INTRODUCTION

Global Value Chains (GVCs) refer to the world as the global factory; however, productive disintegration and trade integration are mainly regional phenomena. More than a global factory, regional factories dominate the international trade of goods and services. Hence, regional trade integration has created favorable conditions for the establishment of GVCs. Nevertheless, it can be said that seeking participation in GVCs was the reason for trade integration with trade agreements that were GVCs-oriented.

According to Meng et al. (2019), it is possible to identify three regional factories with hubs and spikes: Factory Asia dominates the trade in that region, where China is the central hub. Factory North America mainly includes the North American Free Trade Agreement (NAFTA) partners, with the U.S. as the central hub and Germany as the main hub for Factory Europe. Among these networks, the most significant change occurred in Factory Asia, where the central hub was Japan in the 1990s. Since China became a World Trade Organization (WTO) member, its rapid and robust participation left Japan with a more secondary role. Li et al. (2019) estimate that high economic integration in regional production networks translated into high intra-regional GVC activities. Factory Europe is an excellent example, showing the highest share of intra-GVC activities among the three regional production networks. In recent years, China's participation in Factory Asia has increased intra-industry GVC activities getting close to the Factory Europe levels.

Latin American Countries (LCs) were searching for better positioning into the GVCs when COVID-19 occurred. There were concerns about GVC's weaknesses and resilience capacities; LCs also evaluated these challenges for the following years (OECD, 2021). The International Monetary Fund (IMF) argued that while developed economies present institutional strength, have well-equipped health systems, and have the financial resources to deal with the coronavirus outbreak, emerging markets are far from this position (IMF, 2020). Supply chains in emerging economies are characterized by low-trust relationships among firms and other stakeholders and high-cost intermediation, which results in low-efficiency processes that decrease their ability to rebound and reinforce their positions in GVCs (UNCTAD, 2020; ECLAC, 2020a). Another factor is the slowdown in international trade that occurred years before COVID-19. Antras (2020) argues that the pandemic is not a determining factor for a possible de-globalization of production. In the short term, global firms proved to be resilient to the impact of COVID-19, and no significant re-shoring processes are expected (Antras, 2020). Furthermore, D'Aguanno et al. (2021) found that re-shoring increases volatility in GVCs because of the concentration value chains on domestic suppliers.

The Latin American region is used to different disasters and crises; however, the coronavirus outbreak differs substantially in terms of scale, duration, and impact (Azevedo et al., 2020, Ocampo, 2020). The first case of COVID-19 in Latin America was registered on February 26, 2020, and the World Health Organization (WHO) declared the coronavirus a pandemic on March 11 (WHO, 2020). COVID-19 struck this region when an already undermined scenario was developing, including labor informality, low productivity levels, poverty, high-income inequality, and vulnerable health systems (ECLAC, 2020b, Barcena and Cimoli, 2020). The productivity gap between Latin America and the Caribbean region is nearly four times less than advanced economies (World Bank, 2020), severely constraining firms' management and global competitiveness. Adverse effects are evident in the functioning of agriculture, industrial, and services sectors that will last for several years or decades unless there is a more vigorous government response (Hevia and Neumeyer, 2020; Franz, 2020; Cottani, 2020). Furthermore, there is a need for a multi-stakeholder counteraction toward the coronavirus outbreak. These groups include civil society, academia, businesses, and a legitimate political leadership that could get together society's forces and tackles COVID-19 consequences in the short term (ECLAC, 2020b).

This article makes the case of why the pandemic crisis can help reopen the discussion of deeper regional integration in LCs to counteract the effects of global shocks in the future. We propose to evaluate this option against the alternatives of deepening the existing integration with regional hubs or seeking greater diversification with other hubs to reduce the vulnerabilities created by the instability of foreign markets. In that respect, the contribution of this article is the examination of the empirical literature on GVCs in the Latin American region. This review focuses on countries' participation in regional GVCs, the challenges of deeper regional integration, institutions' role in conducting GVCs-oriented policies, and how local firms could improve their performance, business opportunities, and competitiveness. A deeper regional integration discussion was not relevant in the years before the pandemic. LCs were facing problems with low economic growth, natural disasters, and political convulsions while increasing their participation in GVCs hubs. We claim that the pandemic crisis is an opportunity to bring back the discussion of regional GVCs in Latin American and the Caribbean countries as they assess their development model for the next decades.

Likewise, COVID-19 has made evident weakness in the GVCs that has questioned its long-term benefits for export-based developing countries. Since multinational corporations assess COVID-19's impacts on future more frequent shocks (McKinsey Global Institute, 2020), host governments of such investments should reevaluate their participation to reduce potential vulnerabilities from the external markets that may also affect many other medium and small-sized firms. According to Antras (2020), COVID-19 will not result in a slowdown in globalization in the long term; therefore, the pandemic has confirmed the need to reevaluate the integration alternatives of the LCs in GVCs.

The following sections contain an analysis of the development of GVCs in Latin America, their strengths and weaknesses, how COVID-19 has affected firms' managerial activities related to GVCs, and determine if the pandemic has been a breakthrough point for the GVCs in Latin America and the Caribbean region.

As indicated above, COVID-19 has been a wake-up call for the sectors that saw integration into international production chains to sustain their countries' economic growth. However, COVID-19 has revealed that this integration is weak. Therefore, it is essential to define whether to reduce these weaknesses; a more profound integration is needed, seek diversification with other GVCs, or promote a regional GVC.

LATIN AMERICAN COUNTRIES IN GVCS

This section analyzes the main characteristics of LCs' participation in the GVCs. There is extensive empirical literature that, from different perspectives, shows how these countries have inserted some strategic sectors' firms and their economies into GVCs according to their comparative and competitive advantages.

The nature and extent of participation in GVCs are far from even across Latin America and the Caribbean region. These countries joined GVCs in different periods. Mexico started early on in global production fragmentation with assembly operations in the northern border with the United States in the mid-sixties. Countries from South America and the Caribbean consolidated their participation, joining GVCs from China after 2000. Mexico's early participation gave this country a head-start in the manufacturing sector and paved the way for deeper economic integration with the U.S. It also meant that Mexico has a greater dependence on the North American market. South American countries have the United States as one of their significant trade partners; however, Asian and European markets are becoming more critical. Another characteristic of Latin American economic sectors and firms is their weak participation in the region's GVCs. Blyde and Trachtenberg (2020) calculated that the intra-regional foreign value-added in LCs was 5%, which is considerably lower than their Asian (18%) or European counterparts (24%). Likewise, Estevadeordal and Blyde (2016) estimated that 29% of foreign inputs for LCs were intra-regional and the rest from outside the region, particularly North America. This percentage is low when compared with their Asian counterparts (47%).

A country's participation in GVCs is measured as the sum of the backward linkages (BL) and forward linkages (FL). The Latin America and the Caribbean region show a lower BL than the world average, which means its exports incorporate a relatively lower proportion of foreign value-added. In contrast, exports based on natural resources are more predominant (i.e., mining, agriculture, and fishing), determining an FL type of participation in GVCs. This difference is also marked by which Factory they belong to. For example, manufacturing exports from Mexico and Central America (Factory North America) have high foreign input content and participate in the final production stages (BL). In contrast, South American and Caribbean countries (Factory Asia) specialize in exports based on natural resources processed in third countries to be exported again (FL). Table 1 describes the integration in GVCs as a percentage of the value-added of exports for selected countries between 1990 and 2018; also Table 1 includes the Association of Southeast Asian Nations (ASEAN) countries for comparison, as this region has successfullyintegrated GVCs. The percentages shown here are based on data coming from the UNCTAD-Eora GVC due to the availability of the latest information1.

Table 1: Selected LCs integration to GVCs: Backward and Forward Linkages

| Countries | 1990-1994 | 1995-1999 | 2000-2004 | 2005-2009 | 2010-2014 | 2015-2018 |

| Costa Rica | 36.69 | 38.86 | 38.69 | 41.98 | 40.50 | 36.76 |

| Backward | 22.52 | 23.76 | 22.73 | 23.90 | 20.54 | 18.46 |

| Forward | 14.17 | 15.09 | 15.96 | 18.09 | 19.96 | 18.30 |

| Mexico | 36.19 | 43.04 | 41.25 | 41.93 | 44.47 | 42.35 |

| Backward | 25.23 | 33.01 | 31.37 | 30.18 | 31.60 | 30.41 |

| Forward | 10.96 | 10.03 | 9.88 | 11.75 | 12.87 | 11.94 |

| Argentina | 28.87 | 30.25 | 36.90 | 43.01 | 41.44 | 38.22 |

| Backward | 6.87 | 10.52 | 15.19 | 19.77 | 19.71 | 18.80 |

| Forward | 22.01 | 19.73 | 21.71 | 23.24 | 21.73 | 19.42 |

| Brazil | 33.90 | 37.13 | 41.52 | 44.49 | 43.67 | 40.15 |

| Backward | 9.05 | 11.56 | 15.16 | 13.94 | 13.16 | 13.99 |

| Forward | 24.85 | 25.57 | 26.36 | 30.55 | 30.51 | 26.16 |

| Chile | 47.86 | 45.94 | 49.07 | 54.03 | 54.63 | 52.71 |

| Backward | 26.63 | 22.68 | 22.31 | 23.83 | 24.64 | 23.41 |

| Forward | 21.23 | 23.25 | 26.77 | 30.19 | 29.99 | 29.30 |

| Colombia | 29.28 | 30.60 | 33.77 | 36.26 | 36.15 | 34.84 |

| Backward | 9.34 | 9.60 | 12.92 | 11.18 | 9.89 | 8.69 |

| Forward | 19.95 | 21.00 | 20.85 | 25.08 | 26.26 | 26.15 |

| Peru | 39.64 | 41.70 | 45.46 | 51.07 | 50.42 | 45.00 |

| Backward | 8.64 | 8.56 | 8.53 | 10.15 | 11.11 | 9.86 |

| Forward | 31.00 | 33.14 | 36.93 | 40.92 | 39.30 | 35.14 |

| ASEAN(*) | 57.18 | 59.62 | 62.00 | 64.60 | 63.51 | 61.24 |

| Backward | 39.23 | 40.37 | 40.70 | 39.60 | 37.75 | 36.26 |

| Forward | 17.96 | 19.25 | 21.30 | 25.00 | 25.76 | 24.98 |

(*) Cambodia, Indonesia, Philippines, Singapore, Thailand, and Vietnam.

Source: authors' calculations based on UNCTAD-Eora Global Value Chain Database.

Table 1 does not show significant changes in the growing trend of GVC's participation until 2010 when the slowdown of globalization becomes apparent in the participation of most LCs and even for ASEAN countries. However, the differences between Mexico and Costa Rica with the selected South American countries are apparent. The former two countries show a definite backward linkages integration in GVCs, while the South American countries predominate forward linkages, particularly Colombia and Peru. ASEAN countries are included to compare the level of integration, and it is verified that they follow mostly backward linkages like Mexico and Costa Rica. Furthermore, ASEAN countries are integrated into production stages with high technological content, while the countries associated with the Factory North America predominate in more heterogeneous production stages. For instance, the Mexican automotive industry shows high technological content in its participation in GVCs; however, it is not the case for all industries (Sotomayor and Barajas-Escamilla, 2020). In contrast, Costa Rica is still predominant in low technological content production, although with emerging electronic and medical devices industries (Gereffi et al., 2019). Another determinant of the GVC participation is marked by the growing presence of China in world trade since 2000. The increased demand for commodities from South American countries influenced value-added exports with high forward linkages after 2000. In sum, LCs' firms were participants in the trade of products related to GVCs, although not homogenous and in different scales of technological content.

A more in-depth analysis of the bilateral trade relationships with the North American and the Asia GVCs Factories is shown in Table 2. The percentages corresponding to the value-added contributed by the partner in the total value-added exports of the selected LCs countries for 1990, 2000, 2010, and 2019. The United States is considered the central hub for LCs, and China as the main hub for Factory Asia. However, since South American countries are more diversified in their market destination, we include Germany as part of the analysis.

Table 2 Selected LCs Integration into Valued-Added Exports GVCs

| Partner | Costa Rica | Mexico | Argentina | Brazil | Chile | Colombia | Peru | |||

| United States | ||||||||||

| 1990 | 11.68 | 35.73 | 6.17 | 7.66 | 9.23 | 20.00 | 9.50 | |||

| 2000 | 19.09 | 38.02 | 7.57 | 8.81 | 10.34 | 18.95 | 11.01 | |||

| 2010 | 13.44 | 32.64 | 4.70 | 6.03 | 6.14 | 17.58 | 7.09 | |||

| 2019 | 8.20 | 27.45 | 2.97 | 3.83 | 5.56 | 9.54 | 3.28 | |||

| Partner | Costa Rica | Mexico | Argentina | Brazil | Chile | Colombia | Peru | |||

| Germany | ||||||||||

| 1990 | 12.03 | 7.22 | 10.26 | 16.81 | 15.41 | 13.96 | 18.55 | |||

| 2000 | 8.15 | 6.40 | 9.74 | 14.11 | 12.56 | 10.11 | 15.11 | |||

| 2010 | 10.57 | 7.67 | 10.05 | 14.73 | 12.66 | 10.75 | 14.72 | |||

| 2019 | 12.29 | 9.85 | 11.16 | 16.68 | 13.78 | 13.92 | 15.35 | |||

| China | ||||||||||

| 1990 | 0.15 | 0.23 | 0.28 | 0.75 | 0.65 | 0.13 | 1.29 | |||

| 2000 | 1.03 | 1.29 | 1.36 | 3.39 | 3.06 | 0.62 | 5.53 | |||

| 2010 | 2.21 | 3.35 | 3.15 | 7.39 | 7.05 | 1.43 | 12.79 | |||

| 2019 | 2.36 | 3.88 | 3.08 | 7.40 | 6.83 | 1.54 | 11.47 | |||

Source: authors' calculations based on UNCTAD-Eora Global Value Chains Database

Table 2 shows the significance of the U.S. industry as a hub for Mexico and Costa Rica, and to a lesser extent for Colombia. Germany seems to play a role in the trade of value-added exports for the rest of South American countries. As Table 2 shows, it would be too soon to conclude that China will replace the United States as the leading trade partner. Nevertheless, this Asian country is becoming an increasingly reliable business partner for LCs' firms participating in their GVC hub. Furthermore, Europe seems to have a stronger relationship with South American countries. The Free Trade Agreement (FTA) between Chile and the European Union in 2002 has favored these flows. Meanwhile, Brazil's trade relationship with European countries has been traditionally strong, even without an FTA (Martins and Imori, 2014). China's presence in the GVCs has changed these percentages gradually. Table 2 shows increases in the last two periods when China's presence in international trade was emerging. Antras (2020) predicts tensions in international trade between the United States and China that might affect a more significant presence of China in the GVCs. If that is the case, LCs have one more factor to consider in favor of regional GVCs.

De Groot (2018) ranks countries' participation in GVCs where Mexico (21) shows the best positions among LCs, while Brazil and Chile are placed in 44 and 45 in the ranking. Another characteristic is LCs' heterogeneous participation. Mexico and Central American countries show a slow but increasing participation in upstream production processes. Although it should be noted that there are cases in which it has been possible to climb to higher stages of technological content, such as the aerospace and medical device industries in Mexico (Estrada et al., 2016). Since South American and Caribbean countries participate in the early stages of production, the margin for adding more value-added is reduced. However, there are niches where small and medium enterprises (SMEs) found gains in high technological content exports, as Fuerst (2010) showed for GVC clusters in the 3D animation industry in Colombia. The high diversity in the origin and destination of extra-regional exports compensates for the lack of a high GVC participation, which can turn into a positive factor when looking at the opportunities for the region in the post-COVID era.

The integration of LCs in GVCs can be explained by reviewing the contributing factors. First, the economic liberalization process of the 1990s promoted economic growth based on the external sector, and a series of economic policies followed to achieve this objective. Second, LCs trade policies provided the economic environment to attract Foreign Direct Investment (FDI) in producing goods and services for the foreign market (Biglaiser and DeRouen, 2006). Third, regional trade integration was sought to secure free access to the destination market. FTAs were the ideal framework to encourage investment in the productive sectors aimed at exports (Bown et al., 2017). During these years, Mexico consolidated trade integration with the U.S and Canada with NAFTA's signing in 1994. Another critical element in the global economy happened with the entry of China into the WTO in 2000. Indeed, the emergence of China in international production networks was the most critical change since the disintegration of global production began in the 1970s. This country went through a structural change in its industrial and trade sector, from being a region for the final assembly of products to an increasingly complex part of GVCs that require the export and import of more sophisticated parts and components. This has affected the dynamics of the region where Asian countries are more economically interdependent with China. In the last two decades, China emerged as a central global hub for the formation of GVCs, being a primary actor that allowed trade connectivity in Asia (Meng et al., 2019) and other regions such as Latin America (Hou, 2019). China's entry into world trade had different effects on LCs' firms and how these organizations deal with management constraints and new trade challenges. For South American countries, it implied the access into the market of products based on natural resources that this country needed to sustain its double-digit growth (Banacloche et al., 2020). For Mexico and Central America, it meant greater competition for the U.S. market in labor intensive manufacturing products (Jenkins, 2011).

LCs were in this developmental phase of insertion when COVID-19 occurred. After more than a year, the economy's impact is still significant since mass vaccination has not yet been achieved. The main economic policy measures aim to alleviate short term impacts and sustain the health sector. The following section will see an analysis of COVID-19 on the external sector of these economies in more detail.

COVID-19'S IMPACT ON LATIN AMERICA EXTERNAL SECTOR AND GVCs The spread of COVID-19 led countries' authorities to react with lockdowns, quarantine periods, production site closing, and many other restrictions that affect worldwide economic activity (Seric et al., 2020). Gopinath (2020) stated that due to these GVC disruptions, more than 80 countries needed emergency financing packages. Even though the COVID-19 crisis was felt globally, organizations located in emerging markets have additional challenges to overcome due to the context's institutional weakness, inadequate health systems, crowded cities, and labor informality, among other issues (Young et al., 2014; Loayza, 2020).

At the time of the lockdown, the economic growth of LCs was the weakest for the 2014-2019 period (OECD, 2021). Moreover, in several countries, social and political upheavals risk what had been achieved in previous decades. For example, ECLAC (2020c) estimated that the coronavirus in Latin America meant the shutdown of nearly 2.7 million formal businesses and the loss of 8.5 million formal jobs. As a result, the year 2020 ended with a decline in GDP of 6.7 percent, and the GDP per capita returned to 2009 levels (OECD, 2021). Moreover, GDP does not measure economic well-being; it is too soon to estimate how life expectancy, education, and access to a decent living would recover in the coming year. Calculations by Mohieldin and Shehata (2021) show a backward trend in achieving the Sustainable Development Goals (SGDs) for 2030.

Latin America's response to the COVID-19 crisis was not homogeneous. The region swiftly launched economic policy measures (fiscal, monetary, and exchange rate) to contain the consequences of the health crisis due to the sudden economic shock (Bonadio et al., 2020; ECLAC, 2020b; Fugazza, 2020; OECD, 2021; UNCTAD, 2020; Loayza, 2020; Nixon, 2020). These economic measures applied worldwide did not have the expected results for LCs due to their structural problems before the pandemic. According to Ocampo (2020), the lack of a universal health system, the workforce's informality, and the lack of access to water and sewage services for the most impoverished populations made the measures implemented in developed countries ineffective for LCs. Furthermore, Loayza (2020) criticized the effectiveness of lockdowns in developing countries since most of the population is young, while COVID-19 was pervasive for the older population. Lockdowns in poor neighborhoods implied having six or eight people crammed into one room for an extended period, making the contagion spread even faster.

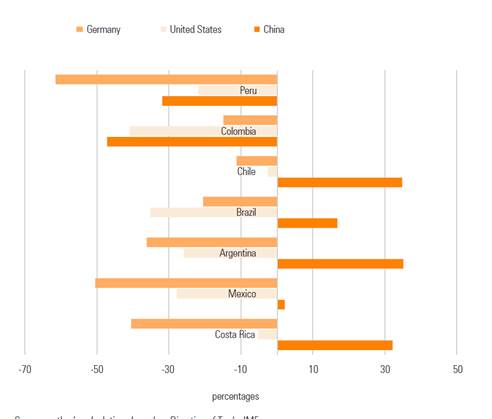

Lockdown measures worldwide damaged GVCs, unsettling the manufacturing activities in the three major hubs for international trade: China, Germany, and the United States (ECLAC, 2020c), affecting their multiple global ramifications, rapidly reaching almost every organization in the emerging economies. According to ECLAC (2020d), GVCs were the main channel for distributing the effects of COVID-19 worldwide. The first reports on the pandemic and GVCs focused on the safety and protection of workers expected to return to work in the shortest time (ECLAC, 2020a). Still, reductions in countries' leading economic indicators rapidly spread globally at the same pace as the coronavirus outbreak did, disrupting the flow of goods and capital and constraining commercial activities in almost every country. However, the expectation of lower commodity, energy, and mineral and metal prices (main components of LCs exports) varied depending on the affected country's central hub. Figure 1 shows the percentage change of total exports between March-June 2019 and March-June 2020.

Source: author's calculations based on Direction of Trade, IMF

Figure 1 Exports to Germany, United States, and China: March-June 2019 and March-June 2020 (% change)

Shipments to the Chinese market demonstrated high resilience during the COVID-19 crisis, except for Colombia and Peru. The percentage changes were positive during March-June 2020 compared with the same period the year before, which is significant considering that the pandemic and lockdowns in these economies were in the initial periods. The results are also explained by the products demanded by the Chinese market in Latin America and the Caribbean region, mainly primary goods and commodities. Regional blocs like MERCOSUR saw a slight increase in their exports to Asia in 2020 (CEPAL, 2021). In addition to this, mining production in the region is highly dependent on China's manufacturing industry. Hence, the movement restrictions and strict lockdowns in Asia have hasty effects on the demand, followed by a fast recuperation by the region.

Exports from the selected LCs to the United States and Germany are most affected, as shown by negative percentage changes in Figure 1. Compared to the previous year, the fall in exports is considerable for Colombia to the United States and the rest of the countries to Germany, particularly with Peru. The export performance can be explained by the type of exported products, mainly primary products and commodities that suffered from the losses in the market demand. In sum, Figure 1 shows that the recovery was fast for exports to the Chinese market, even with all restrictions put into place in the shipment and transportation of goods and services. This sudden recovery would bring managerial implications for LCs' firms, which struggled to maintain their production capacity while trying to accomplish local restrictions due to the pandemic situation.

China played an essential role for GVCs, as a producer and consumer for many globally traded goods (Seric et al., 2020), due to its high integration with global shipping networks and its prevalence in the global port container traffic industry (UNCTAD, 2019). However, after the beginning of the worldwide coronavirus outbreak, by late December 2019, China's industrial production for January and February 2020 combined fell by 13.5% due to several restrictions imposed on local governments' economic activities around the world. This stark drop was reached by neither the SARS outbreak nor by 2008's financial global crisis. Furthermore, LCs trade with China has increased considerably over the last twenty years. However, the trade between this country and Latin America and the Caribbean region altered the GVCs sectors. China's bilateral exports with Latin America and the Caribbean region from February 2018 to February 2020 declined by 12% (Seric et al., 2020).

COVID-19 has also struck the primary logistic infrastructure that allows GVCs to work correctly and with main logistics processes, such as transportation. As a result, vehicles were mobilized with low or no backload journeys or were stopped entirely, generating diseconomies of scale within the operational management of organizations. Moreover, due to the financial crisis that came with COVID-19, the capital flow was impacted, too, delaying payments across supply chains and endangering multiple logistics agents and operators' financial situations (ECLAC, 2020d).

Global maritime container trade has been severely affected since February 2020. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP, 2020), shipping services demand and port traffic have declined; meanwhile, international goods trade did, too, with a significant decline of 5.1% of the global container shipping volume. However, it does not mean a price reduction for transportation. On the contrary, transport rates in 2020 were higher than in 2019, suggesting how the maritime transportation industry managed its operations and efficiency to tackle some of the economic consequences of global maritime cargo reduction (ECLAC, 2020d). Hence, some specific measures were taken in the Pacific for maritime transportation, such as essential cargo movement, prioritization for pharmaceuticals, COVID-19 related equipment and energy goods, and 14-day quarantine periods for fishing vessels.

Consequently, COVID-19 also hampered ports' operations worldwide, dramatically reducing their main activities and risking their transactional efficiency and assets' installed capacity. According to UNESCAP (2020), ports in Asia and the Pacific took strict measures to deal with the pandemic, such as 14-day quarantine periods for arriving vessels, and direct transportation to manufacturing facilities without entering the terminal, and prohibition for crew disembarking processes, among others. This situation would drive LCs' firms to manage their international trade operations considering a supply chains' infrastructure with less operational capacity with the same transportation costs while going through their financial constraints.

Another big concern was the aviation industry; the COVID-19 crisis has caused the closure of borders in many countries, seriously restricting air traffic. According to ECLAC (2020d), in 2020 industry's net losses could reach US$ 84.3 billion, and in May 2020, the global freight tonne-kilometer indicator fell by 62.1% year-on-year. The latter suggests that air traffic restrictions were primarily aimed at nonessential goods to follow the closing borders disclosure and prioritize essential ones, such as food and medical equipment, negatively affecting other goods' international trade. The average decrease in LCs for the freight tonne-kilometer indicator was 46%. Facing passengers' lower demand, airlines decided to turn their planes into cargo transportation units, thus responding to the high demand for essentials (ECLAC, 2020d). How the aviation industry has responded was helpful for the global requirements and their survival. Nevertheless, even if they manage to hold on, the financial recovery would be an enormous challenge ahead for them.

Finally, inland transportation was seriously affected too. Ground transportation represents the initial and the final delivery activity, completing air and sea transportation. Hence, it is highly relevant for firms in order for them to complete their international cargo and to manage local customers' orders. While the world expects a decrease of 18% in truck transportation, Latin America and the Caribbean expect a fall of 20% for it (ECLAC, 2020d). Strict lockdowns in cities and their surroundings mean factories and warehouses closed, and labor mobility restrictions resulted in less land conveyance, where needed.

As can be seen, transportation infrastructure is vital for the adequate operation of GVCs and the organizations within. COVID-19 tested this sector and showed that LCs were not prepared for the disruption. Hence, we argue that the same strength delivered by GVC participants' interconnectedness could turn into a weakness when GVCs face significant and unexpected interruptions. The following section discusses the empirical literature that considers promoting a regional GVC for Latin America to reduce its vulnerability and provide a resilient business environment for firms versus a deeper integration with existing GVCs.

INCREASING LCS PARTICIPATION IN GVCs: UPGRADE OR SEEK REGIONAL GVCS?

What opportunities and challenges do COVID-19 bring for GVCs in Latin America? Will this disruption be the turning point for redefining global networks and the roles of its affiliates? Will it be a determining factor in slowing down even more of the international fragmentation of production as predicted by Timmer et al. (2016)? Or can COVID-19 be seen as an opportunity to test supply chain resilience and strengthen the links established with the countries these exports serve? Should LCs rethink its export-led model to look for a regional GVC? What are the conditions needed to achieve Latin American and Caribbean regional GVCs? Which changes and challenges would this bring to LCs firms' management and their stakeholders in the region? The review of the empirical evidence addresses these questions to determine the chances of a change in the development model based on trade sectors that are GVC-oriented.

A first finding is a consensus in the empirical literature that LCs should keep participating in global trade through GVCs as a development model based on the trade sector. (Amar and Torchinsky, 2019; Bamber and Frederick, 2018; Blyde, 2014; Cadestin et al., 2016; Dussel-Peters, 2018; Hernandez et al., 2014; Ignatenko et al., 2018; Montalbano et al., 2018; Tello, 2017). However, there are two possible paths to increase the LCs' participation. On the one hand, there are supporters of trade policies that aim to integrate into existing GVCs, even in low-cost and labor-intensive sectors. On the other hand, countries should produce higher technological products to insulate them from the competition (Bamber and Frederick, 2018; Zaclicever, 2017). Furthermore, Ndubuisi and Owusu (2020) argued that GVC participation could channel export upgrading. They found a 3.4% increase in export upgrading due to GVC participation for LCs. This strategy change requires a parallel effort to increase a skilled labor force and logistic infrastructure that attracts investment in high-tech sectors. Hence, regional firms would have to compete in the global market and deal with several challenges to incorporate themselves into the current GVCs, even more considering how difficult this could be for LCs' companies, which would be facing financial and operational restrictions during and after COVID-19 crisis.

Likewise, trade policies should also seek FDI as a channel for transmitting technological knowledge where local companies participate. FDI can also reduce the logistics infrastructure gaps, where the most significant disadvantages are shown (De Groot, 2018; Blyde, 2014; Duran and Zaclicever, 2013). For example, regional trade agreements like NAFTA served this purpose where Mexico has been continuously working on climbing to a higher level of technological sophistication in the production of GVCs. Even though it is not homogenous for the entire manufacturing industry, there have been successes in the aerospace and medical device industries (Estrada et al., 2016; Banacloche et al., 2020). Central American countries still keep their production at a low level of technological content. However, China's competition has resulted in changes in their trade policies to find production stages with comparative advantages over China.

The first wave of reports on COVID-19 and GVCs highlighted the global supply chain's weaknesses, particularly from China. In response, countries like the United States considered re-shoring activities to reduce the dependency on external suppliers. ECLAC estimates that, due to COVID-19, a redefinition of global production will imply moving production stages closer to the destination market. This would favor Mexico and Central American countries and imply a deepening relationship with the Factory North America. More dependent on the Chinese market, South American countries will have to back down in their attempt to generate domestic added value to offer their products based on their comparative advantages (ECLAC, 2020b). The latter could mean a significant recoil regarding the region's innovation, technology, and digitalization expectations, emphasizing the secondary role of LCs' firms in the current GVCs.

On the other hand, some authors advocate for the development of regional GVCs. Amar and Torchinsky (2019) claim that LCs have growth potential in GVCs at the regional level. In particular, to reduce South American specialization in primary and extractive sectors. The inherent nature of this trade makes them vulnerable to fluctuations in international commodity prices. It does not mean going back to industrialization by import substitution but relying on intra-regional trade, primarily manufacturing products. As mentioned before, participation in intra-regional GVCs is relatively low. However, intra-regional trade is more intensive in manufactures than extra-regional trade (Banacloche et al., 2020; Amar and Torchinsky, 2019), which opens a potential for the growth of regional GVCs capable of competing with the East Asian countries. Due to the uncertainty in supply activities generated by COVID-19, countries, and businesses will demand less crowded and peripheral cities to integrate their GVCs, despite working under suboptimal economies of scale but achieving more survival opportunities for their operations (Perez-Batres and Treviño, 2020). Moreover, according to Blyde and Trachtenberg (2020), this approach has its advantages, as the growth of intra- regional supply chains would remain resilient to current and future slowdowns of GVCs. Hence, Latin American firms would enter nearer markets and new trade opportunities, working in a more resilient business environment. Nevertheless, some risks would exist associated with companies having fewer economies of scale that could also impact an already low-income population.

There is already evidence of attempts to generate more synergies through GVCs. For instance, Prieto (2018) examines the Pacific Alliance's case for a potential regional GVC. Peru and Chile complement each other in mining, while Mexico could pivot to increasing manufacturing. Mexico and Central American countries are well-positioned within the Factory North America. At the same time, other authors consider Brazil as a potential hub for South American countries since the South American region is a significant destination for Brazilian goods (Martins and Imori, 2014; Hernandez et al., 2014; Sturgeon et al., 2013).

However, some roadblocks prevent the development of intra-regional supply chains. The evident geographical distance issue makes the fragmentation of production stages difficult in different countries of the region due to transportation costs. The Asian region takes advantage of maritime transportation, with transportation costs lower than ground transportation, while LCs depend mainly on ground transportation. The same happens in Europe; however, the distance is much smaller than in LCs, and the transportation infrastructure (physical and logistics) is adequate for GVCs flows (Estevadeordal and Blyde, 2016). Indeed, the infrastructure gap in the transportation and communication sectors was evident during the lockdown. Therefore, LCs face the task of making transport and communications infrastructure the pillars of effective regional integration based on GVCs (Blyde, 2014). All of which would enhance the opportunities for regional economies of scale and provide better competitiveness for firms in Latin America.

The high degree of labor informality is a structural problem for the region. Narula (2020) suggests that COVID-19 be an opportunity to integrate informal companies into the formal sector without the burden of taxes. Informal companies must have an incentive to belong to the formal sector of the economy. The high informality in their economies became a problem when putting into place policies to reduce the impact of COVID-19 on the business sector and their workers; only formal businesses got immediate access to rescue packages. Arriola et al. (2020) found that higher coordination between government and firms can improve risk preparedness by identifying potential threats to essential activities and sharing information in the areas where potential bottlenecks could happen in the upstream production of an international GVC (Arriola et al., 2020).

The potential growth of a regional GVC requires a redefinition of the integration agreements. Regional integration was the model followed in Asia and Europe; they managed to facilitate GVCs; trade agreements did not have the same outcomes for LCs. Zaclicever (2017) applied the Input-Output (IO) tables to analyze Latin American countries' trade networks and found significantly lower intra-regional production integration levels than countries in other regions. However, both extra and intra- regional linkages vary considerably across countries. There is no dependence on a hub, except for Mexico and Costa Rica; instead, it shows diversity in more external networks to the region. For example, Beaton et al. (2017) found five countries with the most diverse external networks (Brazil, Argentina, Peru, Chile, and Colombia). These countries have trade links covering about 91 percent of all potential global trading partners (Beaton et al., 2017). This potential for diversity can be understood as an advantage that these countries can take when hub countries face recessions or suffer shocks that affect the global supply chain. For instance, Mexico was severely affected by the economic downturn of the United States in 2008, while South American countries were not equally affected because of the diversity of international production networks. Thus, Latin American companies could mobilize this experience and these international networks into the new regional GVCs, facilitating their implementation and stability.

Regional integration seeks to reduce tariffs and the free circulation of goods and services as the first integration step. However, there is a series of non-tariff practices that discourages greater integration. The two most cited instances are many regulatory standards and the lack of convergence in Rules of Origin (RoO). The multiplicity of standards forces a country to specialize in one market (Cadestin et al., 2016), which reduces the chances of economies of scale. In addition, the RoO established in regional trade agreements results in trade diversion that prevents greater intermediate production components integration. According to Blyde and Trachtenberg (2020), the lack of synchronization of preferences and RoO blocks intraregional trade and the formation of high-tech supply chains. Moreover, Cadestin et al. (2016) calculated that non-tariff measurements' imposition hurt the gains from reducing tariffs.

According to Duran and Zaclicever (2013), deep regional integration is not a priority due to the different interests in leading countries, such as Mexico and Brazil. Mexico's industrial sector seeks to upgrade towards more sophisticated links in the GVCs in which they have the regulatory framework of the United States-Mexico- Canada (USMCA) agreement. In contrast, with Brazil as a leading country, South American countries have made progress in removing obstacles to trade without reaching a deeper integration, which would have benefited the strengthening of regional networks. An explanation of this lack of priority can be found in Bown et al. (2017), who estimated the Revealed Comparative Advantage (RCA) similarity indices for the LCs and their subregions. They found that the high potential benefits are evident in trade with partners outside the subregions. For instance, the Caribbean countries present more significant potential benefits in trade with Central American countries than with the countries of the same region due to the high similarity index of the RCA. However, it should be noted that the RCA changes and that if an industrial policy is established that changes the patterns of specialization, hopefully, it would be to the benefit of deeper regional integration.

Trade relations established with leading trading partners frame the participation of LCs in GVCs. The United States has traditionally been the most critical partner country for all LCs, followed by Japan and the European countries. However, after China entered the WTO, the trade landscape was restructured. Mexico and Central America continued their dependence on the U.S. market to export intermediate and final goods. South American countries found in China a market for their products based on natural resources. The re-primarization of the economy postponed the idea of deeper regional integration. The long-term objectives of development based on the external sector also changed. For Mexico and Central America, the effort is focused on reaching more sophisticated links in the GVCs; for South America, the efforts are focused on generating exports with a higher domestic value-added content. Therefore, there are not many points of convergence to make regional GVCs a reality. However, the pandemic crisis has brought back the discussion of the potential benefits of a regional GVC that can reduce the impact of future shocks in the Latin American and Caribbean regions. A final element in the discussion is the role of institutions in achieving this goal.

As mentioned above, there are advantages of GVCs for LCs' economic growth and sustainable development. However, generating long-term benefits requires governments, private organizations, FDI, and the public and private educational systems. COVID-19 creates an opportunity to reevaluate all these institutions' roles to face an uncertain global future in the coming years.

The government has traditionally served two roles in an economic development model based on the external sector: a facilitator of business environments to attract FDI and as a regulator of this investment, hoping for job creation and technological knowledge transfer (Horner and Alford, 2019). However, this role has not been enough to actively allow local firms to participate in global production networks and generate more significant domestic content with a higher value of technological knowledge (Assamoi et al., 2019; Bamber and Frederick, 2018). This is even more crucial for SMEs that can benefit from clusters in GVCs that promote innovation and product upgrading (Fuerst, 2010). In addition, governments must ensure a qualified workforce and a logistics infrastructure for transport and communications, so domestic suppliers of inputs for global production could be competitive (Blyde, 2014; Duran and Zacliever, 2013; Cordova and Taquía, 2018; Banacloche et al., 2020).

For LCs, previous empirical evidence outlines policies to enhance participation in global production networks that might be useful for upgrading GVCs. For example, Taglioni and Winkler (2016) emphasize the need to increase the connection of the domestic market with the different segments of the supply chain. Hence, it is necessary to identify the current capacities and skills to the international market demand. An example of this is shown by Estrada et al. (2016) with the Alliance with Transnational Companies (ACT in the Spanish acronyms) model implemented by Pro-Mexico (a government agency), in which Mexican firms are connected as suppliers for global firms and thus have direct contact with the GVCs of the sector. Likewise, ACT requires that multinational firms fulfill domestic industrial goals that benefit the host country. These programs are an example of the role of the government as a facilitator and regulator of foreign investment that promotes the participation of local firms.

However, besides the government and transnational firms, there are other agents to consider. For example, Dussel-Peters (2018) proposes a methodology that includes strategies, policies, and instruments of a glocal (global-local) framework where a dialogue between the public and private sectors is based on macro, meso, micro, and territorial knowledge. According to Dussel-Peters, GVCs production in different stages requires specific instruments and policies that consider an integrated collaboration and coordination approach among the different agents.

Likewise, Lopez and Morales-Fajardo (2018) argue that the benefits of having global firm subsidiaries are not instantly transformed into economic growth. Consequently, they propose a comprehensive approach that includes education, financial, and trade policies to enhance the participation of local companies.

Unlike the policies towards FDI of the 1970s, where the objective was to promote domestic market development, in the 1990s, vertical FDI has been conducive to inserting domestic firms into global production networks. However, as Taglione and Winkler (2016) point out, greater government coordination at the micro-level is required to carry out a GVC-led development. According to them, identifying policies in different stages (entry, expansion, and sustainable development) is critical when export-led development is based on GVCs.

COVID-19 will undoubtedly mean a rearrangement of transnational companies in the world economy. At the same time, recipient countries may decide to continue providing facilities to receive this type of investment with a higher degree of regulation that promotes knowledge transfer and accelerates entry into more complex production processes, such as in Mexico and Central America. In contrast, South American countries would promote the extension of activities that generate domestic added value. Moreover, since the region's interest in the external sector revolves around GVCs, they have a wide margin for cooperation in exchanging knowledge and experiences at the public and private levels.

LCs face the dilemma of deeper integration with their hubs, thereby submitting to external shocks' ups and downs, like COVID-19. Alternatively, LCs could seek the generation of a regional GVC to increase an intra-regional trade based on the manufacturing of goods with higher added value and high technological content capable of competing with their Asian and European counterparts. The literature review showed the challenges of these two alternatives and the work ahead.

CONCLUSION AND POLICY RECOMMENDATIONS

The literature review showed that LCs could extend their participation in regional GVCs. COVID-19 tested GVCs resilience and questioned their relevance as an export development model for developing countries. COVID-19 also opened the discussion regarding the future participation of these countries in the different GVCs hubs. Rodrik (2018) argues that developing countries should not ensure their future in a global fragmentation of production undergoing restructuring going back to 2011. Thus, Rodrik suggests promoting domestic integration policies, where large global corporations link with local producers and domestic labor. These policies would transform the business context where Latin American firms operate, facilitating local trade integration and building new regionally-focused supply chains. The literature review emphasized LCs' potential for deeper regional integration under an institutional framework that supports regional GVCs. GVC-oriented policies require higher integration, particularly non-tariff barriers, to reduce trade blocks, making regional integration more effective. Moreover, deeper regionalization implies reallocating production or distribution facilities to bring more business opportunities and broader markets for LCs firms.

How will COVID-19 change everything that was projected for LCs in future years going forward? A review of the empirical literature reveals some reflections on industrial policy regarding COVID-19. For instance, faced with unexpected shocks, such as COVID-19, identify risk exposures in areas and services that assist GVCs activities for a prompt restart of production. Textile or apparel sectors have a higher risk of exposure to pandemics because they are labor-intensive. In contrast, the agriculture sector has a higher risk of environmental changes (floods, hurricanes, heat). Countries can work on reducing the risks by coordinating industrial policy measures that mitigate the shocks. Distinguish industrial and service sectors where a deep regionalization could reduce short-term shocks such as COVID-19. A map of the GVCs of Latin America and the Caribbean region would serve to identify complementary factors at the domestic firm's level. COVID-19 revealed its unequal effects on employment. Unskilled and skilled labor also require accelerating training programs to increase skilled labor to transfer between sectors. All the above requires regional information and coordination mechanisms that a regional trade agreement could provide.

This study has shown that Latin American firms need to reevaluate their management strategies to compete in the post-COVID-19 era, where priorities have changed. Firms engaged in the production of GVCs goods and services will face more frequent external shocks. Regional GVCs with closer local suppliers could reduce the uncertainties of disruptions in the supply value chain. Under regional GVCs, LCs' firms need to modify their supply contracts, reevaluate their workforce's skills, and identify proper locations and resources that help them achieve economic synergies. In addition, firms would have to leverage their regional competitiveness, since foreign industries and multinationals would need their products and services capacity in the region while re-shoring their business structures.

In this article, we discussed the advantages of a regional GVC in the literature review. It is argued in this work that COVID-19 could be an opportunity to discuss a deeper regionalization focused on GVCs. As well, the generation of databases at a micro level also helps firms know about income and jobs opportunities in innovation and content upgrading activities. Hence, the main empirical contribution of this study is to revive the discussion regarding Latin American GVCs, considering how COVID-19 altered the business environment and the challenges and opportunities that the health crisis has opened to the region. This study provides an additional perspective on the benefits of deeper regional GVCs in Latin America, contrary to the discussed claim of strengthening the existing GVCs. This discussion also implies building upon already developed theoretical perspectives such as the reallocation of economic activities in emerging economies, considering firms' capabilities and business contexts (Capik and Dej, 2018), and China's growing predominance in Latin America (Jenkins, 2018).

On the other hand, the literature review for LCs can be extended to analyzing emerging countries since they based their economies in the external sector. The lessons that emerge from the Latin American economies are several. Among others, how regional trade agreements have opened the market for local firms but hinder further integration due to RoO and differences in trade standards. Likewise, the lack of leadership in the region from Brazil and Mexico is noted.

In sum, COVID-19 has been a turning point in the trajectory of GVCs in Latin America. It has exposed its flaws and vulnerabilities. However, it has also helped to open opportunities for domestic firms by developing a regional domestic market. The empirical evidence shows that a comprehensive program policy with all the stakeholders' involvement can achieve this objective. LCs should not wait until the health crisis is solved to renegotiate current FTAs to reduce evident blocks in trade standards and RoO if they want to change the RCA towards a trade specialization based on regional GVCs.