance. This analysis served to identify the unidimensional structure of the test.

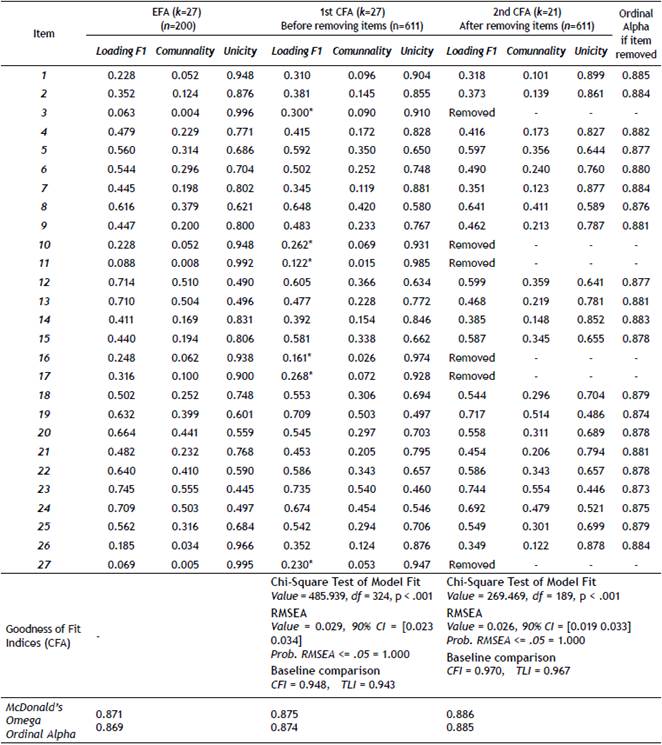

Once the unidimensionality of the test was determined, two confirmatory models were evaluated: the first with the 27 original items and the second with only the 21 items that had factor weights greater than 0.3. Six test items were finally eliminated that did not fulfil the criterion. The results indicated that the best unifactorial model is the one with 21 items, which explained 31.5% of the total variance with suitable indices of fit (see Table 3).

Table 3 Descriptive statistics of the items and results from the exploratory, confirmatory, and reliability analyses.

Note 1: asterisks show those items that have factor loadings less than or equal to 0.3 (removed from the second model).

Note 2: n= number of participants; k= number of items; CFI= Comparative Fit Index; TLI= Tucker Lewis Index.

Internal consistency

Following recommendations from Trizano-Hermosilla and Alvarado (2016), we used McDonald's coefficient omega due to the presence of a pattern of asymmetrical responses in the test items (see Table 4) in addition to the ordinal alpha, which is suggested for items with ordinal measurement. In the various analyses, coefficients were over 0.85, which is interpreted as acceptable in terms of reliability. In the final model, McDonald's Omega was 0.886, 95% CI [0.819 0.926], and Ordinal Alpha was 0.885, 95% CI [0.815 0.924]. Also, the specific analysis of each item based on the ordinal alpha indicated that it was not necessary to eliminate more items to increase the reliability of the test (see Table 3).

Correlation between variables

We correlated the scores with sociodemographic, attitudinal, socioeconomic, and socio-educational variables to evaluate the external validity of the instrument. The results obtained relating to sex show that the women had higher scores in economic and financial literacy t(764) = 2.679, p = .008, d = 0.194: the effect size of this comparison was small. With respect to the attitudinal variables, the scores on the EFL showed small statistically significant correlations in the expected direction with Materialism r(808) = -.170, p < .001 and with Susceptibility to interpersonal influence r(808) = -.209, p < .001. In relation to the two last variables, economic and financial literacy presented medium statistically significant correlations according to what was theoretically expected with the Vulnerability School Index r(810) = -.467, p < .001 and with Home Socioeconomic Status r(774) = .339, p < .001. Table 5 summarizes this information.

Discussion

In this section, the scope of the results is discussed, and we consider the objectives set out in this study. First, the psychometric properties of the EFLT-S were studied, which provided a new instrument to assess adolescents' economic and financial literacy. In addition, each of the specific objectives was fulfilled, which permits us to establish the following lines of discussion.

In relation to the adaptation of the EFLT-S, we followed a procedure that could guarantee the content validity of the instrument. This was undertaken considering the theoretical model as the reference and then checking the item proposals with expert judges.

Once the results of the form of correction were established, although both alternatives produced similar results, the decision was made to use the one with four options that had fewer items, better indices of parsimony, and greater response variability in each item; this respected the Psychogenesis of Economic Thinking model (Denegri, 1995). A possible future challenge could be to apply a new analysis with a greater age range under the Item Response Theory (IRT) framework to determine which of the two alternatives yields results that present better psychometric behaviour. This procedure has been used in several previous studies such as Martínez-León, Mathes, Avendaño, Peña, and Sierra (2018), García-Cueto et al. (2015), and Suárez-Álvarez, Pedrosa, García-Cueto and Muñiz (2016).

The factor structure of the test is clearly unidimensional with adequate saturations in the single factor and adequate indices of fit. These results contribute evidence in favour of the (factor) construct validity, indicating an underlying construct that is common to the 21 test items. This is also theoretically consistent given the purpose of the test is to measure the economic reasoning exemplified in the explanations and cognitive maps that the child uses to represent the economic world (Denegri, 1995).

With respect to the internal consistency, the test results revealed optimal indicators considering coefficients for ordinal items, which means that the items consistently measure the EFL construct.

Finally, the analyses of the correlations indicate that the results of four of the five variables were in line with what was theoretically and empirically expected. In the case of materialism, those subjects who have more elaborate economic reasoning tend to present more unfavourable attitudes to the variable, which is consistent with other studies (Troisi, Christopher, & Marek, 2006). The result about susceptibility to interpersonal influence reveals that those young people who obtain higher test scores are less susceptible to peer influence in the area of consumption and buying, which has been indicated in previous studies (Cárdenas, 2017; Kretschmer & Pike, 2010). Although the effect size of the correlations is small, the EFLT-S manages to identify relationships in the expected direction.

The results of the socio-educational and socioeconomic variables showed that economically disadvantaged families and schools with higher vulnerability rates achieved lower levels of economic reasoning. This finding is consistent with previous studies (Atkinson, McKay, Kempson, & Collard, 2006; Domínguez, 2015; Hastings, Madrian, & Skimmyhorn, 2013).

The previously described correlational results may be considered evidence in favour of the concurrent validity of the test, which is also a form of external validity (Elosua, 2003).

With respect to the sex variable, the results indicate significant differences of low magnitude: females obtain higher levels of economic reasoning, which contradicts previous findings (Lusardi & Mitchell, 2011; Lusardi & Tufano, 2015). However, there are mixed findings: some studies indicate that differences between men and women do not exist (Agencia de Calidad de la Educación, 2017; Agnew & Harrison, 2015; Davies, Mangan, & Telhaj, 2005), but other results show that girls obtain better scores than boys (Denegri & Sepúlveda, 2014).

A possible limitation of the study includes the age homogeneity of the sample since 70% of the participants were between 14 and 15 years of age; therefore, there is a need to extend the age ranges in future research.

Another weakness of the study is the low percentage of variance explained in the Exploratory Factor Analysis (26.59% with sample 1 and then 31.5% with sample 2); however, this situation is countervailed by good indexes of adjustment in the Confirmatory Factor Analysis.

A final limitation is the small "effect size" observed in the correlations: an aspect that should continue to be reviewed in future investigations with diverse populations.

In conclusion, we considered the main contribution of this study to be that the psychometric properties of the test were evaluated, which provides a valid and reliable instrument to measure economic and financial literacy in secondary students: a specific population for which there is no instrument in this area. It provides a tool to diagnose and evaluate this variable in the context of interventions in the field of economic and financial literacy for a segment of the population that is vulnerable due to their developmental characteristics and market pressure when there is scant financial education (Davies, Howie, Mangan, & Shqiponja, 2002; Lusardi & Tufano, 2015).

People's economic education refers to the improvement of economic decision-making processes as they develop competencies to effectively solve problems. In this educational process, formal and informal financial education plays a relevant role. The family is of particular importance as an agent of socialization that influences adult consumers' behaviour (Sandoval-Escobar, Pineda-Marín, & Ávila-Campos, 2018).