1. Introduction

The proliferation of the COVID-19 pandemic brought consequences to the world economy, primarily on productive activities, domestic and foreign trade, and increased unemployment (International Air Transport Association, 2021). The health crisis declared worldwide affected the usual operations of the world economies (Coelho de Azevedo et al., 2021). The most acute economic crisis of capitalism since 1930 came to be through direct impacts on industrial sectors and organizational realities (Bárcena and Cimoli, 2020). Production cycles and chains, the generation of tangible and intangible products, and work methodologies were altered (Abeles et al., 2020). In general, the economic situation of companies worsened, including social and health aspects (Barcena and Cimoli, 2020).

This scenario, comparable to the post-World War II contraction (World Bank Group, 2020), was evidenced during early 2020 with a sharp fall in production in Latin America, the United States, and the United Nations Organization (UN) (2020). Changes in the supply system, mobilization of goods, and new restrictions onset by COVID-19 created a new competitive environment for organizations.

This new environment affected organizations worldwide, the impact of which was felt more strongly by micro and small companies due to the high financial costs they had to bear not to cease operations. Sharma et al. (2020) quantified this effect and found that companies with less capital bore up to 99% of financial risk, compared to 26% attributed to resource changes.

Large companies with the most robust global presence were the least affected. Many of them marketed staple products required to meet the primary needs of society. Small and medium-sized companies suffered heavily from this situation due to needing more resources and skills to meet the logistical challenges. Logistics flows and Supply Chains (SC) activities suffered changes, mainly due to the disruptions arising at the time and the implications for operating costs. The SC, its process management, and logistics operations were directly affected (Melean and Torres, 2021).

There are specific cases from the most involved sectors in Europe and North America; among them, the aviation sector stands out, whose reduction in unit production rates brought on losses of more than USD 800 billion in 2021 (Belhadi et al., 2021). The same occurred with the global air transportation and the automotive sectors, with shreds of evidence of disruptions in people ‘s mobility.

Peru’s hake fishing sector opted to generate small yet efficient value chains based on the impact of COVID-19 to promote artisanal fishing, address the need for employment, and possibly relieve difficulties in the face of the different challenges that the sea typically brings SC in this region (Grillo-Núñez et al., 2021). Per Ivanov and Dolgui (2020), the only way to pull through difficult circumstances is to build an interconnected network of supplies that prevents anything from disrupting efficient SC performance or to bring in change agents to advance developed processes over time (Kumar et al., 2020).

Notably, within the logistics performance index that assesses 163 countries, Peru ranks 83rd in logistics work, whereas Chile is better positioned in 34th place, followed by countries such as Panama, Mexico, Brazil, and Argentina (Candiotti et al., 2023). The result of inadequate management accounts for problems in efficiency indicators (Moreno et al., 2021) when considering that the human factor is a crucial element for value generation (Ponce et al., 2017) and addressing supply chain adaptability.

Timely decisions and actions are critical in situations such as this to establish efficient logistics processes at the supply chain level (Ramos et al., 2022). Resilience and the search for new markets are moving towards better conditions and management. This is why Peruvian society and the world are creating jobs and better advantages, to work more to satisfy the needs of the citizens.

Supply chains regained strength in the face of pandemic-onset disruptions, proving adaptability and experience in the face of changes in markets and society. Despite the collapse caused by international wars and natural disasters, the owners of SC are working tirelessly to maintain a continuous flow of operations, leading to the supply of inputs and products (Moreno et al., 2021). According to Ivanov and Das (2020), supply chains should be protected even more under challenging periods for the country and the world. Creating a new, more dynamic, and co-evolutionary environment will promote the modeling of deeply rooted chains through technology. A competitiveness factor for a country’s growth is good consumer-company connectivity at national and international levels.

Given the importance of acknowledging and correctly implementing supply chain management, this research aimed to analyze its performance in Peruvian companies, emphasizing the adaptability of the developed logistics processes. The aim was to measure the degree of significance of the variables that support supply chains in producing favorable results, all of which lead to successful supply chain management in companies across productive sectors.

2. Materials and method

The research is based on the positivist paradigm under a quantitative, deductive, analytical, and synthetic approach (Carhuancho et al., 2019). A questionnaire was designed for this research to collect information; experts assessed it, and we improved it following their recommendations and suggestions. An adjusted version was obtained and applied to the sample of the selected companies.

Instituto Nacional de Estadística e Informática (National Institute of Statistics and Informatics) [INEI] (2022) data was used to determine the sample, corresponding to the Economically Active Population (EAP) of Metropolitan Lima. Out of 5,288,854 people, those working in companies engaged in the production of goods or services and/or national, international, or transnational logistics operators were taken into account, and a sample of 343 collaborators was attained from this source.

These collaborators belonging to trading companies (23%), distributors (16%), industry (9%), and logistics (52%) were grouped into Peruvian companies (74.3%) and foreign companies (25.7%). The sectors considered included agro-industrial (2.6%), automotive (1.2%), foreign trade (11.4%), construction (2.6%), mass consumption (4.7%), mining and services (55.4%), and others (17.8%). These companies’ logistics processes and value chain performance were evaluated.

The data collection instrument was validated and subjected to Cronbach’s Alpha reliability test beforehand, and it yielded the following values: 0.869, 0.920, and 0.948 (n=60). These values, which afford the instrument high reliability, permitted applying it through the online survey technique. The data or responses collected online were downloaded into an Excel file and transformed into numerical variables to be processed in SPSS 26.00. Likewise, scales were applied per variable, and the description of the results with frequencies and percentages began.

Regarding gender and age of the sample, 51.3% were male and 48.7% were female with a small gender gap (2.6%) between men and women. Age fell into four groups, namely, a) 19-28 years (36.7%), b) 29-38 years (39.9%), c) 39-48 years (16.6%), and d) 49-58 years (6.7%). This distribution accounts for relatively young respondents at the forefront of these logistic processes.

Concerning the theoretical-conceptual evaluation, the contributions of Policarpo Vasquez (2022) were employed to measure logistics tasks in the supply chains as to procurement, storage, and distribution. The management of logistics processes was based on the proposals by Rojas (2021) framed in the dimensions of organization, processes, control, and implementation of improvements. Finally, the definitions of Vigo (2022) on suppliers, physical distribution, transportation, and external customers were considered as determining aspects of the supply chain.

3. Logistics in the supply chain: adapting to a new environment

Logistics involves integrated activities covering data generation, transportation, handling of materials, warehousing, and information exchange (Khan et al., 2019; Martel and Klibi, 2016). Proper logistics management breeds an efficient result in the supply chain, making the most of the environment and staff capacity, thereby ensuring efficiency in operations at the lowest possible cost and least resources employed (Cardona et al., 2018). Logistics involves planning across all supply chain phases to respond quickly to unexpected orders in a highly demanding environment (Romero et al., 2022).

Under this perspective, logistics operators, trading companies, and goods distributors use non-invasive, sustainable-over-time tools. This allows adjusting processes to meet the needs of internal and external customers (Aldakhil et al., 2018). The supply chain represents a unit where various tools and work systems are implemented to ensure efficient process management and logistics flow (Shibao et al., 2017). It ranges from the raw material stage (extraction) to the final use and related information flows (Sánchez et al., 2021).

In Latin America, supply chain operations are continually seeking to be improved while pursuing the advancement of Industry 4.0 (I4.0) (Ghadge et al., 2020; Schmidt et al., 2015; Glas and Kleemann, 2016; Luthra et al., 2020; Yadav et al., 2020). However, these are still being implemented (Luthra et al., 2020; Luthra and Mangla, 2018). The goal is to implement adaptive supply chains capable of coping with unexpected events and deliver timely responses with few faults and operations at optimal levels (Dubey et al., 2019).

According to Policarpo Vasquez (2022), when designing global-reaching supply chains, the focus centers on the fluidity of logistics operations, from procurement to storage to distribution phases. To reach the expected performance, these phases, part of the supply chain, generate a competitive advantage based on ideal and harmonious relationships with suppliers and distributors. An integrated supply chain reduces weaknesses while creating links between participating companies and the producers of goods and services (Banda et al., 2022).

The procurement phase is a strategic area of the supply chain since it is responsible for providing timely responses to demands and satisfying company needs through external sources. It includes planning and managing purchases to keep minimum stocks of raw materials and inputs (Peña et al., 2022). Procurement is the process of acquiring external goods or services to meet the company’s internal needs (Bolaños and Luna, 2019).

Storage is a part of logistics to safeguard items or stocks (Espitia et al., 2019). In this phase, precautions are taken to prevent raw materials from becoming damaged or altering their original composition. Meanwhile, distribution, as a process, bridges production with the market and is linked to logistics operations through market requirements (Fontalvo-Herrera et al., 2019). Distribution refers to the flow of raw materials, capital, and information in a national and global competitive environment, allowing the company to create an adequate work system conducive to developing new market sectors (Neng Chiu, 1995).

When correctly implemented, the processes involved in the phases described above can bring about financial benefits for companies and make a difference to customers who demand adaptability and timeliness. These phases, their stakeholders, and activities are shown in Table 1.

Table 1 Stages in the supply chain: Key stakeholders and activities

| Stages in the supply chain | Stakeholders | Activities |

|---|---|---|

| Procurement | Providers | Demand planning - Responding to the market |

| Planning and implementing purchases of raw materials and inputs | ||

| Satisfying internal and external company needs | ||

| Storage | Company | Store items in the appropriate space |

| Safeguarding and preserving goods | ||

| Distribution | Distributors | Ensuring the flow of goods, capital, and information |

| Ensuring product delivery |

Source: Authors’ own elaboration.

Supply chain management requires handling the processes of different areas and interacting with distributors as best as possible to forge a functional structure based on precise and efficient processes. Working based on this is essential since one of the problems companies face is a need for better process analysis to add value to the final product or service. Given these arguments, correct logistics planning is essential (Torres et al., 2017).

Mubarik et al. (2021) ascertain that companies should develop follow-up strategies throughout the CS to maintain a transparency policy in the face of any situation. Creating healthy relationships and continuous improvement with suppliers and customers will afford the entire CS traceability throughout all its processes and activities by having transparent and standardized procedures developed within a highly competitive environment (Melean and Torres, 2021).

4. Results

4.1. Supply chain: performance and processes

When addressing this phase of the chains of logistics in the companies studied, specifically the supply phase, 79.6% of the participants indicated that they usually do some demanding planning and, based on the results, they plan purchases of raw materials, inputs, and everything needed in the production process (75.8% with positive results). They also considered internal and external customer satisfaction (74%) and customer service (77.6%), which are fundamental for orders to arrive on time and as promised.

In analyzing the suppliers’ role as central players in logistics processes, these were observed to perform actions conducive to contributing, as required, to the performance of supply chains, logistics-wise. They negotiate and enter into agreements in search of efficiency and fluidity of operations. Companies have a portfolio of suppliers regularly evaluated to ensure the essential resources for production and/or distribution.

Thus, 84% of suppliers completed orders as requested in the expected timeframe and conditions, while 81.9% claimed to meet biosafety protocols in the context of COVID-19. A relevant fact is that when faced with contingencies, these suppliers would implement quick solutions (65.3%). Regarding this way of working, Santos and Ruvalcaba (2020) believe that socioeconomic contingency factors are not always easy for organizations to control; however, economic resources, logistics, people, physical network, capabilities, routines, established processes, knowledge, experience, skills, and commitment are deployed as enablers in such circumstances.

Regarding storage, the surveyed companies possess adequate space for storing goods (79.9%) and are cautious in preventing raw materials from being damaged or altering their composition due to exposure to light, temperature, etc. (74.2%). Interestingly, 77.2% of respondents consider that storage-related decisions are made considering the characteristics of the goods and the number of people working in this storage area (65.9%). The warehouses can inventory raw materials according to the needs of the production area (89.2%).

Concerning the distribution stage, this process links production with the market and influences logistics operations (Fontalvo-Herrera et al., 2019); our results align with the information in the Kardex or inventory system (80.8%). The distribution of materials prioritizes safety throughout the process until delivery to the recipient (74.3%). Products are delivered to external clients within the agreed-upon timeframe (78.7%) and meet technical specifications as offered (77.6%). In total, 77.3% of respondents consider that the company observes clients’ requirements, with 76.7% highlighting the post-sale service.

The companies studied have policies in place to ensure staff personal items and resources as needed for moving products (80.1%). A fundamental factor is respect for the agreed-upon delivery deadline. The companies plan distribution and hand each carrier a route sheet with the expected timetables and intervals of tolerance as a preventive measure should there be traffic or any other unforeseen situation (79.1%). However, a common weakness we identified is that employees do not follow policies for locating merchandise in the warehouse; when new merchandise is stocked up, they opt to place it on top or in front, causing the products or materials left underneath or behind to be discarded due to expiration or damage (60.1%).

In this phase, the companies resorted to Ministry of Health biosafety policies (84.2%) to safeguard their collaborators, the fundamental pillar of this process. A key detail is that 82.8% of the companies had contingency plans if a unit suffered an accident or malfunction and that transportation units met the minimum conditions for handling finished products (79.3%). The distribution process adds value in terms of time and location from suppliers to the client (Gutiérrez et al., 2010).

4.2. Process management: A support for logistics tasks

Process management is based on the concept of Rojas (2021), who acknowledges that organization, processes, control, and implementation of logistics improvements ensure the supply chain’s satisfactory performance. All stages of the supply chain generate added value to the product.

In terms of organization, companies prioritize occupational health and safety (81.3%). Employees perform the tasks established in their job manuals, which they are made aware of in the induction process the moment they are employed (78.2%). The execution of the strategic plan is a critical and transcendental document, which has been adjusted to achieve long-term objectives (79.0%).

Regarding the internal processes in place, employees’ responsibilities (74.4%) have been foreseen and delimited according to their duties, in addition to the competencies outlined in management documents (74.9%). As for control, indicators are intended to measure process efficiency (76.7%), permitting, according to the results obtained, the implementation of programs and strategies to increase employee productivity (81.7%) following the market’s demand and the company’s planning.

On the other hand, new philosophies were implemented (70.5%), and methods (78.5%) were aimed at improving the management of each organization so that they could be competitive in a market that was becoming increasingly demanding in terms of product quality and delivery.

Process management is based on structured, controllable activities that guide an organization’s strategic planning, such as Lean Manufacturing and Just in Time (Belekoukias et al., 2014). Companies are organizations created to meet the needs of the public; thus, they are constantly updated.

By planning their activities, companies seek to earn income and build personnel skills by training them to face changing environments (Colina and Albites, 2020).

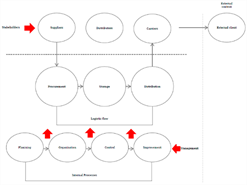

Process management is considered the most essential part of a company’s operations; It comprises a set of stages that maintain an ordered structure and create logical results in a productive process (Maldonado, 2011). As can be seen in Figure 1, the behavior of the supply chains of Peruvian companies, their main actors and the processes carried out. The generation of value, whether by customers or internal or external suppliers, is the determining factor of process management (Jordan et al., 2017). Through the generation of value, companies continually improve, translating into the evolution of the organization’s management (Suárez-Barraza and Miguel-Dávila, 2011).

5. Conclusions and discussion

COVID-19 created dissimilar and volatile conditions for individuals and companies. At the supply chain level, the fragmentation brought about by the pandemic affected the logistical flow, thus demanding the deployment of strategies to minimize the risks from such fracture and irruption. Many companies were concerned, and studies were developed to assess the determinants of their performance and the best way to move forward in these scenarios.

The research made it possible to reveal, through precise data, the ability for adaptation at the level of logistics flows in Peru’s supply chains. Demand planning is vital in organizational activities, including purchasing raw materials, inputs, and everything appertaining to the production process. Internal and external customer satisfaction were also evaluated, assessing the services necessary to ensure that orders were delivered on time and as promised.

Regarding storage activities, the companies have sufficient space to store goods and take precautions to prevent raw materials from being damaged or altering their composition due to light and temperature. Storage-related decisions are made based on product characteristics and the number of workers in the area. Raw materials can be stockpiled in the warehouses per production area needs, and these materials are distributed according to the information recorded in the company’s Kardex or storage system.

Regarding delivery, companies studied have implemented policies for the shipping of goods. An essential factor is meeting delivery deadlines so the companies’ plans are one step ahead. Each carrier is provided with a routing sheet along with the expected deadline and intervals of tolerance as a safety measure in case of traffic jams or any unforeseen event. Safety is a priority throughout the materials distribution process until delivered to the recipients. These companies also implemented a biosafety policy following Ministry of Health directives to protect their business partners as a fundamental pillar. Notably, 82.8% of companies have contingency plans if a unit suffers an accident or damage. The transportation units meet the minimum requirements for the transshipment of finished products; the product is delivered to the external client on time and per technical specifications as prescribed.

Per process management, these companies prioritize occupational health and safety, and their employees follow the steps outlined in their job description, which they are informed of the moment they enter the production process. The execution of the strategic plan is a critical and transcendent document, and it must be adjusted to achieve long-term goals.

Concerning internal processes as established, in addition to the faculties specified in management documents, collaborators’ duties are provided and determined according to their functions. Control indicators are in place to measure process efficiency. The results allow the implementation of plans and strategies aligned with market needs and business goals to ensure employee productivity. Finally, the companies adopt policies to implement new ideas and methods to improve organizational management to be competitive in the increasingly mature Peruvian market through higher quality and meeting product delivery requirements.

Disturbances in supply chain performance are due to its processes and planning of its logistics (Hosseini et al., 2020). It is noteworthy that suppliers across the supply chain satisfy the requirement to complete deliveries within the expected timeframes and conditions while following the biosafety protocols due to COVID-19. Furthermore, suppliers have implemented quick solutions to meet unforeseen events, and companies in the study have a portfolio of suppliers regularly evaluated to determine whether they possess the necessary resources for production and/or distribution.

The supply chain depends on correct logistics planning and management of logistics processes, a key to further such tasks. Improvement, flexibility, and proper resource management are essential to create a resilient and efficient SC environment based on collaborative learning.