INTRODUCTION

Private equity firms are constantly seeking strategies to optimize the value of their portfolio companies. One effective approach is to increase earnings before interest, taxes, depreciation, and amortization (EBITDA). It is often used as a measure of a company's value. Recently, information technology (IT) has become a major factor in creating business value. Consequently, strategies to reduce IT costs have emerged as a way for private equity firms to create value (Diaz Restrepo et al., 2023).

The adoption of technology in private equity has accelerated in recent years as firms have recognized the transformative impact that various systems, hardware, and software can have on private markets. Previously, private equity (PE) firms were viewed as conservative organizations which relied on the quality of their relationships and expertise of their deal as well as operating teams to create value and drive returns (Belderbos et al., 2019; Cohn et al., 2022).

As previously stated by Duchessi et al. (2012), the adoption of technology has been identified as a significant contributor to the value creation process for private equity firms. This value can be observed in a number of contexts, including downstream, midstream, and upstream. In the downstream context, technology enables general practitioners to directly add value to their portfolio companies. In the midstream context, technology allows PE firms to monitor their portfolio entities for more efficient operations (Xu et al., 2017).

What is not known in the PE environment is that IT cost reduction strategies can serve as value-creation schemes that increase earnings before interest, taxes, depreciation, and amortization (EBITDA) in the divestment context of PE firms. In essence, IT cost reduction is the process of identifying and eliminating waste and underutilization. The overarching objective of IT cost reduction is to enhance the value of the business within the IT budget (Duchessi et al., 2012; Lubbers et al., 2015; Meyer, 2014). Also referred to as IT cost optimization, the strategies are substantial in yielding savings that reduce the IT budget size with the amounts being reinvested into other areas that drive business growth. The strategies facilitate further improvement of EBITDA by providing PE firm managers with guidance on which investments should be prioritized based on the run, grow and transform metrics (Leslie & Oyer, 2008; Moszoro, 2014).

The lack of knowledge regarding IT cost reduction as a technology-driven value creation scheme represents a significant obstacle to the improvement of operational efficiency and the enhancement of EBITDA levels within PE firms. This is attributed to the fact that IT cost reduction schemes are key in reducing padding and allowing PE firms to closely track spending, thereby initiating prompt corrective actions to mitigate overages (Lao, 2022; Singh, 2008; Bajulaiye, 2020). The insight doled out in this report will permit PE firms to spot variances in major areas of IT spending while identifying specific line items and owners in the cost center that are driving variation. Codicil to this, bridging this gap will accentuate knowledge of the various schemes that can be used to monitor Capital Expenditure (CAPEX) and operating expenses (OPEX) variance in a bid to maintain flexibility in the face of austerity.

This issue is also given considerable attention in scientific doctrine. For example, Haque (2023) focused on the study of foreign economic activity, which involves the export or import of capital in the form of both direct and portfolio investments. In the conclusion, he noted that the EBITDA indicator reveals the net profit of the firm, which is accordingly reflected before the payment of interest on loans, but he did not disclose the impact of this indicator on taxation and depreciation, which are part of the financial position of the company. Petersone et al. (2022) studied the experience of various companies that faced a systemic crisis and, accordingly, a significant reduction in both revenues and losses. In their opinion, in such conditions, it is possible to increase the EBITDA indicators by increasing the efficiency of the company's cost management. At the same time, they did not define the essence of this process, nor did they reveal the specifics of its optimization.

Krysta and Kanbach (2022) concluded that the optimization of new information technologies will permit companies to more effectively manage international production chains, including at a distance. At the same time, they did not disclose the expediency of expanding opportunities for companies to obtain cross-border loans in portfolio investments. Korteweg (2022) believes that the information productivity of firms depends on the quality of monitoring of direct and indirect costs of information technologies, but the researcher did not determine how the available resources of the enterprise can be optimized for its effective development, particularly investment resources. In their research, Wilson et al. (2022) proposed a model of the optimal portfolio of projects, which involved the use of a neurofuzzy approach. At the same time, they did not disclose the impact of the developed model on the optimization of business processes of the outsourcing company.

Xu et al. (2017) examined traditional cost control methods and their limitations, proposing a digital-era approach for cost control and value creation. It highlights how digital infrastructure like cloud computing and the internet reduces information acquisition costs but increases resource search costs. The study suggests employing Extenics, a method for resolving contradictory problems, combined with intelligent management, as a means of addressing these challenges. The proposed intelligent cost control system integrates physical information systems and utilizes real-time resource data and big data for strategy generation.

Su and Tang (2016) examined the impact of different business strategies on economic performance, particularly focusing on innovation and cost-cutting strategies in the Canadian context. Utilizing data from the Survey of Innovation and Business Strategy, the study employs regression models and propensity score matching to analyze the relationship between business strategies and economic outcomes. The authors suggest that firms prioritizing product innovation tend to be more productive compared to those focusing on cost-cutting, although no significant difference is observed in profitability.

This research paper diverges significantly from conventional papers on value creation, presenting quantitative data on the application of cost reduction strategies with the objective of improving EBITDA. Moreover, the research paper will help practitioners make right decisions because it uses case study approaches which highlight the merits and demerits of the cost reduction strategies. By applying first-hand information from renowned companies and managers, practitioners will be able to navigate the arduous nature of value creation and capitalize on modernized schemes.

The objective of the study is to investigate the methods by which private equity firms can enhance the earnings before interest, taxes, depreciation, and amortization (EBITDA) of their portfolio companies through strategies aimed at reducing IT costs.

MATERIALS AND METHODS

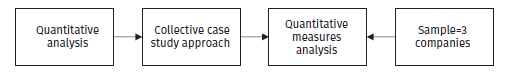

The study used a collective case study approach that involved simultaneous and sequential analysis of multiple cases to create a broader understanding of IT cost reduction strategies used by private equity firms to increase EBITDA and improve exit valuations. Furthermore, this approach was essential for elucidating the manner in which EBITDA affects divestiture valuation within the context of private equity (PE) environments.

A quantitative study design that included large sample sizes was also chosen to aid in the collection of statistical data. The accuracy of the obtained results was increased with the help of statistical data. Their use during the research made it impossible to show personal comments or bias the results, since the data obtained were mostly numerical and fair in all cases (Figure 1)

The model formulation process focused on establishing a set of key metrics that correlate with technology-driven value creation, namely "IT spend." Some changes in "IT spending" have been recorded using qualitative methodologies, and therefore the researcher's introduction of a quantitative aspect to the article is key in determining the effects of the three technology value creation strategies. Table 1 presents the measures to be checked.

Table 1 Measures Value-Creation Impact

| Measure | Value-Creation Strategy | Impact Estimate |

| IT Costs | IT Cost-Reduction | Moderate |

Source: Compiled by the author.

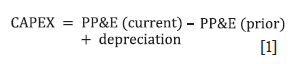

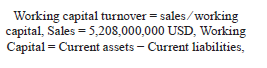

The study employed a series of quantitative measurements to ascertain the impact of the implementation of value creation technology on the organization's IT expenditure. The initial measurement was concerned with margin improvement, which entailed an examination of the enhancement in the profitability of an organization's income statement. The subsequent measurement employed in the study focused on the growth rate. The formula used to calculate (1):

where: PP&E - Property, Plant and Equipment.

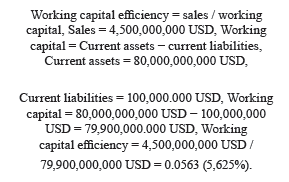

The penultimate measurement entailed an analysis of the efficiency of the use of working capital, employing the turnover ratio of working capital. The measurement was crucial for visualizing the value-creating impact of reduced IT spending on the private equity life cycle as they seek to increase EBITDA and improve valuation for exits. The quantitative case study approach involved a number of steps that were used in the data collection process as illustrated in Figure 2.

The first step was to define the case found on the formulated research questions. Next, cases were selected using a collective approach. The companies for analysis were selected on the basis of an analysis of current private companies in the US market and their former US portfolio company holdings (Vista Equity Partners, The Blackstone Group Inc., CVC Capital Partners).

The data collection process involved the analysis of financial information and annual reports provided by companies that considered the case with a fixed time horizon of 10 to 20 years. The final stage of data collection and analysis focused on re-viewing and sorting the data collected from the case studies.

Charts were created to display and interpret the information.

So, the study will utilize various quantitative measurements to ascertain the extent of the change in "IT spending" following the implementation of the value creation technology. The initial measurement will concentrate on margin enhancement, which assesses the growth in profitability of an organization's income statement. The subsequent measurement employed in the study will specifically target the rate of growth. The second-to-last measurement will entail analyzing the effectiveness of working capital utilization through the turnover ratio of working capital. The measurement will be crucial for visualizing the value-generating impact of decreased IT expenditure on the private equity life cycle, as they strive to enhance EBITDA and enhance valuation for exits.

RESULTS

Vista Equity Partners

The case study analysis of Vista Equity Brother reveals that the company employs a strategy of baselining, which assists in the identification of potential avenues for IT cost reduction. The baseline strategy defines the expected values and conditions against which all performances are compared with the baseline serving as the fixed reference point. The baseline further analyses the current performance of the information technology systems against the anticipated levels for the specific tasks within a pre-established time phase. Instead of this, the anticipated levels for the company were focused on improving the EBITDA margin which has tripled over the past five years. Since the introduction of baseline strategies, the company has recorded EBITDA rates of up to 120 million with the portfolio companies reporting influxes in earnings by 29% and 2.2 on an annual basis (Fintel, 2023). Owing to the impressive performance and growth, the baseline strategy has reduced costs effectively with the company's net worth hitting highs of 86 billion USD in assets under management. As of 2021, the EBITDA margin for the company was set at 22.2%, representing an increase from the 20% reported in the previous year.

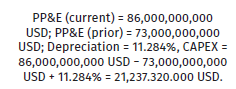

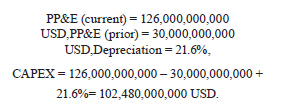

In order to effectively manage capital expenditure, the private equity firm has implemented initiatives such as sourcing optimization, which have significantly reduced IT operating expenses. The sourcing optimization initiative entails the implementation of schemes that optimize the utilization of IT resources and circumstances, thereby enabling Vista Equity Partners to achieve its objectives (Vista, 2021) to find the most effective and quality schemes. Through this strategy, Vista Equity Partners has been able to increase savings potential as elucidated in its capital expenditure rates. As of 2021, the firm's capital investments were set in accordance with the calculations:

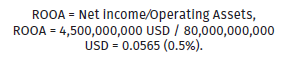

The combination of the baseline and sourcing optimization strategies has come in handy in reducing IT costs in the firm by offering insight into how much the firm is spending on the systems and how much they are getting in return. The baseline strategy has set a point of reference which allows Vista Equity Partners to check its annual spending on system/infrastructure. The EBITDA for the firm as opined prior is 22.2% while the revenue was 4.5 billion USD with its current operating assets being set at 86,000,000,000 USD. Thus:

The ROOA is a clear indication of the fact that Vista Equity Partner has thus far been able to manage its expenses and IT costs through the baseline and sourcing optimization strategies. The latter is quite useful for the company as it helps it determine the risk and return profile. This, therefore, enhances the efficacy of decision-making processes with regard to the generation of value for the firm in both the short and long term. The application of IT cost reduction strategies which are driven by the chief financial officer/chief information officer (CFO/CIO) organization has played a role in improving the EBITDA levels at the company. The CFO, Lauren Dillard, works in tandem with Brent Lanier to evaluate the technology resources at its disposal and their ability to generate sales and working capital. Thus far, the company has been able to increase its working capital turnover rate to 0.0563 (0.5%) with the data:

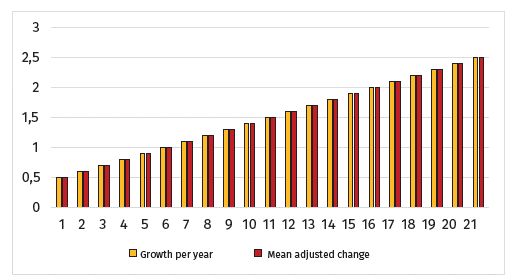

The working capital efficiency is similar to the ROAA with the data revealing that the company is operating efficiently. This result is further informed by the fixed asset utilization data which is derived by dividing the sales by the fixed assets to bring the fixed asset utilization (FAU) to 0.0565 (Fintel, 2023). Suffice to say that the operations of Lauren Dillard and Brent Lanier have helped in the reduction of IT costs and improvement of the EBITDA levels in the company. The combination of baseline strategies, sourcing optimization as well as CFO/CIO involvement is attributed to changes in the profitability and revenue creation rates at Vista Equity Partners (Figure 3).

The EBITDA results show that the three strategies had an extraordinary effect on the company’s performance over the past 5 years with a t-4 mean change being recorded. In fact, the EBITDA margin shows that the PE firm has statistically significant better results when it comes to profits compared to its peers. The mean changes are commingled with the EBITDA with the operating profitability increasing by a rate of 2.2% annually (Hughes, 2013). In light of this, the PE firm creates value through margin expansion and technology-driven strategies.

The Blackstone Group Inc.

Blackstone Group implements the use of sourcing optimization strategy which helps in streamlining the procurement and approval of investments. Most recently, the company acquired the Coupa management solution which has optimized Blackstone Group's operations with collective spend intelligence being driven across the case company (Blackstone, 2012). Thus far, the company's EBITDA has increased by an annual rate of between 2.5% and 560.14% from 2018 through to 2021 (Blackstone Inc., 2023). As of 2021, the company's EBITDA was set at 12,115,000.000 USD which was a 560.14% increase from the number reported in 2020 at 2.86 billion USD (Blackstone, 2021, 2022, 2023).

The sourcing optimization strategy towards Coupa management solutions have allowed Blackstone to better manage and estimate its capital expenditures. The solution streamlines the amount of money spent by the firm on fixed assets and investments (Blackstone, 2021; Hughes, 2013). Furthermore, it defines the consistent processes in the investment portfolio with the data helping in the identification of opportunities across the company and fund levels at Blackstone Group Inc. Similar to Vista Equity Brother, the case firm has increased its savings potential with the CAPEX rates as of 2021 being set at 102,480,000,000 USD:

At Blackstone Group, the use of sourcing optimization has gone a long way in increasing capital efficiency levels. This is attributed to the fact that the strategy evaluates payment strategies for vendors and the number of investment funds pumped into the fund level. Furthermore, it leverages external resources while ensuring that the company invests strategically. On top of this, sourcing optimization has allowed the firm to make continual improvements to its operations on a daily basis while continuously monitoring performance against its goals and analyzing gaps with the aim of determining their root causes. The sourcing optimization has established a closed-loop procedure that links cash management processes at the fund and company levels. This has inadvertently improved decision-making as well as control with the end outcome being an influx in operational flexibility (Choi et al., 2020).

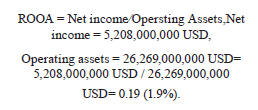

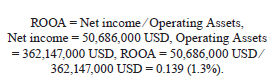

Statistical data from the company reports reveals that the revenue/net income has increased substantially to 5.208 billion USD as of 2021 which was a 567.97% influx from the amounts recorded in 2020 at 1.045 billion USD (Blackstone, 2021, 2022, 2023). In 2018, the company had a net income of 2.05 billion USD which was a 32.49% increase from the 4.79% reported in 2017. The asset growth rates brought about by the sourcing optimization strategy were set at 39.03 billion which is a 55.89% increase from the 26.269 billion USD recorded in 2019. Between 2017 and 2018, the firm reported an increase in asset growth from 28.925 billion USD to 32.586 billion USD by 12.66%. The ROAA has additionally gone up due to sourcing optimization with the below calculations confirming the assumption:

As shown in the preceding section, the ROAA of the company is set at 0,19 which positively contributes to the working capital efficiency. As the number of ROAA increases, so does the working capital efficiency of Blackstone Group. The sourcing optimization has permitted the firm to reduce its working capital when it comes to the use of technology. The working capital efficiency as of 2021 is estimated at:

The company's fixed asset utilization rate is set at 0,19, which indicates that the sourcing optimization strategy has been effective in improving its working capital efficiency. The working capital shows the extent and solvency levels of the Blackstone Group with the sourcing optimization permitting it to review short and long-term strategies (Kaplan & Strömberg, 2008). The flexible investment policies adopted by Blackstone Group are substantial in driving more capital in current assets which results in the increased opportunity cost of profitability. Furthermore, the company has been able to maintain a larger portion of liabilities in its capital structure with the profitability going up through EBITDA influxes caused by the fixed asset utilization.

The mean adjusted change for the company is estimated at t-4 similar to that of Vista Equity Partners. The EBITDA influxes have gone up by 0.19 on an annual basis which is correlated to the operating profitability as well as working capital efficiency. The sourcing optimization has therefore played a substantial role in helping Blackstone Group reduce costs and increase its operation value.

CVC Capital Partners

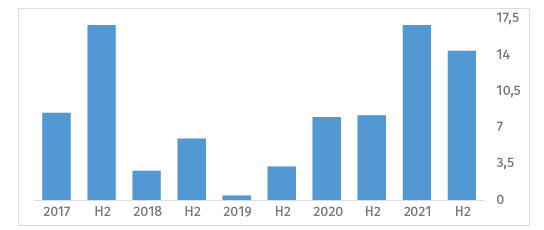

CVC Capital Partners employs sourcing optimization and baselining strategies, which permit the company to expand its margins. The two are primary sources of operational performance improvements as the company is able to achieve cost reductions that optimize its operations (Subirana, 2003). On top of this, baselining has rendered the requisite information vital in negotiating cost savings and enhancing the management of investments at the fund level. The end result is an influx in the EBITDA to at least 17.3 million USD as of 2021 compared to the 9.35 million reported in 2020 (margin expansion of 85.03%) as shown in Figure 4.

Source: Compiled by the author based on CVC (2022).

Figure 4 CVC Capital Partners EBITDA after the Introduction of Sourcing Optimization and Baseline Strategies

The case study analysis reveals that the sourcing optimization strategy has permitted CVC to develop its investments alongside existing technology alliance strategies. The sourcing optimization provides information on which investor assets can be used to improve profitability and EBITDA levels. Thus far, the CAPEX rates at CVC have gone up to 38,900,000 USD after the introduction of the sourcing optimization strategies:

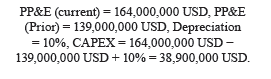

The baseline measures as well as sourcing optimization strategies have been substantial in increasing the net income for the company from 18,707,000 USD in 2020 to 50,686,000 USD in 2021. The operating assets have also gone up from 332,249,000 USD to 362,147,000 USD in the same period. The ROOA for the firm is set at 0.139 which is an indication that the strategies have allowed CVC to return most of the finances spent on assets and investment portfolios:

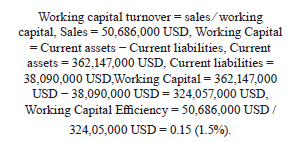

With a ROAA of 0.139, CVC has been able to improve its working capital efficiency with the baseline permitting it to define business and corporate-level strategies. The definition process has allowed it to reduce costs and improve profitability. Currently, the working capital turnover is set at 0.15, which is well within the industry average:

Given that the working capital efficiency is low at 0.15, it can be reasonably assumed that the mean adjusted change is at t-3. This is due to the fact that the case firm has invested a moderate amount of its financial resources and profits into the fund level. Moreover, the performance rates are considerably lower than those of its industry peers. Nevertheless, the implementation of baseline and source optimization strategies has enhanced operational efficiency and overall EBITDA. Table 2 further demonstrates that sourcing optimization, when employed in isolation, is likely to result in an increase in the margin, capital efficiency, CAPEX, and working capital efficiency. This strategy ensures that information technology resources are utilized in an efficient manner, with quality schemes being implemented to minimize waste.

Table 2 Quantitative Peer Comparison Data

| Peer Comparison | |||

|---|---|---|---|

| Vista Equity Partner | The Blackstone Group | CVC Capital Partners | |

| Strategies | Baseline/Sourcing optimization/ CFO and CIO involvement | Sourcing optimization strategy | Sourcing Optimization/ Baseline strategies |

| Margin Expansion | 22.2% | 560.14% | 85.03% |

| CAPEX | 21,237,320,000 USD | 102,480,000,000 USD | 38.900,000 USD |

| Capital Efficiency | 0.0565 | 0.19 | 0.139 |

| Working Capital | 0.0563 | 0.647 | 0.15 |

| Efficiency | |||

| Mean Adjusted change | t-4 | t-4 | t-3 |

Source: compiled by the author.

Table 2 suggests that the implementation of three key strategies, namely baselining to identify opportunities and levers, sourcing optimization, and CFO/CIO involvement, is essential for the expansion of margins while reducing capital expenditures. This is because the baseline strategy lowers the IT cost base with unnecessary items or processes being eliminated. Furthermore, it simplifies the investment and data collection processes with the company budget being maintained. The cost variances and performance of the IT systems at the firms are estimated using the baseline strategy with recommendations being provided on the way forward.

DISCUSSION

Throughout the investment lifecycle, private equity firms strive to enhance EBITDA (earnings before interest, taxes, depreciation, and amortization) to assess the potential for divestment. Vista Equity Partners, The Blackstone Group, and CVC Capital Partners have successfully improved their EBITDA by implementing IT cost reduction strategies. The primary focus of these strategies is to optimize IT costs. The strategies primarily concentrate on identifying and eliminating inefficiencies while enhancing the financial worth of the private equity (PE) sector at both the fund and company levels. It is crucial to acknowledge that the issue of whether the EBITDA improvement resulting from IT cost reduction can be sustained is still unresolved. Optimizing IT spending and eliminating waste can lead to long-term efficiency improvements. Nevertheless, if the cost reductions are excessively profound, they may merely yield a temporary financial surge, resembling financial manipulation, before adversely affecting operational capacities. The longevity of a company is likely to be determined by the continuation of strategic IT investments, coupled with careful reductions in less significant expenses. Examining the EBITDA trends over an extended period after implementation will provide insight into the long-term viability.

The margin expansion rates are bound to increase if the three strategies are combined. This is because the strategies expand the income statement profitability of the organization. The measure reflects the amount of revenue that remains in relation to the IT costs and other costs that are elucidated in the income statement. It is quite imperative to note that the income statement profitability is defined based on the perspective of the case study managers (Murugan & Ramprathap, 2022). Klonowski (2014) opines that while the shareholders are largely interested in the profit margin, the PE manager considers a comprehensive perspective which is oft focused on the EBITDA margin. The EBITDA reflects the earnings that are generated prior to the remuneration of equity and debt. Moreover, finding a reasonable profitability and valuation measure is determined by its persistence with regard to longitudinal sustainability as well as its predictability with regards to whether it is able to forecast the future in a smooth manner.

The sourcing optimization systems dole out insight on how much companies are spending on the systems and the returns generated. The IT cost reduction strategy maximizes savings via leveraged power with the firms gaining an ability to standardize processes and best practices. Casalino et al. (2019) opines that there is a need for firms to adopt private marketplace models when introducing sourcing optimization strategies. The marketplace models nix the siloed approach to decision making with the necessary market information being collected (Jonny, 2022). Furthermore, the information permits the management to gauge how it can improve EBITDA by cutting its operating expenses while improving the total revenue.

The inclusion of the CFO/CIO is momentous in determining the direction of the organization. The two leaders use their capabilities in the execution of investment theses that increase EBITDA rates in the divestment context. Furthermore, they provide guidance on operational excellence and the specific support systems that can uphold the strategic decisions made by the top brass. It is imperative to note that the CFO is tasked with linking the portfolio company with the investors while the CIO builds relationships with other leaders. The relationships are substantial in determining which areas require cost-cutting and continuous improvements.

The analysis of the results and discussion shows concerns regarding the impact of IT-cost reduction on the EBITDA. This is because the EBITDA measurement might overstate the true profitability of the company in industries that are asset intensive. The overstatements are brought about by the exclusion of depreciation. Other critics argue that the EBITDA calculation cannot be used as a performance indicator due to the fact that it does not take into account working capital changes. This is an indicator that the liquidity of a firm might fluctuate along with the capital expenditures, taxes, and interest rates. Additionally, the EBITDA excludes interest on debt as well as capital expenditures, thereby failing to provide a comprehensive estimation of a firm's cash flow generation rates.

Although the IT cost reduction strategies in the cases studied showed an increase in EBITDA, overly aggressive cost-cutting comes with certain risks. Haphazard IT budget cuts can hinder critical investments in innovation and modern technology platforms, leading to a decline in a company's competitiveness over time. In addition, severe spending cuts can damage employee morale and retention if they are perceived as draconian, making it difficult to attract and retain the best IT talent.

Rather, a balanced approach will likely be required to ensure that strategic IT investments remain funded along with pragmatic cost optimization.

On the contrary, the enhancement of the EBITDA is cited by researchers as useful in increasing profitability in absolute terms. The EBITDA margin is calculated by adding the operating income (EBIT) to the amortization and depreciation (Harbula, 2015). The data derived from the calculation can be used to compute the EBITDA ratio whereby the EBITDA is divided by the net sales. The EBITDA measurement enables management to evaluate the net income of the firm while determining the debt service coverage ratio. Moreover, the EBITDA margin measurement is pivotal in determining whether the firms in the collective case study are able to standardize their performance against industry averages. The EBITDA formula provides a fair lens of how well the business is performing while calculating the revenue and cash flow. At that time, Brown et al. (2021) found in their research that some firms can manipulate the EBITDA margin. The researchers gave an example of when such firms give up divisions that are less profitable for the company. The results obtained in the study are consistent with this conclusion. This is because in both works it is proven that the mentioned actions of the companies lead to an influx of activities that are not related to real improvements or changes in the activities of the target company. Thus, the general conclusion is that with the help of EBITDA manipulation, companies can falsify the results of their activities and, in particular, to artificially improve them. In addition, it should be emphasized that similar actions of companies are also aimed at the liquidation of divisions that are economically unprofitable for them and negatively reflect on their investment balance.

According to Heinrich (2023), if a firm has a negative EBITDA, there is a high probability that the organization has low cash flow. A similar position was found in this study, namely, it was established that a positive EBITDA is a sign that the company is highly profitable. With the help of comparative analysis, Heinrich conducted a study of various factors that directly affect the company's investment balance. The effectiveness of this process depends on the correct selection of attachments that are the objects of comparison. The general conclusion in the studies is that high employee turnover indicates that the day-to-day operations of the firm are optimized. Based on this, in the case of obtaining low coefficients, it is advisable to assert the deterioration of the enterprise's productivity, as well as to develop measures to increase this indicator.

Effective implementation and sustainable IT cost reduction requires robust organizational change management. Leadership support that signals strategic priority is essential, as well as trans- parent communication of vision and goals. Building a culture of continuous improvement and cost awareness is vital for sustainable optimization. Proper governance mechanisms must be in place to evaluate IT investments, identify losses, and monitor performance against targets. Employee engagement and incentives related to cost control can further reinforce desired behaviors.

CONCLUSIONS

To summarize, implementing strategies to reduce IT costs can significantly enhance EBITDA rates and levels in the context of PE divestment. The previous report provides quantitative findings on the implementation of IT cost reduction strategies in three companies, demonstrating that all of them lead to an increase in EBITDA levels. Recommendations suggest that combining the strategies of baselining, sourcing optimization and involving the CFO/CIO can greatly enhance value, potentially increasing it by a factor of ten. It is important to mention that while the study findings were consistent in all three cases examined, it may be excessive to generalize them as a universal conclusion for all private equity exit scenarios without additional evidence from a larger sample.

Within the framework of the study, the experience of three companies, namely Vista Equity Brother, The Blackstone Group Inc., CVC Capital Partners, was considered. It is established that the first company systematically uses basic strategies, on the basis of which the factors of IT cost reduction are possible. Vista Equity Brother is actively engaged in the management of capital costs, and therefore independently created a mechanism for optimizing suppliers. The latter, in turn, play an important role in the context of reducing the company's IT operating costs. Thus, the approach consisting of a combination of basic and special supply optimization strategies is effective and allows reducing IT costs in the firm. As for the Blackstone Group's approach, the study found that it is based on a procurement optimization strategy. As a result of its implementation, a closed loop is created, which allows tracking of cash transactions at the firm level. CVC Capital Partners' experience, which is based on the optimization of sources and basic strategies, was also revealed during the research. On the basis of these two approaches, there is an increase in the company's operational efficiency, which contributes to the reduction of IT costs. Consequently, the company is able to utilize its IT resources in a more effective manner in the short term. In the subsequent scientific works, it is recommended that the potential for increasing EBITDA through the application of artificial intelligence be explored. The study provides quantitative evidence that the implementation of IT cost reduction strategies such as baselining, source optimization, and CFO/Director involvement can increase EBITDA for PE firms during the divestiture phase in all cases examined. However, given the limited sample size, future research could examine the implementation and performance evaluation of these strategies across a broader range of PE portfolios and industries. Furthermore, as cost optimization technologies and techniques continue to evolve, there is a need for further research to develop more sophisticated cost optimization models that incorporate newer techniques such as artificial intelligence, with the potential to further enhance EBITDA.