INTRODUCTION

Economic growth (EG) has become a priority for countries worldwide due to its implications for the population's well-being. For this reason, economic policymakers have been concerned with establishing incentive systems that stimulate the mechanisms EG promotes. In this sense, the mechanisms that have become more relevant in recent years are trade liberalization, market integration, and the increase of foreign direct investment (FDI) flows (Abdouli & Hammami, 2017; Adams, 2009; Akinlo, 2004; Azman-Saini et al., 2010; Borensztein et al., 1998; Ibhagui, 2017; Lee & Chang, 2009; Zhang, 2001). In recent decades, FDI has become a significant source of external financing, particularly in developing countries (Makiela & Ouattara, 2018). World Bank data indicates that in 1970, net FDI flows accounted for 0.4 % of global economic activity; in recent years, this figure has exceeded 5 %.

According to the endogenous growth theory (Lucas, 1988; Romer, 1986), FDI can promote EG directly through capital stock accumulation, increase employment, and access to international markets. More precisely, FDI increases the share of total investment in the productive activity of host countries. Likewise, FDI can promote EG indirectly through the diffusion of new technologies, job training, increased productivity, development of competitiveness, and the introduction of new business management practices (Balasubramanyam et al., 1996; De Mello, 1999; Li & Liu, 2005; Makiela & Ouattara, 2018; Romer, 1993). However, in many cases, the positive effects of FDI on EG are not so evident due to the low absorptive capacities of host countries, such as insufficient infrastructure, low development of financial markets, weak macroeconomic stability, institutional failures, and poor human capital formation (Borensztein et al., 1998; Hong, 2014; Iamsiraroj & Ulubasoglu, 2015; Ibhagui, 2017).

In fact, there is no consensus in the empirical literature regarding the effects of FDI on EG. A large body of research finds that FDI has positive effects on EG (Adams, 2009; Borensztein et al., 1998; Sylwester, 2005; Zhang, 2001), while other works find adverse effects (Akinlo, 2004; Dinh et al., 2019; Fry, 1993; Hermes & Lensink, 2003). According to the above, it is of great importance to know the impact of FDI on EG in countries that have chosen to establish economic and trade integration systems as a mechanism to promote economic development. However, the study of the impact of FDI on EG is complex due to the endogenous nature of this relationship (Li & Liu, 2005; Oladipo, 2013). FDI can positively affect EG, leading to an increase in market size, which, in turn, can be very attractive to investors (Li & Liu, 2005).

The eclectic paradigm considers that FDI depends on a series of ownership, location, and internalization advantages, which may be associated with the level of economic development of host countries (Dunning, 1977). Therefore, many empirical studies have found evidence to conclude that between FDI and EG, there is a bidirectional causal relationship (Anaya-Mendoza, 2012; Li & Liu, 2005; Mahmoodi & Mahmoodi, 2016; Oladipo, 2013). Thus, the following conjectures could be reached: i) FDI promotes the EG of host countries, ii) the EG of host countries contributes to attract greater flows of FDI, iii) the impact of FDI on EG is conditioned to the absorptive capacity of host countries.

This paper empirically analyzes the relationship between FDI and EG in the countries of the Pacific Alliance (PA). The PA is an initiative of regional economic integration comprised of Chile, Colombia, Mexico, and Peru, which seeks to promote further growth, development, and competitiveness of the participating economies. Chile is one of the most stable and developed countries in Latin America. Its economy is open and market-oriented, with a strong focus on the export of primary products, especially copper. This country has favorable backgrounds such as i) low inflation, prudent fiscal policies, and a robust financial system; ii) relatively well-developed infrastructure; iii) a high level of education and workforce training compared to other countries in the region. However, it faces challenges such as a significant dependence on mining, especially copper, and a high level of inequality (Raffo López et al., 2018).

Colombia has experienced steady EG in recent decades, driven by the oil, coal, and coffee sectors. The country has made significant efforts to improve its business environment, which is a testament to its commitment to progress. This country has positive factors such as the implementation of various reforms to improve the country's competitiveness, the availability of a relatively young and dynamic workforce, and significant infrastructure projects such as the 4G roads program. However, it faces obstacles such as high levels of corruption; despite progress, security remains a concern in some areas, and although the infrastructure is progressing, considerable improvement is still needed (Owusu-Nantwi & Erickson, 2019).

On the other hand, Mexico is the second-largest economy in Latin America and one of the leading FDI destinations in the region due to its proximity to the United States and trade agreements such as the USMCA. Because of this, it has advantages such as access to international markets through a vast network of free trade agreements and a strong manufacturing sector, especially in the automotive and electronics industries. Additionally, it has abundant natural resources, including oil and gas. Some of its challenges are violence, organized crime, and high levels of government corruption (Raffo López et al., 2018). Finally, Peru has been one of the fastest-growing economies in Latin America in recent decades, driven by mining, agriculture, and tourism. It has a wealth of minerals and natural resources, a positive and constant EG rate, and a relatively stable economy. Like Colombia, it needs to improve its infrastructure, especially in rural areas, and faces a significant challenge due to high poverty levels and inequality (Owusu-Nantwi & Erickson, 2019). According to the economic context of each country, Chile and Mexico are presented as the most suitable countries to maximize the effects of FDI, closely followed by Colombia and Peru, which also have great potential but need to address certain challenges to optimize their benefits. It is important to note that the results of various studies on the relationship in question are diverse, providing a comprehensive understanding of the situation and not always reaching the same conclusions.

The empirical analysis was carried out using time series data with quarterly periodicity for each of the variables observed in each PA member country. First, unit root tests were applied to determine the series' integration order. Subsequently, cointegration tests were performed to estimate a vector autoregressive model (VAR) and determine whether FDI and EG have a long-term relationship. Finally, a multi-variate error-correction model (VEC) was estimated, and Granger (1969) causality tests and impulse response functions (IRFs) were performed. The findings revealed that foreign investment stimulated EG in certain countries, which led to increased investment inflows. However, this relationship was only observed in some cases. Therefore, elements like infrastructure, the development of financial markets, macro-economic stability, the quality of institutions, and human capital could be essential in optimizing the advantages of FDI.

This research significantly contributes to the literature in several ways. First, it focuses on the PA countries (Chile, Colombia, Mexico, and Peru), providing a detailed and specific analysis of how FDI affects EG in a particular region of Latin America. This fills a gap in the literature since many previous studies address this relationship globally or in broader regions. Second, it highlights that the impact of FDI on EG could be conditioned by the absorptive capacity of the recipient countries, emphasizing the importance of factors such as infrastructure, financial market development, macroeconomic stability, institutions, and human capital. Third, it offers valuable insights for public policy formulation, helping policymakers in the PA countries design strategies that improve absorptive capacity and maximize the benefits of FDI.

The document is organized into six sections. The second section reviews the literature and presents the main works on the relationship between FDI and EG. The third section describes the data used. The fourth section defines the research methodology. The fifth section outlines the main empirical results. Finally, the sixth section provides relevant conclusions and recommendations.

LITERATURE REVIEW

There is no clear consensus in the economics literature on the relationship between FDI and EG. The results of empirical research vary depending on the context, methodology, and type of data used. Some works found a positive relationship between FDI and EG; however, others found a negative relationship. Likewise, some works found a unidirectional causal relationship where FDI influences EG, while others found a causal relationship in the opposite direction. In addition, some works have found evidence of a bidirectional causal relationship.

Several studies were conducted using a panel data approach, and they attempted to explain the relationship between FDI and EG, the order of causality, and the conditions under which this relationship was positive. For example, Sylwester (2005) presented empirical evidence to argue that FDI positively affected the growth of gross product per capita in 29 developing countries. Similarly, Owusu-Nantwi and Erickson (2019) found that FDI positively and significantly impacted EG in South American countries. In addition, the authors found evidence of a long-term relationship and a bidirectional causal relationship between the variables. Choe (2003) found that FDI promotes and causes EG in a set of 80 countries, but, in turn, EG attracts higher FDI flows. Other works that found similar results were those by Abdouli and Hammami (2017), Mahmoodi and Mahmoodi (2016), Pradhan (2009), and Tekin (2012).

In contrast to the studies that found a positive correlation between FDI and EG, other papers found negative or ambiguous relationships between these variables. Hermes and Lensink (2003), in a study of 67 developing economies, found that FDI had a negative effect on the growth rate. However, this effect disappeared when economies had a strongly developed financial system. According to this, the development of the financial system was a necessary condition for channeling the positive effects of FDI. These results were similar to those of Fry (1993), who found that FDI adversely affected economic activity in 16 developing countries. Dinh et al. (2019) found that while FDI had a positive effect on EG in the long term, it had a negative effect in lower-middle-income countries in the short term. Additionally, using data from African countries, Osei-Opoku et al. (2019) found that although FDI positively stimulates EG unconditionally, the impact was zero when conditional sectoral effects were introduced. Feeny et al. (2014), using data from Pacific island countries and a set of developing countries, found that the impacts of FDI vary among host countries depending on their level of development.

The reason behind the harmful, ambiguous, or heterogeneous effects of FDI on EG was associated with the absorptive capacity of economies to use the benefits generated by FDI inflows. In this sense, Balasubramanyam et al. (1996), in a study of 46 countries, found that FDI positively affected EG. However, the effect was more substantial in countries with highly skilled workforces and where the export promotion policy was prioritized over import substitution. Borensztein et al. (1998) studied the effect of FDI flows on EG of 69 developing countries and found that FDI was more important than domestic investment for boosting EG because it facilitated the international transfer of technology; however, this effect was maintained only when the host country possessed a minimum stock of human capital.

Adams (2009) found that FDI was positively, though not proportionally, correlated with EG through an analysis of the FDI impact and domestic investment on EG in Sub-Saharan Africa. Additionally, the author found that FDI inflows had a net crowding out effect on domestic investment; therefore, the effect of FDI on EG may be due to the growth in total factor productivity (TFP). However, Makiela and Ouattara (2018), through an analysis of the transmission channels of FDI effects, noticed that FDI did not positively affect EG through TFP, but through input accumulation (capital investments and increased labor demand). Li and Tanna (2019), using data from 51 developing countries, identified a weak relationship between FDI and TFP. However, this relationship was strengthened when contingency factors such as human capital and institutional development were considered. Similarly, Raza et al. (2019) revealed that institutional quality, measured by regulatory quality, corruption control, political stability, and government effectiveness, benefited the relationship between FDI flows and the EG rate in countries of the Organization for Economic Co-operation and Development (OECD).

Li and Liu (2005) observed that FDI had a direct positive effect on the EG of 84 developing countries, but, in turn, FDI promoted growth indirectly through its interaction with human capital. Likewise, Hong (2014) learned that economies of scale, human capital, infrastructure, wage levels, and regional differences actively interacted with FDI inflows to positively impact China's economic development. However, Iamsiraroj and Ulubasoglu (2015), through a meta-analytical study, concluded that FDI positively affected EG when countries possessed a sufficiently developed financial system and when they were widely open to international trade, thus diminishing the importance of human capital training as an absorptive mechanism. Along these lines, Lee and Chang (2009), based on a panel cointegration study for 37 countries, suggested that the potential gains of FDI increase considerably when coupled with financial development in an increasingly global economy. On the contrary, Azman-Saini et al. (2010), in a study of 85 countries, found that FDI alone did not promote output growth. Instead, its positive effects depended on the degree of economic freedom in the host countries. In an analysis of 45 sub-Saharan African countries, Ibhagui (2017) realized that FDI accelerated EG when certain levels of human capital, inflation, population growth, financial market development, and trade liberalization had been achieved.

Plenty of other studies have been conducted through the time series approach and have also found adverse or ambiguous effects of FDI on EG (Akinlo, 2004; Bermejo-Carbonell & Werner, 2018; Encinas-Ferrer & Villegas-Zermeño, 2015; Oudat et al., 2019). For this reason, time series research has been concerned with empirically assessing the conditions that allow channeling technological spillovers originating from FDI inflows and establishing the order of causality between FDI and EG. This avoids the possible heterogeneity bias that originates from aggregating data from different countries into a single sample, as occurs in studies using panel data.

In this context, Egbo et al. (2011) found that FDI positively impacted Nigeria's EG, and they determined unidirectional causality that went from FDI to output growth. In contrast, Sarker and Khan (2020) observed that in Bangladesh, causality went from GDP to FDI. Anaya-Mendoza (2012), in a study of six South American countries, discovered that FDI caused EG in Argentina and Venezuela, while in Chile and Peru, EG caused FDI. Furthermore, empirical evidence suggests that the variables have a bidirectional causal relationship in Brazil and Colombia. By performing the Granger non-causality procedure developed by Toda and Yamamoto (1995) and Dolado and Lütkepohl (1996) on a sample of Latin American countries, Oladipo (2013) noted that FDI caused EG in Bolivia, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, and the Bahamas, while in Trinidad and Tobago EG caused FDI. Bidirectional causality was observed in Argentina, Brazil, Mexico, Peru, and Venezuela.

Similarly, Zhang (2001), in a study of 11 economies in Asia and Latin America, remarked that FDI promoted EG when host countries adopted a liberalized trade regime, improved education, encouraged export-oriented FDI flows, and maintained macroeconomic stability. Evidence of unidirectional causality running from FDI toward EG in Singapore and unidirectional causality from EG to FDI in Brazil, South Korea, Malaysia, and Thailand was found in the short term. In the long-term, unidirectional causality from FDI to EG in Hong Kong and Taiwan, unidirectional causality from EG to FDI in Colombia, and bidirectional causality in Mexico and Indonesia were identified. For Argentina, there was no evidence of causality between the variables. Likewise, In a study for the Lao People's Democratic Republic, Nantharath and Kang (2019) discovered a bidirectional causality relationship between the variables. Hence, FDI, complemented by sufficient infrastructure, education, and institutional framework, stimulated EG, which, in turn, contributed to the attraction of further FDI flows. Ghosh (2019), in an analysis of Japan and South Korea, stated that FDI, capital formation, and female education stimulated EG. Capital formation, female education, and EG contributed to attracting more FDI. However, in the case of South Korea, the causal relationship only went from FDI to EG. Sirag et al. (2018) asserted that FDI led to better economic performance through higher financial development in Sudan, while Meyer and Habanabakize (2018) noted a bidirectional causality relationship between FDI and EG in South Africa; still, in this case, both FDI inflows and EG rate were negatively affected by the level of political risk.

The literature that studies the relationship between FDI and EG presents an extensive and diverse range of findings, analyzing this relationship complex. This complexity is mainly due to the heterogeneity in the socioeconomic characteristics of the countries analyzed and the various methodologies employed in the research. On the one hand, some studies find a positive relationship between FDI and EG. Studies such as those by Owusu-Nantwi and Erickson (2019) and Sylwester (2005) provide strong empirical evidence supporting the positive impact of FDI on EG in developing countries. These studies highlight how FDI can increase gross output per capita and overall economic development. Furthermore, the bidirectional causality identified by Choe (2003) suggests that not only does FDI promote EG, but a growing economy also attracts more FDI. This bidirectional relationship indicates a virtuous circle in which FDI and EG are mutually reinforcing, which can lead to sustained economic development. On the other hand, part of the literature reports a negative or ambiguous relationship between FDI and EG. Studies such as those by Fry (1993) and Hermes and Lensink (2003) reveal a negative impact of FDI on EG, especially in economies with underdeveloped financial systems. These findings suggest that, without the necessary conditions, the potential benefits of FDI cannot be fully exploited and may even lead to adverse economic outcomes. This research paper adds to this open discussion by providing empirical evidence for the PA countries to know whether there is a positive or negative relationship between FDI and EC. It also seeks to identify whether FDI causes EG or, on the contrary, EG causes FDI.

DATA

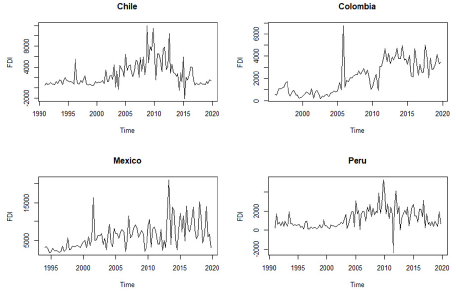

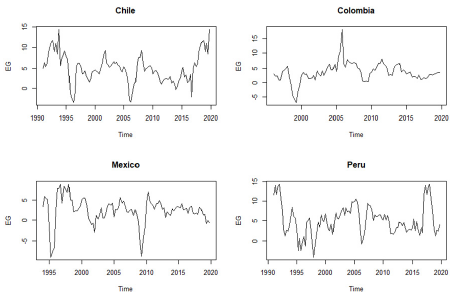

This study used a quarterly time series for FDI and EG in each PA country. FDI was measured as the quarterly flow of foreign investment in the host country in millions of dollars (constant prices of 2015), reported in the financial account liabilities of each country's balance of payments. Meanwhile, EG was measured as the quarterly real annual growth rate without carrying out a seasonal disaggregation. Data from the first quarter of 1991 to the third quarter of 2019 (115 observations) were used for Chile. For Colombia, data from the first quarter of 1996 through the third quarter of 2019 (95 observations) were used. Data from the first quarter of 1994 through the third quarter of 2019 (103 observations) were used for Mexico. For Peru, data from the first quarter of 1991 through the first quarter of 2017 (105 observations) were used. The data for this work were obtained from the International Monetary Fund (IMF) and the Economic Commission for Latin America and the Caribbean (ECLAC-STATS) statistics.

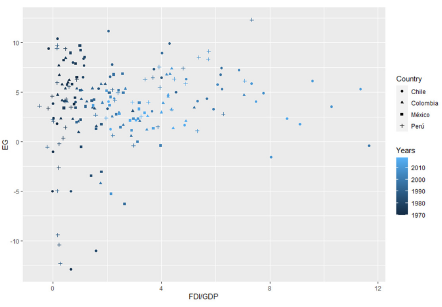

Figure 1 shows, in broad terms, how FDI and EG have behaved in the PA countries from 1970 to the present. The abscissa axis measured FDI as a proportion of GDP, while the annual EG rate was in the ordinate axis. In this sense, FDI gained weight in each country's economic activity. Likewise, the PA countries' economies have constantly expanded over the last 50 years. Therefore, it is expected that FDI and EG will have a positive relationship over time.

METHODOLOGY

The empirical analysis was completed using a time series approach. In this sense, the series should have corresponded to a stationary process, i.e., the data's mean, variance, and autocovariance must be independent of time (Alonso, 2019; Enders, 2015). However, most macroeconomic series were not stationary. Therefore, the empirical analysis began with the performance of unit root tests in order to determine the order of integration of the variables. In this paper, the Dicker-Fuller Augmented (ADF) test (Dickey & Fuller, 1979, 1981), the Philips-Perron (PP) test (Phillips & Perron, 1988), the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test (Kwiatkowski et al., 1992), and the Breitung (2002) test were used. These unit root tests are used because of their statistical accuracy in time series analysis and because they are robust to different assumptions and specifications. In particular, they are robust to the presence of autocorrelation and heteroscedasticity. Since the data used were of quarterly frequency, the HEGY test (Hylleberg et al., 1990) was employed, which allowed for identifying the presence of seasonal unit roots and suggested the necessary transformation to be made to the series to obtain stationary processes.

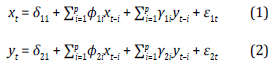

Once the order of integration of the series was determined, we proceeded to estimate different cointegration tests in the estimation framework of a VAR model. Indeed, when there are two variables, x t and y t , that are not exogenous, it is natural to treat each variable symmetrically in order to characterize simultaneous interactions between them (Enders, 2015). In this sense, a VAR model is a system of simultaneous equations of reduced form without constraints, where the law of motion of a variable can be expressed by the past achievements of itself and another endogenous variable (Sims, 1980), as shown in Equations 1 and 2 for a VAR model of p order.

In this case, it was assumed that x t and y t were stationary variables; ε1t and ε2t were white noise and there was no correlation in time between the errors. One way to find the order of the VAR model is to examine the so-called information criteria. The best-known are those of Akaike (AIC), Schwartz (SC), and Hannan-Quin (HQ). However, more attention was paid to the AIC in this work, ensuring that the model perturbations were free of autocorrelation to perform the cointegration analysis.

Cointegration tests allowed us to identify whether FDI and EG had a long-term relationship in the countries analyzed. Therefore, cointegration implies that, although different shocks affect each of the series, forces push them toward an equilibrium relationship in the long term. According to this, two non-stationary series of the same order of integration, x t ~ and y t ~ would be cointegrated if there existed such a linear combination that the resulting series was a stationary process I(0). The vector resulting in this linear combination was known as the cointegrating vector. Thus, in this work, the Johansen (1991) cointegration test, the Engle and Granger (1987) test, and the Phillips and Ouliaris (1990) test were applied.

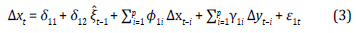

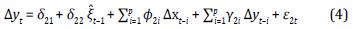

If the series had a long-term relationship, estimating a VEC model to find the short-term relationships among the variables would be possible. According to Engle and Granger's (1987) representation theorem, if there was a long-term relationship among variables, how variables in the short term adjust against imbalances in the long term could be found. Thus, the VEC model demonstrates how a variable changes depending on its past values and those of other variables and random shocks in the previous period, as Equations 3 and 4 show, where  represents the residual or disequilibrium of the previous period.

represents the residual or disequilibrium of the previous period.

Causality tests in Granger's (1969) sense can be performed, and IRFs can be estimated. Granger (1969) developed a test to determine whether the past behavior of one variable (x t ) could predict the behavior of another variable (y t ). Thus, if this occurred, it was said that x t caused y t in Granger's sense. According to this, and given that the variables were endogenous, an unidirectional causality can occur from x t to y, unidirectional causality fromy t to x, and a bidirectional causality between x t andy t when the variables were caused simultaneously. Formally, the causality model was very similar to the one in Equations 1 and 2 for the VAR model. Thus, y t caused x t provided that any ф i was not zero; whereas, x t causedyt provided that any é¡ was not zero. On the other hand, IRFs allowed to know the response of a variable before exogenous impulses or innovations in another variabley t (Lütkepohl, 2005). In this case, variables were expressed in terms of the present value and the past value of random perturbations of themselves or other variables.

RESULTS

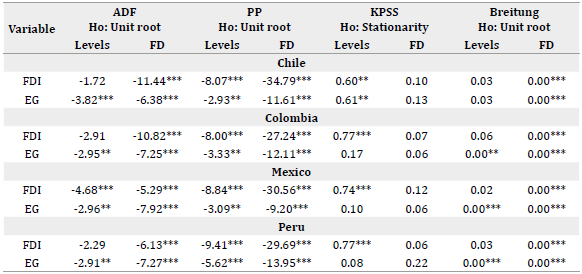

In order to analyze the stationarity of the series, it was crucial to have an idea of how the series behaved over time (Figure A1 and Figure A2). Based on this, unit root tests were performed to determine the order of integration of the series, as shown in Table 1. ADF, KPSS, and Breitung tests showed Chile's stationary FDI in its first difference. The KPSS and Breitung tests indicated that Chile's EG was stationary at its first difference. Therefore, it was concluded that in Chile the series were integrated of order 1, i.e., In Colombia, the ADF, KPSS, and Breitung tests indicated that FDI was However, all tests suggested that EG was stationary, i.e., I(0). In Mexico, the KPSS and Breitung tests indicated that FDI was while all evidence suggested that EG was I(0). In Peru, the ADF, KPSS, and Breitung tests showed that FDI was I(1) while the four tests indicated that EG was I(0).

Table 1 Unit Root Tests

Note. *** is p-value <0.01, ** is p-value <0.5, * is p-value <0.1.

Source: Authors' elaboration.

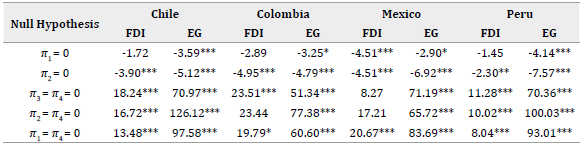

Having series with different orders of integration posed a great difficulty for the empirical analysis because cointegration tests could not be carried out. However, given that the series had a frequency greater than annual, it was possible to find behaviors in the variables that repeated periodically at the same times of the year (Alonso & Semaán, 2010). For this reason, the HEGY test was very important to identify the presence of seasonal unit roots and the appropriate way to obtain stationary series. Table 2 shows that in Chile, FDI had a non-seasonal unit root, while EG had no unit root. In Colombia, both FDI and EG had a non-seasonal unit root; therefore, it could be assumed that the series were I(1). In Mexico, FDI and EG did not have a unit root; thus, the series was considered stationary. In Peru, FDI had a non-stationary unit root every six months; for this reason, the series must be transformed through polynomials of the lag operator to obtain a stationary process. Moreover, EG had no unit root. There was mixed evidence on the order of EG integration in the countries. However, it was assumed that EG was 7(1) and, through the Johansen test, we could verify whether this assumption was adequate.

Table 2 HEGY Test

Note. *** is p-value <0.01, ** is p-value <0.5, * is p-value <0.1.

Source: Authors' elaboration.

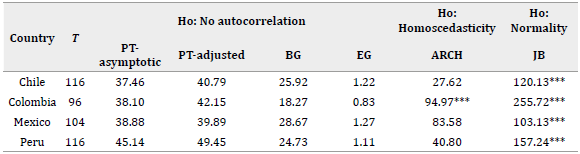

After determining the order of integration of the analyzed series, cointegration tests were performed in the framework of the estimation of a VAR model. Indeed, the VAR model was an indispensable input to apply Johansen's (1991) test for cointegration, Granger (1969) causality test, and the estimation of the VEC model and IRFs. Based on the information criteria, the appropriate model in Chile was VAR (4), in Colombia, VAR (3), and in Mexico and Peru, VAR (6). Additionally, the estimated VAR models met the stability assumptions corresponding to the absence of autocorrelation and heteroscedasticity, as shown in Table 3.

Table 3 Verification of VAR Model Assumptions

Note. *** is p-value <0.01, ** is p-value <0.5, * is p-value <0.

Source: Authors' elaboration.

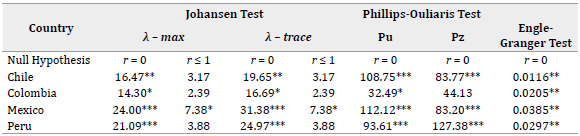

In this context, Table 4 shows the results of the cointegration tests of Johansen (1991), Phillips and Ouliaris (1990), and Engle and Granger (1987). According to the Johansen test, it was possible to reject the null hypothesis of no cointegration in each country using both the X - max and X - trace statistic. These values refer to the statistics used to determine the number of cointegrating vectors between the series based on the respective null hypotheses. Furthermore, it was impossible to reject the null hypothesis that accepts the existence of one or fewer cointegrating vectors. Likewise, the Phillips and Ouliaris and Engle and Granger tests rejected the null hypothesis of no cointegration among the variables. Therefore, it could be concluded that FDI and EG had a long-term relationship in each country of the PA.

Table 4 Cointegration Tests

Note. *** is p-value <0.01, ** is p-value <0.5, * is p-value <0.1.

Source: Authors' elaboration.

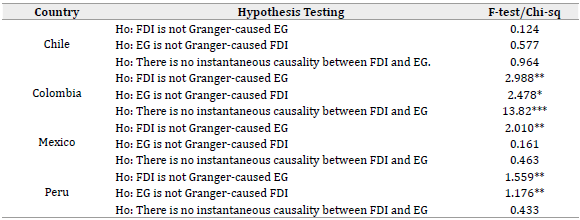

Table 5 shows that in Chile, FDI and EG did not have a causal relationship in Granger's (1969) sense. On the other hand, in Colombia, there was a bidirectional causal relationship between FDI and EG with a significance level of 5 %. In Mexico, there was a unidirectional causal relationship that went from FDI to EG. Similarly, in Peru, there was a unidirectional causal relationship from FDI to EG with a 5 % significance level. However, if a significance level of 10 % is taken, it is possible to conclude that there was a bidirectional causal relationship between the variables in Peru. In addition, there was evidence to affirm that the series only had an instantaneous causal relationship in Colombia.

Table 5 Causality Tests

Note. *** is p-value <0.01, ** is p-value <0.5, * is p-value <0.1.

Source: Authors' elaboration.

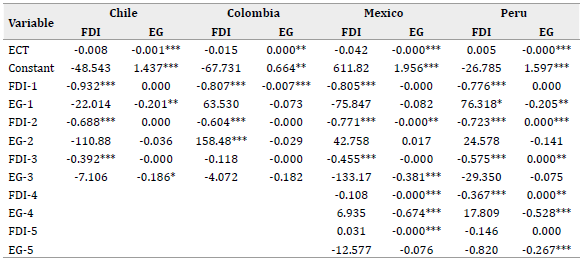

Considering that FDI and EG have a long-term relationship, it was possible to estimate a VEC model using each country's data to know how the variables adjust in short-term to long-term imbalances. Table 6 shows that in Chile, EG responded positively to long-term imbalances in FDI. This effect was statistically significant for the first three lags. However, long-term imbalances in EG did not significantly affect FDI. Therefore, the increase in EG did not contribute to attracting higher investment flows. In Colombia, on the other hand, EG responded negatively to long-term imbalances in FDI. However, the effect was significant only for the first lag. In turn, FDI responded positively to long-term imbalances in EG. In this case, the effect was statistically significant only for the second lag.

Table 6 VEC Model

Note. *** is p-value <0.01, ** is p-value <0.5, * is p-value <0.1.

Source: Authors’ elaboration.

In Mexico, long-term imbalances in FDI positively affected EG, although it was significant only for the first lag. Long-term imbalances in EG had a positive effect on FDI in the first, second, fourth, and fifth lags, and it had a negative effect in the third lag. However, the effects were not statistically significant. In Peru, FDI responded positively to long-term imbalances in EG during the first two lags and negatively from the third to the sixth lag. However, the effects lack statistical significance. In contrast, EG responded positively to long-term imbalances in FDI. This effect was statistically significant for the first four lags.

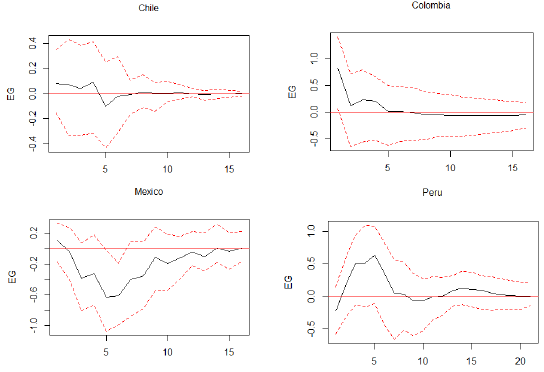

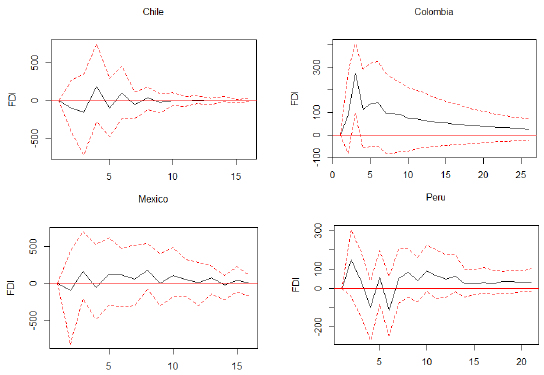

Finally, IRFs were estimated to determine how each variable responded to innovations or exogenous shocks in the other variable. Indeed, Figure 2 shows that in the first period, the innovations in Chile's FDI caused an increase in its EG, which decreased until the fifth period, when an adverse effect was observed. It stabilized from the sixth period onwards. In other words, a random shock in FDI affected EG up to six quarters later. Furthermore, an innovation in EG caused oscillations in FDI that stabilized after seven quarters.

According to Figure 3, in Colombia, a boost in FDI caused a robust positive impact on EG, which started to decrease until the fifth period, when it seemed to stabilize. At the same time, a random impulse from EG positively impacted FDI, which took more than 25 periods to stabilize. Along the same lines, Figure 3 shows that in Mexico, a random impulse in FDI caused a positive impact on EG in the first quarter; however, this effect started to be negative and pronounced as of the second quarter, and it stabilized approximately after 15 quarters. In the meantime, an innovation in EG caused oscillations in FDI, which began to stabilize after ten quarters. Figure 3, on the other hand, indicates that in Peru, a boost in FDI had a positive effect on EG from the first to the fifth quarters, but from the sixth quarter onwards, the impact was negative and stabilized after the 15th quarter. In contrast, a boost in EG caused swings in FDI that stabilized 20 periods later.

The results of this paper support the existing literature. For example, Sylwester (2005) and Owusu-Nantwi and Erickson (2019) also determined that FDI positively and significantly affects EG in developing countries, which aligns with findings in Chile, Mexico, and Peru. Likewise, Choe (2003) and other studies, such as those by Pradhan (2009)) and Mahmoodi and Mahmoodi (2016), identified a bidirectional relationship between FDI and EG, similar to that observed in Colombia and Peru in this study. However, the literature also highlights the specific conditions under which FDI impacts EG, as mentioned by Hermes and Lensink (2003) and Balasubramanyam et al. (1996), who stress the importance of a developed financial system and a minimum level of human capital. The findings that innovations in EG cause fluctuations in FDI, which take time to stabilize, find support in studies such as Dinh et al. (2019) and Osei-Opoku et al. (2019).

The results also align with several economic theories that analyze the relationship between FDI and SG. For example, endogenous growth theory supports the findings that FDI can foster EG by enhancing human capital and promoting innovation through R&D centers (Alvarado et al., 2017), as observed in Chile, Mexico, and Peru. Nonetheless, dependency theory suggests that an over-reliance on FDI can limit local benefits, which could explain why, in some AP countries, EG does not always translate into higher FDI flows. The paradigm of Dunning (1977) explains how multinationals invest in developing countries to take advantage of low labor costs and benefits specific to the local environment, which can integrate these countries into global value chains and stimulate their EC. Finally, international trade theory highlights how FDI can enhance trade and regional competitiveness (Galán & González-Benito, 2006).

CONCLUSIONS

This paper aimed to empirically analyze the relationship between FDI and EG in the PA countries. To achieve this objective, time series data with quarterly periodicity were used for each country. The analysis of the relationship between FDI and EG in Chile, Colombia, Mexico, and Peru has revealed valuable information on how these variables interact over time. The results obtained through cointegration tests, VEC models, causality tests, and IRF analysis offer a comprehensive view of this relationship and can be interpreted through various economic theories.

First, the cointegration tests performed (Johansen, Phillips, Ouliaris, Engle, and Granger) confirm a long-term relationship between FDI and EG in all the countries studied. This finding is consistent with the exogenous growth theory, which posits that variables can be cointegrated and share a common long-term trend, reflecting a stable interdependence between FDI and EG. Second, regarding causality tests, the Granger test shows significant variations among countries. In Chile, no significant causal relationship was identified in the Granger sense between FDI and EG, suggesting that despite the long-term relationship, there is no direct mutual influence in the short term. In Colombia, a bidirectional causal relationship was found between FDI and EG. This indicates that EG and foreign investment mutually reinforce each other, reflecting a dynamic and reciprocal relationship. On the other hand, in Mexico, a unidirectional causality from FDI to EG was observed, implying that foreign investments significantly impact EG but not necessarily the other way around. In Peru, the unidirectional causality from FDI to EG was significant at 5 %, and at a 10 % significance level, a bidirectional causality was identified, suggesting a more complex and variable relationship. Third, the VEC models show that in Chile, EG responds positively to long-term imbalances in FDI, although the long-term effect of imbalances in EG on FDI is not significant. In Colombia, EG responds negatively to imbalances in FDI, while FDI responds positively to imbalances in EG.

This paper contributes to the discussion on the relationship between FDI and EG in developing countries, providing elements for making decisions on economic policy. The overall results indicated that, although FDI and EG have an equilibrium relationship in the long term, FDI does not always translate into higher EG in the PA countries. Similarly, a higher EG was no guarantee of attracting higher FDI flows. Therefore, countries must be more cautious when opting for economic liberalization and integration initiatives as strategies to promote economic development. It is very important to bear in mind that the success of trade liberalization and economic integration policies depends on each country's economic, political, social, and institutional environment. We recommended continuing empirical studies that include elements such as human capital formation, technological gaps, financial market development, institutional strength, infrastructure, incentive systems, and macroeconomic stability in order to better approach the economic reality of the PA countries.